Cardiac Marker Testing Market: Global Industry Analysis and Forecast (2024-2030)

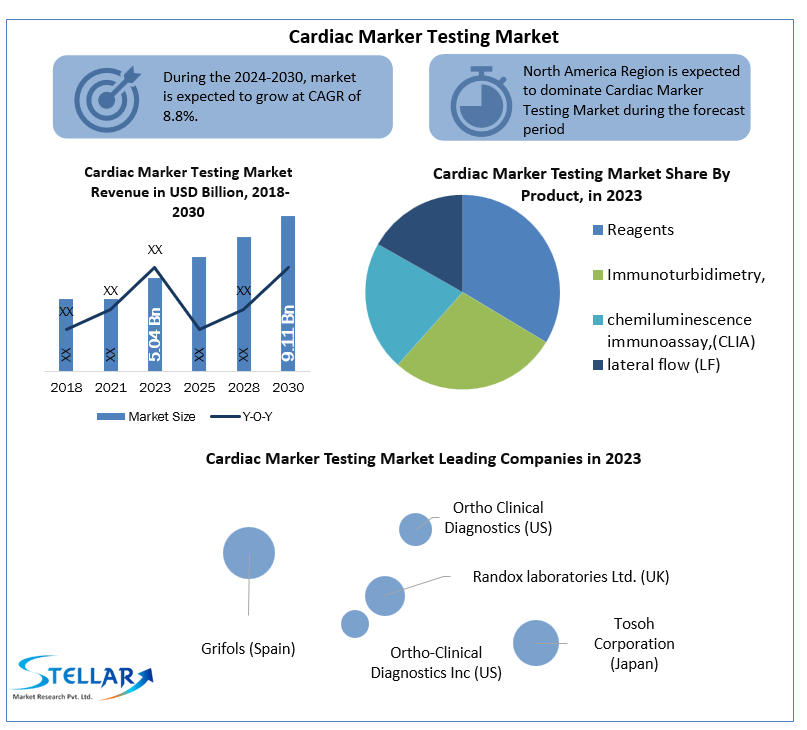

Cardiac Marker Testing Market was valued at USD 5.04 billion in 2023. Global Cardiac Marker Testing Market size is estimated to grow at a CAGR of 8.8 % over the forecast period.

Format : PDF | Report ID : SMR_1104

Cardiac Marker Testing Market Definition:

Cardiac Markers are used for diagnosis and risk stratification of patients with chest pain, for management and prognosis in patients with acute heart failure and suspected acute coronary syndrome. Up to 40% of patients with Acute Myocardial Infractions (AMI), fails in detection of AMI when the patient’s history and ECG are non-diagnostic, these cardiac makers testing in such cases enables the Clinician to rapidly diagnose and treat patients. These report covers the current available Cardiac marker testing of myocardial damage such as creatine kinase (CK) heart type fatty acid-building protein, cardiac troponin T, and Creatine kinase muscle and brain.

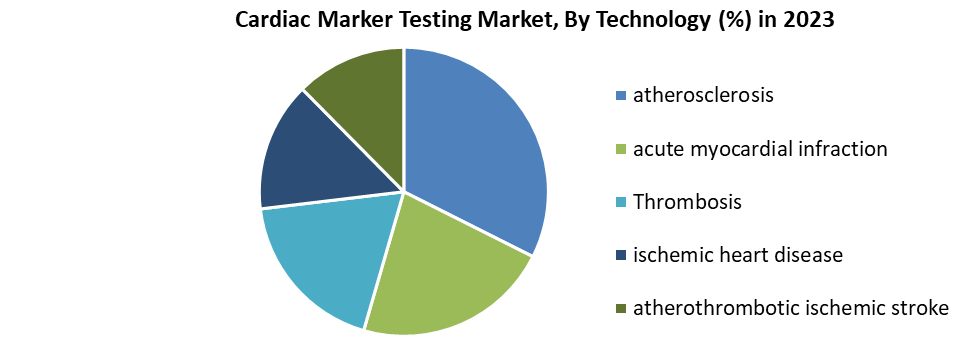

Further, the Cardiac Marker Testing market is segmented by Product, Age Group, Distribution Channel, and geography. On the basis of Product, the Cardiac Marker Testing market is segmented under Immunoturbidimetry, chemiluminescence immunoassay, (CLIA), lateral flow (LF) and florescence immunoassay (FIA), reagents and kits. Based on the Biomarker test, the Cardiac Marker Testing market is segmented Troponin (I or T), Creatine Kinase, hs-CRP, Myoglobin, Bnp or Nt-probnp. Based on the Disease, the Cardiac Marker Testing market is segmented under atherosclerosis, acute myocardial infraction, Thrombosis, ischemic heart disease, atherothrombotic ischemic stroke. By geography, the market covers the following Regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. For each segment, the market sizing and forecasts have been done on the basis of value (in USD Billion/Million).

To get more Insights: Request Free Sample Report

Cardiac Marker Testing Market Dynamics:

According to WHO the cardiovascular diseases are leading cause of death globally taking an estimated 17.9 million of death each year. The National Heart, Lung and Blood Institutes reports that 3, 39,076 people died from heart disease in US. These Growing incidence of the cardiovascular diseases has driven the market of Cardiac Marker testing, helping to determine person’s risks of having Acute Coronary syndrome and Cardiac ischemia conditions and to monitor and manage patients with suspected ACS and cardiac ischemia.

Proper handling and storage of biological samples with the goal of attaining large amount information from limited samples is required while diagnosing the samples. Strict quality control by the professionals are required while handling the samples .Lack of precise assays , limited standardization techniques, Improper storage of the biological samples can restrain the cardiac marker testing market.

Recent advances in cardiac markers testing from commercial devices to emerging technologies like cardiac troponin and natriuretic peptides and Point of care immunoassays has boosted the market. The assays specificity and reliability are improved by enabling the multiplexing through the detection of several molecular targets in single assays. Several companies have developed and continuing POC devices that are portable and capable of performing cardiac marker testing rapidly and with high sensitivity. The Field-Effect Transistor technology has several advantages including rapidity, high sensitivity on microfluidic platform. The growing demand for these technologies among many medical devices infrastructure hospitals, laboratory is likely to fuel the demand of the cardiac marker testing market over the forecasted period.

Cardiac Marker Testing Market Segment Analysis:

By Product, the 2023, global market for cardiac market was estimated at $1328.93 million, with annual growth of 5%the market for cardiac marker is forecasted to reach 2,164.69 million by 2030 Medix Biochemica Group is a global market leading supplier to the IVD industry. Availability due to wide range of Cardiac marker reagents and kits have a growing demand as these products are reliable specific and faster in detection of cardiovascular diseases in initial stages.

By Biomarker Test, The most widely Point-OF-Care (POC) test used by the physicians in labs, clinics are for cardiac markers. The 2019 worldwide market for POC immunoassays designed for self and professional use was $3,971 million. The US market accounts for 55%, the European market accounts for approximately 35%, Japan and Asia represent 5% and the rest of world accounts for the remaining 5% of the market. Troponin (I or T) is the most commonly used and most specific cardiac marker. They give precise results and are elevated (positive) within few hours of heart damage and remains elevated for up to two weeks. The newly developed Creatine Kinase has been largely replaced by troponin and are used to detect a second heart attack that occurs shortly after first. Other cardiac marker test includes hs-CRP, Myoglobin, Bnp or Nt-probnp. The lead cardiac marker Troponin ck-mb estimates the total market of acute cardiac markers care of about US $8 billion.

By Diseases, Acute Coronary syndrome (ACS) is a leading cause if the deaths in UNITED STATES and accounts for 700 hospital discharges annually. Cardiac marker has been a powerful tool to rapidly detect the myocardial necrosis. Increasing sensitive assays for cardiac markers have enabled their use in the emergency department for early diagnosis of ACS. The discovery of cardiac markers has played an essential role in Clinical research, in detecting various CVD diseases like atherosclerosis, acute myocardial infraction, Thrombosis, ischemic heart disease, atherothrombotic ischemic stroke in order to significantly reduce the morbidity and mortality associated with cardiovascular events and improve prognosis.

Cardiac Marker Testing Market Regional Insights:

North America has largest market due to increasing incidence of cardiovascular diseases, followed by china which had the highest number of the heart disease patients last year, followed by India Russia, Inonesia.The heart disease cases nearly doubled over the period causing 9.6 million deaths among men and 8.9 million deaths among women globally. Due to strong investment in R&D, the presence of large manufacturers and the accessibility of their products, as well as the region's well-established healthcare infrastructure, North America dominates the industry. On the other hand, Asia-Pacific is anticipated to experience a quick and profitable growth rate during the forecast period due to the rise in cardiovascular disease cases and the expansion of public-private initiatives to raise awareness among patients and medical professionals about the importance of early diagnosis.

Cardiac Marker Testing Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Global Cardiac Marker Testing market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Cardiac Marker Testing market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Global Cardiac Marker Testing Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Cardiac Marker Testing market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Cardiac Marker Testing market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Global Cardiac Marker Testing market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Global Cardiac Marker Testing market. The report also analyses if the Global Cardiac Marker Testing market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Cardiac Marker Testing market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Global Cardiac Marker Testing market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Global Cardiac Marker Testing market is aided by legal factors.

Cardiac Marker Testing Market Scope:

|

Cardiac Marker Testing Market |

|

|

Market Size in 2023 |

USD 5.04 Bn. |

|

Market Size in 2030 |

USD 9.11 Bn. |

|

CAGR (2024-2030) |

8.8% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Product

|

|

By Biomarker Test

|

|

|

By Diseases

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Cardiac Marker Testing Market Key Players:

- Ortho Clinical Diagnostics (US)

- Randox laboratories Ltd. (UK)

- Guangzhou Wondfo Biotech Co., Ltd (China)

- Tosoh Corporation (Japan)

- Roche Diagnostics Ltd. (Switzerland)

- Abbott Laboratories (US)

- Siemens Healthineers AG (Germany)

- DiaSorin S.p.A. (Italy)

- Becton, Dickinson and Company (US)

- Bio-Rad Laboratories, Inc. (US)

- PerkinElmer Inc. (US)

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- bioMérieux SA (France)

- LSI Medience Corporation (Japan)

Frequently Asked Questions

North America region is expected to hold the highest share in the Cardiac Marker Testing Market.

The market size of the Cardiac Marker Testing Market by 2030 is expected to reach USD 9.11 Billion.

The forecast period for the Cardiac Marker Testing Market is 2024-2030.

The market size of the Cardiac Marker Testing Market in 2023was valued at USD 5.04 Billion.

1. Scope of the Report

2. Research Methodology

2.1. Research Process

2.2. Global Cardiac Marker Testing Market: Target Audience

2.3. Global Cardiac Marker Testing Market: Primary Research (As per Client Requirement)

2.4. Global Cardiac Marker Testing Market: Secondary Research

3. Executive Summary

4. Competitive Landscape

4.1. Market Share Analysis by Region in 2023(%)

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Stellar Competition matrix

4.2.1. Global Stellar Competition Matrix

4.2.2. North America Stellar Competition Matrix

4.2.3. Europe Stellar Competition Matrix

4.2.4. Asia Pacific Stellar Competition Matrix

4.2.5. South America Stellar Competition Matrix

4.2.6. Middle East and Africa Stellar Competition Matrix

4.3. Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

4.4. Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

4.5. Market Dynamics

4.6. Market Drivers

4.7. Market Restraints

4.8. Market Opportunities

4.9. Market Challenges

4.10. PESTLE Analysis

4.11. PORTERS Five Force Analysis

4.12. Value Chain Analysis

5. Global Cardiac Marker Testing Market Segmentation

5.1. Global Cardiac Marker Testing Market, by Region (2023-2030)

5.1.1. North America

5.1.2. Europe

5.1.3. Asia-Pacific

5.1.4. Middle East & Africa

5.1.5. South America

5.2. Global Cardiac Marker Testing Market, by Product (2023-2030)

5.2.1. Reagents

5.2.2. Immunoturbidimetry

5.2.3. Chemiluminescence immunoassay, (CLIA)

5.2.4. Lateral flow (LF)

5.2.5. Florescence immunoassay (FIA)

5.3. Global Cardiac Marker Testing Market, by Biomarker Test (2023-2030)

5.3.1. Troponin (I or T)

5.3.2. hs-CRP

5.3.3. Myoglobin

5.3.4. Bnp or Nt-probnp

5.4. Global Cardiac Marker Testing Market, by Diseases (2023-2030)

5.4.1. Atherosclerosis

5.4.2. Acute myocardial infraction

5.4.3. Thrombosis

5.4.4. Ischemic heart disease

5.4.5. Atherothrombotic ischemic stroke

6. North America Cardiac Marker Testing Market Segmentation

6.1. North America Cardiac Marker Testing Market, by Product (2023-2030)

6.1.1. Reagents

6.1.2. Immunoturbidimetry

6.1.3. Chemiluminescence immunoassay, (CLIA)

6.1.4. Lateral flow (LF)

6.1.5. Florescence immunoassay (FIA)

6.2. North America Cardiac Marker Testing Market, by Biomarkers Test (2023-2030)

6.2.1. Troponin (I or T)

6.2.2. hs-CRP

6.2.3. Myoglobin

6.2.4. Bnp or Nt-probnp

6.3. North America Cardiac Marker Testing Market, by Diseases (2023-2030)

6.3.1. Atherosclerosis

6.3.2. Acute myocardial infraction

6.3.3. Thrombosis

6.3.4. Ischemic heart disease

6.4.5. Atherothrombotic ischemic stroke

6.4. North America Toys Market, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Cardiac Marker Testing Market Segmentation

7.1. Europe Cardiac Marker Testing Market, by Product (2023-2030)

7.2. Europe Cardiac Marker Testing Market, by Biomarkers Test (2023-2030)

7.3. Europe Cardiac Marker Testing Market, by Distribution Channel (2023-2030)

7.4. Europe Cardiac Marker Testing Market, by Country (2023-2030)

8. Asia Pacific Cardiac Marker Testing Market Segmentation

8.1. Asia Pacific Cardiac Marker Testing Market, by Product (2023-2030)

8.2. Asia Pacific Cardiac Marker Testing Market, by Biomarkers Test (2023-2030)

8.3. Asia Pacific Cardiac Marker Testing Market, by Distribution Channel (2023-2030)

8.4. Asia Pacific Cardiac Marker Testing Market, by Country (2023-2030)

9. Middle East and Africa Cardiac Marker Testing Market Segmentation

9.1. Middle East and Africa Cardiac Marker Testing Market, by Product (2023-2030)

9.2. Middle East and Africa Cardiac Marker Testing Market, by Biomarkers Test (2023-2030)

9.3. Middle East and Africa Cardiac Marker Testing Market, by Distribution Channel (2023-2030)

9.4. Middle East and Africa Cardiac Marker Testing Market, by Country (2023-2030)

10. South America Cardiac Marker Testing Market Segmentation

10.1. South America Cardiac Marker Testing Market, by Product (2023-2030)

10.2. South America Cardiac Marker Testing Market, by Biomarkers Test (2023-2030)

10.3. South America Cardiac Marker Testing Market, by Distribution Channel (2023-2030)

10.4. South America Cardiac Marker Testing Market, by Country (2023-2030)

11. Company Profiles

11.1. Key Players

11.1.1. Roche Diagnostics Ltd. (Switzerland)

11.1.1.1. Company Overview

11.1.1.2. Product Portfolio

11.1.1.3. Financial Overview

11.1.1.4. Business Strategy

11.1.1.5. Key Developments

11.1.2. Ortho Clinical Diagnostics (US)

11.1.3. Randox laboratories Ltd. (UK)

11.1.4. Guangzhou Wondfo Biotech Co., Ltd (China)

11.1.5. Tosoh Corporation (Japan)

11.1.6. Roche Diagnostics Ltd. (Switzerland)

11.1.7. Abbott Laboratories (US)

11.1.8. Siemens Healthineers AG (Germany)

11.1.9. DiaSorin S.p.A. (Italy)

11.1.10. Becton, Dickinson and Company (US)

11.1.11. Bio-Rad Laboratories, Inc. (US)

11.1.12. PerkinElmer Inc. (US)

11.1.13. Thermo Fisher Scientific Inc. (US

12. Key Findings

13. Recommendations