Disposable E-cigarettes Market- Global Industry Analysis and Forecast (2025-2032)

The Disposable E-cigarettes Market size was valued at USD 6.46 Bn. in 2024 and the total Global Disposable E-cigarettes revenue is expected to grow at a CAGR of 11.42 % from 2025 to 2032, reaching nearly USD 15.34 Bn. by 2032.

Format : PDF | Report ID : SMR_1732

Disposable E-cigarettes Market Overview:

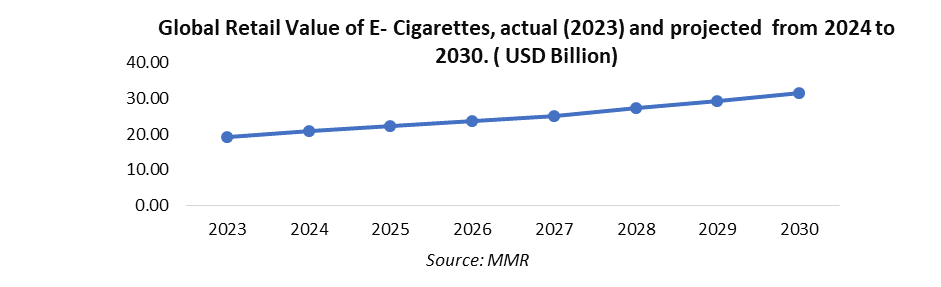

The rising awareness about safer alternatives to tobacco consumption has stimulated the adoption of e-cigarettes including disposable e-cigarettes across the globe. Additionally, the increasing availability of disposable cigarettes in different types and flavors is expected to drive the growth of the market. Disposable e-cigarettes have changed dramatically between 2018 and 2022, quintupling in volume capacity, nearly tripling in average nicotine strength, and falling in average per milliliter price of e-liquid by nearly 70%. The shift in the e-cigarette marketplace towards disposables has been partially brought about by the FDA’s policy prioritizing enforcement against most flavored closed cartridge-based e-cigarettes that exempted disposable e-cigarettes. The regulatory action provided consumers with a plethora of product choices and the market with competition, and the findings of this paper exemplify how e-cigarette manufacturers responded in an under-regulated market.

The report on the Global Disposable Electronic Cigarettes Market provides a comprehensive market analysis. It provides insights into the current and future market trends, along with an overview of the major regional markets and their respective growth prospects. The report offers an in-depth assessment of the key market drivers and restraints, opportunities and challenges faced by the vendors, and the competitive landscape that helps the stakeholders make the right decisions to maximize their returns.

- From February 2, 2020, to March 26, 2023, disposable e-cigarette sales increased by 196.2% (4.0 million units to 11.9 million units); their unit share increased from 25.8% to 53.4% of total e-cigarette sales. As of March 26, 2023, 80.0% of disposable sales were of flavors other than tobacco, mint, and menthol.

- Among youth who used e-cigarettes in 2022, 55.3% used disposable e-cigarettes. The most commonly used flavors of disposable e-cigarettes were fruit (69.1%) and candy/desserts/other sweets (311.42%) (NYTS).

To get more Insights: Request Free Sample Report

Disposable E-cigarettes Market Dynamics:

Cost Concerns, Convenience, and Flavor Variety to Drive the Growth of the Disposable E-cigarettes Market

Disposable e-cigarettes are less expensive than e-cigarettes, Concerned about costs is driving the Disposable e-cigarette market. The allure of disposable vapes lies in their simplicity and convenience. Users appreciate the ready-to-use nature of disposable vapes, which require no maintenance or setup. Their compact size and lightweight design make them ideal for on-the-go vaping. Additionally, disposable vapes often come in a variety of flavors, catering to diverse preferences is also drives the Disposable e-cigarette market. The convenience of shopping for different products, flavors, and forms of e-cigarettes including disposable products such as vaping in a single place is the primary driving force for consumers to visit nearby stores including supermarkets, hypermarkets, convenience stores, and others.

Challenges and Regulatory Restrictions of Disposable E-cigarettes in Global Markets

Limited battery life and the inability to be customized like traditional e-cigarettes, pose a challenge for the manufactures. Antigua and Barbuda to Uruguay, and Argentina to Sri Lanka, a growing number of countries have implemented bans on disposable vapes, reflecting a global shift towards sustainability and public health awareness. Among the nations are Bhutan, Brazil, Cambodia, and China, where stringent measures are in place to curb the environmental impact. The list extends to East Timor, Ethiopia, Gambia, and Hong Kong, among others, highlighting the widespread adoption of regulatory measures to address the challenges posed by disposable vapes.

Disposable E-cigarettes Market Segment Analysis:

The offline distribution channel dominated the market share in 2024. The convenience of shopping for different products, flavors, and forms of e-cigarettes including disposable products such as vaping in a single place is the primary driving force for consumers to visit nearby stores including supermarkets, hypermarkets, convenience stores, and others. Easy accessibility of e-cigarette stores and vape shops to try out and test the devices before making a purchase decision is expected to drive the segment growth through the forecast period.

Sainsbury's, the second prominent chain of supermarkets in the United Kingdom offers disposable vape - Aqua Vape Smok Disposable Mbar Pro in the flavor of Mango Ice.

Disposable E-cigarettes Market Regional Analysis:

North America held the largest share in 2024 for the Disposable e-cigarette market. There are hundreds of independent e-cigarette companies, thousands of “vape shops,” and many online retailers, leading to a wide variety of product characteristics, including ingredients and nicotine content. A large proportion of e-cigarettes in the U.S. market are imported. Disposable e-cigarettes sold in the USA have nearly tripled in nicotine strength, quintupled in e-liquid capacity, and dropped in price by nearly 70%. The current generation of disposable e-cigarettes in the USA contains nicotine levels comparable to several cartons of cigarettes.

Asia Pacific is the fastest-growing region through the forecast period. Five out of the global top 10 cigarette markets are located in Asia Pacific, including China, Indonesia, Japan, Vietnam, and Bangladesh. The top 10 brands in the region were Chinese brands, taking advantage of the large size of the local market.

Disposable vapes pick up pace, and stricter rules are being considered, especially in Europe. The chance of changing vaping laws for disposable vapes is growing, as authorities see the need to address environmental worries. Countries like Australia, France, and the United Kingdom are already moving to ban disposable vapes, possibly inspiring other European nations to do the same soon. In France, the National Assembly has unanimously approved a bill to ban single-use disposable electronic cigarettes. The legislation, driven by concerns over youth appeal and environmental impact, potentially taking effect by September 2024.

Disposable E-cigarettes Market Competitive Landscape:

- In January 2024, in Australia, authorities are taking decisive action to end recreational vaping, starting with a phased ban on disposable vapes. From January 1, 2024, imports of disposable vapes are prohibited, with a complete ban on non-therapeutic vapes, including refillable devices, to follow in March.

- In August 2023, Quebec's health minister announced the ban on vaping products with a flavor or aroma other than tobacco. The government also be limiting the maximum nicotine concertation of all vaping products and their packaging and it also regulate some aspects of vaping products that make them more appealing to young clients.

- In June 2023, Altria divested its proprietary e-cigarette brand to JUUL Labs and ceased production of its e-cigarette line to prioritize the pursuit of more compelling reduced-risk tobacco product opportunities.

- In June 2023, Imperial Brands plc announced its acquisition of nicotine pouches from TJP Labs, marking its entry into the U.S. oral market. This strategic move empowers ITG Brands, the company’s U.S. arm, to introduce 14 distinct product variants housed in a pouch format that has shown strong performance in consumer trials.

Disposable E-cigarettes Market Scope:

|

Disposable E-cigarettes Market |

|

|

Market Size in 2024 |

USD 6.46 Bn. |

|

Market Size in 2032 |

USD 15.34 Bn. |

|

CAGR (2025-2032) |

11.42 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Flavor tobacco Non-tobacco |

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Disposable E-cigarettes Market key players:

- Altria Group Inc.

- Japan Tobacco Inc.

- British American Tobacco PLC

- Philip Morris International Inc.

- JUUL Labs, Inc.

- Shenzhen iSmoka Electronics Co. Ltd.

- Hangsen Holding Co. Ltd.

- Vapor4Life, Inc.

- Geekvape

Frequently Asked Questions

Limited battery life is a Challenge for the market growth.

The Market size was valued at USD 6.46 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of5.11.42% from 2025 to 2032, reaching nearly USD 15.34 Billion.

The segments covered in the market report are By Flavor and Distribution Channel.

1. Disposable E-cigarettes Market: Research Methodology

2. Disposable E-cigarettes Market: Executive Summary

3. Disposable E-cigarettes Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Disposable E-cigarettes Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. Disposable E-cigarettes Market: Dynamics

6.1. Market Driver

6.1.1. Increasing Consumer Awareness

6.1.2. Innovation in Product Offerings

6.2. Market Trends by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Drivers by Region

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

6.4. Market Restraints

6.5. Market Opportunities

6.6. Market Challenges

6.7. PORTER’s Five Forces Analysis

6.8. PESTLE Analysis

6.9. Strategies for New Entrants to Penetrate the Market

6.10. Analysis of Government Schemes and Initiatives for the Disposable E-cigarettes Industry

6.11. Regulatory Landscape by Region

6.11.1. North America

6.11.2. Europe

6.11.3. Asia Pacific

6.11.4. Middle East and Africa

6.11.5. South America

7. Disposable E-cigarettes Market Size and Forecast by Segments (by Value Units)

7.1. Disposable E-cigarettes Market Size and Forecast, by Flavor (2024-2032)

7.1.1. Tobacco

7.1.2. Non-tobacco

7.2. Disposable E-cigarettes Market Size and Forecast, by Distribution Channel (2024-2032)

7.2.1. Online

7.2.2. Offline

7.3. Disposable E-cigarettes Market Size and Forecast, by Region (2024-2032)

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East and Africa

7.3.5. South America

8. North America Disposable E-cigarettes Market Size and Forecast (by value Units)

8.1. North America Disposable E-cigarettes Market Size and Forecast, by Flavor (2024-2032)

8.1.1. Tobacco

8.1.2. Non-tobacco

8.1.3. Others

8.2. North America Disposable E-cigarettes Market Size and Forecast, by Distribution Channel (2024-2032)

8.2.1. Online

8.2.2. Offline

8.3. North America Disposable E-cigarettes Market Size and Forecast, by Country (2024-2032)

8.3.1. United States

8.3.2. Canada

8.3.3. Mexico

9. Europe Disposable E-cigarettes Market Size and Forecast (by Value Units)

9.1. Europe Disposable E-cigarettes Market Size and Forecast, by Flavor (2024-2032)

9.1.1. Tobacco

9.1.2. Non-tobacco

9.2. Europe Disposable E-cigarettes Market Size and Forecast, by Distribution Channel (2024-2032)

9.2.1. Online

9.2.2. Offline

9.3. Europe Disposable E-cigarettes Market Size and Forecast, by Country (2024-2032)

9.3.1. UK

9.3.2. France

9.3.3. Germany

9.3.4. Italy

9.3.5. Spain

9.3.6. Sweden

9.3.7. Russia

9.3.8. Rest of Europe

10. Asia Pacific Disposable E-cigarettes Market Size and Forecast (by Value Units)

10.1. Asia Pacific Disposable E-cigarettes Market Size and Forecast, by Flavor (2024-2032)

10.1.1. Tobacco

10.1.2. Non-tobacco

10.2. Asia Pacific Disposable E-cigarettes Market Size and Forecast, by Distribution Channel (2024-2032)

10.2.1. Online

10.2.2. Offline

10.3. Asia Pacific Disposable E-cigarettes Market Size and Forecast, by Country (2024-2032)

10.3.1. China

10.3.2. S Korea

10.3.3. Japan

10.3.4. India

10.3.5. Australia

10.3.6. ASIAN

10.3.7. Rest of Asia Pacific

11. Middle East and Africa Disposable E-cigarettes Market Size and Forecast (by Value Units)

11.1. Middle East and Africa Disposable E-cigarettes Market Size and Forecast, by Flavor (2024-2032)

11.1.1. Tobacco

11.1.2. Non-tobacco

11.2. Middle East and Africa Disposable E-cigarettes Market Size and Forecast, by Distribution Channel (2024-2032)

11.2.1. Online

11.2.2. Offline

11.3. Middle East and Africa Starch-based bio plastics Market Size and Forecast, by Country (2024-2032)

11.3.1. South Africa

11.3.2. GCC

11.3.3. Egypt

11.3.4. Rest of ME&A

12. South America Starch-based bio plastics Market Size and Forecast (by Value Units)

12.1. South America Disposable E-cigarettes Market Size and Forecast, by Flavor (2024-2032)

12.1.1. Tobacco

12.1.2. Non-tobacco

12.2. South America Disposable E-cigarettes Market Size and Forecast, by Distribution Channel (2024-2032)

12.2.1. Online

12.2.2. Offline

12.3. South America Disposable E-cigarettes Market Size and Forecast, by Country (2024-2032)

12.3.1. Brazil

12.3.2. Argentina

12.3.3. Rest of South America

13. Company Profile: Key players

13.1. Altria Group Inc.

13.1.1. Company Overview

13.1.2. Financial Overview

13.1.3. Business Portfolio

13.1.4. SWOT Analysis

13.1.5. Business Strategy

13.1.6. Recent Developments

13.2. Japan Tobacco Inc.

13.3. British American Tobacco PLC

13.4. Philip Morris International Inc.

13.5. JUUL Labs, Inc.

13.6. Shenzhen iSmoka Electronics Co. Ltd.

13.7. Hangsen Holding Co. Ltd.

13.8. Vapor4Life, Inc.

13.9. Geekvape

14. Key Findings

15. Industry Recommendation