US Revenue Cycle Management Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

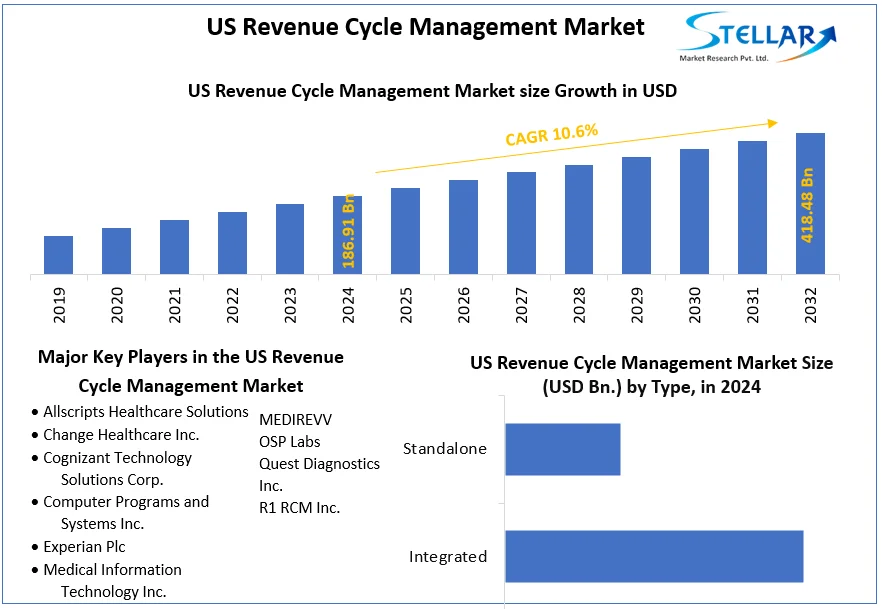

The US Revenue Cycle Management Market size was valued at USD 186.91 Bn. in 2024 and the total US Revenue Cycle Management revenue is expected to grow at a CAGR of 10.6% from 2025 to 2032, reaching nearly USD 418.48 Bn. in 2032.

Format : PDF | Report ID : SMR_1628

US Revenue Cycle Management Market Overview

Revenue Cycle Management is a financial process in healthcare using specialized software. It integrates business and clinical aspects by linking administrative data, like patient details and insurance information, to their health records. It involves pre-visit insurance checks, treatment coding, and communication with insurance companies to ensure accurate billing and payment for healthcare services. The rising adoption of outsourcing healthcare Revenue Cycle Management (RCM) solutions is driven by added value, business opportunities, and financial considerations. The U.S. healthcare sector is growing thanks to increased spending, a growing number of established facilities, higher healthcare IT investments, advanced infrastructure, and a focus on patient-provider relationships.

The comprehensive report serves as a detailed analysis of the US Revenue Cycle Management Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the US Revenue Cycle Management Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

US Revenue Cycle Management Dynamics

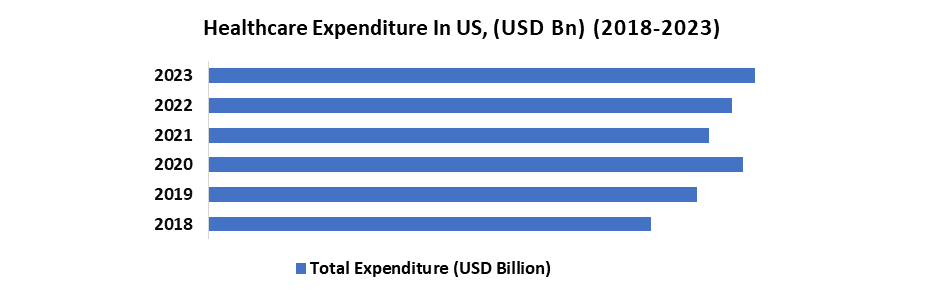

Increasing Healthcare Expenditure to Drive the US Revenue Cycle Management Market

Increasing healthcare costs are complicating billing processes and causing higher claim denials. This increasing complexity is fostering a demand for efficient Revenue Cycle Management (RCM) solutions. Hospitals and healthcare providers, under pressure to maximize revenue, are investing more in RCM solutions to streamline claims processing, enhance coding accuracy, and reduce denials. The complexities in insurance plans and regulations are creating US Revenue Cycle Management market opportunities for specialized Revenue Cycle Management services such as coding audits, denials management, and compliance solutions. The rise in Revenue Cycle Management investments is driving the development of innovative technologies like AI-powered automation, cloud-based platforms, and data analytics, resulting in improved efficiency and accuracy.

The increasing US Revenue Cycle Management market attracts new players, intensifying competition and driving down prices for Revenue Cycle Management (RCM) services. Growing healthcare regulations raise compliance costs for Revenue Cycle Management vendors. To contain costs, healthcare providers may outsource to low-cost RCM vendors, potentially impacting quality and control. The shift to digital workflows raises data security concerns, demanding substantial cybersecurity investments. Ethical concerns arise as an emphasis on revenue collection potentially prioritizes profit over patient care.

Rising healthcare spending offers growth opportunities for the US Revenue Cycle Management market but raises concerns about affordability, quality, and ethics. Factors like market segments, government policies, and healthcare reforms play crucial roles, requiring a balance between financial viability and patient-centered practices for long-term sustainability.

US Revenue Cycle Management Market Segment Analysis

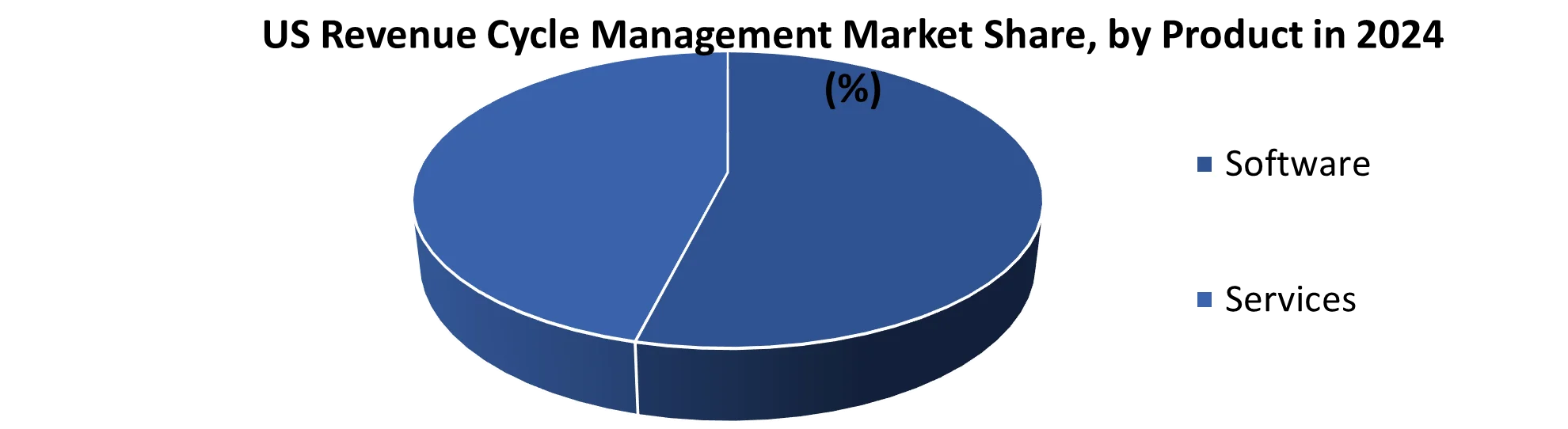

Based on Product, the Services segment held the largest market share of about 68% in the US Revenue Cycle Management Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 10.8 % during the forecast period. It stands out as the dominant segment within the US Revenue Cycle Management Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Growing factors in Revenue Cycle Management include widespread EHR adoption, complex healthcare billing, and providers' increasing focus on financial performance. The US Revenue Cycle Management market is segmented into impactful services. Active claims management improves reimbursement rates, reducing denials for healthcare providers, leading to increased revenue and improved cash flow. Accurate coding is vital for obtaining proper reimbursement, contributing to higher revenue and fewer denials. Denial management involves identifying and appealing denied claims, aiding in recovering lost revenue. Patient engagement initiatives expedite payment collection and enhance patient satisfaction. RCM analytics provide valuable insights, aiding in identifying areas for improvement and optimizing the revenue cycle management process.

Additionally, Revenue Cycle Management services pose challenges for healthcare providers. Costs are high, especially for smaller entities. The complexity of the Revenue Cycle Management process requires experienced professionals for effective management. Due to the sensitive nature of patient data, choosing a provider with a strong data security track record is crucial. Integrating RCM systems with other healthcare IT systems, like EHRs, is challenging. The heavily regulated US Revenue Cycle Management industry demands providers to ensure compliance with all applicable laws and regulations.

|

US Revenue Cycle Management Market Scope |

|

|

Market Size in 2024 |

USD 186.91 Billion |

|

Market Size in 2032 |

USD 418.48 Billion |

|

CAGR (2025-2032) |

10.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By Type

|

|

|

By Function

|

|

|

By Delivery Mode

|

|

|

By Physician Specialty

|

|

|

By Sourcing

|

|

|

By End User

|

|

Leading Key Players in the US Revenue Cycle Management Market

- Allscripts Healthcare Solutions

- Change Healthcare Inc.

- Cognizant Technology Solutions Corp.

- Computer Programs and Systems Inc.

- Experian Plc

- Medical Information Technology Inc.

- MEDIREVV

- OSP Labs

- Quest Diagnostics Inc.

- R1 RCM Inc.

Frequently Asked Questions

Data Privacy and Security Concerns and Explainability and Trust Issues are expected to be the major restraining factors for the US Revenue Cycle Management market growth.

The US Revenue Cycle Management Market size was valued at USD 186.91 Billion in 2024 and the total US Revenue Cycle Management revenue is expected to grow at a CAGR of 10.6% from 2025 to 2032, reaching nearly USD 418.48 Billion By 2032.

1. US Revenue Cycle Management Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. US Revenue Cycle Management Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. US Revenue Cycle Management Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. US Revenue Cycle Management Market: Dynamics

4.1. US Revenue Cycle Management Market Trends

4.2. US Revenue Cycle Management Market Drivers

4.3. US Revenue Cycle Management Market Restraints

4.4. US Revenue Cycle Management Market Opportunities

4.5. US Revenue Cycle Management Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. US Revenue Cycle Management Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. US Revenue Cycle Management Market Size and Forecast, by Product (2024-2032)

5.1.1. Software

5.1.2. Services

5.2. US Revenue Cycle Management Market Size and Forecast, by Type (2024-2032)

5.2.1. Integrated

5.2.2. Standalone

5.3. US Revenue Cycle Management Market Size and Forecast, by Function (2024-2032)

5.3.1. Product Development

5.3.2. Member Engagement

5.3.3. Network Management

5.3.4. Care Management

5.3.5. Claims Management

5.3.6. Risk and Compliances

5.4. US Revenue Cycle Management Market Size and Forecast, by Delivery Mode (2024-2032)

5.4.1. Web based

5.4.2. Cloud based

5.5. US Revenue Cycle Management Market Size and Forecast, by Physician Specialty (2024-2032)

5.5.1. Oncology

5.5.2. Cardiology

5.5.3. Anesthesia

5.5.4. Radiology

5.5.5. Pathology

5.5.6. Pain Management

5.5.7. Emergency Service

5.6. US Revenue Cycle Management Market Size and Forecast, by Sourcing (2024-2032)

5.6.1. In-house

5.6.2. External RCM Apps/ Software

5.6.3. Outsourced RCM Services

5.7. US Revenue Cycle Management Market Size and Forecast, by End-User (2024-2032)

5.7.1. Physician Back office,

5.7.2. Hospitals

5.7.3. Diagnostic Laboratories

6. Company Profile: Key Players

6.1. Allscripts Healthcare Solutions

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Change Healthcare Inc.

6.3. Cognizant Technology Solutions Corp.

6.4. Computer Programs and Systems Inc.

6.5. Experian Plc

6.6. Medical Information Technology Inc.

6.7. MEDIREVV

6.8. OSP Labs

6.9. Quest Diagnostics Inc.

6.10. R1 RCM Inc.

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook