Latin America Online Gambling Market - Industry Analysis and Forecast (2024-2030)

Latin America Online Gambling Market was valued nearly US$ 12.18 Bn. in 2023. Latin America Online Gambling Market size is estimated to grow at a CAGR of 3.23%

Format : PDF | Report ID : SMR_225

Latin America Online Gambling Market Overview:

For years, Latin America has been on the minds of online gambling investors. It's a massive market with millions around the world interested in betting on sports & playing online casino games. Latin America was a little late to the game when it came to legalization. Some countries, such as Costa Rica and Panama, have legalized online gambling for over a decade. However, many countries are currently experiencing a surge in Gaming demand.

To get more Insights: Request Free Sample Report

In Latin America, where's the online gambling legal:

Only a few Latin countries allow online gambling. Below are a few of them:

Colombia

Colombia made online gambling, including sports betting & online casinos, legal in 2016. Since then, the industry has exploded, bringing in $19.6 Mn for the government in 2019. Colombia's internet gambling profits are driven by sports betting, as they are in many other sports-loving countries.

Argentina & Brazil are two countries that share a border.

Legalizing online gambling is a provincial affair in Argentina. Mobile betting is legal in 14 of the country's 24 jurisdictions, with some also allowing online casinos. iGaming is a $2.4 Bn industry, according to our study report. After years of protest, Latin America's most populous country authorized internet gambling in 2018. Licensing attempts have been reluctant to take off, but the business is likely to exceed $1 Bn in the coming years.

Mexico, Paraguay, & Peru are three of the world's most populous countries.

Mexico allows land-based enterprises to provide internet gambling. As a result, many Mexicans prefer to place their bets at offshore casinos & sportsbooks. The finest Bitcoin casinos offer superior security, high-quality games, and simple banking. Offshore betting becomes more enticing as a result of this. Most forms of online gambling are permitted in Paraguay. However, the industry is modest, generating only about $4 Mn each year. Peru, on the other hand, allows slot machines and table games. Races, sports betting, and lottery games, however, are prohibited.

Costa Rica and Panama are two countries in Central America.

Costa Rica and Panama, as previously indicated, have long promoted internet casinos. Costa Rica has about 400 gambling establishments. Surprisingly, many businesses are unable to provide their services to Costa Ricans. Panama has laws that are similar to those in the United States. Hundreds of online casinos obtain licenses in the country but offer their services to people from other countries. Panama is a popular choice for investors because of its cheap taxes and licensing costs.

Market Driving factors:

Offshore Gambling Sites That Are Safe:

The simple accessibility of offshore gambling sites is the key cause for the desire for online gambling in Latin America. Many of these businesses have licenses from Latin American countries such as Panama, Costa Rica, and Curacao. They give excellent safety and service. Importantly, these operators have earned a reputation for being reliable. People have no reason to avoid them any longer.

Support on the Go:

In the last 15 years, tens of millions of individuals in Latin America have used mobile phones to access the Internet. Importantly, mobile technology has progressed to the point where even a low-cost Android handset can run hundreds of sophisticated games. People who use their smartphones for pleasure don't need to go looking for a desktop computer to play slots or place soccer bets. They only require their smartphone. They must, of course, select a reputable mobile gaming website.

For the iGaming sector, Latin America holds a lot of promise. Markets that have already opted to regulate online casinos & sportsbooks are enjoying steady growth, while countries with favourable rules on the horizon are expecting explosive growth over the coming years. The legal position of online gambling differs from country to country throughout the continent. Except for official lotteries, several countries, like Ecuador & Brazil, now outlaw all kinds of gambling, with the assumption that online gambling is included. While it is not formally controlled in other nations, it is also not aggressively forbidden.

Bolivia & Nicaragua included the online gaming as part of their broader gambling regulation system. Online gambling is controlled on a province-by-province basis in Argentina. Bolivia, Mexico, & Brazil are among the countries that are exploring or pursuing changes to their online gaming legislation. Proposed legislation is now being considered in the latter two countries. Meanwhile, Colombia has been changing its regulatory framework in order to better accommodate the digital age. Brazil is known as Latin America's sleeping giant, but there are several more markets that offer iGaming operators options worth considering. As we approach 2021, we provide a country-by-country breakdown of the South American online gambling business.

Argentina

Argentina is Latin America's 4th biggest country and 2nd largest economy, with a population of approximately 45 million people. Gambling is controlled on a province-by-provincial basis, with operators limited to serving citizens of their home province. Operators are allowed to offer nearly any form of gambling in those that wish to regulate.

The online gaming and betting industry in the country is expected to produce $2.4 billion in yearly income. In order to recover from the 2020 financial catastrophe, the government recently declared that the federal tax on internet gambling would be raised from 2% to 5%. This is distinct from provincial and municipal taxes; the province of Buenos Aires levies a 25% tax on gross gaming earnings. Buenos Aires is a city in Argentina.

Markets with a Wide Range of Options:

Another reason why people are flocking to online gambling sites is that there is something for everyone. It makes no difference if people enjoy soccer betting, video game competitions, or bingo. If people really can play it online, there's a website that will sell it to people. The best part is that many gambling companies offer all of these betting options on a single website. On the same app, user may play slots, engage in a poker tournament, and wager on sports. This makes things easier.

The objective of the report is to present a comprehensive analysis of the Latin America Online Gambling Market to the stakeholders in the industry. The report provides trends that are most dominant in the Latin America Online Gambling Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Latin America Online Gambling Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Latin America Online Gambling Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Latin America Online Gambling Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Latin America Online Gambling Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Latin America Online Gambling Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Latin America Online Gambling Market is aided by legal factors.

Latin America Online Gambling Market Scope:

|

Latin America Online Gambling Market |

|

|

Market Size in 2023 |

USD 12.18 Bn. |

|

Market Size in 2030 |

USD 15.21 Bn. |

|

CAGR (2024-2030) |

3.23% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Type

|

|

by Device

|

|

|

Country Scope |

|

Major Players operating in the Latin America Online Gambling Market are:

- William Hill PLC

- Bet365 Group Ltd.

- Paddy Power Betfair PLC

- Betsson AB

- Ladbrokes Coral Group PLC

- The Stars Group Inc.

- 888 Holdings PLC

- Sky Betting and Gaming

- Kindred Group PLC

- GVC Holdings PLC

Frequently Asked Questions

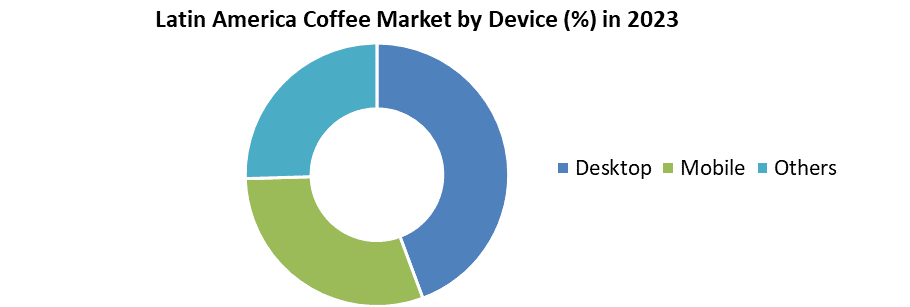

Mobile segment is the dominating end use segment in the market.

William Hill PLC, Bet365 Group Ltd., Paddy Power Betfair PLC, Betsson AB Ladbrokes Coral Group PLC, The Stars Group Inc., 888 Holdings PLC, Sky Betting and Gaming, Kindred Group PLC, GVC Holdings PLC.

The major factors for the growth of the Latin America Online Gambling market includes high internet penetration and increasing use of mobile phones among individuals for playing online games from their homes and public places.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Latin America Online Gambling Market Executive Summary

2.1. Market Overview

2.2. Market Size (2023) and Forecast (2024 – 2030) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Country

3. Latin America Online Gambling Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Latin America Online Gambling Market: Dynamics

4.1. Latin America Online Gambling Market Trends

4.2. Latin America Online Gambling Market Drivers

4.3. Latin America Online Gambling Market Restraints

4.4. Latin America Online Gambling Market Opportunities

4.5. Latin America Online Gambling Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Blockchain

4.8.2. Real-time rendering

4.8.3. Technological Roadmap

4.9. Regulatory Landscape

5. Latin America Online Gambling Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030)

5.1. Latin America Online Gambling Market Size and Forecast, by Type (2024-2030)

5.1.1. Sports Betting

5.1.2. Casinos

5.1.3. Poker

5.1.4. Bingo

5.1.5. Others

5.2. Latin America Online Gambling Market Size and Forecast, by Device (2024-2030)

5.2.1. Desktop

5.2.2. Mobile

5.2.3. Others

5.3. Latin America Online Gambling Market Size and Forecast, by Country (2024-2030)

5.3.1. Brazil

5.3.2. Mexico

5.3.3. Colombia

5.3.4. Argentina

5.3.5. Peru

5.3.6. Ecuador

5.3.7. Chile

5.3.8. Rest of Latin America

6. Company Profile: Key Players

6.1. William Hill PLC

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.3.3. Regional Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bet365 Group Ltd.

6.3. Paddy Power Betfair PLC

6.4. Betsson AB

6.5. Ladbrokes Coral Group PLC

6.6. The Stars Group Inc.

6.7. 888 Holdings PLC

6.8. Sky Betting and Gaming

6.9. Kindred Group PLC

6.10. GVC Holdings PLC

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook