Biochar Market Industry Analysis and Forecast (2026-2032) Drivers, Statistics, Dynamics, Segmentation by Technology, Type and Application

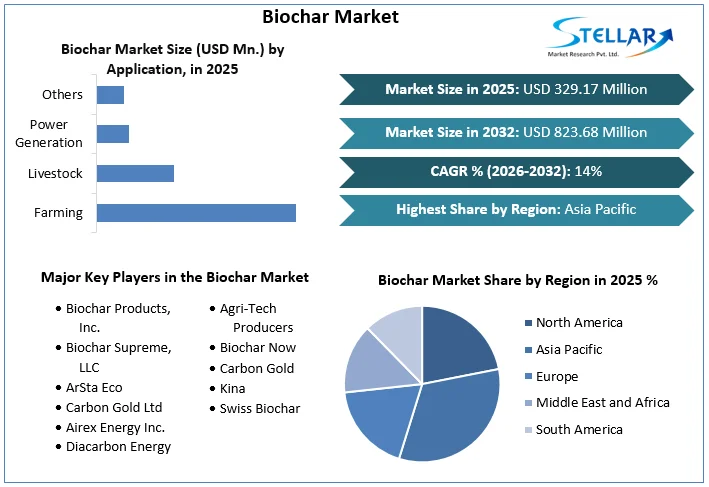

The Global Biochar Market size was valued at USD 329.17 Million in 2025 and the total Biochar revenue is expected to grow at a CAGR of 14% from 2026 to 2032, reaching nearly USD 823.68 Million by 2032.

Format : PDF | Report ID : SMR_1608

Biochar Market Overview

The Biochar Market is a rapidly booming sector, which is primarily focused on the production and utilization of Biochar. Biochar is a carbon- rich substance procured from the pyrolysis of Biomass. It is described as a material that resembles charcoal that is created by burning biomass, or organic material derived from forestry and agricultural waste. The material produced by this technique is black, highly porous, light, and has a huge surface area. Approximately 70% of it’s the composition is carbon. The elements that make up the remaining percentage are nitrogen, hydrogen, and oxygen, among others. Biochar is obtained from several non-fossil based carbonaceous organic materials, and its chemical composition can differ depending on the feedstock used to make it and the production method that has been employed.

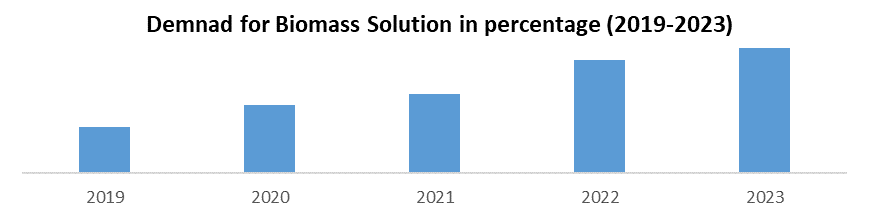

The Biochar Market has seen significant growth fuelled by several key driving factors such as Increase in the Biomass Solution Demand, increased investments in the Agricultural sector and the Enhancement of Soil and Organic Food production. Though the Biochar market has seen some tremendous rise in the past few years the market faces some restraints such as the Lack of Product Knowledge and technological Inefficiencies which can hamper the growth of the Biochar Market.

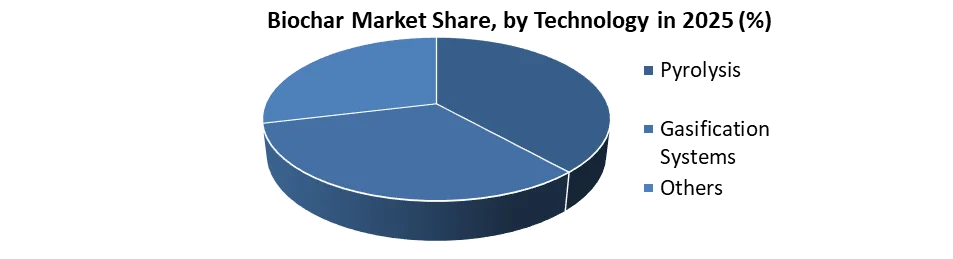

The Biochar Market is segments based on Technology, Type and Application. Pyrolysis, Gasification Systems and some others technologies are used in the Biochar Market, whereas, Gasified Rice Hull Biochar, Sawdust Biochar and Bark and Wood Biochar are the Types we see in the Biochar Market. The Biochar Market has various applications such as Farming, Livestock and Power generation. The global Biochar market is expected to capture the maximum Application attention in the coming years, driven by its environmental benefits and potential to replace traditional fossil-based carbon sources.

The Biochar Market is prominently dominated by the Asian-Pacific region with having more than 40% share due to the significant increase in the agriculture and economic development in the region, Asia- Pacific region is followed by North America with holding the second largest market share in the Global Biochar Market. Europe, South America and Middle East are among the emerging region for the Biochar Market. The Biochar Market is highly fragmented with numerous key players such as Biochar Products Inc, Biochar Supreme, LLC, ArSta Eco, Carbon Gold Ltd, Airex Energy Inc, Diacarbon Energy, Agri-Tech Producers, Biochar Now, Carbon Gold, Kina and the Swiss Biochar.

To get more Insights: Request Free Sample Report

Biochar Market Dynamics

Drivers

Biomass Solution Demand, One of the major factors propelling the global Biochar market is the increasing need for solutions linked to biomass. The increase in primary fuel prices, which are necessary for the production of energy, is driving this surge. An increasing number of people are looking into sustainable and alternative energy sources as the price of traditional fuels rises. Because it offers a sustainable method of producing energy, Biochar made from biomass is essential in meeting this requirement. Furthermore, Biochar improves soil fertility and sequesters carbon, both of which are advantageous to the environment. Because of its two purposes, Biochar is a desirable option for those pursuing sustainable farming methods and renewable energy sources. This has led to the market for Biochar expanding rapidly worldwide.

Agricultural Sector Investments, The Biochar market is driven by government investments in the agriculture sector, which promotes growth and sustainability. For instance, nations all across the world are providing funding to support sustainable farming methods and improve soil health. Projects incorporating Biochar for enhanced soil quality are funded by the USDA's Conservation Innovation Grants (CIG) program in the United States. The growing acceptance of organic farming and increased understanding of its benefits further propels the use of Biochar. Farmer integration of Biochar into practices is encouraged by EU efforts supporting organic agriculture, such as the Common Agricultural Policy (CAP). Consequently, the growing application of Biochar in agriculture supports global initiatives for ecologically sustainable and climate-resilient farming while simultaneously improving soil fertility.

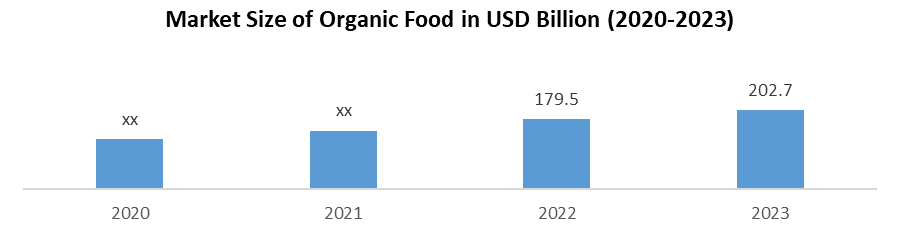

Enhancement of Soil and Organic Food production, with functioning as a soil amendment, Biochar enhances the availability of nutrients, water retention, and soil structure. For example, farmers are using Biochar to improve soil fertility in areas with problems involving soil degradation, such as sections of Africa and Asia. More sustainable land use methods and higher agricultural productivity are the consequences of this. Also, Due to increased awareness of environmental and health issues, there is a global demand for organic food. As a sustainable and organic way to improve the soil, Biochar helps organic farming. Organic farmers in Europe, especially in Germany and Switzerland, are using charcoal to grow organic foods that are high in nutrients.

Livestock Feed Use, inclusion of Biochar in the livestock feed has resulted in the enhancement of the animal health. As the Biochar provides vital nutrients and increases the general health, which helps the growth rates and increases resilience to illness. Also, it has been demonstrated that using Biochar in feed for livestock lowers ammonia emissions, improving the air quality for both employees and animals. By reducing the negative environmental effects of livestock operations, this is consistent with sustainable agricultural practices. In addition to its immediate benefits to animals, Biochar improves soil quality when added to soil or mixed into animal bedding. By adding Biochar to slurry or litter, soil fertility is increased and sustainable farming methods are supported by the soil's ability to sequester carbon.

Restraints for the Biochar Market

Though the Biochar has multiple potential benefits, it faces certain restrains such as limited understanding of it applications and advantages, lack of product knowledge and Technological Inefficiencies.

Lack of Product Knowledge, many consumers and Application s are not familiar with the uses and benefits of Biochar due to the lack of education about Biochar application in agriculture, environmental sustainability and other industries. Also, due to lack of thorough understanding, companies in the waste management, environmental solutions, and agriculture sectors are hesitant to include Biochar into their operations. Uncertainties regarding the efficacy of Biochar, its application techniques, and its possible return on investment could be the cause of this hesitation. Which ultimately results in hindering the expansion of the Biochar Market. And because of the insufficient product knowledge, Biochar producers face difficulties in expanding their market reach with potential customers like farmers and industrial stakeholders.

Technological Inefficiencies, is another major restraint for the Biochar market. Biochar producers face difficulties in expanding their market reach when potential customers, including farmers and industrial stakeholders, A major obstacle is the lengthy process of producing Biochar, which results in delays when contrasted with the expedited creation of chemical fertilizers. This inefficiency makes it more difficult for the market to quickly satisfy demand. Furthermore, the process of producing Biochar requires a lot of resources, including a lot of energy, specialized machinery, and particular raw materials.

These elements have an impact on environmental sustainability and cost-effectiveness in addition to contributing to inefficiencies. The large-scale implementation of Biochar is hindered by inefficient technologies that limit its scalability. The growing need for environmentally and agriculturally sustainable solutions is hampered by this constraint. Moreover, the intricate procedures involved in using Biochar impede its smooth assimilation into a range of sectors, such as forestry, agriculture, and the environment. Biochar's potential benefits in various areas are impacted by the difficulties in implementing it effectively due to inefficiencies in application methods.

Biochar Market Segmentation

By Technology, The various technologies used in the Biochar production process are used to segment the Biochar market. These technological advancements are essential in defining the properties and uses of Biochar. Segmentations based on Technology includes Pyrolysis, Gasification Systems and others. Pyrolysis, involves heating biomass without oxygen, is a popular process for producing Biochar. Through the conversion of organic materials into Biochar, a stable product rich in carbon is produced. The Pyrolysis segment held the largest Biochar Market share in 2025 and is expected to retain its dominance during the forecast period. The segment is also expected to grow at a high CAGR during the forecast period.

This is attributed to its affordable, convenient, and capable of processing a wide range of feedstock, pyrolysis is a widely used technology. Another method for producing Biochar is Gasification. It entails converting biomass into a gas mixture so that energy can be produced using it. The carbon content and porous structure of the Biochar produced by gasification operations are its distinguishing features. This approach is used to manufacture smaller amounts of this char in a reaction vessel that receives direct heating and air addition. This technology is getting more and more popular because it emits fewer air pollutants. But compared to other approaches, this one is a little less effective.

By Type, the Biochar Market is further segmented by Gasified Rice Hull Biochar (GRHB), Sawdust Biochar (SDB), Bark and Wood Biochar (BWB). Gasified Rice Hull is a kind of Biochar made from rice hulls that have been gasified. This particular type of Biochar is produced by gasifying or pyrolyzing rice hulls, which yields a substance that is high in carbon. GRHB is used for its capability to serve as a source of phosphorus and potassium for container-grown plants. And, SDB is a kind of Biochar that is made when sawdust, usually from the processing or manufacturing of wood, is carbonized through pyrolysis. Sawdust Biochar is used in various sectors, which includes agriculture and soil improvement. Its porous structure contributes to enhanced water retention and nutrient availability in soils. Whereas, BWB is a Biochar variant which is used from the production of the pyrolysis or carbonization of bark and wood materials. BWB is commonly used for soil amendment processes. Its inclusion in the soil improves the soil composition, water retention and nutrient content which contributes to the plant growth.

By Application, the segment is further divided into Farming, Livestock, Power Generation and others. In accordance to the Biochar market, Biochar is used as a soil additive in agricultural. Enhancing soil structure, increasing water retention, and creating a favourable environment for beneficial microbes are all made possible by Biochar. Overall soil fertility and crop yield may rise as a result of this. Farmers use Biochar to the soil in order to encourage productive and sustainable farming methods. In the livestock industry, Biochar is usually used by mixing it with animal feed.

Biochar in farming is the most widely used application in the Biochar Market. Biochar has the potential to improve livestock digestion, lower methane emissions, and improve the general health of animals. Farmers seek to maximize the nutritional value and environmental impact of livestock farming by including Biochar into feed compositions. Biochar is used in power generation applications because of its role in biomass gasification. Biochar and other biomass are gasified to create syngas, a combination of flammable gases. This syngas provides a renewable energy source that can be used to generate power. Biochar power generation is in line with sustainable energy practices and helps facilitate the shift to greener, more ecologically friendly power sources.

Competitive Landscape of the Biochar Market

The Biochar market is highly competitive globally, with major manufacturers vying for market share. Numerous businesses support innovation and strategic efforts, which in turn contribute to the expansion of the market. Some of the dominating key players in the Biochar Market includes Biochar products Inc., Biochar Supreme LLC, ArSta Eco, Carbon Gold Ltd, Airex Energy Inc, Diacarbon Energy, Agri-Tech Producers, Biochar Now, Carbon Gold, Kina and the Swiss Biochar. Nexus Development Capital has invested $5 million in Standard Biocarbon, a Maine-based company, to help with the manufacturing of sustainable Biochar. With this funding, the company has been able to finish installing important equipment and increase its operations.

Its goal is to start producing high-quality Biochar on a commercial scale in the first quarter of 2025. Venture capital firms in India invested over $1.2 billion into agri-tech start-ups, with over 100 deals. Agri-tech investments are growing tremendously as founders and investors recognize the potential of distribution, consumption and direct market access. An 85% increase over 2020 saw venture capital investors pour $51.7 billion into agrifood technology in 2021. One of the most prosperous agri-tech start-ups, AgriWebb has raised over $43 million via five fundraising rounds. Also in the year 2023, Eco Allies and Biochar Now expanded their joint venture to include a 2nd Biochar Plant in Mexico.

|

Biochar Market Scope |

|

|

Market Size in 2025 |

USD 329.17 Mn. |

|

Market Size in 2032 |

USD 823.68 Mn. |

|

CAGR (2026-2032) |

14% |

|

Historic Data |

2020-2024 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Technology

|

|

By Type

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of Biochar Market

- Biochar Products, Inc.

- Biochar Supreme, LLC

- ArSta Eco

- Carbon Gold Ltd

- Airex Energy Inc.

- Diacarbon Energy

- Agri-Tech Producers

- Biochar Now

- Carbon Gold

- Kina

- Swiss Biochar

Frequently Asked Questions

The Biochar Market is expected to grow at a CAGR of 14% during forecasting period 2026-2032.

Biochar Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The important key players in the Biochar Market are – Biochar Products Inc, Biochar Supreme, LLC, ArSta Eco, Carbon Gold Ltd, Airex Energy Inc, Diacarbon Energy, Agri-Tech Producers, Biochar Now, Carbon Gold, Kina and the Swiss Biochar

The Global Market is studied from 2020 to 2032.

1. Biochar Market: Research Methodology

2. Biochar Market: Executive Summary

3. Biochar Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Biochar Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Biochar Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Biochar Market Size and Forecast, by Technology (2025-2032)

5.1.1. Pyrolysis

5.1.2. Gasification Systems

5.1.3. Others

5.2. Biochar Market Size and Forecast, by Type (2025-2032)

5.2.1. Gasified Rice Hull Biochar (GRHB)

5.2.2. Sawdust Biochar (SDB)

5.2.3. Bark & Wood Biochar (BWB)

5.3. Biochar Market Size and Forecast, by Application (2025-2032)

5.3.1. Farming

5.3.2. Livestock

5.3.3. Power Generation

5.3.4. Others

5.4. Biochar Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Biochar Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Biochar Market Size and Forecast, by Technology (2025-2032)

6.1.1. Pyrolysis

6.1.2. Gasification Systems

6.1.3. Others

6.2. North America Biochar Market Size and Forecast, by Type (2025-2032)

6.2.1. Gasified Rice Hull Biochar (GRHB)

6.2.2. Sawdust Biochar (SDB)

6.2.3. Bark & Wood Biochar (BWB)

6.3. North America Biochar Market Size and Forecast, by Application (2025-2032)

6.3.1. Farming

6.3.2. Livestock

6.3.3. Power Generation

6.3.4. Others

6.4. North America Biochar Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Biochar Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Biochar Market Size and Forecast, by Technology (2025-2032)

7.1.1. Pyrolysis

7.1.2. Gasification Systems

7.1.3. Others

7.2. Europe Biochar Market Size and Forecast, by Type (2025-2032)

7.2.1. Gasified Rice Hull Biochar (GRHB)

7.2.2. Sawdust Biochar (SDB)

7.2.3. Bark & Wood Biochar (BWB)

7.3. Europe Biochar Market Size and Forecast, by Application (2025-2032)

7.3.1. Farming

7.3.2. Livestock

7.3.3. Power Generation

7.3.4. Others

7.4. Europe Biochar Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Biochar Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Biochar Market Size and Forecast, by Technology (2025-2032)

8.1.1. Pyrolysis

8.1.2. Gasification Systems

8.1.3. Others

8.2. Asia Pacific Biochar Market Size and Forecast, by Type (2025-2032)

8.2.1. Gasified Rice Hull Biochar (GRHB)

8.2.2. Sawdust Biochar (SDB)

8.2.3. Bark & Wood Biochar (BWB)

8.3. Asia Pacific Biochar Market Size and Forecast, by Application (2025-2032)

8.3.1. Farming

8.3.2. Livestock

8.3.3. Power Generation

8.3.4. Others

8.4. Asia Pacific Biochar Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Biochar Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Biochar Market Size and Forecast, by Technology (2025-2032)

9.1.1. Pyrolysis

9.1.2. Gasification Systems

9.1.3. Others

9.2. Middle East and Africa Biochar Market Size and Forecast, by Type (2025-2032)

9.2.1. Gasified Rice Hull Biochar (GRHB)

9.2.2. Sawdust Biochar (SDB)

9.2.3. Bark & Wood Biochar (BWB)

9.3. Middle East and Africa Biochar Market Size and Forecast, by Application (2025-2032)

9.3.1. Farming

9.3.2. Livestock

9.3.3. Power Generation

9.3.4. Others

9.4. Middle East and Africa Biochar Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Biochar Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Biochar Market Size and Forecast, by Technology (2025-2032)

10.1.1. Pyrolysis

10.1.2. Gasification Systems

10.1.3. Others

10.2. South America Biochar Market Size and Forecast, by Type (2025-2032)

10.2.1. Gasified Rice Hull Biochar (GRHB)

10.2.2. Sawdust Biochar (SDB)

10.2.3. Bark & Wood Biochar (BWB)

10.3. South America Biochar Market Size and Forecast, by Application (2025-2032)

10.3.1. Farming

10.3.2. Livestock

10.3.3. Power Generation

10.3.4. Others

10.4. South America Biochar Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Oracle

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Biochar Products, Inc.

11.3. Biochar Supreme, LLC

11.4. ArSta Eco

11.5. Carbon Gold Ltd

11.6. Airex Energy Inc.

11.7. Diacarbon Energy

11.8. Agri-Tech Producers

11.9. Biochar Now

11.10. Carbon Gold

11.11. Kina

11.12. Swiss Biochar