US Generic Drugs Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

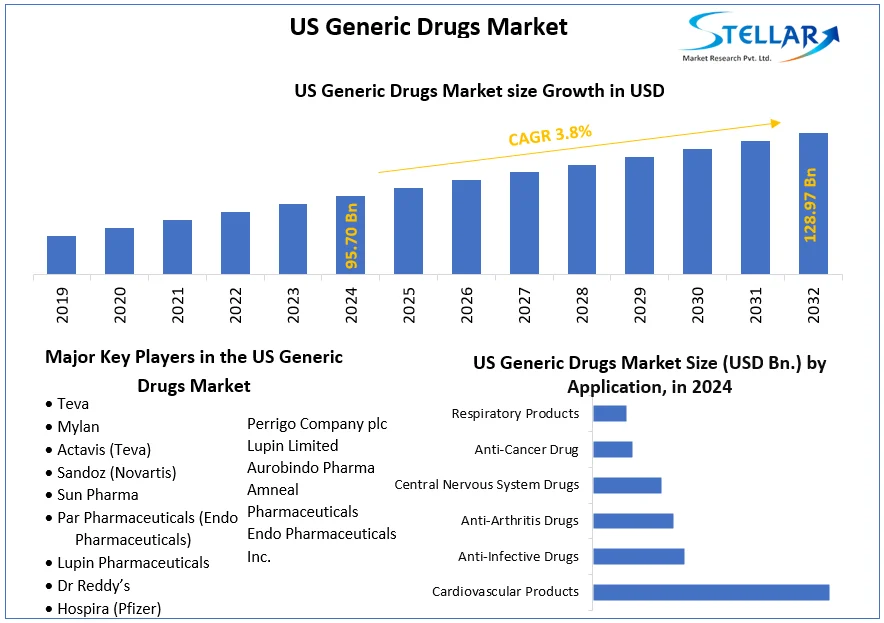

The US Generic Drugs Market size was valued at USD 95.70 Billion in 2024 and the total US Generic Drugs revenue is expected to grow at a CAGR of 3.8% from 2025 to 2032, reaching nearly USD 128.97 Billion.

Format : PDF | Report ID : SMR_1609

Generic drugs, bioequivalent to brand-name counterparts, offer cost-effective alternatives post-patent expiry. Rigorously tested for quality and safety, they improve healthcare accessibility and affordability. The US Generic Drugs Market availability and affordability drive market growth and expired patents contribute significantly. In rising healthcare costs, payers and providers promote generics for cost containment. The government initiatives and incentives added encourage their use, fostering a positive market outlook. The aging population and patent expirations for blockbuster drugs create additional growth opportunities for generic manufacturers, influencing the US Generic Drugs market dynamics positively.

|

The comprehensive report serves as a detailed analysis of the US Generic Drugs Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the US Generic Drugs Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

Increasing Demand for Chronic Disease Management Drives the US Generic Drugs Market

The rising demand for managing chronic diseases is positively impacting the US Generic Drugs market. Conditions like diabetes, cardiovascular issues, and respiratory disorders are widespread, necessitating prolonged medication use. As the population ages and chronic diseases become more prevalent, the importance of affordable medication options grows. Generic drugs emerge as a cost-effective alternative, containing identical active ingredients to brand-name counterparts.

They ensure similar therapeutic effects at a significantly lower cost, making them appealing to patients, healthcare providers, and payers. Healthcare providers prioritize generic drugs for chronic disease management due to their proven safety and efficacy. Payers recognize the cost-saving potential, offering preferential coverage and lower co-pays for generics. Formulary management programs promote generic options, further boosting their utilization.

Government Initiatives and Policies Impact to The US Generic Drugs Market

The US Generic Drugs market expedites generic drug approval, fostering competition, and reducing prices. Medicare Part D Coverage extends drug coverage, including generics, for seniors, enhancing medication accessibility. Medicaid Drug Rebate Programs encourage generic coverage in Medicaid, broadening access for low-income individuals. The Biosimilars Act introduces a pathway for affordable biosimilar drugs, providing more treatment options and fostering competition. FDA Drug Quality and Security Initiatives improve oversight to enhance the quality and safety of generic drugs.

|

Initiative/Policy |

Description |

Impact |

|

Hatch-Waxman Act (1984) |

Established a 30-month exclusivity period for the first generic entrant, reduced FDA fees for generics, and streamlined the approval process. |

Lower drug prices for consumers increased access to medications. |

|

Medicare Prescription Drug, Improvement, and Modernization Act (2003) |

Created Medicare Part D prescription drug benefit, which included incentives for generic use. |

Increased generic drug utilization among Medicare beneficiaries. |

|

Affordable Care Act (2010) |

Required most covered prescription drugs to have a generic equivalent available on formularies, expanded Medicaid, and provided subsidies for low-income individuals. |

Higher generic drug utilization rates, and greater affordability for low-income individuals. |

|

FDA Abbreviated New Drug Application (ANDA) Review Process |

A streamlined process for generic drug approval, focusing on bioequivalence testing. |

Faster US Generic Drugs market entry for generics, and reduced drug development costs. |

|

FDA Generic Drug User Fee Amendments (GDUFA) |

Established user fees paid by the industry to fund FDA generic drug activities. |

More efficient generic drug review process, faster approvals. |

|

Protecting Consumer Access to Generic Drugs Act (Pending) |

Aims to prevent "pay-for-delay" agreements between brand and generic manufacturers. |

Potentially lower generic drug prices, but possible disruption to existing generic availability. |

|

CREATES Act |

Require pharmaceutical companies to provide rebates to Medicaid programs for brand-name drugs with available generics. |

Reduced Medicaid drug expenditures, freeing up resources for other healthcare services. |

The US Generic Drugs Market balances exclusivity periods, encouraging research while allowing timely entry of generics. The Drug Price Transparency Initiative mandates pricing disclosure, promoting transparency and potential price competition.

US Generic Drugs Market Segment Analysis

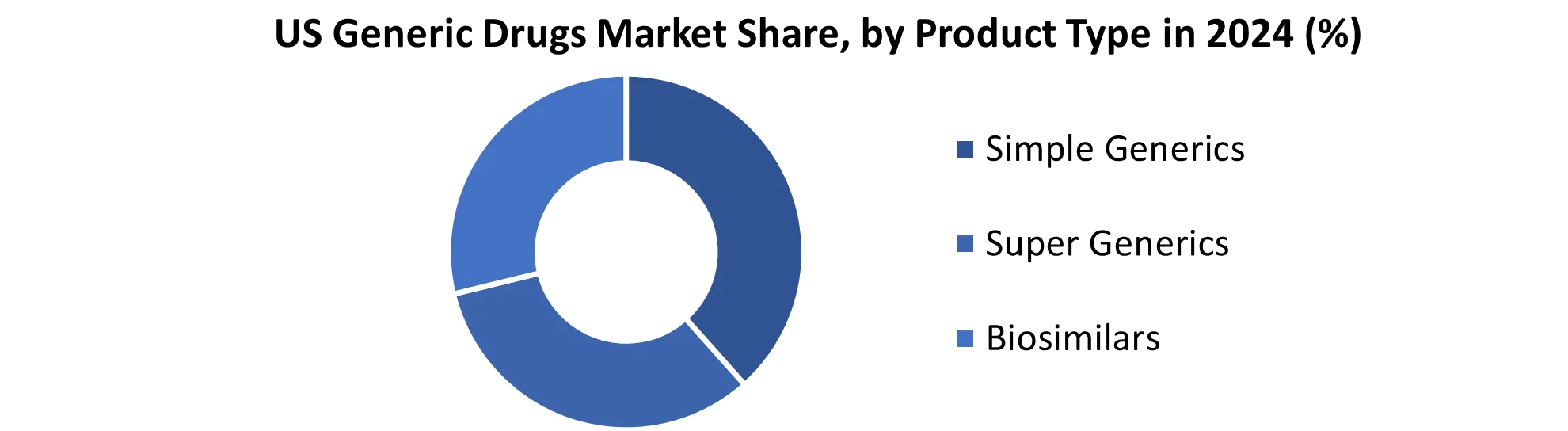

Based on Product, the Simple Generics segment held the largest market share of about 45% in the US Generic Drugs Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 3.9% during the forecast period. It stands out as the dominant segment within the US Generic Drugs Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

The US Generic Drugs Market increased the affordability and accessibility of generic drugs, often 80-90% cheaper than their branded counterparts, and widened access to crucial medications, particularly for those on fixed incomes. Enhanced competition, stemming from multiple manufacturers producing the same generic drug, drives down prices, fostering cost-effectiveness and compelling branded drug makers to lower their prices. Lower costs also contribute to improved medication adherence, resulting in better health outcomes and reduced long-term healthcare expenses. Additionally, the availability of simple generics across various therapeutic areas ensures a broad range of treatment options for patients dealing with common ailments and chronic conditions.

The importance of low-cost, simple generics impedes investment in research for innovative drugs, particularly for complex or rare diseases, hindering progress in treating challenging medical conditions. Quality concerns persist, as variations in manufacturing processes, inactive ingredients, or drug delivery systems potentially impact generic drug quality compared to branded drugs. Intense competition in the simple US Generic Drugs market leads to market consolidation, with a few large manufacturers dominating, reducing competition and potentially granting these manufacturers more power to increase prices. Generic drug manufacturing carries environmental consequences, including resource use and waste generation, emphasizing the need to incorporate sustainable practices to minimize the industry's environmental footprint.

|

US Generic Drugs Market Scope |

|

|

Market Size in 2024 |

USD 95.70 Billion |

|

Market Size in 2032 |

USD 128.97 Billion |

|

CAGR (2025-2032) |

3.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By Application

|

|

|

By Distribution Channel

|

|

Leading Key Players in the US Generic Drugs Market

- Teva

- Mylan

- Actavis (Teva)

- Sandoz (Novartis)

- Sun Pharma

- Par Pharmaceuticals (Endo Pharmaceuticals)

- Lupin Pharmaceuticals

- Dr Reddy’s

- Hospira (Pfizer)

- Endo International plc

- Perrigo Company plc

- Lupin Limited

- Aurobindo Pharma

- Amneal Pharmaceuticals

- Endo Pharmaceuticals Inc.

Frequently Asked Questions

Ans. Stringent regulation and Rising manufacturing costs are expected to be the major restraining factors for the US Generic Drugs market growth.

Ans. The US Generic Drugs Market size was valued at USD 95.70 Billion in 2024 and the total US Generic Drugs revenue is expected to grow at a CAGR of 3.8% from 2025 to 2032, reaching nearly USD 128.97 Billion By 2032.

1. US Generic Drugs Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. US Generic Drugs Market Trends

2.1 Market Consolidation

2.2 Adoption of Advanced Manufacturing Technologies

2.3 Pricing and Reimbursement Trends

3. US Generic Drugs Market Import Export Landscape

3.1 Import Trends

3.2 Export Trends

3.3 Regulatory Compliance

3.4 Major Export Destinations

3.5 Import-Export Disparities

4. US Generic Drugs Market: Dynamics

4.1.1 Market Driver

4.1.2 Market Restraints

4.1.3 Market Opportunities

4.1.4 Market Challenges

4.2 PORTER’s Five Forces Analysis

4.3 PESTLE Analysis

4.4 Regulatory Landscape

4.5 Analysis of Government Schemes and Initiatives for the US Generic Drugs Industry

4.6 The Pandemic and Redefining of The US Generic Drugs Industry Landscape

5. US Generic Drugs Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

5.1 US Generic Drugs Market Size and Forecast, by Product(2024-2032)

5.1.1 Simple Generics

5.1.2 Super Generics

5.1.3 Biosimilars

5.2 US Generic Drugs Market Size and Forecast, Application(2024-2032)

5.2.1 Cardiovascular Products

5.2.2 Anti-Infective Drugs

5.2.3 Anti-Arthritis Drugs

5.2.4 Central Nervous System Drugs

5.2.5 Anti-Cancer Drug

5.2.6 Respiratory Products

5.3 US Generic Drugs Market Size and Forecast, Distribution Channel (2024-2032)

5.3.1 Hospitals

5.3.2 Pharmacies

5.3.3 Private Clinics

5.3.4 Drug Stores

5.3.5 Retail Pharmacies

5.4 US Generic Drugs Market: Competitive Landscape

5.5 STELLAR Competition Matrix

5.6 Competitive Landscape

5.7 Key Players Benchmarking

5.7.1 Company Name

5.7.2 Service Segment

5.7.3 End-user Segment

5.7.4 Revenue (2024)

5.7.5 Company Locations

5.8 Leading US Generic Drugs Companies, by market capitalization

5.9 Market Structure

5.9.1 Market Leaders

5.9.2 Market Followers

5.9.3 Emerging Players

5.10 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 Teva

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Mylan

6.3 Actavis (Teva)

6.4 Sandoz (Novartis)

6.5 Sun Pharma

6.6 Par Pharmaceuticals (Endo Pharmaceuticals)

6.7 Lupin Pharmaceuticals

6.8 Dr Reddy’s

6.9 Hospira (Pfizer)

6.10 Endo International plc

6.11 Perrigo Company plc

6.12 Lupin Limited

6.13 Aurobindo Pharma

6.14 Amneal Pharmaceuticals

6.15 Endo Pharmaceuticals Inc.Key Findings

7. Industry Recommendations

8. Terms and Glossary

9. US Generic Drugs Market: Research Methodology