Esports Market: Industry Analysis and Forecast (2024-2030) Trends, Drivers, Statistics, Segmentation by Game Genre, Platform and Revenue Model

The Esports Market size was valued at USD 3.8 Billion in 2023 and the total Esports revenue is expected to grow at a CAGR of 9.04% from 2024 to 2030, reaching nearly USD 6.96 Billion by 2030.

Format : PDF | Report ID : SMR_1584

The Esports Market Overview

Electronic sports, or Esports for short, are video games played competitively. In Esports, teams and professional players battle it out in a variety of video games, frequently in leagues, tournaments, or other formal settings. There are several platforms on which these competitions can be held, such as PC, console, and mobile devices.

With a devoted fan base, professional players, and substantial prize pools, The Esports market have seen a sharp increase in popularity. Some most popular Esports games are Overwatch, League of Legends, Dota 2, and Counter-Strike: Global Offensive. Esports competitions attract sizable audiences for both online and in-person viewing, ranging from modest local competitions to grand global championships. Beyond players, The Esports Market also employs a wide range of professionals in support positions, coaching, analysis, castings, and other tasks. With the help of streaming services like Twitch and YouTube, fans can now follow their favorite players and teams and watch contests live, Esports has become a popular kind of entertainment.

The increased investments and sponsorships in the Esports market and growing popularity for video games, has ultimately resulted in gaining higher revenues in the Esports market. With the introduction of E-sports betting and increasing demand of video games the Esports market has seen a substantial growth globally. While, development in technologies, professionalization, career opportunities and rise in the Mobile Esports has proved to be the key driving factors in the Esports market.

North America holds a larger market share, with the US dominating the market share globally. Numerous franchised leagues were founded in the US to propel the growth of Esports sector. It is expected that the market grow quickly in the upcoming years. It is predicted that the rapidly expanding gaming sector in the Asia Pacific area is going to soon rule the global Esports business. Esports has been proclaimed as an official sport in China. It shifted the general public toward the Esports sector. To grow Esports in China, numerous businesses are employing experts. South Korea is well-known for its Esports games, which offer the greatest development environment for companies looking to grow into the Esports market. South Korea worked with numerous Esports organizations to advance the Esports sector in their area.

Esports Market Dynamics

Trends contributing the expansion of Esports Market

Increased Investments and Sponsorships has helped substantially for the Esports market to gain financial support as brands have recognized the value of Esports and entered into sponsorship deals, and others have included experiential marketing into their Esports strategy. Sponsors and advertisers represent 60% of Esports Market revenue. In the year 2023, Esports ad revenues were $200 million. Esports Market offer marketers a wide and active fan base, the capacity to target particular demographics, chances for interactive engagement, broad brand exposure through content and sponsorships, direct fan base access through influencer partnerships, insightful data, a stage for showcasing innovations, and a global reach that is not restricted by location.

Growing Popularity of Video games has increased with several reasons including Global Connectivity, which helps players from around the world to compete against each other. This global connectivity is a fundamental aspect of Esports Market, allowing for international tournaments and competitions. With the introduction of streaming Platforms like YouTube and Twitch, Esports visibility and appeal have increased dramatically thanks to the opportunity to watch live streams, view highlights, and interact with the gaming community.

The data clearly demonstrates a rise of players over time, indicating the expanding demand of video games on a global scale.

The growing trend of Esports betting is helping the Esports market to grow at a significant pace. The market of Esports betting has grew as a result of popularity of fantasy Esports. Users create their own teams and compete against other users in fantasy Esports, which amplifies the excitement of betting.

Key Driving factors

Developments in Technologies, such as improved graphics, faster internet speed and advanced streaming platforms. Modern gaming peripherals, high-performance hardware, virtual reality (VR), artificial intelligence (AI), augmented reality (AR) and other technological advancements have improved the gaming experience for both participants and spectators. The global VR market size was estimated at USD 59.96 billion. Esports experience and general popularity have also been greatly influenced by advancements in gaming technology and infrastructure, such as specialized arenas, cloud gaming platforms, and fast internet access. Esports are predicted to grow even more immersive and thrilling in the future as technology advances, drawing in a bigger audience and reaffirming its place as a major player in the Esports Market.

Professionalization and Career opportunities, in the Esports have proved to be the significant drivers for the Esports Market with Professional player turning to be the most recognized career pathway where people join teams and compete in elite competitions to win cash prizes and take part in sponsorships and advertising. Similarly, many career opportunities have emerged through the Esports industry which primarily includes- Esports Hosts/Show casters where individuals offer analysis and commentary, which heightens viewer interest and excitement. Team Owner/Manager are accountable for overseeing an Esports team's finances and operations and for making critical decisions that guarantee the team's success. Esports Admin oversees the organizing, coordinating, and communication of Esports events' administrative duties. Esports Streamer produce Esports-related material that offers viewers amusement, insight, and commentary.

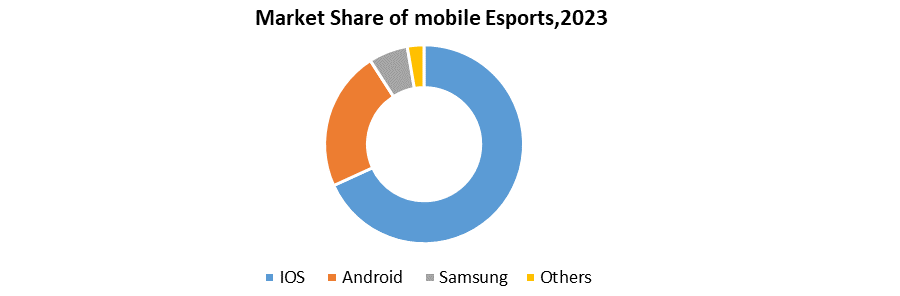

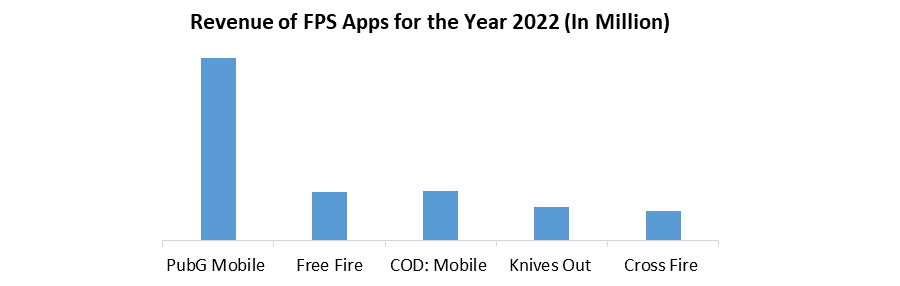

Mobile Esports, have helped the Esports market to grow with its rising popularity of mobile gaming, both recreationally and competitively. The continued widespread use of smartphones has greatly aided the explosive expansion of mobile Esports in recent years, especially in areas like South America, Africa, India, China, and Southeast Asia where access to high-performance gaming PCs is limited. In 2022, the mobile gaming market accounted for 50% of all gaming revenue worldwide. In 2023, Mobile Legends: Bang Bang achieved the highest peak views of any Esports revenue of mobile Esports market was reported to be around 1.2 billion U.S. dollars in 2022. Some big players in the mobile Esports platforms are iOS, Android, Samsung, Unity, Unreal Engine, and Cocos2d.

Restraints, although the Esports market has grown significantly in recent years, it still faces obstacles and limitations similar to those faced by any industry. Several significant obstacles facing the Esports industry include

Monetization Challenges, even though there is a sizable and expanding Esports audience, making money from the sector can be difficult. Several Esports leagues and competitions find it difficult to make enough money using conventional strategies like ticket sales, sponsorships, and advertising. The "2023 Esports Report" highlights that monetization remains a significant challenge for the industry.

Health and Addiction, is one major challenge for the Esports Industry as it can have some adverse effects on the players which includes Physical as well as psychological issues like emotional deregulation, addiction, aggressiveness, sadness, and anxiety.

Regulatory and Legal Challenges, because there is a lack of industry standardization, marketers encounter difficulties differentiating legitimate tournaments from fraudulent ones, as well as problems pertaining to teams, tournaments, and their promotional efforts. In International Contests player transfers can be hampered by geopolitical tensions, visa restrictions, and The financial limitations of developing nations and shifts in consumer buying habits during recessions potentially effect on sponsorship and advertising allocations, which lead to a decrease in Esports marketing expenditures. Trade disputes, which can impact the Esports ecosystem's overall competitiveness.

Esports Market Segmentation

By Game genre, Esports Market comes with a wide range of game genres, some prominent game genre includes- First-Person Shooter (FPS), Multiplayer Online Battle Arena (MOBA), Real-Time Strategy (RTS), Battle Royale, and Sports Simulation.

By Platform, the Esports market is further classified in three formats, namely- PC Esports, Mobile Esports and Console Esports.

|

|

Popular Game |

Annual Revenue (In USD) |

Tournaments and Leagues |

Annual revenue |

|

PC Esports |

Counter-Strike: Global Offensive (CS:GO) |

$6.7 billion |

ESL Pro League (CS:GO) |

$xx |

|

Mobile Esports |

PUBG Mobile |

$1.1 billion |

PUBG Mobile World League |

$xx |

|

Console Esports |

FIFA |

$5.8 billion |

FIFA Eworld Cup |

$xx |

By Revenue Model, the segment has two types, Free to Play (F2P), where users can download and play free-to-play games without having to pay anything up front. Whereas, to access P2P games, a one-time purchase or subscription charge is needed. The P2P market is expected to grow at a CAGR of 9.61%. And the F2P market was valued at a whopping $40.68 billion in the year 2022, as allows players to access games without an upfront cost.

Competitive Landscape

Esports market is framed by diverse range of players including Game developers, event organizers, streaming platforms, sponsors and investors. With each participant trying to sustain in the industry with constant innovation, enhancements and strategic investments to emerge as the dominant player. Activision Blizzard revealed their second-quarter financial results in July 2023, revealing $13.2 billion in cash and short-term investments. Additionally, the business has completed a number of acquisitions. In 2016, it paid $5.9 billion to acquire Candy Crush creator King Digital Entertainment. Activision Blizzard paid an undisclosed sum in 2022 to acquire Proletariat, a maker of mobile games.

With the release of Dungeon Hunter 6, in September 2023, Gameloft began work on reviving the legendary Dungeon Hunter franchise. The game was a big development for the brand as it attempted to release simultaneously in both the Eastern and Western markets.

To make their dominance more prominent in the Esports market, Tencent Holdings made significant investments in various companies, including gaming companies. On September 01, 2023, the company made its most recent investment in Comein Finance as a part of its Corporate Minority. Also, Tencent has made investments in Activision Blizzard, Riot Games, and Epic Games. The government of Saudi Arabia has committed to invest USD 3.3 billion in the gaming industry to make the region more established in the Esports market.

|

Esports Market Scope |

|

|

Market Size in 2023 |

USD 3.8 Bn. |

|

Market Size in 2030 |

USD 6.96 Bn. |

|

CAGR (2023-2030)) |

9.04% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Game genre

|

|

By Platform Type

|

|

|

By Revenue Model

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of Esports Market

- Activision Blizzard Inc. (U.S.)

- Electronics Arts Inc. (U.S.)

- Gameloft SE (France)

- HTC Corporation

- Intel Corporation

- Modern Times Group (Sweden)

- Nintendo of America Inc. (U.S.)

- Twitch Interactive, Inc. (U.S.)

- Tencent Holdings Limited (China)

- NVIDIA Corporation (U.S.)

Frequently Asked Questions

The Esports Market is expected to grow at a CAGR of 9.04% during forecasting period 2023-2029.

Esports Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The important key players in the Esports Market are – Activision Blizzard Inc. (U.S.), Electronics Arts Inc. (U.S.), Gameloft SE (France), HTC Corporation, Intel Corporation, Modern Times Group (Sweden), Nintendo of America Inc. (U.S.), Twitch Interactive, Inc. (U.S.), Tencent Holdings Limited (China), NVIDIA Corporation (U.S.)

The Global Market is studied from 2023 to 2030.

1. Esports Market : Research Methodology

2. Esports Market : Executive Summary

3. Esports Market : Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Esports Market : Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Esports Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Esports Market Size and Forecast, by Game Genre mode (2023-2030)

5.1.1. FPS

5.1.2. MOBA

5.1.3. RTS

5.1.4. Sport simulation

5.2. Esports Market Size and Forecast, by Platform Type(2023-2030)

5.2.1. PC

5.2.2. Mobile

5.2.3. Console

5.3. Esports Market Size and Forecast, by Revenue Model (2023-2030)

5.3.1. Free to Play (F2P)

5.3.2. Pay to Play (P2P)

5.4. Esports Market Size and Forecast, by Region (2023-2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Esports Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Esports Market Size and Forecast, by Game Genre (2023-2030)

6.1.1. FPS

6.1.2. MOBA

6.1.3. RTS

6.1.4. Sport simulation

6.2. North America Esports Market Size and Forecast, by Platform (2023-2030)

6.2.1. PC

6.2.2. Mobile

6.2.3. Console

6.3. North America Esports Market Size and Forecast, by Revenue Model (2023-2030)

6.3.1. Free to Play (F2P)

6.3.2. Pay to Play (P2P)

6.4. North America Esports Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Esports Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Esports Market Size and Forecast, by Game Genre (2023-2030)

7.1.1. FPS

7.1.2. MOBA

7.1.3. RTS

7.1.4. Sport simulation

7.2. Europe Esports Market Size and Forecast, by Platform (2023-2030)

7.2.1. PC

7.2.2. Mobile

7.2.3. Console

7.3. Europe Esports Market Size and Forecast, by Revenue Model (2023-2030)

7.3.1. Free to Play (F2P)

7.3.2. Pay to Play (P2P)

7.4. Europe Esports Market Size and Forecast, by Country (2023-2030)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Esports Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Esports Market Size and Forecast, by Game Genre (2023-2030)

8.1.1. FPS

8.1.2. MOBA

8.1.3. RTS

8.1.4. Sport simulation

8.2. Asia Pacific Esports Market Size and Forecast, by Platform (2023-2030)

8.2.1. PC

8.2.2. Mobile

8.2.3. Console

8.3. Asia Pacific Esports Market Size and Forecast, by Revenue Model (2023-2030)

8.3.1. Free to Play (F2P)

8.3.2. Pay to Play (P2P)

8.4. Asia Pacific Esports Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Esports Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Esports Market Size and Forecast, by Game Genre mode (2023-2030)

9.1.1. FPS

9.1.2. MOBA

9.1.3. RTS

9.1.4. Sport simulation

9.2. Middle East and Africa Esports Market Size and Forecast, by Platform (2023-2030)

9.2.1. PC

9.2.2. Mobile

9.2.3. Console

9.3. Middle East and Africa Esports Market Size and Forecast, by Revenue Model (2023-2030)

9.3.1. Free to Play (F2P)

9.3.2. Pay to Play (P2P)

9.4. Middle East and Africa Esports Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Esports Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Esports Market Size and Forecast, by Game Genre mode (2023-2030)

10.1.1. FPS

10.1.2. MOBA

10.1.3. RTS

10.1.4. Sport simulation

10.2. South America Esports Market Size and Forecast, by Platform (2023-2030)

10.2.1. PC

10.2.2. Mobile

10.2.3. Console

10.3. South America Esports Market Size and Forecast, Revenue Model (2023-2030)

10.3.1. Free to Play (F2P)

10.3.2. Pay to Play (P2P)

10.4. South America Esports Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Oracle

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

12. Activision Blizzard Inc. (U.S.)

13. Electronics Arts Inc. (U.S.)

14. Gameloft SE (France)

15. HTC Corporation

16. Intel Corporation

17. Modern Times Group (Sweden)

18. Nintendo of America Inc. (U.S.)

19. Twitch Interactive, Inc. (U.S.)

20. Tencent Holdings Limited (China)

21. NVIDIA Corporation (U.S.)