Blood Culture Test Market: Global Industry Analysis and Forecast (2024-2030)

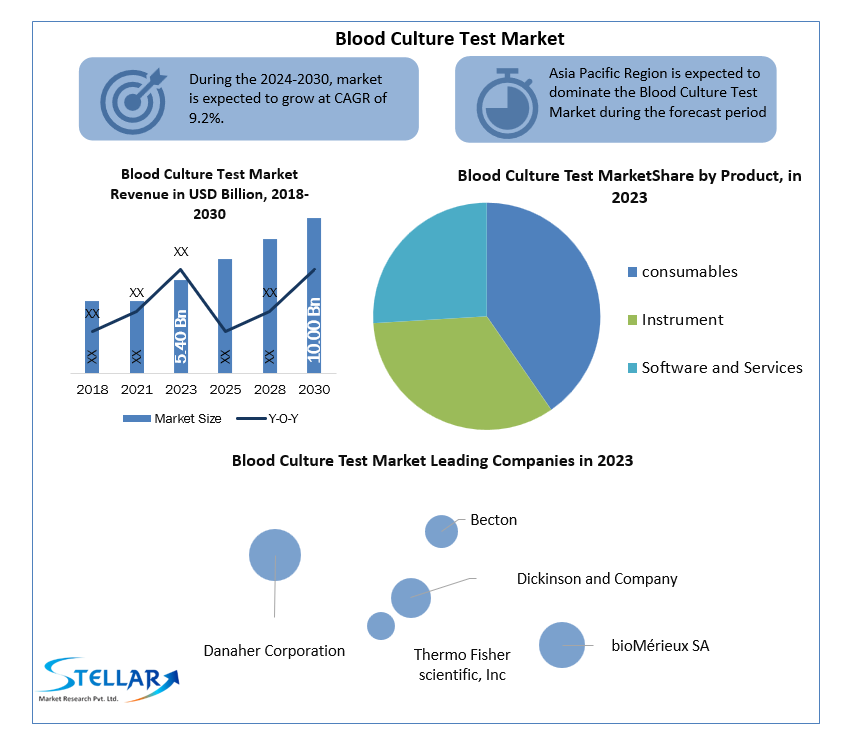

Blood Culture Test Market was valued at USD 5.40 billion in 2023. Global Blood Culture Test Market size is estimated to grow at a CAGR of 9.2 % over the forecast period.

Format : PDF | Report ID : SMR_1102

Blood Culture Test Market Definition:

Bloodstream infection (BSI) have substantial impact on mortality and morbidity. Blood cultures are the reference method for diagnosis of BSI. Manual methods for blood culturing remain the main method for detection of bloodstream infection in LMICs, Automated systems for blood culture incubation growth monitoring are used routinely in high-income countries.

A concerning study indicated that although 72% of COVID-19 patients received antimicrobial therapies, only 8% had confirmed bacterial/fungal coinfections during hospital admission. With more than 200 million confirmed cases of COVID-19 worldwide, these high rates of inappropriate antibiotic use have worrying implications for the growth of antimicrobial resistance. Without factoring in the effect of COVID-19, the growth of AMR is expected to result in a 25% increase in healthcare costs in low-income countries, versus a 6% increase in high-income countries by 2050. To address this AMR crisis, a wider access to blood culture in LMICs is urgently needed, as it is the first step to enable subsequent pathogen identification (ID) and antimicrobial susceptibility testing (AST) for improved antimicrobial stewardship and surveillance.

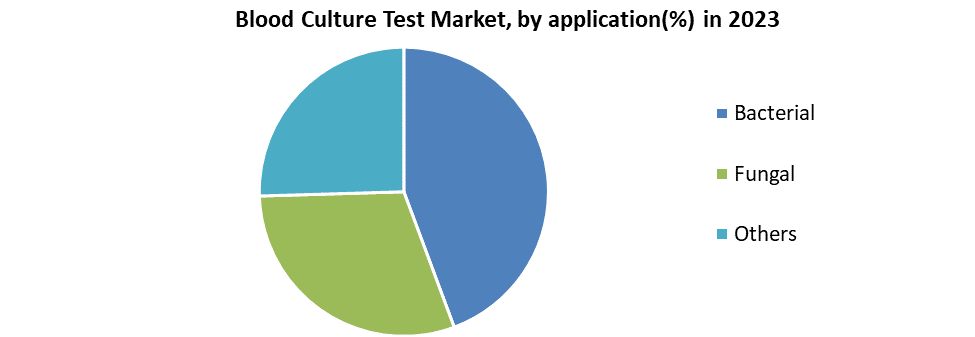

Further, the Blood Culture Test market is segmented by Product, Age Group, Distribution Channel, and geography. On the basis of Product, the Blood Culture Test market is segmented by Consumable, Instrument, Software and services. Based on the Technology the Blood Culture Test market is segmented under the Conventional and automated. Based on the Application, the Blood Culture Test market is segmented under the channels of Bacterial, Fungal, others. By geography, the market covers the following Regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. For each segment, the market sizing and forecasts have been done on the basis of value (in USD Billion/Million).

To get more Insights: Request Free Sample Report

Blood Culture Test Market Dynamics:

Bloodstream infection are serious infection associated with high morbidity and mortality. Globally, bloodstream infection affects about 30million people leading to 6 million deaths with 3 million new-borns and 1.2million children suffering from sepsis annually. In Eastern African countries the proportion of the bloodstream infection is reported to range from 12 % to 19%. The World Health Organization (WHO) estimates that there are roughly 250,000 cases of BSIs in the United States each year, and that 80,000 of those cases include catheters. Hospitals and clinical diagnostics laboratories therefore have a strong demand for sophisticated products for the detection of bacterial, fungal, and mycobacterial illnesses. Sepsis, BSIs, and increasing rates of infectious diseases are predicted to be the key market growth drivers

Blood culture test can sometime be subjected to false errors. The Blood culture can become contaminated with microorganisms from environment, which can multiply inside the cell culture. Giving false impression that those organisms present in the blood. Automated blood culture equipment is more expensive since it has more sophisticated features and functions. Automated tools like the PCR cost between US$10,000 and US$15,000, and MALDI-TOF MS systems cost between US$150,000 and US$850,000. Due to their restricted funding, academic research facilities typically cannot afford such expensive systems. The overall cost of ownership of these instruments also rises as a result of the maintenance charges and numerous other indirect expenses. This is a significant barrier to automated blood culture instrument adoption, particularly among small-scale end users.

With the implementation of substantial test menu and automation advancements as well as the introduction of more than 70 new tests, LCD maintained its focus on scientific innovation and leadership in 2018. Through licencing agreements, acquisitions, and internal development, LCD is concentrated on the extension of current molecular diagnostics projects as well as the launch of novel assays and test platforms.

Scientists, academic institutions, and researchers are working on a number of R&D initiatives. For instance, a study carried out at the University of Nebraska Medical Centre in May 2017 discovered that a revolutionary blood-drawing method could reduce culture contamination (UNMC). 1,808 blood cultures and 904 participant patients from the emergency room were included in the study. Magnolia Medical Technologies created SteriPath, a product that the Food and Drug Administration (FDA) has deemed safe and effective. According to the study, it might decrease antibiotic use while also bringing down healthcare expenditures.

Blood Culture Test Market Segment Analysis:

By Product, Due to the rise in demand for blood culture media, assays, kits, and reagents, the consumables segment dominated the global blood culture test market in 2023 and is predicted to do so again throughout the projected period. The instrument segment, however, is anticipated to increase significantly during the projection period. This is explained by the fact that equipment utilised in hospitals and diagnostic labs enables quick results and great accuracy for bacterial and fungal detection. In 2018, LCD continued its emphasis on scientific innovation and leadership with the introduction of significant test menu and automation enhancements and by launching more than 70 new tests. LCD is focused on the expansion of existing programs in molecular diagnostics as well as the introduction of new assays and assay platforms through licensing partnerships, acquisitions and internal development. The BIOFIRE Blood Culture identification enables rapid and accurate automated detection of pathogens and antibiotic resistance genes associated with the bloodstream infection.

By technology, The global alliance for diagnostic is leading a request for protocols (REP) to accelerate the development of innovative solutions for simplified and improved blood culture technologies. A budget envelops of USD$0.5to $1.5 million is available to support applicants to advance development technologies that meet a set of predefined key product requirements. The market is anticipated to expand as a result of rising demand for cutting-edge diagnostic tools including microarray, PCR, and Peptide Nucleic Acid—Fluorescent in Situ Hybridization (PNA-FISH). The PNA-FISH technology sub-segment is anticipated to grow at the highest CAGR during the forecast period as a result of its benefits, including improved accuracy, shorter test times, and increased test specificity. The demand for blood culture testing has increased as a result of expanding healthcare infrastructure and rising disposable income in the Asia Pacific and MEA region. Additionally, it is anticipated that increased government initiatives to provide healthcare facilities of higher quality, along with the accessibility of new technologies, will increase the use of these tests.

By Application, The bacterial infection is one of the main causes of bloodstream infection and sepsis, the bacterial sector experienced the largest increase in 2019 and is expected to continue to lead in the near future. However, because sepsis and bloodstream infections are becoming more commonplace worldwide, the fungal category is anticipated to have significant expansion during the projected period. As BSIs are common and sepsis cases are increasing globally, the fungal infections market is expected to increase profitably over the study period. For instance, Candida species are the main causative agents of fungal sepsis, which accounts for 15% to 20% of infections associated to healthcare.

Blood Culture Test Market Regional Insights:

Due to the rising frequency of bloodstream infections and the region's advanced healthcare infrastructure, North America accounted for a significant portion of the global market for blood culture tests in 2019 and is predicted to continue dominating the sector throughout the projected period. The market is also expanding as a result of increased consumer knowledge and acceptance of novel diagnostic techniques, robust economic expansion, and rising demand for cutting-edge medical facilities. The market for blood culture tests is also expanding due to an increase in R&D efforts to create novel blood culture tests and the presence of key competitors operating in the area.

The availability of cutting-edge diagnostics products and the presence of highly developed healthcare infrastructure in European nations like Germany, the U.K., Switzerland, and France are expected to fuel market growth in Europe. Additionally, manufacturers' increasing R&D expenditures for the creation of new products are anticipated to fuel growth.

Blood Culture Test Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Global Blood Culture Test market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Blood Culture Test market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Global Blood Culture Test Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Blood Culture Test market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Blood Culture Test market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Global Blood Culture Test market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Global Blood Culture Test market. The report also analyses if the Global Blood Culture Test market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Blood Culture Test market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Global Blood Culture Test market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Global Blood Culture Test market is aided by legal factors.

Blood Culture Test Market Scope:

|

|

|

|

Market Size in 2023 |

USD 5.40 Bn. |

|

Market Size in 2030 |

USD10.00 Bn. |

|

CAGR (2024-2030) |

9.2 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

|

by Product

|

|

|

by application

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Blood Culture Test Market Key Players:

- Becton

- Dickinson and Company

- bioMérieux SA

- Thermo Fisher scientific, Inc

- Danaher Corporation

- Luminex Corporation

- Roche

- BrU.K.er Corporation

- Abbott Laboratories.

- Labcorp

Frequently Asked Questions

North America region is expected to hold the highest share in the Blood Culture Test Market.

The market size of the Blood Culture Test Market by 2030 is expected to reach USD 10.00 Billion.

The forecast period for the Blood Culture Test Market is 2024-2030.

The market size of the Blood Culture Test Market in 2023 was valued at USD 5.40 Billion.

- Scope of the Report

- Research Methodology

- Research Process

- Global Blood Culture Test Market: Target Audience

- Global Blood Culture Test Market: Primary Research (As per Client Requirement)

- Global Blood Culture Test Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2023 (%)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- South America Stellar Competition Matrix

- Middle East and Africa Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2023 (%)

- Global Blood Culture Test Market Segmentation

- Global Blood Culture Test Market, by region (2023-2030)

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- Global Blood Culture Test Market, by Product (2023-2030

- consumables

- Instrument

- Software and Services

- Global Blood Culture Test Market, by Technology (2023-2030

- Conventional

- Automated

- Global Blood Culture Test Market, by Application (2023-2030

- Bacterial

- Fungal

- Others

- Global Blood Culture Test Market, by region (2023-2030)

- North America Blood Culture Test Market Segmentation

- North America Blood Culture Test Market, by Product (2023-2030

- consumables

- Instrument

- Software and Services

- North America Blood Culture Test Market, by Technology (2023-2030

- Conventional

- Automated

- North America Blood Culture Test Market, by Application (2023-2030

- Bacterial

- Fungal

- Others

- North America Toys Market, by Country (2023-2030

- United States

- Canada

- Mexico

- North America Blood Culture Test Market, by Product (2023-2030

- Europe Blood Culture Test Market Segmentation

- Europe Blood Culture Test Market, by Product (2023-2030

- Europe Blood Culture Test Market, by Technology (2023-2030

- Europe Blood Culture Test Market, by Application (2023-2030

- Europe Blood Culture Test Market, by Country (2023-2030

- Asia Pacific Blood Culture Test Market Segmentation

- Asia Pacific Blood Culture Test Market, by Product (2023-2030

- Asia Pacific Blood Culture Test Market, by Technology (2023-2030

- Asia Pacific Blood Culture Test Market, by Application (2023-2030

- Asia Pacific Blood Culture Test Market, by Country (2023-2030

- Middle East and Africa Blood Culture Test Market Segmentation

- Middle East and Africa Blood Culture Test Market, by Product (2023-2030

- Middle East and Africa Blood Culture Test Market, by Technology (2023-2030

- Middle East and Africa Blood Culture Test Market, by Application (2023-2030

- Middle East and Africa Blood Culture Test Market, by Country (2023-2030

- South America Blood Culture Test Market Segmentation

- South America Blood Culture Test Market, by Product (2023-2030

- South America Blood Culture Test Market, by Technology (2023-2030

- South America Blood Culture Test Market, by Application (2023-2030

- South America Blood Culture Test Market, by Country (2023-2030

- Company Profiles

- Key Players

- Thermo Fisher scientific, Inc

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Becton

- Dickinson and Company

- bioMérieux SA

- Thermo Fisher scientific, Inc

- Danaher Corporation

- Luminex Corporation; Roche

- BrU.K.er Corporation

- Abbott Laboratories.

- Labcorp

- Thermo Fisher scientific, Inc

- Key Players

- Key Findings

- Recommendations