Global Bio-Plastic Market- Potential Effect on Upcoming Future Growth, Competitive Analysis and Forecast 2032

The Global Bio-Plastic Market size was valued at USD 9.79 Billion in 2024 and the total Bio-Plastic revenue is expected to grow at a CAGR of 19.4% from 2025 to 2032, reaching nearly USD 40.44 Billion by 2032

Format : PDF | Report ID : SMR_1614

Bio-Plastic Market Overview

Materials created entirely or partially from renewable biological sources, such as garbage, plants, or microbes, compared to conventional petroleum-based sources, are known as Bio-plastics. Their qualities range from biodegradability to rapid biological degradability, usually within eight to ten weeks under ideal conditions. They are designed to be more environmentally friendly. Biobased, partially biobased, and non-biobased are the three primary categories of Bio-Plastics, and each has unique characteristics. Among the many varieties of Bio-Plastics that are available are polylactic acid (PLA) and polyhydroxyalkanoates (PHA), which are well-known for their exceptional mechanical strength, flexibility, and biocompatibility.

The Bio-Plastics Market future, specifically in packaging is optimistic, with several other key driving factors such as Environmental Concerns, Global Market Trends, and Paradigm change in packaging further fuelling the Bio-Plastic Market to grow significantly. Though the Bio-Plastic Market has a great future ahead, its growth is mainly hampered by some major restraints including Production Technology challenges and Global Focus Challenges. The Bio-Plastic Market is segmented By Application and By Type. The Global Bio-Plastic market is dominated by key players which include Braskem, Novamont SpA, Teijin Limited, Toray Industries, Toyota Tsusho, M&G Chemicals, PTT Global Chemical Public Company, Biopak, Eco-Products, Inc, Trellis Earth, and BioMass Packaging.

The Global Bio-Plastic Market has been dominated by Europe, which held the largest market share with over 40%. Asia-Pacific, however, is considered to be the fastest-growing market for Bio-Plastics thanks to its significant manufacturing capacity for Bio-Plastics, which comprises about 45% of the global packaging industry. The rise in awareness among the masses and the enactment of stringent banns in nations like China, India, and Japan have hugely contributed to the consumption of Bio-Plastic in the APAC region. The Bio-Plastic Market in the Asia-Pacific region is estimated to grow at the fastest CAGR in the forecasting period of 2024-2029, because of the increasing environmental concerns and a growing emphasis on sustainable practices.

To get more Insights: Request Free Sample Report

Bio-Plastic Market Dynamics

Driving Factors for the Bio-Plastic Market

Environmental Concerns, the rise in awareness among consumers regarding environmental concerns has become a pivotal driving factors for the global Bio-Plastic market. This phenomenon is contributed by several factors such as Consumer Demand for Sustainability, Government Regulations, Reduced Carbon Footprint, and many more. As, Bio-Plastics offer an eco-friendly substitute for the conventional plastics, which contributes in the pollutions control and resource depletion activities. This change in the approach amongst the masses helps the Bio-Plastics market to grow.

Also, governments globally are taking imperative actions by enacting stringent regulations on single-use plastics, recognizing their adverse environmental impact. For instance, EU's Single-Use Plastics Directive, implemented since 2021, prohibits the sale of various single-use plastic products like cotton swabs, cutlery, plates, and drinking straws. This change in approach of the government propels the Bio-Plastic market to grow exponentially. To reduce the carbon footprints, many people shift towards the Bio-Plastic market, as it provides a more environmentally friendly alternative to plastics derived from fossil fuels.

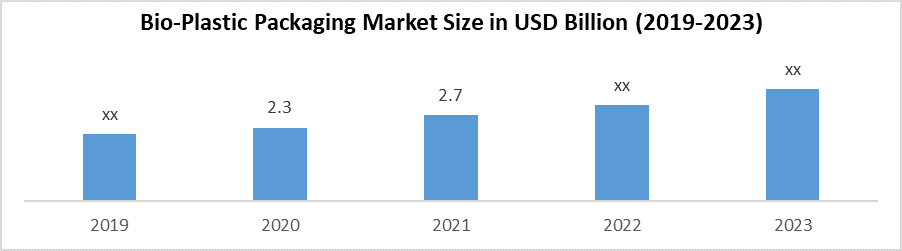

Paradigm Change in Packaging, the market for Bio-Plastics is expanding due to the combined influence of two major factors: the rise in demand for flexible packaging and the availability of renewable resources. This calculated shift to sustainable inputs is in perfect option with the changing environmental demands of industry and customer both. The market for Bio-plastics is being driven primarily by the rise in flexible packaging demand, which is linked to the growing world population and increased food consumption. Flexible packaging applications increasingly choose Bio-Plastics due to their eco-friendliness and adaptability. For example, the food industry's growing demand for eco-friendly and practical packaging has resulted in a rise in the use of Bio-Plastics for products such as food wrappers and pouches.

Sustainable Alternatives, One of the main factors propelling the Bio-Plastics market is the increasing need for sustainable alternatives to conventional plastics on a global scale. The need to minimize plastic pollution and lower carbon footprints has led to a faster uptake of bio-plastics as environmental concerns grow. Growing demand for environmentally friendly materials from both consumers and businesses has brought bio-plastics to light as a potential answer. Many big firms like Coca-Cola, Nestle, Nike and Ford are actively involved in exploring the application of Bio-Plastics, with Coca-Cola introducing Plant Bottle made from 30% plant-based plastic, reflecting a broader industry trend towards more eco-conscious practices. As the environmental impact of conventional plastics is being more widely acknowledged, there is a trend towards sustainability. This puts bio-plastics at the forefront of the global drive towards packaging options that are more environmentally friendly and responsible.

Restraints Faced by the Bio-Plastic market

Production Technology Challenges, the limitations imposed by production technology issues are one of the major restrain facing the bio-plastics sector. There are obstacles in the way of the bio-plastics industry's production technology advancement, which negatively impacts total production costs and efficiency. The Complexity and sophistication in the manufacturing process of the Bio-Plastics leads to increased production costs, attributing bio-plastics as a more expensive alternative compared to traditional plastics. These higher costs are credited to various factors like the need for specialized equipment, precise production conditions and advance technology. The substantial costs related to the raw materials needed for the production of bio-plastics increase the financial constraints.

The purchasing of sustainable and bio-based feedstocks contributes an additional expense to the production of bio-plastics, even though it is in line with environmental objectives. Businesses in this industry frequently struggle to strike a balance between sustainability goals and financial sustainability. Also, the bio-plastics sector is experiencing a slowdown in technological advancement. The efficient and economical large-scale manufacture of bio-plastics is impeded by persistent obstacles in technology development, even as firms work to overcome limits related to commercial scale. This bottleneck restricts the industry's ability to make bio-plastics at a competitive scale, which slows down the industry's development toward mainstream acceptance.

Global Focus Challenge, another potential hindrance to the Bio-Plastics market is the challenges accompanied with the global emphasis on sustainable alternatives. As the bi-Plastic market felicitates significant growth, the increasing focus on the sustainability brings complexities that hinder the progress for the Bio-Plastic Market. Though admirable, the increased emphasis on sustainability and global awareness come with drawbacks, such strict rules and guidelines. Promoting sustainable practices, such as the usage of bio-plastics, is something that governments and international organizations are increasingly doing.

However, the players in the bio-plastics market face significant obstacles in navigating these rules, guaranteeing compliance, and achieving the changing standards. Also, Demand for sustainable alternatives is mostly driven by consumer preferences. For the industry to prosper, these preferences must be met. However, there are differences in consumer knowledge and awareness regarding bio-plastics, which creates market uncertainty. A further degree of complication is added when it becomes necessary for education and awareness campaigns to be widely adopted.

Market Segmentation for the Bio-Plastic Market

By Type, the Bio-Plastic Market is further segmented into Biodegradable and Non- Biodegradable. Bio-based biodegradable refers to the Bio-Plastics materials made from renewable resources that naturally break down to save the environment. Applications are found in the consumer goods, horticultural, and packaging sectors. Whereas, in Non-Biodegradable, Bio-Plastics don't break down naturally, instead, they come from renewable resources. Because of their unique qualities, these Bio-Plastics provide a substitute for traditional plastics in a range of applications. The biodegradable bioplastics segment dominated the market in 2023 and is expected to hold the largest Bio-plastics Market share over the forecast period. The biodegradable bioplastics segment in the Bio-Plastics market is a specific category within the broader bioplastics industry.

By Application, the Bio-Plastic market is spread across various application offering versatility of Bio-Based materials. Key applications segments include: Flexible Packaging, Textiles, Automotive & Transportation, Agriculture & Horticulture and others. Flexible Packaging finds substantial use of Bio-Plastic, with providing an eco-friendly alternative to conventional plastics. The flexible packaging holds a significant share in the packaging industry with over 40%. Bio-Plastics are prominently used in the textile industry, which contributes to the sustainable practices in fabric production. Bio-Plastics in textile application is increasing substantially resulting the future demand for the Bio-Plastics Market. In the same way Bio-Plastic play a key role in the automotive application by offering environmentally friendly solutions in vehicle components. Also, Bio-Plastics are heavily used in agriculture and horticulture for several applications, which helps in sustainable practices in the industry. The increased awareness for eco-friendly solutions has significantly driven the adoption of Bio-Plastic in the Agriculture Industry.

Competitive Landscape of the Bio-Plastic Market

The major key players dominating the Bio-Plastic Market are Braskem, Novamont SpA, Teijin Limited, Toray Industries, Toyota Tsusho, M&G Chemicals, PTT Global Chemical Public Company, Biopak, Eco-Products, Inc, Trellis Earth, and BioMass Packaging. In October 2023, Versalis, Eni's chemical subsidiary, successfully completed the acquisition of Novamont.

Novamont SpA, has also been actively involved in research and innovation. In 2021, the company allocated 50 million euros for research and innovation efforts, which highlights its commitment to staying one step ahead in the sustainable solutions. Teijin Limited, a Japanese based company formed a cooperative research and development contract with Garwood Medical Devices, demonstrating its commitment to creativity. Teijin has invested in this partnership, demonstrating its dedication to cutting-edge technologies. In October 2023, NatureWorks announced the next phase of construction on a new facility, representing a substantial investment in the Asia Pacific region.

Corbion a leading firm in the Bio-Plastic invested an undisclosed amount in the Phycom Microalgae as part of their Private Equity ventures. The UK government's Innovate UK program has awarded £273,000 to Biome Bioplastics to help a joint project with a £350,000 total budget. With this money, they hope to grow their bioplastics-related efforts. Also, in a recent business update for FY2023, the parent company, Biome Technologies plc, announced robust revenue growth in its Bioplastics subsidiary.

|

Bio-Plastic Market Scope |

|

|

Market Size in 2024 |

USD 9.79 Bn. |

|

Market Size in 2032 |

USD 40.44 Bn. |

|

CAGR (2025-2032) |

19.4% |

|

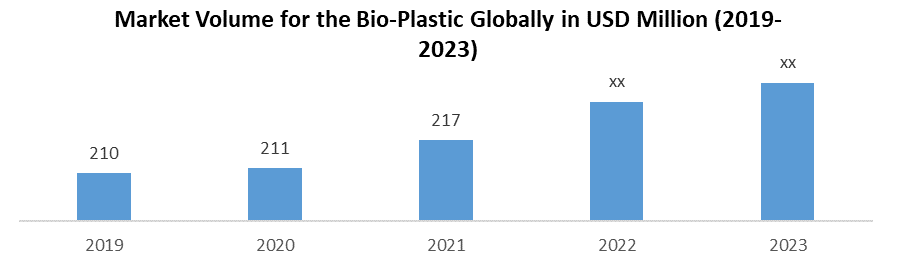

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of Bio-Plastic

- Braskem

- Novamont SpA

- Teijin Limited

- Toray Industries

- Toyota Tsusho

- M&G Chemicals

- PTT Global Chemical Public Company

- Biopak

- Eco-Products, Inc

- Trellis Earth

- BioMass Packaging

Frequently Asked Questions

Ans: The Bio-Plastic Market is expected to grow at a CAGR of 19.4% during forecasting period 2025-2032.

Ans: Bio-Plastic Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

Ans: The important key players in the Bio-Plastic Market are Braskem, Novamont SpA, Teijin Limited, Toray Industries, Toyota Tsusho, M&G Chemicals, PTT Global Chemical Public Company, Biopak, Eco-Products, Inc, Trellis Earth, and BioMass Packaging.

Ans: The Global Market is studied from 2025 to 2032.

1. Bio-Plastic Market : Research Methodology

2. Bio-Plastic Market : Executive Summary

3. Bio-Plastic Market : Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Bio-Plastic Market : Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Bio-Plastic Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Bio-Plastic Market Size and Forecast, by Type (2024-2032)

5.1.1. Biodegradable

5.1.2. Non-biodegradable

5.2. Bio-Plastic Market Size and Forecast, by Application (2024-2032)

5.2.1. Flexible Packaging

5.2.2. Textile

5.2.3. Agriculture and Horticulture

5.2.4. Consumer Good

5.2.5. Others

5.3. Bio-Plastic Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Bio-Plastic Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Bio-Plastic Market Size and Forecast, by Type (2024-2032)

6.1.1. Biodegradable

6.1.2. Non-biodegradable

6.2. North America Bio-Plastic Market Size and Forecast, by Application (2024-2032)

6.2.1. Flexible Packaging

6.2.2. Textile

6.2.3. Agriculture and Horticulture

6.2.4. Consumer Good

6.2.5. Others

6.3. North America Bio-Plastic Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Bio-Plastic Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Bio-Plastic Market Size and Forecast, by Type (2024-2032)

7.1.1. Biodegradable

7.1.2. Non-biodegradable

7.2. Europe Bio-Plastic Market Size and Forecast, by Application (2024-2032)

7.2.1. Flexible Packaging

7.2.2. Textile

7.2.3. Agriculture and Horticulture

7.2.4. Consumer Good

7.2.5. Others

7.3. Europe Bio-Plastic Market Size and Forecast, by Country (2024-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Bio-Plastic Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Bio-Plastic Market Size and Forecast, by Type (2024-2032)

8.1.1. Biodegradable

8.1.2. Non-biodegradable

8.2. Asia Pacific Bio-Plastic Market Size and Forecast, by Application (2024-2032)

8.2.1. Flexible Packaging

8.2.2. Textile

8.2.3. Agriculture and Horticulture

8.2.4. Consumer Good

8.2.5. Others

8.3. Asia Pacific Bio-Plastic Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Bio-Plastic Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Bio-Plastic Market Size and Forecast, by Type (2024-2032)

9.1.1. Biodegradable

9.1.2. Non-biodegradable

9.2. Middle East and Africa Bio-Plastic Market Size and Forecast, by Application (2024-2032)

9.2.1. Flexible Packaging

9.2.2. Textile

9.2.3. Agriculture and Horticulture

9.2.4. Consumer Good

9.2.5. Others

9.3. Middle East and Africa Bio-Plastic Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Bio-Plastic Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Bio-Plastic Market Size and Forecast, by Type (2024-2032)

10.1.1. Biodegradable

10.1.2. Non-biodegradable

10.2. South America Bio-Plastic Market Size and Forecast, by Application (2024-2032)

10.2.1. Flexible Packaging

10.2.2. Textile

10.2.3. Agriculture and Horticulture

10.2.4. Consumer Good

10.2.5. Others

10.3. South America Bio-Plastic Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Braskem

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Novamont SpA

11.3. Teijin Limited

11.4. Toray Industries

11.5. Toyota Tsusho

11.6. M&G Chemicals

11.7. PTT Global Chemical Public Company

11.8. Biopak

11.9. Eco-Products, Inc

11.10. Trellis Earth

11.11. BioMass Packaging

12. Key Findings

13. Industry Recommendation