Power Transportation and Distribution Equipment Market: Industry Analysis and Forecast

Power Transportation and Distribution Equipment Market was valued at USD 253.94 billion in 2023 and is expected to grow at a CAGR of 7.1 %.

Format : PDF | Report ID : SMR_1053

Power Transportation and Distribution Equipment Market Overview:

The rapid rise in population in the world is expected to fuel the Power Transportation and Distribution Equipment Market. Growth in development and urbanization presents robust market opportunities in this sector; considering all these relative factors, the need for the T&D equipment market is expected to rise. According to State Policies, the demand for electricity generation grows twice the rate of primary energy demand.

Devices that govern and regulate the T&D network are known as power T&D equipment. These can help with efficient power generation and emissions reduction in various industries, including residential and commercial. Circuit breakers, transformers, fuses, and switchgear are all critical components of the T&D system.

The effect of the COVID-19 pandemic on the Power T&D Equipments market is devastating, with the market experiencing negative demand. The pandemic has suspended all the ongoing projects and the entire supply chain of the power industry. With infrastructure development gaining traction among the nations across the globe, the T&D Equipment market is projected to grow steadily.

To get more Insights: Request Free Sample Report

Technology advancement in the electronification of vehicles: Electrification of transportation and heating for long-term carbon reduction; significant developments in power transmission and distribution (T&D) systems around the world. Future electricity grids and T&D networks will become more intelligent, more decentralized, and more connected, providing a slew of benefits in increased reliability, security, environmental sustainability, asset utilization, and more control and real-time consumption production optimization.

The shift to EV-operated vehicles is evident in developed countries like the USA, Europe, etc. With climate change, the reduction in emissions is the main agenda for the nations around the globe; thus EV market is expected to gain momentum in ASEAN countries. The sale of EV vehicles has risen by a staggering 108 % compared to 2020, reaching 6.7 million units.

Increase in Development and Demand for Electricity: Governments in developing countries are taking significant steps in developing electric infrastructure in rural and underdeveloped areas. Further, the aging infrastructure in developing countries due to lack of up-gradation and maintenance can be banked upon to cause an increase in demand for Power T&D equipment.

The increase in global warming has resulted in rising temperatures more than ever before, increasing electric consumption due to the high usage of air conditioners and refrigerators. Rising temperatures have also forced economies to rely on electric-operated machinery for less pollution; thus manufacturing industry has become electric intensive. In the US, for the last few years manufacturing industry has accounted for 30 % i.e., 650 billion kWh of the total power generated; this figure is expected to rise due to technological advancement and automation.

Smart Grid: A smart grid is a two-way technology that enables the communication between the user and utility and controls power flow or control load in real-time; Smart Grid has IoT integration. It implements efficient power and transmission systems and consumer and renewable integration. It offers features such as reduction of Transmission and Distribution losses, better asset management, accessibility to electricity etc.

In 2020, the Smart Grid market was valued at 30.1 million USD with an expected growth rate of 19.1 %. Such a rapid rise in the Smart Grid industry is expected to stimulate demand for Power Transportation and Distribution Equipment Market.

Power Transportation and Distribution Equipment Market Segment Analysis:

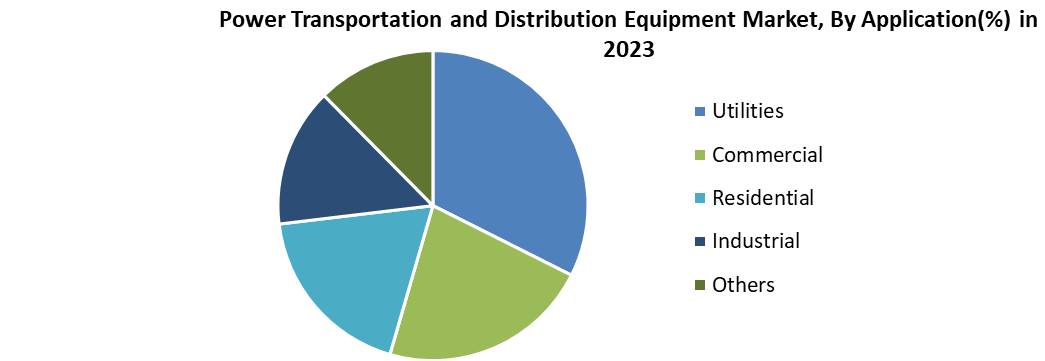

The Power Transportation and Distribution Equipment Market is segmented by Equipment type, application, and geographical region in this report. Power Transportation and Distribution Equipment Market by type is divided into transformer, circuit breakers, inductors and capacitors, meters, fuses, and equipment and by application into utilities, commercial, residential, industrial, and other segments. The report also contains geographical segmentation of Europe, North America, Asia-Pacific, Middle East, and South America.

Transformers are the devices responsible for the final voltage distribution of power and stabilization. Rising infrastructural development and the integration of renewable energy resources are expected to drive demand for transformers. In 2021, the transformer market was valued at 55.2 billion USD and is expected to grow at a 6.3 % CAGR during the research period.

Circuit breakers are devices that interrupt current fluctuations and secure the circuit; the market of circuit breakers is valued at 14.4 billion dollars in 2021. Switchgears are devices used to switch on/off the course and control and regulate power. Switch Gear Market accounts for a 30 percent share of the T&D Equipment market. With a forecast to reach 94.4 billion USD by 2030, Switch Gears are expected to dominate this segment.

The commercial and industrial applications of Power T&D equipment are projected to increase given the adoption of smart cities, new industrial projects, and renewable energy generation. The requirement for distribution of power in developing countries is expected to rise due to development of rural areas.

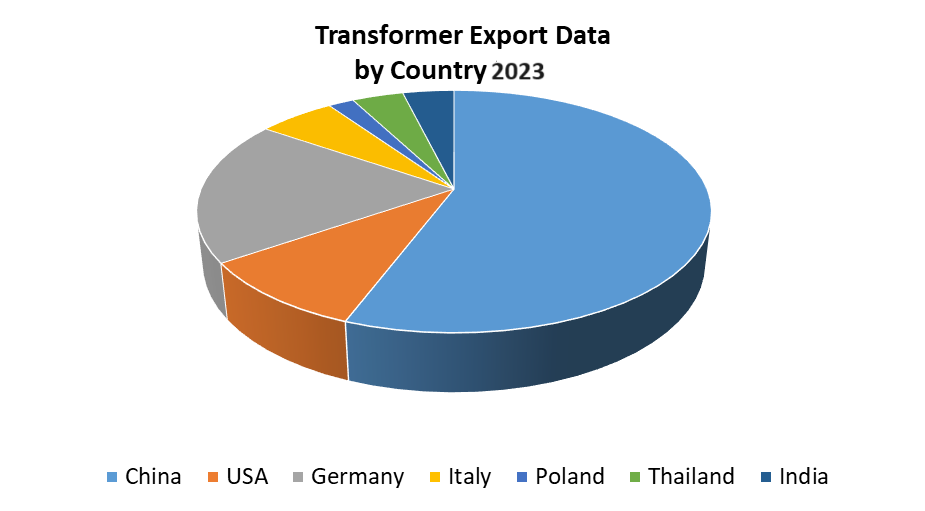

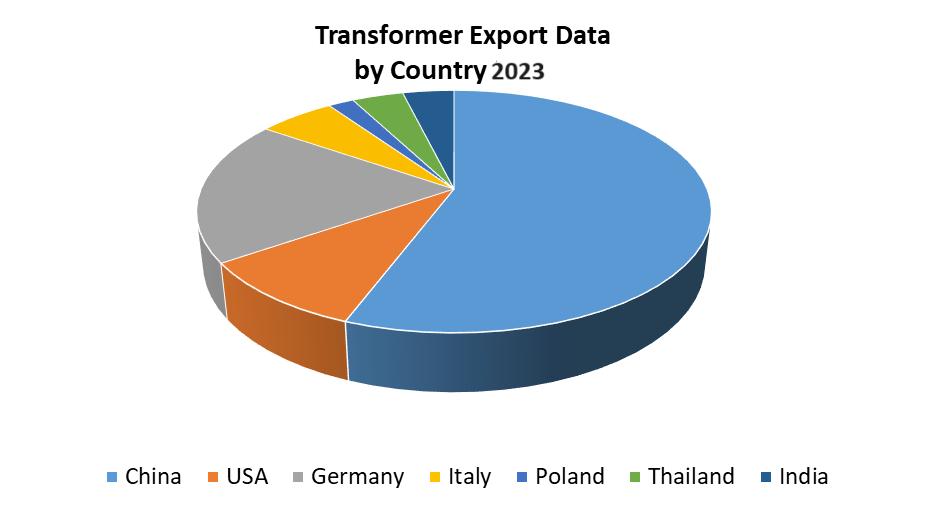

In 2023, China was the major exporter of transformer equipment, holding 29 % of the market share, followed by Germany and the USA. The Netherlands showed the quickest growth rate for the export of electrical transformer equipment.

Power Transportation and Distribution Equipment Market Regional Insights:

The report contains an in-depth analysis of the T&D Equipment market by geographical region across North America, Asia-Pacific, South America, Middle East, and Africa. The presence of developing countries like India and China is expected to drive the growth of the Power Transportation and Distribution Equipment Market in this region. Asia-Pacific is projected to account for 62 % of the total development of the T&D Equipment market. In 2023, China had a significant share of 24 % of the global energy demand for electricity. India's power system is undergoing a transformation driven by a national renewable energy target of 450 GW by 2030. Thus Asia Pacific proves to be a lucrative market for Power T&D Equipment.

The rising temperatures, increase in the sale of EV vehicles, renewable penetration, and development are the drivers of T&D Equipment in Europe. In 2023, 29 GW addition of solar and wind capacity aided renewable energy generation across Europe. With surging carbon prices and stringent emission laws, countries are taking significant steps to reduce their carbon footprint.

For instance, Hungary brought its coal exit date forward by five years to 2025, and Greece aims to put existing lignite capacities out of operation by 2023. These changes have brought a shift in electricity generation and distribution requiring modern T&D equipment, thus stimulating an increase in demand.

According to US energy information and administration, power generation in North America is projected to increase from 4115.54 billion KWh to 4201 billion KWh by 2023 due to planned additions to US wind and solar capacity. The power consumption in the US is expected to be second to the only Asia Pacific during the projection period. The infrastructural development in the Middle East and Africa is anticipated to create surge in demand for Power T&D Equipments.

This report aims to analyze current market trends and potential opportunities to enhance growth to succeed in the industry. The report identifies factors influencing market dynamics and development of the Power Transportation and Distribution Equipment Market and how this will control investment during the forecasting period. The report studies regional markets to provide valuable insights into revenue and predicted value; information also includes the competitive landscape of key industry players and their recent developments.

Through comprehensive research supported by qualitative and quantitative data, this report provides essential information on the market behavior during the forecast period (2024-2030). It also recognizes dominant segments in the market, projects their development, and identifies new elements that will dominate with technological advancements.

The report contains detailed analyses through Porter's five forces model to determine the industry's structure and help devise a corporate strategy for the market. The model reports provide essential information about stakeholders' influence, product quality, substitute products, etc. The report also analyses whether the Power Transportation and Distribution Equipment Market is accessible for new competitors to gain a foothold, whether they enter or exit the market regularly, and if a few players dominate it.

A measured approach is adopted through Pestel analysis to quantify factors including government policies, economic structure, and political situations that will affect the development of this sector. Economic variables aid in studying financial performance drivers that impact the Power Transportation and Distribution Equipment Market. The report also considers environmental and legal factors that may affect the progress in this industry.

Power Transportation and Distribution Equipment Market Scope:

|

Power Transportation and Distribution Equipment Market |

|

|

Market Size in 2023 |

USD 253.94 Bn. |

|

Market Size in 2030 |

USD 410.45 Bn. |

|

CAGR (2024-2030) |

7.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By equipment type

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Major Competitors

The Power T&D Equipment demands innovation and progress in a continuously changing landscape with new government policies and development. Thus, significant players often opt for strategies to invest in research and more recent technologies to be market-ready. Details profiles about the competitors, including revenue, market size, analysis, and technological advancements, are covered in this report.

- Hitachi ABB Power Grids (Switzerland)

- Schneider Electric (France)

- Siemens (Germany)

- Eaton Corporation (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Hammond Power Solutions (Canada)

- Toshiba Corporation (Japan)

- General Electric (US.)

- TE Connectivity (Switzerland)

- Powell Industries Inc. (US.)

- Fuji Electric Co. Ltd (Japan)

- Bharat Heavy Electricals Limited (BHEL) (India)

- Chint Group (China)

- Basler Electric Company (US.)

- CG Power and Industrial Solutions Limited (India)

- G&W Electric (US.)

- S&C Electric (US.)

- Itron (US.)

- Landis+GYR (Switzerland)

Frequently Asked Questions

Asia-pacific region is projected to multiply and acquire a major share in the forecast period.

Power Transportation and Distribution Equipment Market is expected to grow at a CAGR of 7.1 percent during the forecasting period.

Hitachi ABB Power Grids (Switzerland), Schneider Electric (France), Siemens (Germany), and Eaton Corporation (Ireland) are the major players.

- Scope of the Report

- Research Methodology

- Research Process

- Global Power Transportation and Distribution Equipment Market: Target Audience

- Global Power Transportation and Distribution Equipment Market: Primary Research (As per Client Requirement)

- Global Power Transportation and Distribution Equipment Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2023(%)

- North America

- Europe

- Asia Pacific

- Middle East

- South America

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- Middle East Stellar Competition Matrix

- South America Stellar Competition Matrix

- Key Players Benchmarking: by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2023(%)

- Global Power Transportation and Distribution Equipment Market Segmentation

- Global Power Transportation and Distribution Equipment Market, by Region (2023-2030)

- North America

- Europe

- Asia-Pacific

- Middle East

- South America

- Global Power Transportation and Distribution Equipment Market, by Equipment Type (2023-2030)

- Transformer

- Switch Gear

- Circuit Breaker

- Inductors and Capacitors

- Meters

- Fuses and Equipment

- Global Power Transportation and Distribution Equipment Market, by Application (2023-2030)

- Utilities

- Commercial

- Residential

- Industrial

- Others

- Global Power Transportation and Distribution Equipment Market, by Region (2023-2030)

- North America Power Transportation and Distribution Equipment Market Segmentation

- North America Power Transportation and Distribution Equipment Market, by Equipment Type (2023-2030)

- Transformer

- Switch Gear

- Circuit Breaker

- Inductors and Capacitors

- Meters

- Fuses and Equipment

- North America Power Transportation and Distribution Equipment Market, by Application (2023-2030)

- Utilities

- Commercial

- Residential

- Industrial

- Others

- North America Power Transportation and Distribution Equipment Market, by Equipment Type (2023-2030)

-

- North America Power Transportation and Distribution Equipment Market, by Country (2023-2030)

- United States

- Canada

- Mexico

- North America Power Transportation and Distribution Equipment Market, by Country (2023-2030)

- Europe Power Transportation and Distribution Equipment Market Segmentation

- Europe Power Transportation and Distribution Equipment Market, by Equipment Type (2023-2030)

- Europe Power Transportation and Distribution Equipment Market, by Application (2023-2030)

- Europe Power Transportation and Distribution Equipment Market, by Country (2023-2030)

- Asia Pacific Power Transportation and Distribution Equipment Market Segmentation

- Asia Pacific Power Transportation and Distribution Equipment Market, by Equipment Type (2023-2030)

- Asia Pacific Power Transportation and Distribution Equipment Market, by Application (2023-2030)

- Asia Pacific Power Transportation and Distribution Equipment Market, by Country (2023-2030)

- Middle East T&D Equipment Market Segmentation

- Middle East Power Transportation and Distribution Equipment Market, by Equipment Type (2023-2030)

- Middle East Power Transportation and Distribution Equipment Market, by Application (2023-2030)

- Middle East Power Transportation and Distribution Equipment Market, by Country (2023-2030)

- South America T&D EquipmentMarket Segmentation

- South America T&D EquipmentMarket, by Equipment Type (2023-2030)

- South America T&D EquipmentMarket, by Application (2023-2030)

- South America T&D EquipmentMarket, by Country (2023-2030)

- Company Profiles

- Key Players

- Siemens (Germany)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Hitachi ABB Power Grids (Switzerland)

- Schneider Electric (France)

- Eaton Corporation (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Hammond Power Solutions (Canada)

- Toshiba Corporation (Japan)

- General Electric (US.)

- TE Connectivity (Switzerland)

- Powell Industries Inc. (US.)

- Fuji Electric Co. Ltd (Japan)

- Bharat Heavy Electricals Limited (BHEL) (India)

- Chint Group (China)

- Basler Electric Company (US.)

- CG Power and Industrial Solutions Limited (India)

- G&W Electric (US.)

- S&C Electric (US.)

- Itron (US.)

- Landis+GYR (Switzerland)

- Siemens (Germany)

- Key Players

- Key Findings

- Recommendations