Logistics Market Global Industry Analysis and Forecast (2026-2032)

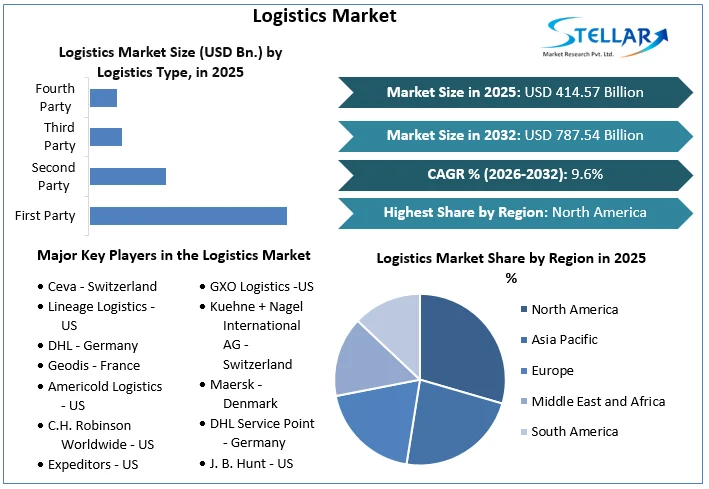

The Logistics Market size was valued at USD 414.57 Billion in 2025 and the total Global Logistics revenue is expected to grow at a CAGR of 9.6 % from 2026 to 2032, reaching nearly USD 787.54 Billion by 2032.

Format : PDF | Report ID : SMR_1811

Logistics Market Overview

The global logistics market is a dynamic component of the economy, around the planning, implementation, and control of the efficient flow and storage of goods, services, and information from point of origin to point of consumption. The crucial importance in supply chain management, facilitating trade and commerce worldwide. Key drivers of the logistics market include globalization, e-commerce growth, technological advancements, and infrastructure development. Major players in the industry offer a range of services, including transportation, warehousing, inventory management, and freight forwarding. The market is highly competitive, with companies continually innovating to meet evolving customer demands and market trends.

The Stellar Market Research report provides an analysis of the Logistics (DEM) market, both in the past and present, as well as future estimates. The market estimates are based on a comprehensive research methodology that includes primary research, secondary research, and expert advice. The report takes into account current market dynamics, economic, social, and political factors, as well as regulations, government spending, and research and development growth. Positive and negative changes to the market are also considered.

The report also includes an analysis of both quantitative and qualitative data, with a forecast period extending from 2026 to 2032. The report takes into consideration various factors such as product pricing and penetration at both country and regional levels, country GDP, market dynamics of parent market and child markets, end application industries, major players, consumer buying behavior, and economic, political, and social scenarios of countries.

The report is divided into various segments to provide a detailed analysis of the market from every possible aspect. The market outlook section gives a detailed analysis of market evolution, growth drivers, restraints, opportunities, and challenges, Porter's 5 Forces Framework, macroeconomic analysis, value chain analysis, and pricing analysis that directly shape the market at present and over the forecasted period. The drivers and restraints cover the internal factors of the market, while opportunities and challenges are the external factors affecting the market. The market outlook section also indicates the trends influencing new business development and investment opportunities.

To get more Insights: Request Free Sample Report

Logistics Market Dynamics

E-commerce Expansion and Trade Agreements Drive Market Growth in Logistics Industry

E-commerce belongs to the buying and selling of goods over the internet. Shipping goods to customers is handled by third-party service providers. Logistics services are also used in the e-commerce sector to manage and oversee e-commerce businesses' supply chains, allowing these businesses to focus on marketing and other company operations. As a result of the numerous benefits that logistics provides the e-commerce business, the adoption of these services is increasing significantly, boosting market growth. During the predicted period, the global logistics market is expected to grow owing to the emerging popularity of outsourcing in multinational corporations (MNCs) to distribute and manufacture on a global scale.

- According to the World E-Commerce Forum (WORLDEF), the global e-commerce volume has been reached to USD 6.5 trillion by 2023, USD 5.5 trillion by the end of 2022, and up 14% from $4.9 trillion in 2021.

- According to India Brand Equity Foundation (IBEF), the Indian eCommerce market grown by 21.5% in 2022, reaching $74.8 billion.

Logistics provides numerous benefits, including improved delivery performance, lower operational costs, and higher levels of customer satisfaction. As a result, many manufacturers and retailers around the world consider it a critical aspect of their business. Additionally, it contributes to an organization's competitiveness in terms of flexibility, delivery, quality, and cost. Globalization is a new factor driving market growth, with many multinational corporations outsourcing logistics results. Furthermore, logistics enables organizations to separate different stages of a manufacturing process across multiple countries. It further reduces the total cost of manufacturing.

Varied Governance Standards Challenge Industry Consistency

To increase profitability and viability, transportation and logistics companies around the world are concentrating on improving supply chain efficiency. Common governance guidelines are necessary for the logistics sector.

The lack of government involvement and the absence of regional organizations, that actively launched and coordinated global logistics standardization activities, and has hampered the level of logistics standardization in European nations like the United Kingdom, Germany, and France. Every vendor is able to offer the majority of solutions in one package owing to the common standardization in logistics management.

Logistics Trends

Over the past five years, the supply chain industry has seen significant investment, with 74% of global supply chain leaders expecting to increase their investment in innovation and technology in 2025. Automation, artificial intelligence (AI), and data insights are expected to drive supply chain efficiencies, improving throughput, accuracy, and efficiency while decreasing labor dependence. Advances in robotics and automation enabled businesses to reduce their dependence on labor. Inventory data, such as RFID tags and real-time data, also improves workflows and accuracy. Companies that have not embraced these technologies lag behind competitors, struggling to lower costs and meet customer fulfillment expectations.

Warehouse automation and robots become more widely accepted.

The US ecommerce industry has been experienced rapid growth, with sales reaching $1 trillion in 2023. However, rising transportation and warehouse costs and a worsening labor shortage are putting pressure on businesses to meet customer expectations for fast and reliable order fulfillment. Businesses are embracing automation and robotics to manage warehousing and fulfillment challenges, offering omnichannel options and reducing costs. In the next 2-5 years, 54% considered robotic picking systems. Warehouse operators are also considering goods-to-person (GTP) systems and autonomous mobile robots (AMRs) to improve efficiency and meet labor needs.

Artificial Intelligence (AI) and data help strengthen logistics operations and decisions.

A survey shows that 22% of businesses has used AI in their supply chain in 2024, enabling predictive demand prediction and rerouted products. 15% use AI-driven supply chain management, presenting a growth opportunity. However, 33.5% struggle to find solutions with robust analytic capabilities. With ecommerce growth has increased by 5% in 2024, businesses need partners with robust data integration and analytical capabilities for informed logistics decisions.

Logistics Market Segment Analysis

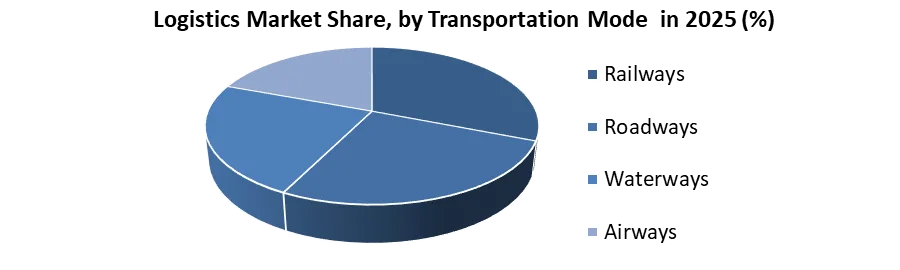

By Transporation Mode, According to SMR research, the Transportation segment is divided into Railways, Roadways, Waterways, and Airways. The Roadways segment dominated the market, with a highest market share in 2025 renowned for its extensive reach and cost-effectiveness, road transportation plays a pivotal role in distribution logistics within the marketing domain. It serves as a linchpin in the ever-expanding global e-commerce logistics market, contributing to its substantial growth. Particularly, the Roadways transportation segment has experienced remarkable market development, with particular prominence in regions such as the United States. Concurrently, the Airways Transportation segment, a critical player in the global e-commerce market, is positioned for rapid growth. This phenomenon underscores the increasing reliance on air transportation within the logistics sector, a trend observed on a global scale and transcending geographical boundaries.

Logistics Market Regional Analysis

North America has been dominated the Logistics Market, with a highest market revenue share in 2025. This growth is attributed to the region's highly developed infrastructure, particularly its extensive rail and road connectivity. The United States, in particular, boasts a sophisticated supply chain network that integrates producers and consumers through various transportation modes, including air and express delivery services, freight rail, maritime transport, and truck transport. This robust infrastructure contributes to the United States' position as a key market for logistics in the region.

The market report on logistics covers major countries such as the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil. These countries represent significant markets for logistics services, each with its own unique characteristics and challenges. As the region continues to witness economic growth and industrial development, the demand for efficient logistics solutions is expected to increase, driving further innovation and investment in the sector.

Logistics Market Competitive Landscape

The logistics market is highly competitive, with key players vying for market share globally. Major companies like DHL, UPS, and FedEx dominate the industry, offering a wide range of services including transportation, warehousing, and supply chain management. Regional players, such as Kerry Logistics in Asia and Geodis in Europe, also play significant roles. The market is characterized by mergers and acquisitions, technological advancements, and a focus on sustainability. Companies are investing in automation, AI, and data analytics to enhance operational efficiency and customer service. Overall, the competitive landscape is dynamic, driven by innovation and the evolving needs of the supply chain industry.

- ICT-AGRI-FOOD and BLE have been working very successfully with ESA for many years and in 2021 signed a Memorandum of Intent with ESA to highlight and reinforce this exchange and joint activities between the two organisations.

- In June 2023, GEODIS announced that it has opened its new Mexico City multi-user warehousing and distribution centre has begun operations . For GEODIS customers, the 145,000 square foot logistics centre supports omnichannel operations like e-Commerce, retail, and wholesale.

- In May 2023, FedEx Express introduced one-stop logistical solutions for dangerous commodities in Cebu. Hazardous Materials are chemicals or products that, when handled carefully, endangered human health, public safety, or the environment.

- In May 2023, Austrian logistics company Cargo-Partner declared that it has been purchased by Nippon Express Co., Ltd. for up to $150 million. Nippon Express' capacity to provide a range of logistical services between Asia and Europe is strengthened by the acquisition of Cargo-Partner.

- In March 2023, DSV has purchased the American-based shipping and logistics firms Global Diversity Logistics and Sand M Moving Systems West. The acquisitions enhance DSV's expanding cross-border services to Latin America, align with its new Phoenix-Mesa Gateway Airport operations, and strengthen its position within the semiconductor industry.

- In June 2022,Nippon Express Co., Ltd. introduced a new logistics service specifically designed for the pharmaceutical industry. This service enables the safe and efficient storage and transportation of pharmaceutical products at extremely low temperatures, which is crucial during the research and development phase as well as the formulation process.

- In Janurary 2021, Kuehne+Nagel signed an agreement with the biotechnology company Moderna, which develops messenger RNA (mRNA) therapeutics and vaccines, to ensure the distribution and stockpiling of Moderna's COVID-19 vaccine. Kuehne+Nagel supported the global distribution of vaccine doses from Moderna's international supply chain, which is based in Europe. This includes distribution in Europe, Asia, the Middle East, Africa, and some markets in the United States.

|

Logistics Market Scope |

|

|

Market Size in 2025 |

USD 414.57 Bn. |

|

Market Size in 2032 |

USD 787.54 Bn. |

|

CAGR (2026-2032) |

9.6% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

Segments |

by Transportation Mode

|

|

by Logistics Type

|

|

|

by Customer Type

|

|

|

by Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Logistics Market

- Ceva - Switzerland

- Lineage Logistics - United States

- DHL - Germany

- Geodis - France

- Americold Logistics - United States

- C.H. Robinson Worldwide - United States

- Expeditors - United States

- DHL Supply Chain - Germany

- Kerry Logistics - Hong Kong

- Expeditors International of Washington Inc - United States

- GXO Logistics - United States

- Kuehne + Nagel International AG - Switzerland

- Maersk - Denmark

- DHL Service Point - Germany

- J. B. Hunt - United States

- XPO - United States

- DSC Logistics - United States

- JD Logistics - China

- APL Logistics - Singapore

- XPO Logistics - United States

- Ryder - United States

Frequently Asked Questions

Increasing reliance on digital channels, and rise of e-commerce are the drivers of the Logistics market.

Investors capitalize on opportunities in the Logistics market by investing in leading players, and exploring emerging startups and partnerships within the market provide potential avenues for growth and diversification.

The Market size was valued at USD 414.57 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 9.6% from 2026 to 2032, reaching nearly USD 787.54 billion.

The Logistics is Segmented On The Basis Of Transportation Mode, Logistics Type, Application, Customer Type And Geography.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Logistics Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Logistics Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. New Launches and Innovations

4. Logistics Market: Dynamics

4.1. Logistics Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Logistics Market Drivers

4.3. Logistics Market Restraints

4.4. Logistics Market Opportunities

4.5. Logistics Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Logistics Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Logistics Market Size and Forecast, by Transportation Mode (2025-2032)

5.1.1. Railways

5.1.2. Roadways

5.1.3. Waterways

5.1.4. Airways

5.2. Logistics Market Size and Forecast, by Logistics Type (2025-2032)

5.2.1. First Party

5.2.2. Second Party

5.2.3. Third Party

5.2.4. Fourth Party

5.3. Logistics Market Size and Forecast, by Customer Type (2025-2032)

5.3.1. B2B

5.3.2. B2C

5.4. Logistics Market Size and Forecast, by Application (2025-2032)

5.4.1. Healthcare

5.4.2. Industrial and Manufacturing

5.4.3. Aerospace

5.4.4. Telecommunication

5.4.5. Others

5.5. Logistics Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Logistics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Logistics Market Size and Forecast, by Transportation Mode (2025-2032)

6.1.1. Railways

6.1.2. Roadways

6.1.3. Waterways

6.1.4. Airways

6.2. North America Logistics Market Size and Forecast, by Logistics Type (2025-2032)

6.2.1. First Party

6.2.2. Second Party

6.2.3. Third Party

6.2.4. Fourth Party

6.3. North America Logistics Market Size and Forecast, by Customer Type (2025-2032)

6.3.1. B2B

6.3.2. B2C

6.4. North America Logistics Market Size and Forecast, by Application (2025-2032)

6.4.1. Healthcare

6.4.2. Industrial and Manufacturing

6.4.3. Aerospace

6.4.4. Telecommunication

6.4.5. Others

6.5. North America Logistics Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Logistics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Logistics Market Size and Forecast, by Transportation Mode (2025-2032)

7.2. Europe Logistics Market Size and Forecast, by Logistics Type (2025-2032)

7.3. Europe Logistics Market Size and Forecast, by Customer Type (2025-2032)

7.4. Europe Logistics Market Size and Forecast, by Application (2025-2032)

7.5. Europe Logistics Market Size and Forecast, by Country (2025-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Logistics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Logistics Market Size and Forecast, by Transportation Mode (2025-2032)

8.2. Asia Pacific Logistics Market Size and Forecast, by Logistics Type (2025-2032)

8.3. Asia Pacific Logistics Market Size and Forecast, by Customer Type (2025-2032)

8.4. Asia Pacific Logistics Market Size and Forecast, by Application (2025-2032)

8.5. Asia Pacific Logistics Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Rest of Asia Pacific

9. Middle East and Africa Logistics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Logistics Market Size and Forecast, by Transportation Mode (2025-2032)

9.2. Middle East and Africa Logistics Market Size and Forecast, by Logistics Type (2025-2032)

9.3. Middle East and Africa Logistics Market Size and Forecast, by Customer Type (2025-2032)

9.4. Middle East and Africa Logistics Market Size and Forecast, by Application (2025-2032)

9.5. Middle East and Africa Logistics Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Nigeria

9.5.4. Rest of ME&A

10. South America Logistics Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Logistics Market Size and Forecast, by Transportation Mode (2025-2032)

10.2. South America Logistics Market Size and Forecast, by Logistics Type (2025-2032)

10.3. South America Logistics Market Size and Forecast, by Customer Type (2025-2032)

10.4. South America Logistics Market Size and Forecast, by Application (2025-2032)

10.5. South America Logistics Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. Ceva - Switzerland

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Lineage Logistics - United States

11.3. DHL - Germany

11.4. Geodis - France

11.5. Americold Logistics - United States

11.6. C.H. Robinson Worldwide - United States

11.7. Expeditors - United States

11.8. DHL Supply Chain - Germany

11.9. Kerry Logistics - Hong Kong

11.10. Expeditors International of Washington Inc - United States

11.11. GXO Logistics - United States

11.12. Kuehne + Nagel International AG - Switzerland

11.13. Maersk - Denmark

11.14. DHL Service Point - Germany

11.15. J. B. Hunt - United States

11.16. XPO - United States

11.17. DSC Logistics - United States

11.18. JD Logistics - China

11.19. APL Logistics - Singapore

11.20. XPO Logistics - United States

11.21. Ryder - United States

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook