Asia Pacific Pediatric Medical Device Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

The Asia Pacific Pediatric Medical Device Market size was valued at USD 7.79 Bn. in 2024 and the total Asia Pacific Pediatric Medical Device Market revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 14.63 Bn. by 2032.

Format : PDF | Report ID : SMR_1659

Asia Pacific Pediatric Medical Device Market Overview

Pediatric medical devices cater to patients from birth through age 21 and subpopulations include neonates, infants, children, and adolescents. Some devices are designed for children, while others are adapted from adult applications. Designing for pediatrics is challenging due to size differences, activity levels, changing body structures, and long-term device use concerns. Pediatric medical devices through initiatives such as increased labeling for pediatric use, recruiting pediatric experts for advisory panels, protecting child clinical trial participants, and collaborating on post-market surveillance effectiveness. Pediatric medical devices are tailored for children leading to the common repurposing of adult devices in Pediatrics.

The analysis reveals insights into the current market scenario, emerging trends, and possibilities. Industry professionals, policymakers, and investors stand to gain actionable intelligence through a strategic examination of market dynamics, technological strides, and key stakeholders. Focusing exclusively on pediatric medical devices, the report aims to empower decision-makers by presenting a holistic understanding of the market landscape and its potential evolution. Asia Pacific Pediatric Medical Device market stands out for its innovative approach, meeting unique healthcare needs for children with a diverse range of diagnostic, therapeutic, and monitoring solutions. The report navigates through this market's nuances, covering various specialties and addressing challenges while providing a detailed overview of Asia Pacific pediatric medical devices.

To get more Insights: Request Free Sample Report

Asia Pacific Pediatric Medical Device Market Dynamics

The rising burden of chronic diseases and congenital disabilities in children.

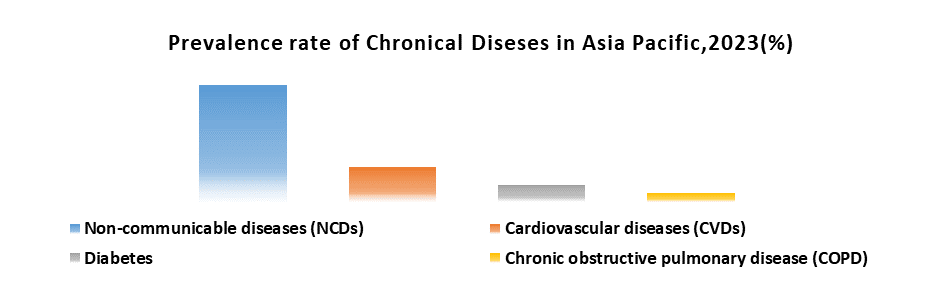

The Asia Pacific Pediatric Medical Device Market involvements increased demand thanks to rising chronic diseases like diabetes, asthma, obesity, and cardiovascular issues in children. The necessity for specialized devices, such as continuous monitoring tools, medication delivery systems, and tailored diagnostic tools, has surged. Additionally, children with congenital disabilities require complex medical devices for respiratory support, mobility assistance, feeding, and specialized surgical equipment. In response to the rising demand in the Asia Pacific Pediatric Medical Device Market, manufacturers drive innovation and development. Emphasis lies on miniaturization, creating smaller, more comfortable devices for children. Designs prioritize ease of use for both children and caregivers, and manufacturers work towards developing cost-effective devices accessible across diverse economic demographics in the region.

In the dynamic Asia Pacific Pediatric Medical Device Market, increasing market segments address specific conditions like diabetes, driving demand for tailored glucose monitoring devices and insulin pumps for children. The importance extends to home healthcare solutions and wearable devices, enhancing disease management beyond hospitals, improving children's quality of life, and reducing caregiver burden. In response to rising demand, Asia Pacific governments are considering investing in healthcare infrastructure, subsidizing pediatric medical devices, and strengthening regulations for child-specific safety. Economic disparities pose access challenges, requiring affordable solutions. Ethical considerations highlight the importance of informed consent and long-term impact assessments when deploying advanced medical devices in children. The burden of chronic diseases and congenital disabilities shapes the market, driving innovation and policy changes for the well-being of the pediatric population.

Growing demand for point-of-care (POC) devices:

In the Asia Pacific Pediatric Medical Device Market, improved accessibility through portable and user-friendly Point-of-Care (POC) devices facilitates faster results, particularly in remote areas. This accessibility allows earlier diagnosis and intervention for pediatric health conditions, enhancing treatment outcomes and potentially mitigating long-term complications, especially in regions with limited access to advanced healthcare facilities. In the Asia Pacific Pediatric Medical Device industry, Point-of-Care (POC) devices offer real-time monitoring of vital signs in children, aiding in managing conditions like blood sugar levels and oxygen saturation.

They enable proactive management of chronic conditions and swift responses to emerging issues. POC devices also serve screening purposes in schools and communities, identifying potential health concerns in children early on. In the Asia Pacific Pediatric Medical Device Market, Point-of-Care (POC) devices offer improved cost-effectiveness compared to traditional diagnostics, positively impacting healthcare budgets in developing APAC countries. This affordability promotes wider adoption in resource-limited settings, enhancing the availability and accessibility of pediatric healthcare services.

POC blood glucose monitors empower children with diabetes to manage their condition effectively at home. Rapid diagnostic tests for diseases like malaria and dengue ensure quicker identification and treatment, improving outcomes. Portable pulse oximeters are crucial for monitoring oxygen levels, especially in emergencies or for respiratory conditions. Challenges include regulatory variations, the need for proper training, and robust data management for device integration. Despite obstacles, the increasing demand for POC devices in the Asia Pacific Pediatric Medical Device Market offers an opportunity to improve pediatric healthcare accessibility, disease management, and cost-effectiveness. Addressing challenges is crucial for successful device integration into the regional healthcare landscape.

Reimbursement uncertainties:

In the Asia Pacific Pediatric Medical Device Market, reduced market adoption stems from reimbursement uncertainties. Hospitals and providers hesitate to adopt innovative pediatric devices without clear reimbursement pathways, delaying market penetration. This discourages manufacturers from investing in research and development (R&D), affecting the return on investment. To secure reimbursement, price reductions may be required, impacting profitability and limiting resources for innovation. Ultimately, reimbursement uncertainties hinder access to advanced medical devices, potentially delaying diagnosis, and treatment, and improving health outcomes for pediatric patients.

In the Asia Pacific Pediatric Medical Device Market, potential counter-arguments to reimbursement challenges include growing demand for child health, increasing disposable income, and a focus on cost-effective devices with clear value propositions for reimbursement approval. Some governments are streamlining approval processes and improving reimbursement clarity. The impact is complex, varying by device category, country regulations, and market dynamics. Collaboration between manufacturers, healthcare providers, and policymakers may address challenges, ensuring access to essential pediatric devices and fostering continued market growth.

Asia Pacific Pediatric Medical Device Market Segment Analysis:

By Product, the In Vitro Diagnostic (IVD) devices segment held the largest market share of about 25% in the Asia Pacific Pediatric Medical Device Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 8.3% during the forecast period. It stands out as the dominant segment within the Asia Pacific Pediatric Medical Device Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration. In Vitro Diagnostic (IVD) devices play a pivotal role in early disease detection and diagnosis in children. They facilitate rapid testing for infectious diseases, screen newborns for genetic disorders, and monitor chronic conditions like diabetes and asthma. Early detection ensures timely intervention, enhancing health outcomes and reducing long-term complications.

Additionally, IVD devices empower efficient management of chronic conditions, offering precise data for informed treatment decisions and ultimately improving the quality of life for children facing prolonged health challenges. In the Asia Pacific region, In Vitro Diagnostic (IVD) devices are gaining popularity due to their cost-effectiveness and the rise of point-of-care (POC) testing. These devices, more affordable than traditional methods, improve accessibility for families. The increasing availability of POC IVD devices enables immediate testing in diverse healthcare settings, promoting faster decision-making for providers.

Growing awareness, run by child health initiatives and improved healthcare infrastructure, is driving the adoption of IVD devices across various facilities in the region. In the Asia Pacific pediatric medical device market, In Vitro Diagnostic (IVD) devices are pivotal, aiding early disease detection, enhancing chronic disease management, providing cost-effective solutions, and improving healthcare access and outcomes for children.

Cardiac monitors actively detect potential issues like arrhythmias promptly, enhancing monitoring. Pacemakers and implantable cardioverter-defibrillators actively regulate heart rhythm, improving the quality of life and life expectancy for children with specific conditions.

The development of portable, user-friendly point-of-care devices improves cardiac diagnostics access in remote Asia Pacific regions. Asia Pacific Pediatric Medical Device industry manufacturers prioritize cost-effective solutions, addressing affordability and ease of use in resource-limited settings. This approach leads to improved survival rates, better long-term outcomes, and reduced healthcare burden associated with pediatric heart diseases, fostering a brighter for affected children.

Advanced diagnostic tools, such as Echocardiography, actively help in the early detection of congenital heart defects through non-invasive visualization. Minimally invasive catheterization procedures, like balloon angioplasty, actively correct defects without extensive surgery, dynamically reducing risks and recovery time for young patients.

Asia Pacific Pediatric Medical Device Market Regional Insights:

China leads the Asia Pacific in Pediatric medical device demand and is driven by a growing child population, rising incomes, and government healthcare emphasis. Domestic firms such as Mindray and Beijing Shenwei dominate and global giants like Medtronic and Philips are gaining ground. With a steadfast focus on children's health, China's Pediatric device market is poised for sustained growth. India ranks as the second-largest Pediatric medical device market in the Asia Pacific and is composed of rapid growth driven by a youthful population, increasing family incomes, and substantial government healthcare investments, the market is a mix of domestic leaders like Trivitron Healthcare and MTF alongside foreign contributors. Expect dynamic growth ahead.

Additionally, South Korea boasts a sophisticated pediatric medical device market, led by domestic giants Samsung Medison and LG Electronics. While foreign players like Medtronic and Philips make strides, the country embraces cutting-edge technologies. Similarly, Japan's mature market favors local leaders Canon Medical and Terumo, with growing contributions from foreign firms like Medtronic and Siemens Healthineers. In Australia, a well-developed landscape sees foreign powerhouses Medtronic, Philips, and Abbott Laboratories dominating the pediatric medical device sector, highlighting the nation's advanced technology adoption.

Malaysia, Indonesia, Vietnam, and Bangladesh are emerging markets for pediatric medical devices and are witnessing increased demand for affordable options. These markets are characterized by a blend of local and international companies, catering to the need for basic and cost-effective medical devices. In Bangladesh, being a least developed country, the focus is on accessibility.

Competitive Landscape for the Asia Pacific Pediatric Medical Device Market

The Asia Pacific Pediatric Medical Device Market is expected to be highly competitive active presence of numerous market players. Major companies are striving to introduce cost-efficient and advanced implant-focused products to meet the increasing demand, consequently fostering overall market growth. Key players are adopting various business strategies, including technical partnerships and mergers and acquisitions (M&A) to remain competitive in the matcha tea market. For instance,

- In 2021, the company introduced the Miniature Embrace™ MRI-safe neurostimulator for pediatric epilepsy treatment. In 2022, it obtained approval from China's NMPA for the InFuse Bone Graft in pediatric spinal fusion surgeries.

- In 2022, the company revealed the BeneVision N Series patient monitoring system, designed for pediatric care, including NICUs. In 2023, a strategic partnership was formed with Aga Khan University Hospital in Pakistan for advanced pediatric medical equipment and training programs.

- Received NMPA approval for the Cardioplegia Delivery System in pediatric cardiac surgeries. In 2023, expanded the portfolio with minimally invasive surgical devices, including thoracoscopic instruments for pediatric lung surgeries.

These strategic endeavors underscore the Asia Pacific Pediatric Medical Device industry's commitment to diversifying product lines, innovating within segments, and adopting strategic partnerships to compete effectively in the market landscape. As consumer preferences evolve, these proactive strategies position the Asia Pacific Pediatric Medical Device manufacturers for sustained growth and competitiveness in the dairy market.

|

Asia Pacific Pediatric Medical Device Market Scope |

|

|

Market Size in 2024 |

USD 7.79 Bn. |

|

Market Size in 2032 |

USD 14.63 Bn. |

|

CAGR (2025-2032) |

8.2% |

|

Historic Data |

2019-2022 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By End User

|

|

|

Country Scope |

|

Asia Pacific Pediatric Medical Device Market Key Players

- Hamilton Medical AG (Hamilton Bonaduz AG)

- TSE spol. s.r.o. (TSE Medical)

- Fritz Stephan GmbH

- Phoenix Medical Systems Pvt. Ltd.

- Trimpeks

- Atom Medical Corporation

- Baxter International, Inc.

- Elektro-Mag

- Koninklijke Philips N.V.

- Ningbo David Medical Device Company Ltd.

- Novonate Inc.

- Phoenix Medical Systems Pvt Ltd.

- Stryker Corporation

Frequently Asked Questions

Supply Chain disruptions and Reimbursement uncertainties are expected to be the major restraining factors for the market growth.

China is expected to lead the global Asia Pacific Pediatric Medical Device market during the forecast period.

The Market size was valued at USD 7.79 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 14.63 Billion.

The segments covered in the market report are By Product and End User.

1. Asia Pacific Pediatric Medical Device Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. Asia Pacific Pediatric Medical Device Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. Asia Pacific Pediatric Medical Device Market Import Export Landscape

3.1. Import Trends

3.2. Export Trends

3.3. Regulatory Compliance

3.4. Major Export Destinations

3.5. Import-Export Disparities

4. Asia Pacific Pediatric Medical Device Market: Dynamics

4.1.1. Market Drivers

4.1.2. Market Restraints

4.1.3. Market Opportunities

4.1.4. Market Challenges

4.2. PORTER’s Five Forces Analysis

4.3. PESTLE Analysis

4.4. Regulatory Landscape

4.5. Analysis of Government Schemes and Initiatives for the Asia Pacific Pediatric Medical Device Industry

4.6. The Pandemic and Redefining of The Asia Pacific Pediatric Medical Device Industry Landscape

5. Asia Pacific Pediatric Medical Device Market Size and Forecast by Segments (by Value USD)

5.1. Asia Pacific Pediatric Medical Device Market Size and Forecast, by Product (2024-2032)

5.1.1. Cardiology Devices

5.1.2. In Vitro Diagnostic (IVD) Devices

5.1.3. Diagnostic Imaging Devices

5.1.4. Anesthesia & Respiratory Care Devices

5.2. Asia Pacific Pediatric Medical Device Market Size and Forecast, by End-user (2024-2032)

5.2.1. Hospitals

5.2.2. Pediatric Clinics

5.2.3. Ambulatory Surgical Centers

5.3. Asia Pacific Pediatric Medical Device Market Size and Forecast, by Country (2024-2032)

5.3.1. China

5.3.2. India

5.3.3. South Korea

5.3.4. Japan

5.3.5. Australia

5.3.6. Malesia

5.3.7. Indonesia

5.3.8. Vietnam

5.3.9. Bangladesh

6. Asia Pacific Pediatric Medical Device Market: Competitive Landscape

6.1. STELLAR Competition Matrix

6.2. Competitive Landscape

6.3. Key Players Benchmarking

6.3.1. Company Name

6.3.2. Service Segment

6.3.3. End-user Segment

6.3.4. Revenue (2024)

6.3.5. Company Locations

6.4. Leading Asia Pacific Pediatric Medical Device Companies, by market capitalization

6.5. Market Structure

6.5.1. Market Leaders

6.5.2. Market Followers

6.5.3. Emerging Players

6.6. Mergers and Acquisitions Details

7. Company Profile: Key Players

7.1. Medtronic plc

7.1.1. Company Overview

7.1.2. Business Portfolio

7.1.3. Financial Overview

7.1.4. SWOT Analysis

7.1.5. Strategic Analysis

7.1.6. Scale of Operation (small, medium, and large)

7.1.7. Details on Partnership

7.1.8. Regulatory Accreditations and Certifications Received by Them

7.1.9. Awards Received by the Firm

7.1.10. Recent Developments

7.2. Abbott Laboratories

7.3. Cardinal Health, Inc.

7.4. GE HealthCare Technologies, Inc.

7.5. Hamilton Medical AG (Hamilton Bonaduz AG)

7.6. TSE spol. s.r.o. (TSE Medical)

7.7. Fritz Stephan GmbH

7.8. Phoenix Medical Systems Pvt. Ltd.

7.9. Trimpeks

7.10. Atom Medical Corporation

7.11. Atom Medical Corporation

7.12. Baxter International, Inc.

7.13. Elektro-Mag

7.14. Koninklijke Philips N.V.

7.15. Ningbo David Medical Device Company Ltd.

7.16. Novonate Inc.

7.17. Phoenix Medical Systems Pvt Ltd.

7.18. Stryker Corporation

8. Key Findings

9. Industry Recommendations