Australia Pet Wearable Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

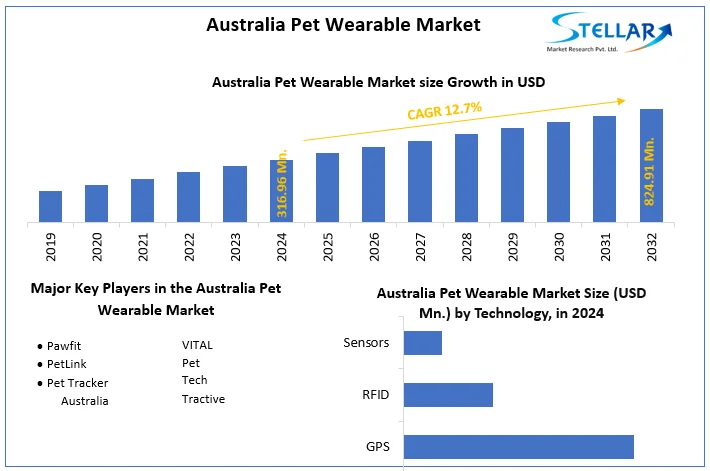

The Australian Pet Wearable Market size was valued at USD 316.96 Mn. in 2024. The total Australian Pet Wearable Market revenue is expected to grow at a CAGR of 12.7% from 2025 to 2032, reaching nearly USD 824.91 Mn. in 2032.

Format : PDF | Report ID : SMR_1569

Australia Pet Wearable Market Overview

The Stellar report analysis for the Australian pet wearable market gives insights into the rapidly growing market, which is being driven by rising pet ownership. The study analyzes trends, difficulties, and possibilities related to revolutionary innovations such as GPS trackers. It focuses on the market's impact on veterinary care, preventative healthcare, and the changing landscape, providing an integrated perspective. Pet ownership in Australia has risen to more than 25 million, owing to increased ownership rates. Growing disposable income encourages increased spending on pet care and technology adoption. Technological developments, such as reduction in size and improved sensors, drive innovation in pet wearables.

To get more Insights: Request Free Sample Report

Increased worries about pet health and safety drive demand, while integration with smart homes reflects an increasing trend in automated pet care through linked devices. Manufacturers create user-friendly pet wearables with distinct features and data analytics systems. Retailers increase their distribution channels and build dedicated departments for wearables. Software developers create AI-powered platforms and subscriptions for individualized pet health information. Veterinary integration entails developing solutions for the seamless integration of wearable data. Wearables designed for certain health issues, breeds, or outdoor activities are being explored in specific industries.

Integration with Smart Homes

Pet wearables in Australia are increasingly designed to integrate with smart home systems. It allows seamless communication between the wearable device and other smart devices in the home, creating a connected and convenient pet care ecosystem. According to Stellar research found that Australia's tech-savvy pet owners are interested in pet wearables at 42%. The desire for ease is seen in smart home integration, which provides automated pet care while appealing to busy owners. Improved safety features, such as GPS tracking and smart doorbells, help with proactive health monitoring, allowing for early intervention based on vital signs and activity data. Innovative pet wearables products, such as those from FitBark and Whistle, highlight smart home connectivity features, encouraging competition and innovation.

The improved functionality achieved through integration offers value, justifying higher prices and enhancing the demand for products. Moving forward, integrated pet wearables are expected to be able to communicate data with vets, allowing for remote monitoring and individualized care treatments.

- 2% of Australians own at least one smart home device

- 84% of Australian pet owners are interested in pet wearables with smart home integration features.

- The average spending per pet in Australia reached $XX Million in 2024

Lack of awareness of pet wearables among Australian pet owners

A significant challenge is the relatively low awareness of pet wearables among Australian pet owners. Many are not familiar with the benefits and functionalities of these devices, leading to a slower adoption rate. Limited knowledge prevents the pet wearables business, limiting growth and reducing profitability for producers and merchants. Lack of awareness among pet owners leads to missed opportunities for preventive health management and early disease detection. Established pet care products face competition and benefit from increased recognition. Negative perceptions resulting from a lack of awareness harm the brand image and restrict future adoption.

- According to Stellar Studies revealed that XX% of Australian pet owners were unsure about the benefits of pet wearables.

- Only 35% of Australian pet owners were aware of pet wearables.

Australia Pet Wearable Market Segment Analysis

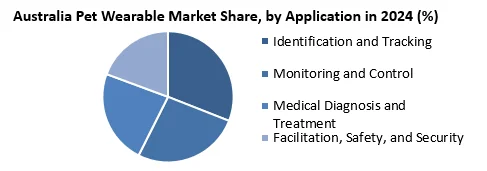

By Application, Medical Diagnosis and Treatment segments hold the smaller share of the Australian pet Wearable market, estimated at around XX%. Facilitating early health issue detection through vital signs monitoring, pet wearables offer valuable data for veterinary care, aiding in diagnosis and treatment plans. The contribution encourages preventative healthcare, enhancing life expectancy. Wearable data provides veterinary doctors with valuable insights, improving diagnostic accuracy and personalized therapies. Continuous remote monitoring, especially for chronic illnesses or postoperative treatment, improves convenience while lowering stress. Early detection of vital sign changes enables preemptive actions, thereby averting sickness. Owners, armed with useful health insights, feel empowered to provide preventive treatment and keep control over their pet's health.

|

Australia Pet Wearable Market Scope |

|

|

Market Size in 2024 |

USD 316.96 Mn. |

|

Market Size in 2032 |

USD 824.91 Mn. |

|

CAGR (2025-2032) |

12.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Technology

|

|

By Application

|

|

Key Players in the Australia Pet Wearable Market

- Pawfit

- PetLink

- Pet Tracker Australia

- VITAL Pet Tech

- Tractive

Frequently Asked Questions

Wearables need climate-adapted designs due to Australia's diverse weather conditions, ensuring durability and functionality in varying temperatures.

The Australian Pet Wearable Market size was valued at USD 316.96 Million in 2024. The total Australian Pet Wearable market revenue is expected to grow at a CAGR of 12.7% from 2025 to 2032, reaching nearly USD 824.91 Million by 2032.

1. Australia Pet Wearable Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Australia Pet Wearable Market: Dynamics

2.1. Australia Pet Wearable Market Trends

2.2. PORTER’s Five Forces Analysis

2.3. PESTLE Analysis

2.4. Value Chain Analysis

2.5. Regulatory Landscape of the Australia pet wearable Market

2.6. Technological Advancements in the Australian Pet Wearable Market

3. Analysis of Types of Pet wearable and market trends in Australia

3.1. GPS Trackers

3.2. Health Monitoring Devices in Australia

3.3. Automated Pet Access Control

3.4. Integration with Smart Home Systems

3.5. Advancements in Pet Wearable Technology

4. Australia Pet Wearable Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032)

4.1. Australia Pet Wearable Market Size and Forecast, by Technology (2024-2032)

4.1.1. GPS

4.1.2. RFID

4.1.3. Sensors

4.2. Australia Pet Wearable Market Size and Forecast, by Application (2024-2032)

4.2.1. Identification and Tracking

4.2.2. Monitoring and Control

4.2.3. Medical Diagnosis and Treatment

4.2.4. Facilitation, Safety, and Security

5. Australia Pet Wearable Market: Competitive Landscape

5.1. STELLAR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2023)

5.4. Market Analysis by Organized Players vs. Unorganized Players

5.4.1. Organized Players

5.4.2. Unorganized Players

5.5. Leading Australia Pet Wearable Market Companies, by market capitalization

5.6. Market Trends and Challenges in Australia

5.6.1. Technological Advancements

5.6.2. Affordability and Accessibility

5.6.3. Shortage of Skilled Professionals

5.7. Market Structure

5.7.1. Market Leaders

5.7.2. Market Followers

5.7.3. Emerging Players in the Market

5.7.4. Challenges

5.7.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Pawfit

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Details on Partnership

6.1.7. Potential Impact of Emerging Technologies

6.1.8. Regulatory Accreditations and Certifications Received by Them

6.1.9. Strategies Adopted by Key Players

6.1.10. Recent Developments

6.2. PetLink

6.3. Pet Tracker Australia

6.4. VITAL Pet Tech

6.5. Tractive

7. Key Findings

8. Industry Recommendations

9. Australia Pet Wearable Market: Research Methodology