Asia Pacific Smart Wearables Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

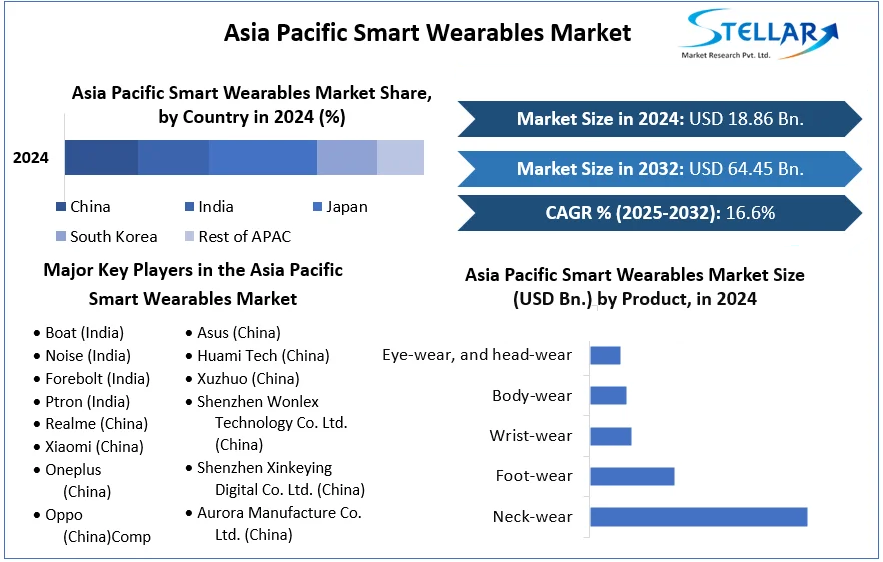

The Asia Pacific Smart Wearables Market is estimated to grow at a CAGR of 16.6% during the forecast period. Asia Pacific Smart Wearables Market is expected to reach US$ 64.45 Bn. in 2032 from US$ 18.86 Bn in 2024.

Format : PDF | Report ID : SMR_733

Asia Pacific Smart Wearables Market Overview:

During the forecasted period, the smart wearable market in Asia Pacific is expected to develop at the fastest rate. The region's growing electronics industry and rapid increase in disposable income are driving the Asia Pacific Smart Wearable Market.

Due to growing consumer preference for connected devices and smart wearables, technological growth in the consumer electronics market, the growth in remote work, and increased interest in health monitoring during the COVID-19 pandemic, the Asia Pacific smart wearable devices market will grow by 16.6% annually, with a total addressable market cap of $231.05 billion between 2021 and 2030.

To get more Insights: Request Free Sample Report

Asia Pacific Smart Wearables Market Dynamics:

The desire for aesthetically appealing advanced featured products with the capacity to better service consumers' daily necessities, such as time schedules, has boosted the market for smartwatches globally, thanks to rising urbanization rates.

Furthermore, due to increased spending for their regular work hours tracking and luxury expectations, the large millennial generation has started adopting smartwatches. Millennial spending is predicted to rise across major nations, according to the International Council of Shopping Centers (ICSC).

Fiber optic sensors (FOSs) have also been widely regarded as a viable alternative to traditional sensors in smart fabrics and clothes. Their compact size and superior metrological features are the reasons behind this. While this may not be the case in all cases, businesses such as Lucyd are focused on the ergonomics of head-mounted displays. Companies hope to expand the use of head-mounted displays across industries by lowering their size and weight.

The COVID-19 outbreak and worldwide shutdown limitations have had an impact on global industrial activities. The electronics industry has been seriously impacted, with huge implications for its supply chain and manufacturing facilities. During February and March, production in China and Taiwan came to a halt, affecting many OEMs around the world.

Remote monitoring of COVID-19 symptoms is currently in high demand in the healthcare industry. In the past year, companies have released a number of IoT-based gadgets and wearables, with promising results in terms of high accuracy in identifying patients in the prodromal phase and monitoring symptoms including breathing rate, heart rate, and temperature. For example, EOFlow, a developer of wearable drug delivery solutions, developed a new smartphone application for interaction with wearable insulin delivery devices in March 2021, which was also approved for sale in South Korea.

The most well-known and extensively used healthcare wearables for monitoring important indicators are sports and fitness gadgets. Wearable devices are used by athletes to keep track of their heart rate, blood pressure, and other vital indications. As a result of the rising prevalence of lifestyle problems such as obesity, stroke, type 2 diabetes, heart disease, and atherosclerosis throughout Asia Pacific, people have begun to pay more attention to their health. As a result, the number of gyms and fitness centers in the region is expanding, boosting sales of wearable medical devices. China, for example, has the largest health and fitness clubs in the area in 2020, according to the International Health, Racquet & Sports club Association (IHRSA) Media Report 2021, with 27,000 clubs. In 2020, Australia will have 3,715 health and fitness clubs.

The market's dominance is attributable to a shift in adult tastes toward sports and leisure activities, as well as the emergence of smart and advanced activity-tracking wearables. In March 2020, Fitbit Inc. announced Fitbit Charge 4, their most advanced health and activity tracker. The most up-to-date sensors and functionalities, as well as built-in GPS, Spotify, and connect and control tools, are all included in this new device.

Asia Pacific Smart Wearables Market Segment Analysis:

Based on Product, the Asia Pacific Smart Wearables Market is segmented into neck-wear, foot-wear, wrist-wear, body-wear, eye-wear, and head-wear, and others. The wrist wear segment is expected to dominate the market as smartwatches are becoming more and more trendy and with advancements in the smartwatches, they are becoming of more utility thereby increasing the scope of wrist-wear segment in the Asia Pacific Smart Wearables Market. Head-mounted display devices are predicted to grow significantly over the forecast period. Furthermore, advancements in augmented reality (AR) and virtual reality (VR) are gaining traction in the healthcare profession. Virtual reality technologies and virtual reality headsets are used in medical practice to enhance surgical training and operations.

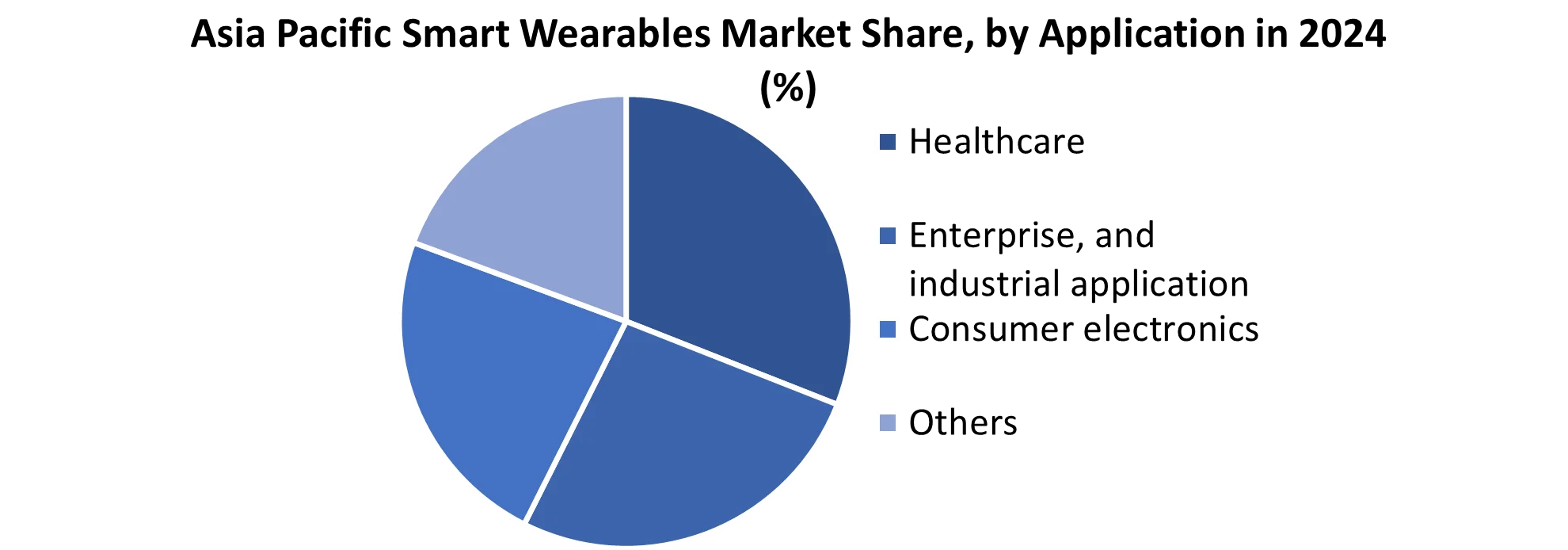

Based on Application, The Asia Pacific Smart Wearables market is segmented into healthcare, enterprise, and industrial application, consumer electronics, and others. The Consumer Electronics segmentation area is expected to account for more than 45% of Asia Pacific Region’s revenue followed by the Healthcare segment. Smart Wearable consumer electronics are predicted to develop as the number of connected devices grows and machine-to-machine communication expands, resulting in market growth.

Asia Pacific Smart Wearables Market Regional Insights:

The above figure shows that in 2024, India and China accounted for around 30% market share in the Smartwatches segment and in 2024 it has grown with the highest CAGR as India gained a lot of share in the Global Smartwatch Market.

Due to rising prevalence of chronic conditions like as obesity and diabetes, as well as increased awareness of pedometers and smart watches in this area, Japan will continue to dominate the Smart wearable market throughout the forecast period.

The wearables market in China has taken on a new shape, fueled in part by the purchases of increasingly affluent customers. According to a recent estimate by a Chinese government think tank, around 80% of the world's smart wearable devices are made in the southern Chinese port city and manufacturing hub of Shenzhen. Shenzhen, the base camp of many Chinese tech titans, is the largest R&D and production center for smart wearables, according to the China Center for Information Industry Development report.

In India, a considerable portion of the population suffers from lifestyle-related disorders like diabetes and obesity, which have elevated cancer risk. This has increased the demand for wearable gadgets as a result of society's concerns about early disease diagnosis. According to the International Diabetes Federation (IDF) Report 2019, India is second only to China in terms of the number of people affected by diabetes mellitus. Diabetes affects 8.9% of people in India between the ages of 20 and 79 years. This translates to 77,005,600 instances of adult diabetes, with the number expected to reach 100 million by 2030. A whopping 57% of people have never been diagnosed with diabetes. India currently accounts for one out of every six people on the planet suffering from diabetes.

The objective of the Asia Pacific Smart Wearables report is to present a comprehensive analysis of the Asia Pacific Smart Wearables market to the stakeholders in the industry. The Asia Pacific Smart Wearables report provides trends that are most dominant in the Asia Pacific Smart Wearables market and how these trends will influence new business investments and market development throughout the forecast period. The Asia Pacific Smart Wearables report also aids in the comprehension of the Asia Pacific Smart Wearables Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Smart Wearables market report will assist in understanding which market segments, regions, and factors affecting the Asia Pacific Smart Wearables market, as well as key opportunity areas, will drive the industry and market growth over the forecast period. The Asia Pacific Smart Wearables report also includes the competitive landscape of key industry players, as well as their recent developments in the Asia Pacific Smart Wearables market. The Asia Pacific Smart Wearables report investigates factors such as company size, market share, market growth, revenue, production volume, and profits of the market's key players.

The report includes Porter's Five Force Model, which aids in the development of market business strategies. The report assists in determining the number of competitors, who they are, and the quality of their products in the Asia Pacific Smart Wearables market. The report also examines whether it is easy for a new player to gain a foothold in the Asia Pacific Smart Wearables market, whether they enter or exit the market on a regular basis, whether the market is dominated by a few players, and so on.

The Asia Pacific Smart Wearables report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Smart Wearables market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Smart Wearables market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Smart Wearables market is aided by legal factors.

Asia Pacific Smart Wearables Market Scope:

|

Asia Pacific Smart Wearables Market |

|

|

Market Size in 2024 |

USD 18.86 Bn. |

|

Market Size in 2032 |

USD 64.45 Bn. |

|

CAGR (2025-2032) |

16.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Product

|

|

By Application

|

|

|

Country Scope |

China India Japan South Korea Australia ASEAN Rest of APAC |

Asia Pacific Smart Wearables Market Key Players

Frequently Asked Questions

China is expected to hold the highest share in Asia Pacific Smart Wearables Market.

The Asia Pacific Smart Wearables Market is expected to grow at a CAGR of 16.6% during the forecast period. Asia Pacific Smart Wearables Market is expected to reach US$ 64.45 Bn. in 2032 from US$ 18.86 Bn in 2024

Asia Pacific region held the highest share in 2024.

The Asia Pacific Smart Wearables Market is studied from 2024 to 2032.

- Scope of the Report

- Research Methodology

- Research Process

- Asia Pacific Smart Wearables Market: Target Audience

- Asia Pacific Smart Wearables Market: Primary Research (As per Client Requirement)

- Asia Pacific Smart Wearables Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Stellar Competition matrix

- Key Players Benchmarking: by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Asia Pacific Smart Wearables Market Segmentation

- Asia Pacific Smart Wearables Market, by Product (2024-2032)

- Neck-wear

- Foot-wear

- Wrist-wear

- Body-wear

- Eye-wear, and head-wear

- Others

- Asia Pacific Smart Wearables Market, by Application (2024-2032)

- Healthcare

- Enterprise, and industrial application

- Consumer electronics

- Others

- Asia Pacific Smart Wearables Market, by Country (2024-2032)

- India

- China

- Japan

- South Korea

- Thailand

- Malaysia

- Rest of Asia Pacific

- Asia Pacific Smart Wearables Market, by Product (2024-2032)

- Company Profiles

- Key Players

- Boat (India)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Noise (India)

- Forebolt (India)

- Ptron (India)

- Realme (China)

- Xiaomi (China)

- Oneplus (China)

- Oppo (China)

- Asus (China)

- Huami Tech (China)

- Xuzhuo (China)

- Shenzhen Wonlex Technology Co. Ltd. (China)

- Shenzhen Xinkeying Digital Co. Ltd. (China)

- Aurora Manufacture Co. Ltd. (China)

- Boat (India)

- Key Players

- Key Findings

- Recommendations