Isoprene Market: Global Industry Analysis and Forecast (2025-2032)

The Isoprene Market size was valued at USD 3.68 Bn. in 2024 and the total Global Isoprene revenue is expected to grow at a CAGR of 7.5% from 2025 to 2032, reaching nearly USD 6.57 Bn. by 2032.

Format : PDF | Report ID : SMR_1713

Isoprene Market Overview

Isoprene is a colorless, volatile liquid hydrocarbon obtained in processing petroleum and coal tar to be used as a chemical raw material. The isoprene market is witnessing robust global growth, driven by factors such as escalating demand for synthetic rubber, increasing automotive production, and the rising utilization of isoprene in healthcare. The SMR analysis thoroughly examines essential market aspects, including profit margins, revenue trends, industry statistics, market barriers, and key players.

With a thorough examination, the report dissects the profit margins of key players across diverse regions and segments, offering valuable insights into market profitability dynamics. Also, the market trends underscore a consistent growth trajectory, supported by the growing adoption of isoprene-based products across multiple sectors, driven by its versatile attributes and broad applications.

The isoprene market offers demanding investment prospects driven by its crucial role in various industries. The soaring demand for synthetic rubber, predominantly driven by the automotive, construction, and consumer goods sectors, promotes a profitable investment environment. The growing automotive production globally, especially in emerging markets, signifies a substantial opportunity for investors due to isoprene's indispensable usage in the tire and automotive part manufacturing.

The increasing adoption of isoprene in healthcare applications, particularly in medical devices and pharmaceuticals, presents an attractive investment opportunity, poised for growth with ongoing advancements in healthcare technology. These factors collectively contribute to the isoprene market's appeal to investors seeking promising returns.

- The leading supplier countries of isoprene rubber include China, Russia, and Japan. On the other hand, Vietnam, India, and China stand out as the top buyer nations for isoprene rubber. In terms of importing, China, the United States of America, and the Philippines rank as the top three countries. Equally, China, Russia, and Japan are the top exporters of isoprene rubber globally.

To get more Insights: Request Free Sample Report

Isoprene Market Dynamics

Elastomer Industry Growth

Isoprene is a crucial raw material for the production of elastomers, which are used in various applications such as footwear, construction, and industrial goods. The growth of these industries directly impacts the demand for Isoprene. Elastomers, also known as rubber materials, possess unique properties like elasticity and resilience, making them indispensable across various industries. In the footwear sector, Isoprene-derived elastomers are extensively utilized for manufacturing shoe soles, heels, and other components.

The elasticity and durability of Isoprene-based elastomers enhance the comfort, longevity, and performance of footwear products. Similarly, in the construction industry, Isoprene-based elastomers find broad applications in seals, gaskets, roofing materials, adhesives, and sealants. These materials offer exceptional weather resistance, adhesion, and flexibility, making them ideal for sealing and bonding in construction projects.

The growing focus on environmental sustainability is a significant trend impacting the isoprene market.

Growing environmental concerns, there's a shift towards sustainable and bio-based alternatives to traditional petrochemical-derived materials. Isoprene derived from renewable sources such as biomass or bio-based feedstocks is gaining traction, aligning with the broader trend towards sustainability. Market diversification is evident with the emergence of bio-based isoprene, supplementing the dominance of traditional fossil fuel-derived isoprene. Technological progressions in fermentation and extraction methods are driving efficiency and cost-effectiveness in bio-isoprene production, raising its adoption and further driving the shift towards sustainable options.

Supply Chain Disruptions

Disruptions in the supply chain, such as transportation delays, geopolitical tensions, and natural disasters, affect the availability of raw materials and distribution channels for isoprene products. These disruptions are expected to lead to inventory shortages, increased lead times, and higher operational costs. Inventory management becomes challenging due to unpredictable supply chains, making it hard for manufacturers to maintain consistent inventory levels. The dependence on just-in-time inventory management can lead to production slowdowns or finished goods shortages. Also, disruptions increase operational costs as companies incur expenses for expedited shipping, securing alternative raw material sources, and managing inventory fluctuations, further impacting profitability and operational efficiency.

- SMR Report highlights the price surge for isoprene in North America in September 2022. The increase was attributed to a combination of factors, including supply chain disruptions, heavy demand, and pre-existing supply issues.

- According to SMR analysis, Rise in Global Shipping costs from 2021 to 2023. That is expected to affect transportation costs, which significantly impact the landed price of raw materials like isoprene.

Isoprene Market Segment Analysis

By Grade, the polymer-grade segment held the largest market share in the Global Isoprene Market in 2024. According to SMR analysis, the segment is further expected to grow at a CAGR of XX% during the forecast period. Polymer-grade isoprene has more applications and a higher value than chemical-grade, it frequently has higher profit margins. Due to the higher labor force required for manufacture, distribution, and transportation. Its significance lies in tire production, where it serves as a key component for synthetic polyisoprene rubber, vital for automotive tires.

The escalating demand for vehicles drives the need for polymer-grade isoprene. Well-known for representing natural rubber's qualities such as elasticity, durability, and resilience, it finds extensive use across automotive, footwear, and construction industries. The SMR report provides a comprehensive examination of the polymer-grade isoprene segment within the larger isoprene market. Its dominant market share, projected growth, and indispensable role in various industries underscore its significance and potential for continued growth.

Isoprene Market Regional Analysis

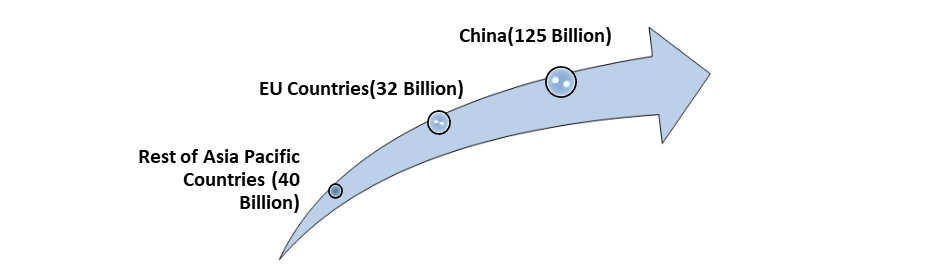

Asia Pacific leads the global isoprene market due to various factors. The region has increasing opportunities in the automotive industry, especially in China, India, and Japan, driving demand for isoprene, essential in synthetic rubber for tires and automotive parts. Also, the growing construction sector, driven by urbanization and infrastructure projects, boosts demand for isoprene-based elastomers in roofing materials and adhesives. Asia Pacific benefits from cost-competitive production, facilitated by established chemical manufacturing facilities and abundant raw materials, attracting domestic and international players to the market.

Sustainability concerns are encouraging a shift towards bio-based alternatives to conventional isoprene, with Asia Pacific observing remarkable advancements. Companies in the region are actively engaged in researching and developing bio-isoprene production technologies. For Example, in 2024, a Chinese biotechnology firm partnered with a European counterpart to establish a significant bio-isoprene production facility in China, reflecting the region's commitment to sustainable innovation.

China has gained a strong lead in the Asia Pacific isoprene market because of several important factors. The country has a strong manufacturing base and is home to a sizeable portion of the world's chemical production facilities, including isoprene factories. Additionally, favorable governmental policies aimed at stimulating growth in the chemical industry further strengthen China's leadership position, underscoring the nation's prominence in the regional and worldwide isoprene market landscape.

In the year 2022, a predominant portion of the chemical industry's capital expenditure was allocated to investments within China.

Isoprene Market Competitive Landscape

The entrance of start-up players into the isoprene market brings notable impacts to the market landscape. It promotes market diversification by introducing innovative technologies and production methods, increasing options beyond traditional petrochemical-derived isoprene. Diversification provides the rising demand for sustainable solutions, enhancing market competitiveness. Additionally, heightened competition among players is expected to lead to price reductions and spur established entities to innovate and refine their production processes. The focus on sustainability by new entrants raises awareness within the isoprene market, influencing consumer preferences and nudging the industry towards environmentally friendly alternatives.

- To develop chemical recycling technologies that use used tires to achieve high-yield isoprene production, Bridgestone Corporation partnered with the National Institute of Advanced Industrial Science and Technology (AIST), Tohoku University, ENEOS Corporation, and JGC Holdings Corporation in February 2022.

- Kraton Crop was acquired by South Korean petrochemical company DL Chemical Co., Ltd. in March 2022. Following its acquisition, Kraton is now a fully owned subsidiary of DL Chemical. Extending investment and gaining further original technology through technical development, helps DL Chemical build a new materials industry ecosystem and helps both companies achieve their goals of being leaders in specialized chemicals.

|

Isoprene Market Scope |

|

|

Market Size in 2024 |

USD 3.68 Bn. |

|

Market Size in 2032 |

USD 6.57 Bn. |

|

CAGR (2025-2032) |

7.5 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Grade Polymer Grade Chemical Grade |

|

By Application Tires Adhesives Industrial Rubber Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Isoprene Market

- Spectrum Chemical Mfg

- Braskem

- KANTO CHEMICAL CO., INC.

- Junsei Chemical Co.,Ltd

- Xingrui Industry CO., LTD.

- Merck

- LyondellBasell Industries

- Alfa Aesar, Thermo Fisher Scientific.

- Pon Pure Chemicals Group

- Exxon mobil chemical

- BASF

- Kraton Corporation

- Hi-Tech Polymer

- REDCO

- Harboro Rubber

- Rubber mill

- tiger-poly

- Hanna Rubber Company

- Zeon

- Pon Pure Chemicals Group

- Henan Fengda Chemical Co., Ltd

Frequently Asked Questions

Some challenges faced by the isoprene market include fluctuations in raw material prices, environmental concerns regarding production processes, and the emergence of alternative materials. Regulatory compliance and geopolitical factors also impact market dynamics.

The isoprene market is increasingly focusing on sustainable production practices, including the development of bio-based isoprene and improvements in manufacturing processes to reduce carbon emissions. Recycling initiatives for end-of-life rubber products also contribute to environmental sustainability efforts.

The Market size was valued at USD 3.68 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 7.5% from 2025 to 2032, reaching nearly USD 6.57 Billion.

The segments covered in the market report are by grade and Application.

1. Isoprene Market: Research Methodology

2. Isoprene Market: Executive Summary

3. Isoprene Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Isoprene Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Isoprene Market Size and Forecast by Segments (by Value Units)

6.1. Isoprene Market Size and Forecast, by Type (2024-2032)

6.1.1. Polymer Grade

6.1.2. Chemical Grade

6.2. Isoprene Market Size and Forecast, by Application (2024-2032)

6.2.1. Tires

6.2.2. Adhesives

6.2.3. Industrial Rubber

6.2.4. Others

6.3. Isoprene Market Size and Forecast, by Region (2024-2032)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Isoprene Market Size and Forecast (by value Units)

7.1. North America Isoprene Market Size and Forecast, by Type (2024-2032)

7.1.1. Polymer Grade

7.1.2. Chemical Grade

7.2. North America Isoprene Market Size and Forecast, by Application (2024-2032)

7.2.1. Tires

7.2.2. Adhesives

7.2.3. Industrial Rubber

7.2.4. Others

7.3. North America Isoprene Market Size and Forecast, by Country (2024-2032)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. Europe Isoprene Market Size and Forecast (by Value Units)

8.1. Europe Isoprene Market Size and Forecast, by Type (2024-2032)

8.1.1. Polymer Grade

8.1.2. Chemical Grade

8.2. Europe Isoprene Market Size and Forecast, by Application (2024-2032)

8.2.1. Tires

8.2.2. Adhesives

8.2.3. Industrial Rubber

8.2.4. Others

8.3. Europe Isoprene Market Size and Forecast, by Country (2024-2032)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. Austria

8.3.8. Rest of Europe

9. Asia Pacific Isoprene Market Size and Forecast (by Value Units)

9.1. Asia Pacific Isoprene Market Size and Forecast, by Type (2024-2032)

9.1.1. Polymer Grade

9.1.2. Chemical Grade

9.2. Asia Pacific Isoprene Market Size and Forecast, by Application (2024-2032)

9.2.1. Tires

9.2.2. Adhesives

9.2.3. Industrial Rubber

9.2.4. Others

9.3. Asia Pacific Isoprene Market Size and Forecast, by Country (2024-2032)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Isoprene Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Isoprene Market Size and Forecast, by Type (2024-2032)

10.1.1. Polymer Grade

10.1.2. Chemical Grade

10.2. Middle East and Africa Isoprene Market Size and Forecast, by Application (2024-2032)

10.2.1. Tires

10.2.2. Adhesives

10.2.3. Industrial Rubber

10.2.4. Others

10.3. Middle East and Africa Starch-based bio plastics Market Size and Forecast, by Country (2024-2032)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Starch-based bio plastics Market Size and Forecast (by Value Units)

11.1. South America Isoprene Market Size and Forecast, by Type (2024-2032)

11.1.1. Polymer Grade

11.1.2. Chemical Grade

11.2. South America Isoprene Market Size and Forecast, by Application (2024-2032)

11.2.1. Tires

11.2.2. Adhesives

11.2.3. Industrial Rubber

11.2.4. Others

11.3. South America Isoprene Market Size and Forecast, by Country (2024-2032)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. Spectrum Chemical Mfg

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Braskem

12.3. KANTO CHEMICAL CO.,INC.

12.4. Junsei Chemical Co.,Ltd

12.5. Xingrui Industry CO., LTD.

12.6. Merck

12.7. LyondellBasell Industries

12.8. Alfa Aesar, Thermo Fisher Scientific.

12.9. Pon Pure Chemicals Group

12.10. Exxonmobilchemical

12.11. BASF

12.12. Kraton Corporation

12.13. Hi-Tech Polymer

12.14. REDCO

12.15. Harboro Rubber

12.16. Rubbermill

12.17. tiger-poly

12.18. Hanna Rubber Company

12.19. Zeon

12.20. Pon Pure Chemicals Group

12.21. Henan Fengda Chemical Co., Ltd

13. Key Findings

14. Industry Recommendation