Mexico IVF Services Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The Mexico IVF Services Market size was valued at USD 986.07 Million in 2024 and the total Mexico IVF Services revenue is expected to grow at a CAGR of 9.2% from 2025 to 2032, reaching nearly USD 1993.84 Million in 2032.

Format : PDF | Report ID : SMR_1589

Mexico IVF Services Market Overview

In IVF, eggs from a woman and sperm from a man are combined in a lab dish. The resulting viable embryos are placed in a woman's uterus for pregnancy. The research delves into Mexico IVF Services market, analyzing factors such as market trends, competition, and technological advancements to offer comprehensive insights into the reproductive procedure. Infertility rates are rising due to delayed pregnancies, environmental factors, and lifestyle changes. IVF treatments are gaining increased awareness and acceptance. Disposable incomes are growing, healthcare infrastructure is improving, and fertility clinics, along with specialized professionals, are increasing. Government initiatives actively support assisted reproductive technologies.

- In 2023, Mexico conducted over 40,000 IVF cycles, signifying a substantial demand for treatment.

- Success rates for IVF with fresh non-donor eggs in Mexico, varying from 50% to 60%, hinge on factors like patient age and medical conditions.

The comprehensive report serves as a detailed analysis of the Mexico IVF Services Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the Mexico IVF Services Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

Technological Advancements and Rising Success Rates Drive the Mexico IVF Services Market

In the Mexico IVF Services Market, advancements in IVF technologies, such as improved embryo culture, pre-implantation genetic testing (PGT), and minimally invasive procedures, actively increase accessibility and affordability. These improvements, including sperm selection and blastocyst transfer, actively elevate success rates, alleviating emotional stress for infertile couples. Minimally invasive procedures and embryo monitoring actively improve the patient experience, actively reducing discomfort and anxiety. The booming Mexico IVF Services market actively drives economic growth, generating jobs in healthcare and related industries. Mexico's cost-effective and successful IVF services actively position it as a key destination for medical tourism, benefiting both the healthcare sector and the broader economy.

|

Technology |

Description |

Impact |

|

Improved Laboratory Techniques |

|

|

|

Improved Diagnostics and Selection |

|

|

|

Emerging Technologies |

|

|

In the Mexico IVF services market, growing demand raises ethical concerns about the potential exploitation of egg donors, especially in regions with lax regulations. It's imperative to actively monitor and enforce ethical guidelines. Despite lower costs in some countries, IVF imposes a significant financial burden on many families. Improving accessibility requires actively increasing insurance coverage and financial assistance programs. While technological advancements mitigate risks, IVF still presents potential health complications.

Maintaining transparency and ensuring informed consent are vital for ethical and responsible practices. The emotional toll of infertility treatment and potential setbacks psychologically taxing, underscoring the need for comprehensive support systems throughout the process. Unequal access to advanced technologies and quality IVF care exacerbates existing social inequalities, particularly impacting low-income families and marginalized communities.

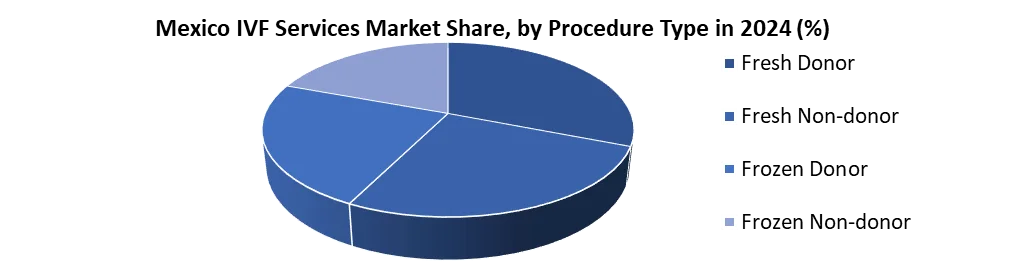

Mexico IVF Services Market Segment Analysis

Based on Procedure Type, the Fresh Non-donor segment held the largest market share of about 58% in the Mexico IVF Services Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 9.5% during the forecast period. It stands out as the dominant segment within the Mexico IVF Services Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

The Mexico IVF Services Market choosing fresh non-donor eggs in fertility treatments increases success rates by enhancing fertilization and embryo development due to their higher quality and youth. Couples, especially those dealing with same-sex infertility or genetic conditions, establish a crucial genetic connection with their child. In Mexico, the option proves more cost-effective, as expenses for egg retrieval and screening are lower than purchasing donor eggs.

In Mexico IVF Services Market the limited availability of certain fresh non-donor eggs leads to waiting lists and treatment delays, especially during peak demand periods. The ethical concerns regarding potential donor exploitation emphasize the necessity for ethical egg donation practices and ensuring informed donor consent. Experienced professionals typically keep medical risks, such as ovarian hyperstimulation syndrome and infection during the egg retrieval process, at generally low levels.

As Mexico's egg donation regulations grow, it underscores the importance of choosing a clinic that adheres to ethical guidelines and laws. Couples actively consult with their doctor to customize treatment according to their individual needs and preferences.

|

Mexico IVF Services Market Scope |

|

|

Market Size in 2024 |

USD 986.07 Million |

|

Market Size in 2032 |

USD 1993.84 Million |

|

CAGR (2025-2032) |

9.2 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Procedure Type

|

|

By End-User

|

|

Leading Key Players in the Mexico IVF Services Market

- Max Healthcare,

- Bloom In Vitro Fertilization (IVF),

- CCRM Fertility.,

- OXFORD FERTILITY,

- Create Health (Create Fertility),

- Medicover,

- Aevitas Fertility Clinic,

- BioART Fertility Clinic

- Prelude Fertility, Inc.

Frequently Asked Questions

Financial Burden and Limited Insurance Coverage are expected to be the major restraining factors for the Mexico IVF Services market growth.

The Mexico IVF Services Market size was valued at USD 986.07 Million in 2024 and the total Mexico IVF Services revenue is expected to grow at a CAGR of 9.2% from 2025 to 2032, reaching nearly USD 1993.84 Million By 2032.

1. Mexico IVF Services Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Impact of Artificial Intelligence (AI) On Mexico IVF Services Market.

2.1 Embryo Selection and Grading

2.2 Sperm Selection and Motility Analysis

2.3 Automation and Streamlining of Processes

3. Mexico IVF Services Market: Dynamics

3.1.1 Market Driver

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the Mexico IVF Services Industry.

3.6 The Pandemic and Redefining of The Mexico IVF Services Industry Landscape.

4. Mexico IVF Services Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 Mexico IVF Services Market Size and Forecast, by Procedure Type (2024-2032)

4.1.1 Fresh Donor

4.1.2 Fresh Non-donor

4.1.3 Frozen Donor

4.1.4 Frozen Non-donor

4.2 Mexico IVF Services Market Size and Forecast, End-User (2024-2032)

4.2.1 Fertility Clinics

4.2.2 Surgical Centers

4.2.3 Hospitals

4.2.4 Clinical Research Institutes

5. Mexico IVF Services Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading Mexico IVF Services Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 Max Healthcare,

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Bloom In Vitro Fertilization (IVF),

6.3 CCRM Fertility.,

6.4 OXFORD FERTILITY,

6.5 Create Health (Create Fertility),

6.6 Medicover,

6.7 Aevitas Fertility Clinic,

6.8 BioART Fertility Clinic

6.9 Prelude Fertility, Inc.

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. Mexico IVF Services Market: Research Methodology