HVAC System Market Analysis Growth Potential, Competitive Landscape, and Strategic Outlook (2025-2032)

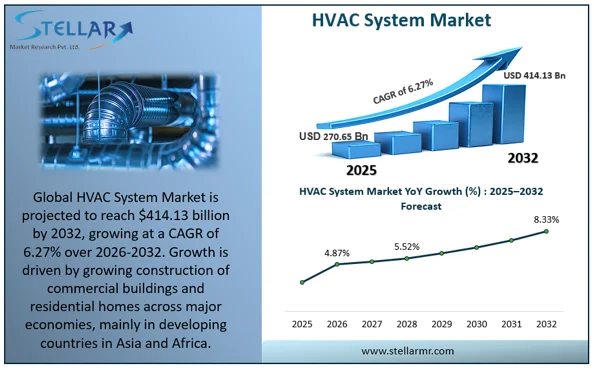

Global HVAC System market size was valued, USD 270.65 Billion in 2025 and is expected to reach USD 414.13 Billion by 2032 at a CAGR of 6.27%.

Format : PDF | Report ID : SMR_470

HVAC (Heating, Ventilation and Air Conditioning) System Market Key Highlights:

- Global HVAC System Market Volume is expected to grow at a CAGR of 5.12% over 2025-2032.

- Asia pacific HVAC System Market value is expected to grow at a CAGR of 7% during forecast period (2026-2032).

- Cooling Equipment held the largest share in the HVAC System Market with a 48.67% market share in 2025.

- In 2025, Heat Pumps captured the largest 43.12% share of the Heating Equipment segment owing to their ability to provide both heating and cooling in one system.

- Air Handling Units contributes the highest share of the market owing to growing importance given to indoor air quality.

- Residential segment is projected to record the highest CAGR of 7.15% during the forecast period (2026-2032).

- Heat pump adoption is growing faster than air conditioners worldwide.

- U.S. heat pump shipments reached nearly 4.20 million units in 2025.

- France installed above 550,000 heat pumps, leading European adoption.

- Germany saw a 47% drop in heat pump sales, reflecting policy impact.

To get more Insights: Request Free Sample Report

HVAC System Market Dynamics:

Increased Construction Activities Driving HVAC System Market Growth

The global market for HVAC System is experiencing growth driven by increased construction activities across commercial, residential, and industrial sectors. Growing urbanization, infrastructure development, and government initiatives supporting sustainable and energy-efficient buildings are accelerating demand for advanced HVAC system installations. In 2025, the worldwide construction sector is expected to grow at around 4% annually, creating strong opportunities for HVAC manufacturers through higher installations, retrofits, and project-based deployments.

HVAC System Market Growth Driven by Growing Energy Efficiency Demands

The HVAC System Market is growing owing to stricter energy efficiency standards aimed at reducing energy consumption and emissions. By 2032, the global market is expected to grow at a CAGR of 6.27%, driven by demand for energy-efficient HVAC systems. This shift not only supports environmental goals but also appeals to consumers seeking lower utility bills and cost-effective solutions.

HVAC System Market Trends:

The HVAC System Market is witnessing substantial growth, driven by key trends such as growing demand for green building investments, energy-efficient systems, and technological innovations. Governments worldwide are enforcing stricter energy efficiency regulations, fuelling the adoption of sustainable HVAC solutions like heat pumps and electrification technologies.

Green building projects and government investments, for example the U.S. Department of Energy’s $6 billion investment in decarbonization initiatives, are further boosting the demand for energy-efficient HVAC systems. These trends are collectively reshaping the future of the HVAC System Market globally, promoting both healthier indoor environments and sustainability.

|

HVAC System Market Stakeholders and Focus Areas |

|||

|

Stakeholder |

Market Focus |

Key Actions/Strategies |

Import/Export Considerations |

|

HVAC Manufacturers & Suppliers |

China, India, Southeast Asia: Budget systems |

Focus on cost-effective units for high-volume demand. |

Export affordable units; Import components. |

|

US, Australia, Northern Europe: Premium systems |

Offer smart HVAC systems and heat pumps. |

Import advanced systems; Export premium units. |

|

|

Policymakers & Regulators |

US, Europe: Energy efficiency & greener upgrades |

Enforce energy standards, subsidize green upgrades. |

Focus on energy efficiency standards for imports. |

|

Investors & Industry Analysts |

China, India: Market growth via rising middle class |

Invest in high-growth markets and market penetration. |

Export capital to emerging markets for mass units. |

|

Commercial & Residential Builders |

US, Europe: Premium HVAC systems |

Focus on high-end, energy-efficient solutions. |

Import premium systems; Export luxury HVAC. |

HVAC System Market Segment Analysis:

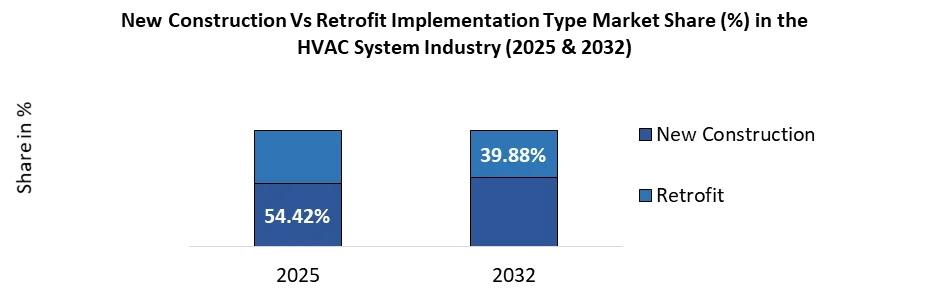

By Implementation Type, the New Construction segment held the largest share of 54.42% the global HVAC System Market in 2025.This growth is driven by increasing urbanization and infrastructure development, driving demand for energy-efficient, advanced HVAC systems in new buildings. Furthermore, new construction allows for the integration of smart, high-performance HVAC solutions from the outset.

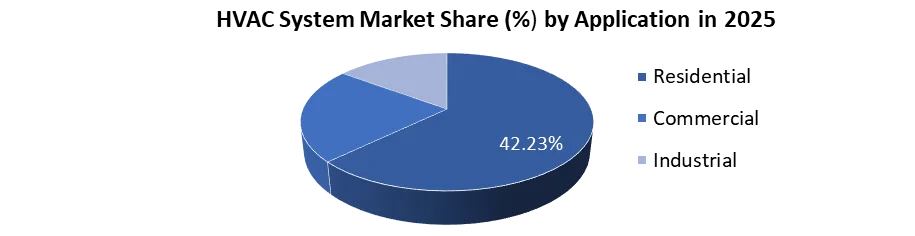

Based on Application, The Residential segment captured the largest 42.23% share of the global HVAC System Market in 2025. The growing demand for sophisticated HVAC systems is driven by the growth in urbanization, disposable incomes, and the increasing awareness regarding indoor air quality in residential buildings.

HVAC System Market Regional Analysis:

- Asia Pacific held the dominant share in the global HVAC System market with a share of 40.72% in 2025. This dominance is driven by rapid industrialization, urbanization, and a significant increase in infrastructure spending across the region. Furthermore, the presence of major HVAC players and the availability of advanced products, like Godrej’s premium air conditioners, featuring IoT controls and advanced cooling and air purification technologies, are further fuelling market growth in Asia Pacific.

- In 2025, North America followed with around 28.56% in the global HVAC System market. This growth is attributed to growing adoption of modern technologies and the replacement and upgrade of older HVAC systems with newer, more efficient control systems. This creates lucrative opportunities for HVAC system providers, as the region continues to focus on improving energy efficiency and smart building solutions.

Country wise Insight in HVAC System Market:

|

Country |

Key Developments (2024 -2025) |

Growth Opportunities |

|

China |

Rapid urbanization, expansion of residential & commercial construction, strong local OEM presence, and increasing adoption of energy?efficient systems. |

Mass?market HVAC systems, entry?level units, smart ACs, and IoT?enabled solutions for urban housing projects. |

|

United States |

Focus on premium HVAC systems, retrofit & replacement of old infrastructure, and deployment of advanced control and smart technologies. |

Smart HVAC controls, heat pumps, energy optimization services, and retrofit upgrade solutions. |

|

India |

Increased construction activity, policy emphasis on energy efficiency, and growing middle?class demand for affordable cooling/heating solutions. |

Cost?competitive and energy?efficient HVAC units, localized manufacturing, and service & maintenance expansion. |

HVAC System Market Competitive Landscape:

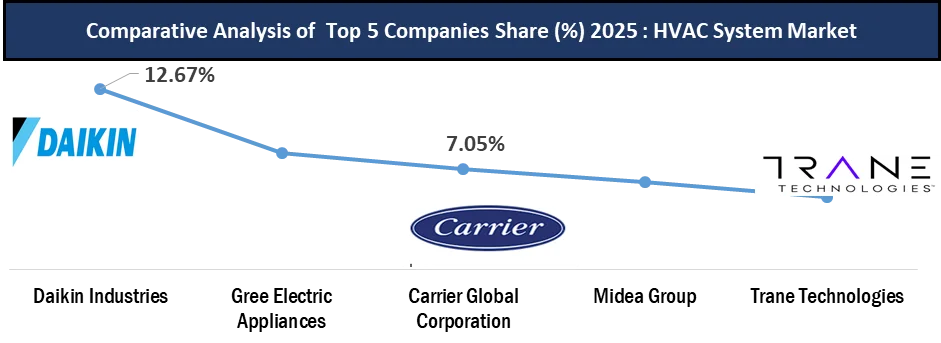

The HVAC System Market’s competitive landscape is defined by innovation, efficiency requirements, regional growth variations, and strategic service offerings. The ability to balance cost competitiveness with advanced technology solutions will determine market leadership in the coming years.

HVAC Industry News:

- February 2025: Carrier Ventures invested in ZutaCore, specializing in liquid cooling systems for data centers, enhancing cooling efficiency for high-density computing driven by AI growth.

- February 2025: Hisense launched variable refrigerant flow systems with advanced inverter technology, targeting energy efficiency for large commercial buildings.

|

HVAC System Market Scope |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 270.65 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

6.27% |

Market Size in 2032: |

USD 414.13 Billion |

|

HVAC System Market Segment Analysis |

By Product Type

|

|

|

|

By Implementation Type |

|

||

|

|

By Application |

|

|

HVAC System Market, by Region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN and Rest of APAC)

South America (Brazil, Argentina Rest of South America)

Middle East & Africa (South Africa, GCC, and Rest of ME&A)

HVAC System market Key Companies:

- Daikin Industries Ltd.

- Carrier Global Corporation

- Trane Technologies plc

- Johnson Controls International plc

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Midea Group

- Gree Electric Appliances Inc.

- Haier Smart Home Co. Ltd.

- Lennox International Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- Bosch Thermotechnology

- Siemens AG

- Danfoss Group

- Schneider Electric SE

- Hitachi Ltd.

- Fujitsu General Limited

- Toshiba Corporation

- Nortek Air Management

- Rheem Manufacturing Company

- York (Johnson Controls brand)

- Electrolux AB

- Whirlpool Corporation

- Ferroli Group

- Modine Manufacturing Company

- Ingersoll Rand

- Systemair AB

Frequently Asked Questions

Asia Pacific is projected to hold the largest share because of the increasing spending on infrastructure and construction projects.

The market size of the HVAC System Market by 2032 is USD 414.13 billion

The HVAC System Market is expected to grow at a CAGR of 6.27 % during 2025–2032.

Leading manufacturers include Daikin Industries Ltd., Carrier Global Corporation, Midea Group, Trane Technologies plc, Johnson Controls and others

1. HVAC System Market: Executive Summary

1.1. Executive Summary

1.1.1. Market Size (2025) & Forecast (2026-2032)

1.1.2. Market Size (by Value in USD Billion & Volume in 000 Units) - By Segments, Regions, and Country

2. HVAC System Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Positioning of Key Players

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Headquarter

2.3.3. Product Segment

2.3.4. End User Segment

2.3.5. Implementation Type

2.3.6. Total Company Revenue (2024)

2.3.7. Market Share (%)

2.3.8. Profit Margin (%)

2.3.9. Growth Rate (%)

2.3.10. Integration Capabilities

2.3.11. Geographical Presence

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

2.6. Global vs. Regional Players Comparative Analysis

2.7. Leading Global Food Processing and Handling Equipment Manufacturers

2.8. Emerging Regional Players & Localized Manufacturers

3. HVAC System Market: Dynamics

3.1. HVAC System Market Trends

3.2. HVAC System Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Key Opinion Leader Analysis for the HVAC System Market

3.6. Analysis of Government Schemes and Support for the Industry

3.7. Regulatory Framework & Compliance Landscape

3.8. Supply Chain Analysis

4. HVAC System Market Demand Analysis HVAC System Market

4.1. Regional Demand Analysis for HVAC Systems (2025–2032)

4.2. Demand for HVAC Systems in Key Industrial Sectors

4.3. Residential vs Commercial HVAC System Demand Trends

4.4. Impact of Energy Efficiency Regulations on HVAC System Demand

4.5. Influence of Sustainability Initiatives on HVAC System Market Demand

5. HVAC System Market Trade Analysis (2025)

5.1. Global Import and Export Volumes of HVAC System by Region

5.2. Major Exporting and Importing Countries for Industrial HVAC System

5.3. Trade Regulations, Industrial Standards, and Certification Requirements

5.4. Global Trade Flow Mapping and Value Chain Shifts

5.5. Impact of Supply Chain Disruptions on HVAC System Availability

6. HVAC System Market Pricing Analysis (2025)

6.1. Average Pricing Trends for HVAC Systems in 2025

6.2. Regional Pricing Analysis of HVAC Systems (2025)

6.3. Price Comparison: Heating Equipment, Cooling Equipment, and Ventilation Equipment

6.4. Pricing Strategies of Key Players in the HVAC System Market

6.5. Factors Affecting HVAC System Prices: Raw Materials, Labor, and Regulations

6.6. Pricing Impact of Sustainability and Energy Efficiency Regulations

6.7. Influence of Global Supply Chain on HVAC System Pricing (2025)

6.8. Pricing Forecast for Industrial vs Residential HVAC Systems

7. HVAC System Market Supply Chain & Manufacturing Insights

7.1. Overview of the Global HVAC System Supply Chain Structure

7.2. Key Raw Materials and Components in HVAC System Manufacturing

7.3. Regional Manufacturing Hubs and Footprint in HVAC System Production

7.4. Technological Advancements and Automation in HVAC Manufacturing

7.5. Optimization Strategies in HVAC System Inventory Management and Logistics

7.6. Impact of Global Supply Chain Disruptions on HVAC System Availability

7.7. Localization and Near-Shoring Trends in HVAC System Manufacturing

7.8. Sustainability Practices in HVAC System Manufacturing Processes

7.9. Tiered Supplier Ecosystem and Supplier Integration in HVAC Manufacturing

7.10. Cost Structure Dynamics and Pricing Trends in HVAC System Manufacturing

8. HVAC System Market End-User & Buyer Insights

8.1. Key End-Users in the HVAC System Market: Residential, Commercial, and Industrial

8.2. Buyer Preferences and Trends in HVAC System Purchases

8.3. Factors Influencing Buyer Decisions: Cost, Efficiency, and Sustainability

8.4. Buyer Demand for Energy-Efficient and Smart HVAC Systems

8.5. Impact of Environmental Regulations on Buyer Behaviour

9. HVAC System Market Technology & Innovation Trends

9.1. Smart HVAC Systems and IoT Integration

9.2. AI and Machine Learning in HVAC Control and Predictive Maintenance

9.3. Advanced Energy?Efficient Technologies (Heat Pumps, Inverter Drives)

9.4. Integration with Building Management Systems (BMS) and Smart Buildings

9.5. Next?Generation Refrigerants and Low?GWP Solutions

9.6. Digital Twins and Simulation Tools for HVAC Design & Optimization

10. HVAC System Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000 Units) (2025-2032)

10.1. HVAC System Market Size and Forecast, By Product Type (2025-2032)

10.1.1. Heating Equipment

10.1.1.1. Heat Pumps

10.1.1.2. Furnaces

10.1.1.3. HVAC Systems

10.1.1.4. Unitary Heaters

10.1.2. Cooling Equipment

10.1.2.1. Unitary Air Conditioners

10.1.2.2. VRF Systems

10.1.2.3. Chillers

10.1.2.4. Room Air Conditioner

10.1.2.5. Coolers

10.1.2.6. Cooling Towers

10.1.3. Ventilation Equipment

10.1.3.1. Air-Handling Units

10.1.3.2. Air Filters

10.1.3.3. Dehumidifiers

10.1.3.4. Ventilation Fans

10.1.3.5. Humidifiers

10.1.3.6. Air Purifiers

10.2. HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

10.2.1. New Construction

10.2.2. Retrofit

10.3. HVAC System Market Size and Forecast, By Application (2025-2032)

10.3.1. Residential

10.3.2. Commercial

10.3.3. Industrial

10.4. HVAC System Market Size and Forecast, By Region (2025-2032)

10.4.1. North America

10.4.2. Europe

10.4.3. Asia Pacific

10.4.4. Middle East and Africa

10.4.5. South America

11. North America HVAC System Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000 Units) (2025-2032)

11.1. HVAC System Market Size and Forecast, By Product Type (2025-2032)

11.1.1. Heating Equipment

11.1.1.1. Heat Pumps

11.1.1.2. Furnaces

11.1.1.3. HVAC Systems

11.1.1.4. Unitary Heaters

11.1.2. Cooling Equipment

11.1.2.1. Unitary Air Conditioners

11.1.2.2. VRF Systems

11.1.2.3. Chillers

11.1.2.4. Room Air Conditioner

11.1.2.5. Coolers

11.1.2.6. Cooling Towers

11.1.3. Ventilation Equipment

11.1.3.1. Air-Handling Units

11.1.3.2. Air Filters

11.1.3.3. Dehumidifiers

11.1.3.4. Ventilation Fans

11.1.3.5. Humidifiers

11.1.3.6. Air Purifiers

11.2. HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

11.2.1. New Construction

11.2.2. Retrofit

11.3. HVAC System Market Size and Forecast, By Application (2025-2032)

11.3.1. Residential

11.3.2. Commercial

11.3.3. Industrial

11.4. North America HVAC System Market Size and Forecast, by Country (2025-2032) (by Value in USD Billion & Volume in 000 Units)

11.4.1. United States

11.4.1.1. United States HVAC System Market Size and Forecast, By Product Type (2025-2032)

11.4.1.2. United States HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

11.4.1.3. United States HVAC System Market Size and Forecast, By Application (2025-2032)

11.4.2. Canada

11.4.2.1. Canada HVAC System Market Size and Forecast, By Product Type (2025-2032)

11.4.2.2. Canada HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

11.4.2.3. Canada HVAC System Market Size and Forecast, By Application (2025-2032)

11.4.3. Mexico

11.4.3.1. Mexico HVAC System Market Size and Forecast, By Product Type (2025-2032)

11.4.3.2. Mexico HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

11.4.3.3. Mexico HVAC System Market Size and Forecast, By Application (2025-2032)

12. Europe HVAC System Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000 Units) (2025-2032)

12.1. Europe HVAC System Market Size and Forecast, By Product Type (2025-2032)

12.2. Europe HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

12.3. Europe HVAC System Market Size and Forecast, By Application (2025-2032)

12.4. Europe HVAC System Market Size and Forecast, By Country (2025-2032)

12.4.1. United Kingdom

12.4.2. France

12.4.3. Germany

12.4.4. Italy

12.4.5. Spain

12.4.6. Sweden

12.4.7. Russia

12.4.8. Rest of Europe

13. Asia Pacific HVAC System Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000 Units) (2025-2032)

13.1. Asia Pacific HVAC System Market Size and Forecast, By Product Type (2025-2032)

13.2. Asia Pacific HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

13.3. Asia Pacific HVAC System Market Size and Forecast, By Application (2025-2032)

13.4. Asia Pacific HVAC System Market Size and Forecast, by Country (2025-2032)

13.4.1. China

13.4.2. S Korea

13.4.3. Japan

13.4.4. India

13.4.5. Australia

13.4.6. Indonesia

13.4.7. Malaysia

13.4.8. Philippines

13.4.9. Thailand

13.4.10. Vietnam

13.4.11. Rest of Asia Pacific

14. Middle East and Africa HVAC System Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000 Units) (2025-2032)

14.1. Middle East and Africa HVAC System Market Size and Forecast, By Product Type (2025-2032)

14.2. Middle East and Africa HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

14.3. Middle East and Africa HVAC System Market Size and Forecast, By Application (2025-2032)

14.4. Middle East and Africa HVAC System Market Size and Forecast, By Country (2025-2032)

14.4.1. South Africa

14.4.2. GCC

14.4.3. Nigeria

14.4.4. Rest of ME&A

15. South America HVAC System Market Size and Forecast by Segmentation (by Value in USD Billion & Volume in 000 Units) (2025-2032)

15.1. South America HVAC System Market Size and Forecast, By Product Type (2025-2032)

15.2. South America HVAC System Market Size and Forecast, By Implementation Type (2025-2032)

15.3. South America HVAC System Market Size and Forecast, By Application (2025-2032)

15.4. South America HVAC System Market Size and Forecast, By Country (2025-2032)

15.4.1. Brazil

15.4.2. Argentina

15.4.3. Colombia

15.4.4. Chile

15.4.5. Rest of South America

16. Company Profile: Key Players

16.1. Daikin Industries Ltd.

16.1.1. Company Overview

16.1.2. Business Portfolio

16.1.3. Financial Overview

16.1.4. SWOT Analysis

16.1.5. Strategic Analysis

16.1.6. Recent Developments

16.2. Carrier Global Corporation

16.3. Trane Technologies plc

16.4. Johnson Controls International plc

16.5. LG Electronics Inc.

16.6. Mitsubishi Electric Corporation

16.7. Panasonic Holdings Corporation

16.8. Samsung Electronics Co. Ltd.

16.9. Midea Group

16.10. Gree Electric Appliances Inc.

16.11. Haier Smart Home Co. Ltd.

16.12. Lennox International Inc.

16.13. Honeywell International Inc.

16.14. Emerson Electric Co.

16.15. Bosch Thermotechnology

16.16. Siemens AG

16.17. Danfoss Group

16.18. Schneider Electric SE

16.19. Hitachi Ltd.

16.20. Fujitsu General Limited

16.21. Toshiba Corporation

16.22. Nortek Air Management

16.23. Rheem Manufacturing Company

16.24. York (Johnson Controls brand)

16.25. Electrolux AB

16.26. Whirlpool Corporation

16.27. Ferroli Group

16.28. Modine Manufacturing Company

16.29. Ingersoll Rand

16.30. Systemair AB

17. Key Findings

18. Analyst Recommendations

19. HVAC System Market: Research Methodology