Asia Pacific Electric Scooter Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities, and Forecast (2025-2032)

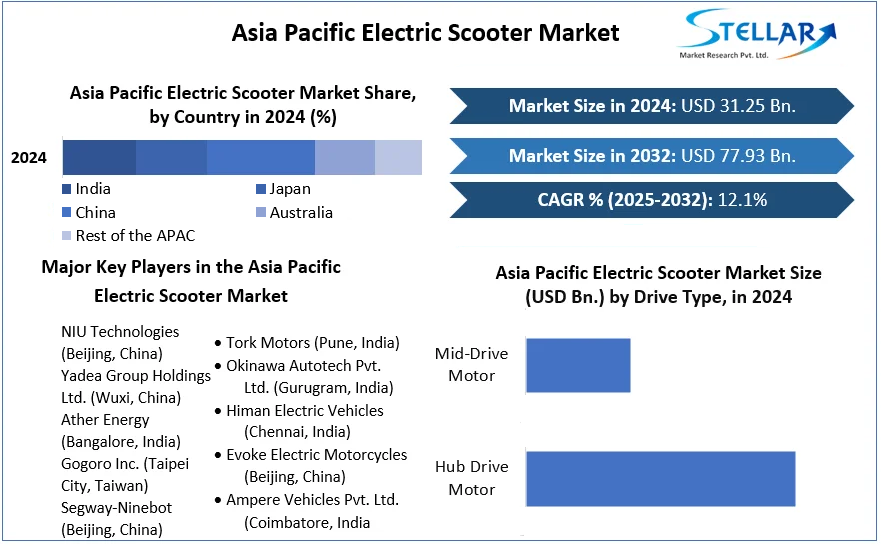

Asia Pacific Electric Scooter Market size was valued at USD 31.25 Bn. in 2024 and is expected to reach USD 77.93 Bn. by 2032, at a CAGR of 12.1%.

Format : PDF | Report ID : SMR_2233

Asia Pacific Electric Scooter Market Overview

An electric scooter is a two-wheeled vehicle powered by an electric motor and battery. It offers an eco-friendly mode of transportation, including a rechargeable battery, and a lightweight design. Typically includes features including headlights, brakes, and digital displays for speed and battery life monitoring. The rapid urbanization, environmental concerns, and government initiatives to promote sustainable transportation which drive the Asia Pacific Electric Scooter Market growth. Countries such as China, India, Japan and South Korea are leading the growth, and China dominates the Asia-Pacific electric scooter industry. This is due to its large population, advanced productivity and supporting infrastructure.

Government incentives including higher fuel prices, urban road congestion, subsidies and tax incentives for electric vehicle (EV) buyers in India are driving the Asia Pacific Electric Scooter Market. Growth advances in battery technology have led to the adoption of electric scooters in this segment, making these practical and affordable vehicles. Companies such as Ola Electric, Ather Energy, Bajaj Auto and Hero Electric are major players in India, innovating and expanding their product range to meet the needs of different customers.

India's electric scooter market grew in April-May 2023, with performances from major players. Ola Electric led with sales climbing from 21,822 to 28,438 units, marking a 30.32% increase. TVS Motor and Ather Energy also showed substantial gains, with sales doubling or more, reflecting a robust expansion in the sector among rising consumer interest and demand.

Japan and South Korea contribute to the growth of the market with their technological prowess with high-quality and technologically advanced electric scooters. The increasing trend in ride-sharing and the growing development of extensive charging infrastructure is accelerating demand for electric scooters, which is driving the Asia Pacific Electric Scooter Market growth. Increasing investments from domestic and international players are aimed at tapping the increasing demand for electric scooters. Continued improvement and technological advances, supportive regulatory frameworks, and growing awareness of the benefits of electric scooters.

To get more Insights: Request Free Sample Report

Asia Pacific Electric Scooter Market Dynamics

Increasing focus on sustainable transportation solutions to Boost Market Growth

With increasing environmental awareness, there is a remarkable shift in cleaner modes of transportation, and electric scooters have emerged as a leading alternative. Compared to cars for traditional gas-powered vehicles, these vehicles play an important role in reducing air pollution and greenhouse gas emissions. They are efficient and use electricity from renewable sources, thus helping to improve urban air quality and reduce carbon footprints throughout the region. Electric scooters reduce noise pollution, urbanize living quarters and encourage eco-friendly travel through their quiet operation. Supporting infrastructure development and incentives by governments drives Asia Pacific Electric Scooter Market growth, creating a sustainable ecosystem for electric mobility solutions.

Electric scooters offer a clean and efficient alternative to traditional gas-powered cars, significantly reducing urban air pollution and greenhouse gas emissions. By utilizing electricity from renewable sources, electric scooters contribute to improving air quality and lowering carbon footprints across cities.

Their quiet operation reduces noise pollution improves urban living, and promotes a healthy and pleasant city environment. Government support through infrastructure development and incentives for Asia Pacific Electric Scooter Market growth, and establishes a strong ecosystem for electric propulsion solutions. As technological advances continue to improve battery efficiency and rechargeability, electric scooters are playing an increasingly important role in green transportation systems and urban development in the Asia Pacific.

Rapid advancement in battery technology to present a lucrative opportunity for Market growth

Lithium-ion batteries have revolutionized electric scooters, providing increased energy efficiency, faster charging times and longer life compared to traditional lead-acid batteries. These technological advances have enabled the use of electric scooters to travel daily the practicality and attractiveness have improved dramatically. Due to battery life and better handling, today’s electric scooters now boast wider ranges, making them a convenient option for traveling long distances without worrying about frequent refills.

Manufacturers continue to innovate, pushing the limits of battery capacity to meet growing consumer demand for reliable and sustainable urban mobility solutions. This helps to drive the Asia Pacific Electric Scooter Market growth. The electric scooter market significantly contributed to this trend, reflecting a growing consumer preference for sustainable and cost-effective transportation options. This surge highlights the increasing penetration of electric scooters in India's market.

The addition of safety features in the technical design of electric scooters further contributes to their market growth. Many models are now equipped with an anti-lock braking system (ABS), providing better control and stability during sudden or emergency stops. Integrated LED lighting systems improve visibility for riders and other road users, improving safety in low-light conditions, which boosts the Asia Pacific Electric Scooter Market growth.

Some electric scooters have advanced connectivity options, allowing them to combine smartphones with geofencing capabilities to prevent theft. These innovations enhance safety appeal to tech-savvy customers looking for smart features that enhance their riding experience. With safety and technological advancements, the electric scooter market benefits from a supportive regulatory environment and increasing urbanization across the Asia Pacific to invest in rental services and dedicated routes to encourage electric vehicles.

The lack of adequate charging infrastructure is a challenge to Market Growth

The limited number of charging stations directly affects the convenience and feasibility of using an electric scooter for daily commuting. Potential users are hesitant to adopt an electric scooter because they fear running out of power without nearby charging options, causing “range anxiety”. This issue is particularly evident in densely populated urban areas where public spaces are required at a high cost, and in rural or less developed areas where such facilities are limited.

The lack of standardized charging features across product types and models complicates the user experience and limits interoperability, limiting usage which hampers Asia Pacific Electric Scooter Market growth. The time required to charge electric scooters compared to the quick refueling of traditional gasoline-powered vehicles exacerbates this problem, as users are less willing to endure long wait times. The rising cost of charging and maintaining extensive systems creates a financial strain on government and private entities, slowing down infrastructure. Lack of government incentives and policies that force a charging station a encourage installation also helps slow the growth of needed jobs.

Asia Pacific Electric Scooter Market Segment Analysis

Based on Battery Type, the market is segmented into Lithium-Ion Batteries, Sealed Lead Acid Batteries and Nickel Metal Hydride Batteries. Lithium-ion batteries are expected to dominate the Asia Pacific Electric Scooter Market during the forecast period. Lithium-ion batteries have a high capacity, allowing electric scooters to travel longer distances on a single charge compared to other types of batteries. This functionality is important for urban commuters who rely on electric scooters for daily transportation. Lithium-ion batteries have a long life and can withstand many charge and discharge cycles, making them a cost-effective solution in the long run. The slightly faster charging time further enhances its usefulness for every day.

As the lightweight lithium-ion batteries contribute to the speed and performance of all-electric scooters, making them smoother, and more responsive. Advances in technology have improved the safety and reliability of these batteries, reducing the risk of overheating for both producers and users. The declining cost of lithium-ion batteries due to economies of scale and increased production efficiency has made electric scooters more affordable and accessible. This helped to increase the demand for lithium-ion batteries to manufacture electric scooters and this drives Asia Pacific Electric Scooter Market growth. Government policies and subsidies in countries like China, Japan, and India have accelerated the adoption of lithium-ion battery-powered electric scooters by promoting eco-friendly transportation solutions.

Based on Voltage, the market is categorized into 36V, 48V, 60V, 72V and above 72V. 48V dominates the Asia Pacific Electric Scooter Market. The excellent 48V balance of performance, performance and cost, makes it very popular with consumers and manufacturers. The 48V electric scooter offers great power to handle medium distances and urban traffic with ease. It also offers enough speed and range for everyday transportation needs. This balance ensures that scooters have the power to handle a variety of terrains and inclines without compromising energy efficiency. This is essential to maximize battery life and times the lower the number of recharges.

48V systems are more expensive than their high-voltage counterparts, both in terms of initial purchase price and ongoing maintenance costs, making them accessible to a wider audience. This affordability extends to different segments of replacement and battery packs, which are readily available for the 48V models and which boosts Asia Pacific Electric Scooter Market growth. The 48V is manufactured extensively by leading electric scooter manufacturers in the region, contributing to a variety of models that meet customer preferences and needs. This extensive range ensures that customers have as many possibilities as possible to select and support the market well in terms of service and parts availability.

Asia Pacific Electric Scooter Market Country Insights

China held the largest Asia Pacific Electric Scooter Market share in 2024 and is expected to have the highest CAGR during the forecast period. Strong support from the Chinese government through subsidies and good policies has led to a significant increase in the production and adoption of electric scooters. These programs have encouraged local manufacturers to innovate and scale up.

China has manufacturing capabilities, enabling it to produce many affordable electric scooters. This cost advantage has made electric scooters more accessible. The country’s rapid urbanization and growing environmental concerns have led to a demand for environmentally friendly transportation solutions. This makes electric scooters ideal for urban areas travelers. The presence of leading electric scooter manufacturers such as NIU Technologies, Yadea and Segway solidifies China’s leadership in this market. These companies have expanded their footprint internationally, reinforcing China’s dominance in the Asia Pacific Electric Scooter Market.

The advent of smart technology and connectivity features in electric scooters was a hit with tech-savvy consumers, increasing the popularity and adoption rates of these vehicles. Advanced battery technology led to the development and expansion of electric scooters, making them a viable alternative to conventional vehicles.

Table: Top 5 Electric Scooters in China in 2023

|

Number |

Company |

Description |

|

1 |

Nine Tech |

Nine Tech has over 4,800 global intellectual property rights, focusing on innovative short-haul transportation and robotics. Products include smart electric balance bikes, scooters, karts, two-wheelers, and sharing scooters. Available in more than 100 countries. |

|

2 |

Xiaomi |

Xiaomi is a consumer electronics company with a focus on smartphones and smart hardware. Its electric scooters are known for stable bodies, safety, easy installation, and stylish designs. Xiaomi connects over 130 million smart devices globally. |

|

3 |

Benlg |

Benlg is committed to environmental protection with production bases in China, Indonesia, Thailand, and Vietnam. It offers electric scooters, serving customers in 65 countries. |

|

4 |

Yadea |

Yadea, China’s first listed electric two-wheeler company, focuses on high-end electric scooters. It provides leading electric mobility solutions and aims to lead the new trend of short-distance transportation. |

|

5 |

Xinri |

Xinri specializes in large green transportation with products like electric motorcycles, three-wheeled motorcycles, bicycles, and more. It exports to over 70 countries, emphasizing technical research and development. |

India is the fastest-growing country in the Asia Pacific Electric Scooter Market. The government is emphasizing zero-emission vehicles and high-efficiency lithium-powered batteries. With more than a million units sold annually, electric scooters are gaining popularity among urban commuters. Their cost-effectiveness, low operating costs and significant fuel savings make them ideal transportation options. Advanced features, such as those found in Ather Energy's 450X model, include touchscreen dashboards, Google navigation, and remote monitoring, enhancing convenience and security. The simplicity of maintenance, minimal noise pollution, and safety features add to their appeal.

The ability to bypass traffic congestion provides significant time-saving benefits. As the threat of climate change looms, India’s adoption of eco-friendly electric scooters underscores the country’s commitment to sustainable transport.

Asia Pacific Electric Scooter Market Competitive Landscape

Key players in the Asia Pacific Electric Scooter Market are NIU Technologies and Segway-NinebotYadea Group Holdings Ltd. (Wuxi, China), Ather Energy (Bangalore, India), Gogoro Inc. (Taipei City, Taiwan), Segway-Ninebot (Beijing, China), Sunra Electric Vehicle (Jiangsu, China), Vmoto Limited (Perth, Australia) and others. Many Key players have employed strategic partnerships and acquisitions to expand their market presence.

For Instance, Gogoro has partnered with DCJ and Yadea, China's top gas-powered and electric two-wheel vehicle manufacturers respectively, to introduce its battery-swapping network in China. This collaboration aims to revolutionize urban transportation by deploying Gogoro's innovative electric refueling system across major Chinese cities. DCJ and Yadea develop new electric two-wheel vehicles compatible with Gogoro's battery-swapping platform, enhancing sustainability and convenience for urban commuters. With China's ambitious climate goals driving electric vehicle adoption, this partnership underscores a commitment to reducing emissions and advancing green mobility solutions. The initiative, expected to launch in multiple cities starting this year, marks a significant step towards creating a smarter and more sustainable urban transport infrastructure in China.

The Asia Pacific Electric Scooter Market is rapidly evolving, driven by increasing urbanization, environmental concerns, and technological advancements. Countries like China and India are leading the adoption of electric scooters, supported by government incentives and regulations favoring eco-friendly transportation solutions. Key players such as NIU Technologies, Yadea, and Ather Energy are innovating with advanced battery technologies and smart features, enhancing the appeal and practicality of electric scooters for urban commuters.

The Asia Pacific Electric Scooter Market growth is also boosted by partnerships and strategic initiatives focusing on battery-swapping technologies such as Gogoro's collaboration with DCJ and Yadea in China. As consumer awareness grows and infrastructure improves, the electric scooter market in Asia Pacific is poised for continued expansion, offering sustainable mobility solutions that address both environmental challenges and urban mobility needs.

Asia Pacific Electric Scooter Market Scope

|

Asia Pacific Electric Scooter Market |

|

|

Market Size in 2024 |

USD 31.25 Bn. |

|

Market Size in 2032 |

USD 77.93 Bn. |

|

CAGR (2025-2032) |

12.1% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Asia Pacific Electric Scooter Market Segments |

By Battery Type Lithium-Ion Batteries Sealed Lead Acid Batteries Nickel Metal Hydride Batteries |

|

By Voltage 36V 48V 60V 72V Above 72V |

|

|

By Drive Type Hub Drive Motor Mid-Drive Motor |

|

|

By End Use Personal Commercial |

|

Asia Pacific Electric Scooter Market Key Players

- NIU Technologies (Beijing, China)

- Yadea Group Holdings Ltd. (Wuxi, China)

- Ather Energy (Bangalore, India)

- Gogoro Inc. (Taipei City, Taiwan)

- Segway-Ninebot (Beijing, China)

- Sunra Electric Vehicle (Jiangsu, China)

- Vmoto Limited (Perth, Australia)

- Evolet India (Gurugram, India)

- Hero Electric (New Delhi, India)

- Terra Motors Corporation (Tokyo, Japan)

- Okai (Shanghai) Electric (Shanghai, China)

- Z Electric Vehicle Corporation (Hong Kong, China)

- Lohia Auto Industries (Noida, India)

- Evoke Motorcycles (Beijing, China)

- Tork Motors (Pune, India)

- Okinawa Autotech Pvt. Ltd. (Gurugram, India)

- Himan Electric Vehicles (Chennai, India)

- Evoke Electric Motorcycles (Beijing, China)

- Ampere Vehicles Pvt. Ltd. (Coimbatore, India

Frequently Asked Questions

China is expected to dominate the Asia Pacific Electric Scooter market during the forecast period.

The Asia Pacific Electric Scooter market size is expected to reach USD 77.93 Bn by 2032.

The major top players in the Asia Pacific Electric Scooter Market are NIU Technologies (Beijing, China), Yadea Group Holdings Ltd. (Wuxi, China), Ather Energy (Bangalore, India), Gogoro Inc. (Taipei City, Taiwan), Segway-Ninebot (Beijing, China),Sunra Electric Vehicle (Jiangsu, China), Vmoto Limited (Perth, Australia) and Others.

The increasing demand for efficient, environmentally friendly, and cost-effective urban mobility solutions drives Electric Scooter Market growth.

1. Asia Pacific Electric Scooter Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia Pacific Electric Scooter Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Asia Pacific Electric Scooter Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Asia Pacific Electric Scooter Market: Dynamics

4.1. Asia Pacific Electric Scooter Market Trends

4.2. Asia Pacific Electric Scooter Market Drivers

4.3. Asia Pacific Electric Scooter Market Restraints

4.4. Asia Pacific Electric Scooter Market Opportunities

4.5. Asia Pacific Electric Scooter Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Asia Pacific Electric Scooter Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

5.1. Asia Pacific Electric Scooter Market Size and Forecast, by Battery Type (2024-2032)

5.1.1. Lithium-Ion Batteries

5.1.2. Sealed Lead Acid Batteries

5.1.3. Nickel Metal Hydride Batteries

5.2. Asia Pacific Electric Scooter Market Size and Forecast, by Voltage (2024-2032)

5.2.1. 36V

5.2.2. 48V

5.2.3. 60V

5.2.4. 72V

5.2.5. Above 72V

5.3. Asia Pacific Electric Scooter Market Size and Forecast, by Drive Type (2024-2032)

5.3.1. Hub Drive Motor

5.3.2. Mid-Drive Motor

5.4. Asia Pacific Electric Scooter Market Size and Forecast, by End Use (2024-2032)

5.4.1. Personal

5.4.2. Commercial

5.5. Asia Pacific Electric Scooter Market Size and Forecast, by Country (2024-2032)

5.5.1. China

5.5.2. S Korea

5.5.3. Japan

5.5.4. India

5.5.5. Australia

5.5.6. Indonesia

5.5.7. Malaysia

5.5.8. Vietnam

5.5.9. Taiwan

5.5.10. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. NIU Technologies (Beijing, China)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Yadea Group Holdings Ltd. (Wuxi, China)

6.3. Ather Energy (Bangalore, India)

6.4. Gogoro Inc. (Taipei City, Taiwan)

6.5. Segway-Ninebot (Beijing, China)

6.6. Sunra Electric Vehicle (Jiangsu, China)

6.7. Vmoto Limited (Perth, Australia)

6.8. Evolet India (Gurugram, India)

6.9. Hero Electric (New Delhi, India)

6.10. Terra Motors Corporation (Tokyo, Japan)

6.11. Okai (Shanghai) Electric (Shanghai, China)

6.12. Z Electric Vehicle Corporation (Hong Kong, China)

6.13. Lohia Auto Industries (Noida, India)

6.14. Evoke Motorcycles (Beijing, China)

6.15. Tork Motors (Pune, India)

6.16. Okinawa Autotech Pvt. Ltd. (Gurugram, India)

6.17. Himan Electric Vehicles (Chennai, India)

6.18. Evoke Electric Motorcycles (Beijing, China)

6.19. Ampere Vehicles Pvt. Ltd. (Coimbatore, India)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook