US Patient Monitoring Device Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

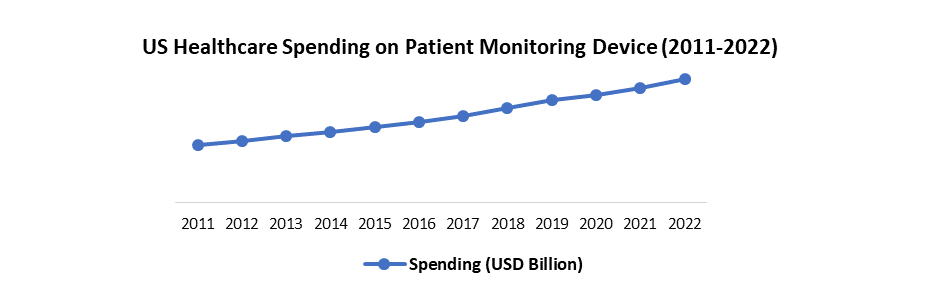

The US Patient Monitoring Device Market size was valued at USD 9.28 Bn. in 2024 and the total US Patient Monitoring Device revenue is expected to grow at a CAGR of 4.3% from 2025 to 2032, reaching nearly USD 13.00 Bn. in 2032.

Format : PDF | Report ID : SMR_1620

US Patient Monitoring Device Market Overview-

Patient monitoring devices, utilized in hospitals, clinics, and homes track vital signs and health parameters. The Common types include pulse oximeters, blood pressure monitors, glucometers, ECGs, and respiratory monitors. These devices help healthcare providers in early problem detection, informed treatment decisions, and treatment effectiveness evaluation.

The report analyses the US Patient Monitoring Device market and covers trends, technological advancements, and potential disruptions that shape the market. It assesses market size, growth, economic factors, regulations, and commercial drivers. The competitive landscape is analyzed, highlighting differentiation among key operators and drawing on historical data, industry insights, and the report forecasts sector. The economic downturn prompted this analysis and revealed the US Patient Monitoring Device industry's resilience challenges. The report aims to equip stakeholders with crucial, concise information for informed decision-making in this dynamic sector. The targeted audiences include People with Healthcare professionals, Secondary Audiences, Government agencies, policymakers, and pharmaceutical companies in the US Patient Monitoring Device industry.

To get more Insights: Request Free Sample Report

US Patient Monitoring Device Market Dynamics:

Remote monitoring improves the quality of care and reduces healthcare costs to drive the US Patient Monitoring Device Market

The impact of Remote Patient Monitoring (RPM) on the US Patient Monitoring Device Market is profound. As RPM revolutionizes healthcare with its continuous vital signs tracking and proactive intervention capabilities, it not only improves patient outcomes but also drives significant changes in the US Patient Monitoring Device market landscape. The demand for patient monitoring devices is likely to surge as healthcare providers increasingly adopt RPM solutions to improve the quality of care. The market is expected to witness a shift toward advanced monitoring technologies to support chronic disease management, especially for conditions like diabetes and heart failure.

This surge in demand is driven by the effectiveness of RPM in promoting treatment plan adherence and minimizing complications. Additionally, the cost-saving benefits of RPM, through the prevention of hospital readmissions and shortened hospital stays, likely drive increased adoption, making it a transformative force in the US Patient Monitoring Device Market.

The collection and transmission of sensitive health data through Remote Patient Monitoring (RPM) raise concerns about potential breaches, giving rise to data privacy and security concerns. RPM effectiveness is limited by technology access and usability issues, as not all patients have the necessary skills or access to use these devices. Lack of access could exacerbate healthcare disparities among certain groups. Overdependence on technology leads to misdiagnosis by neglecting other clinical cues. Additionally, implementing RPM programs increases the workload of healthcare providers, requiring extra training and support.

The impact of US Remote Patient Monitoring (RPM) varies based on device types and applications. Positive examples include blood pressure monitors for hypertension management, glucometers aiding diabetics, and activity trackers promoting physical activity. Also, drawbacks include inaccurate data leading to misdiagnosis, excessive alarms causing alert fatigue, and the high cost of certain devices as a barrier for financially constrained patients.

US Patient Monitoring Device Market Segment Analysis

Based on Application, the Hospitals segment held the largest market share of about 55% in the US Patient Monitoring Device Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 4.5% during the forecast period. It stands out as the dominant segment within the US Patient Monitoring Device Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Primary users actively drive US Patient Monitoring Device market growth by purchasing and utilizing diverse devices for various applications. They boost demand for devices to monitor critically ill patients, improve patient safety, and advance clinical decision-making. This active engagement serves as a testing ground for refining new technologies and contributes valuable data for developing monitoring devices. Additionally, challenges include potential price pressure on manufacturers due to high purchasing power, potential delays in adopting promising devices due to complex procurement processes, and concerns about data privacy and security with patient monitoring data collected in hospitals.

Collaborating with manufacturers, hospitals actively design devices tailored to specific clinical needs and provide feedback for improvements. Advocating for crucial policies that incentivize investment in patient monitoring technology is essential. Additionally, hospital-specific requirements complicate and increase development costs. Interoperability challenges arise from a lack of standardization, and resistance to change impedes the adoption of proven beneficial technologies.

In driving the US Patient Monitoring Device Market and impacting patient care, hospitals play a vital role. However, addressing potential negative impacts is crucial to ensure optimal technology utilization, improved outcomes, and a booming market. Additionally, the rise of remote patient monitoring shapes traditional hospital-home care lines, posing new opportunities and challenges. Hospitals pressured to reduce costs while maintaining high-quality care, find cost-effective monitoring solutions crucial. Key challenges include data sharing and interoperability, impeding seamless device integration across different care settings.

US Patient Monitoring Device Market Scope:

|

US Patient Monitoring Device Market |

|

|

Market Size in 2024 |

USD 9.28 Billion |

|

Market Size in 2032 |

USD 13.00 Billion |

|

CAGR (2025-2032) |

4.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By Application

|

|

Leading Key Players in the US Patient Monitoring Device Market

- 3M

- Bionet America

- A&D Medical

- Biotronik

- Abbott

- Bittium Corp

- ADC

- Blink Device Co

- Adroit Medical Systems

- Boston Scientific

- Ad-Tech Medical

- BrainCool

- Advanced Brain Monitoring

- Cadwell Laboratories

- Advantage Home Telehealth

- Cardinal Health

- AEON Global

- Care Innovations

- Aerotel Medical Systems

- Carewell

- AirLife

- Ceribell

- Ambio Health

- ChoiceMMed

Frequently Asked Questions

High costs and Limited reimbursement are expected to be the major restraining factors for the US Patient Monitoring Device market growth.

The US Patient Monitoring Device Market size was valued at USD 9.28 Billion in 2024 and the total US Patient Monitoring Device revenue is expected to grow at a CAGR of 4.3 % from 2025 to 2032, reaching nearly USD 13.00 Billion By 2032.

1. US Patient Monitoring Device Market Introduction

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Executive Summary

1.4 Emerging Technologies

1.5 Market Projections

1.6 Strategic Recommendations

2. US Patient Monitoring Device Market Import Export Landscape

2.1 Import Trends

2.2 Export Trends

2.3 Regulatory Compliance

2.4 Major Export Destinations

2.5 Import-Export Disparities

3. US Patient Monitoring Device Market: Dynamics

3.1.1 Market Drivers

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the US Patient Monitoring Device Industry.

3.6 The Pandemic and Redefining of The US Patient Monitoring Device Industry Landscape

4. US Patient Monitoring Device Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 US Patient Monitoring Device Market Size and Forecast, By Product (2024-2032)

4.1.1 EEG

4.1.2 MEG

4.1.3 TCD

4.1.4 Pulse Oximeter

4.1.5 Spirometer

4.1.6 Fetal Monitor

4.1.7 Temperature Monitoring

4.1.8 MCOT

4.1.9 ECG

4.1.10 ICP

4.1.11 ILRs

4.1.12 Blood Glucose Monitoring

4.1.13 Blood Pressure Monitor

4.2 US Patient Monitoring Device Market Size and Forecast, By Application (2024-2032)

4.2.1 Hospitals

4.2.2 ASCs

4.2.3 Home care setting

5. US Patient Monitoring Device Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading US Patient Monitoring Device Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 3M

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Bionet America

6.3 A&D Medical

6.4 Biotronik

6.5 Abbott

6.6 Bittium Corp

6.7 ADC

6.8 Blink Device Co

6.9 Adroit Medical Systems

6.10 Boston Scientific

6.11 Ad-Tech Medical

6.12 BrainCool

6.13 Advanced Brain Monitoring

6.14 Cadwell Laboratories

6.15 Advantage Home Telehealth

6.16 Cardinal Health

6.17 AEON Global

6.18 Care Innovations

6.19 Aerotel Medical Systems

6.20 Carewell

6.21 AirLife

6.22 Ceribell

6.23 Ambio Health

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. US Patient Monitoring Device Market: Research Methodology