US Prefilled Syringes Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

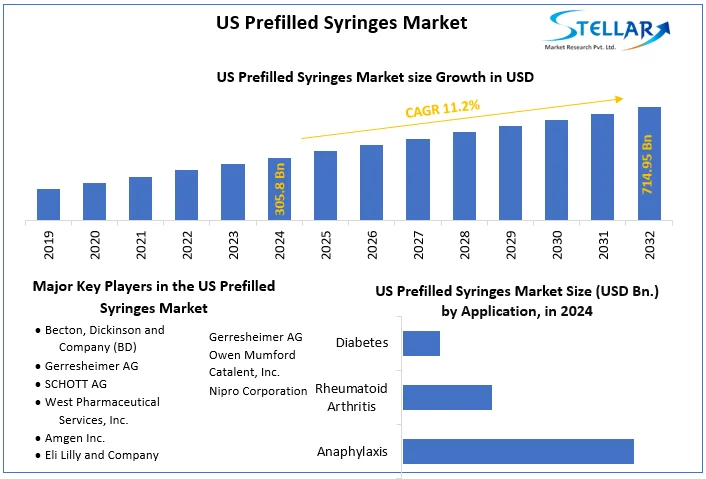

The US Prefilled Syringes Market size was valued at USD 305.8 Bn. in 2024 and the total US Prefilled Syringes revenue is expected to grow at a CAGR of 11.2% from 2025 to 2032, reaching nearly USD 714.95 Bn. in 2032.

Format : PDF | Report ID : SMR_1645

US Prefilled Syringes Market Overview

Prefilled syringes are disposable and contain injectable substances, offering reliable, safe, cost-effective, and sterile medication delivery. Increased benefits, coupled with a rise in chronic disorders are driving the US Prefilled Syringes Market growth. The growing use of injectables, home healthcare, self-medication, and technological advancements has driven the prefilled syringes market. Emerging market healthcare infrastructure and wearable drug delivery tech adoption present additional growth opportunities.

The comprehensive report researches the dynamic landscape of the US Prefilled Syringes Market, offering detailed analysis and strategic insights for stakeholders. It investigates the nuanced trends, drivers, challenges, and opportunities in the sector. Utilizing a meticulous methodology combining primary and secondary research, the report unveils complex market dynamics, consumer behavior, regulatory frameworks, and competitive landscapes. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving US Prefilled Syringes market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

US Prefilled Syringes Market Dynamics:

Growing Adoption of Self-Injecting Parenteral Devices to Drive the US Prefilled Syringes Market.

The surge in self-injecting device adoption fuels demand for compatible prefilled syringes, enhancing patient autonomy and flexibility in home medication management. The not only improves treatment devotion and accuracy but also potentially lowers healthcare costs by reducing hospital visits and professional administration. The US Prefilled Syringes Market synergy of self-injection devices with prefilled syringes empowers patients, fostering autonomy and self-management. Self-injecting parenteral devices (SIPDs) empower patients with chronic diseases, enabling home medication administration, enhancing convenience, and minimizing reliance on hospital visits or healthcare professionals.

The US Prefilled Syringes Market Proper patient training is essential to address concerns about the potential misuse of self-injecting devices. Healthcare professionals carefully assess whether self-injection, while convenient, suits all patients. Thorough cost-effectiveness evaluations are necessary to assess additional healthcare costs associated with developing self-injecting devices. Robust quality control and user training are crucial to addressing technical issues like device malfunctions or user errors. The risk of overdependence on technology potentially diminishes the role of healthcare professionals in patient education and support.

The rising use of self-injecting devices is poised to positively influence the US prefilled syringes market. The increasing demand for compatible syringes, alongside improved patient convenience, medication accuracy, and potential cost savings, is to drive market growth. However, justifying potential negative impacts through proper training, cost considerations, and responsible use is crucial for maximizing the benefits of this technological advancement.

US Prefilled Syringes Market Segment Analysis

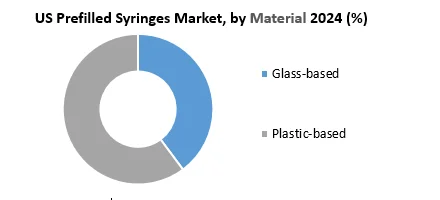

Based on Material, the Glass segment held the largest market share of about 65% in the US Prefilled Syringes Market in 2024.According to the STELLAR analysis, the segment is expected to grow at a CAGR of 11.3% during the forecast period. It stands out as the dominant segment within the US Prefilled Syringes Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Glass prefilled syringes offer superior barrier properties and shield drugs from container interactions for improved stability. The US Prefilled Syringes Market With broad chemical compatibility, glass accommodates various drugs, minimizing potential reactions. The transparency of glass allows visual inspection for clarity and detection of particulate matter. Plastic alternatives boast lower manufacturing costs, lighter weight for ease of transport, and shatter resistance, and some are recyclable, aligning with sustainability goals, and potentially lowering healthcare costs.

Glass prefilled syringes incur higher manufacturing costs, impacting expenses. Susceptible to breakage, they pose product waste and injury risks during handling and transport. Heavier than plastic, glass syringes intensify transportation and storage costs. Plastic alternatives face compatibility issues with certain drugs, potential adsorption, and degradation risks. Despite advancements, some plastics lack glass's superior barrier properties, impacting drug stability. Traditional plastic materials raise sustainability concerns due to waste management and environmental impacts.

Material choice in the US prefilled syringes market involves a nuanced balance of pros and cons. Glass, dominant for superior barriers and drug compatibility, faces competition from cost-effective plastic solutions driven by advancements addressing compatibility, barriers, and sustainability. Glass likely endures for applications demanding peak drug stability and clarity.

|

US Prefilled Syringes Market Scope |

|

|

Market Size in 2024 |

USD 305.8 Billion |

|

Market Size in 2032 |

USD 714.95 Billion |

|

CAGR(2025-2032) |

11.2 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Material

|

|

By Design

|

|

|

By Therapeutic

|

|

|

By Application

|

|

Leading Key Players in the US Prefilled Syringes Market

- Becton, Dickinson and Company (BD)

- Gerresheimer AG

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- Amgen Inc.

- Eli Lilly and Company

- Gerresheimer AG

- Owen Mumford

- Catalent, Inc.

- Nipro Corporation

Frequently Asked Questions

Stringent regulation and Rising costs are expected to be the major restraining factors for the US Prefilled Syringes market growth.

The US Prefilled Syringes Market size was valued at USD 305.8 Billion in 2024 and the total US Prefilled Syringes revenue is expected to grow at a CAGR of 11.2% from 2025 to 2032, reaching nearly USD 714.95 Billion By 2032.

1. US Prefilled Syringes Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. US Prefilled Syringes Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 - 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. US Prefilled Syringes Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Headquarter

3.3.3. Product Segment

3.3.4. End-User Segment

3.3.5. Y-O-Y%

3.3.6. Revenue (2024)

3.3.7. Profit Margin

3.3.8. Market Share

3.3.9. Company Locations

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.5.1. Strategic Initiatives and Developments

3.5.2. Mergers and Acquisitions

3.5.3. Collaboration and Partnerships

3.5.4. Product Launches and Innovations

4. US Prefilled Syringes Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. US Prefilled Syringes Market Size and Forecast by Segments (by Value USD Million)

5.1. US Prefilled Syringes Market Size and Forecast, By Material (2024-2032)

5.1.1. Glass-based

5.1.2. Plastic-based

5.2. US Prefilled Syringes Market Size and Forecast, By Design (2024-2032)

5.2.1. Single-chamber Prefilled Syringes

5.2.2. Dual-chamber Prefilled Syringes

5.2.3. Customized Prefilled Syringes

5.3. US Prefilled Syringes Market Size and Forecast, By Therapeutic (2024-2032)

5.3.1. Large Molecules

5.3.2. Small Molecules

5.4. US Prefilled Syringes Market Size and Forecast, By Application (2024-2032)

5.4.1. Anaphylaxis

5.4.2. Rheumatoid Arthritis

5.4.3. Diabetes

6. Company Profile: Key players

6.1. Becton, Dickinson and Company (BD)

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.2.1. Total Revenue

6.1.2.2. Segment Revenue

6.1.3. Product Portfolio

6.1.3.1. Product Name

6.1.3.2. Product Details (Price, Features, etc.)

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. Gerresheimer AG

6.3. SCHOTT AG

6.4. West Pharmaceutical Services, Inc.

6.5. Amgen Inc.

6.6. Eli Lilly and Company

6.7. Gerresheimer AG

6.8. Owen Mumford

6.9. Catalent, Inc.

6.10. Nipro Corporation

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook