Carbon Neutral Market: Global Industry Analysis and Forecast (2024-2030), Technology Trends.

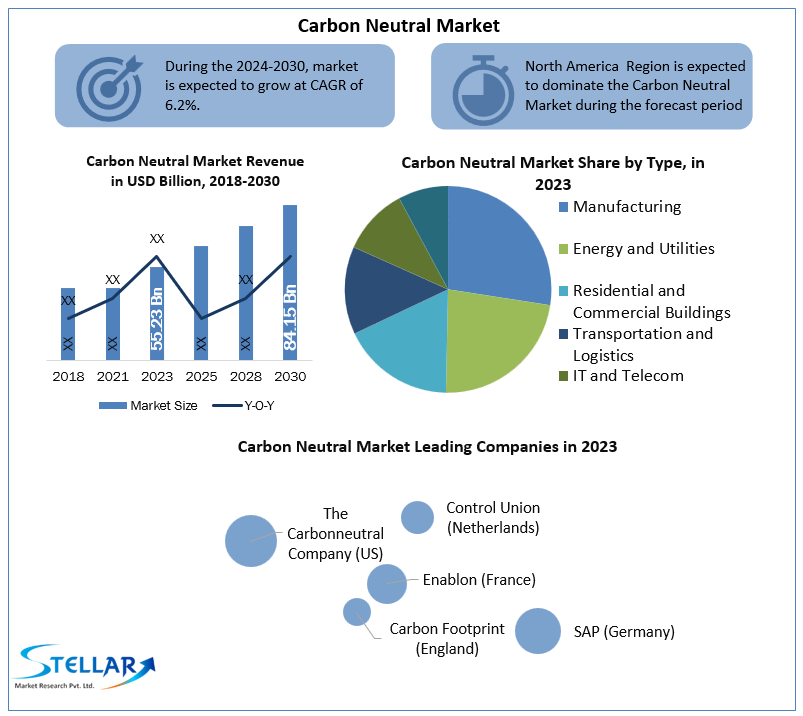

Carbon Neutral Market size was valued at US$ 55.23 Bn. in 2023 and the total revenue is expected to grow at a CAGR of 6.2% through 2024 to 2030, reaching nearly US$ 84.15 Bn.

Format : PDF | Report ID : SMR_148

Carbon Neutral Market Overview:

Carbon-neutrality is achieved when the utility's generation of power sold emits zero CO2 or is offset by sustainable carbon sequestration. When companies, processes, and products quantify their carbon emissions and compensate for them through carbon offsetting programmes, they become carbon neutral. In addition to avoidance and reduction, carbon offsets are an important part of a comprehensive climate strategy.Greenhouse gases, such as CO2, distribute uniformly in the atmosphere, implying that greenhouse gas concentrations are roughly the same everywhere around the globe. As a result, where emissions are created or avoided on the planet has no bearing on the global concentration of greenhouse gases or the greenhouse gas effect. As a result, emissions that cannot be prevented in one location can be offset by carbon offset initiatives in another. This can be accomplished, for example, by forest conservation, afforestation, or the increase of renewable energy sources.

Though Carbon Neutral Market forecasting through 2030is based on real output, demand and supply of 2020, 2020 numbers are also estimated on real numbers published by key players as well all-important players across the world. Market forecasting till 2030 is done based on past data from 2016 to 2019 with the impact of global lock down on the market in 2020 and 2021.

To get more Insights: Request Free Sample Report

Carbon Neutral Market Dynamics:

In today's society, people prefer to do business with organizations who are socially and environmentally conscious. According to a survey of customers in the United Kingdom and the United States, 88% would prefer companies that would help them "be more ecologically friendly and ethical in your daily life." That implies, if you don't indicate your company is attempting to become carbon-neutral, you risk disappointing a lot of your present and potential customers. Allowing employees to strive toward carbon-neutral solutions pushes them to think outside the box when developing new products and services, resulting in growth of Carbon Neutral Market with increased revenue streams.

Adopting renewable energy solutions as a power source is a key aspect of becoming carbon-neutral. All enterprises, particularly large-scale commercial and industrial operations such as manufacturing, office buildings, hospitality operations such as restaurants and hotels, and retail, face significant electricity expenditures.

Switching to alternative energy sources, such as solar, will lower your expenses immediately, resulting in a lower electricity payment. You may often minimize or eliminate your out-of-pocket payments by taking advantage of government discounts and rebates.

These advantages also apply to business travel. You can cut emissions and associated costs by lowering the number of vehicles on the road and optimizing your commercial travels. This involves cutting down on plane travel as well.

Carbon Neutral Market Segment Analysis:

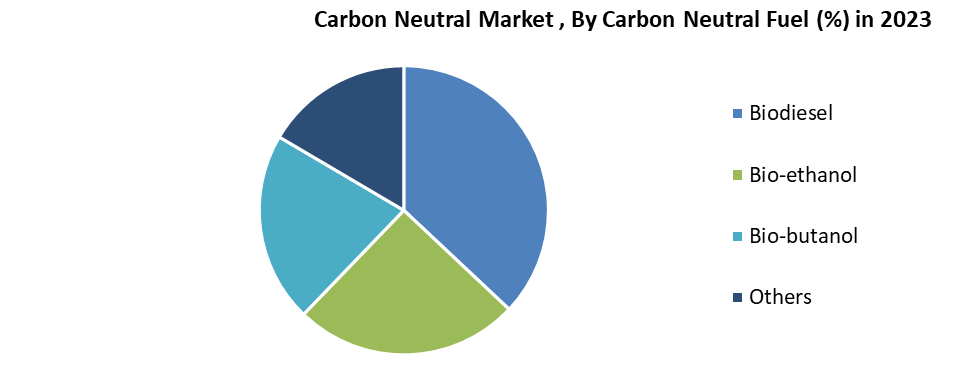

The Carbon Neutral Market is segmented by Carbon Neutral Fuel, Vertical, and Component.

Based on the Carbon Neutral Fuel, the Carbon Neutral Market is segmented into Biodiesel, Bio-ethanol, Bio-butanol, and others. Biodiesel segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. The plants that provide biodiesel with their feedstocks, such as soybeans and palm oil trees, absorb carbon dioxide (CO2) as they grow; this is why the US government considers biodiesel to be carbon-neutral. The CO2 absorbed by these plants compensates for the CO2 produced during the production and combustion of biodiesel. Biodiesel produced in the United States is largely made from soybean oil. Biodiesel can also be made from used vegetable oils or animal fats, such as restaurant grease and oil.

Large areas of natural vegetation and forests have been removed and burned in several regions of the world to cultivate soybeans and palm oil trees for biodiesel production. Land removal and burning may have more severe environmental consequences than the possible benefits of using biodiesel made from soybeans and palm oil trees. These are the key benefits of the biodiesel that are expected to drives the growth of this segment in the carbon neutral market during the forecast period 2024-2030.

Based on the Vertical, the market is segmented into Manufacturing, Energy and Utilities, Residential and Commercial Buildings, Transportation and Logistics, IT and Telecom, and others. Energy and Utilities segment is expected to hold the largest share in the Carbon Neutral Market of xx% by 2030. Global energy consumption has climbed at around twice the average growth rate, according to the International Energy Agency (IEA). The surge is due to a strong global economy and increased heating and cooling needs in a few places of the world. In recent years, demand for fossil fuels, natural gas, solar, and wind energy has increased by double digits. Energy demands increased as a result of increased electricity demand. As a result of the high energy use, CO2 emissions increased by 1.7 percent in 2017.

The development and early adoption of a number of technologies by consumers, businesses, and utilities are paving the way for both power users (individual customers and communities) and power producers (large-scale utilities) to become carbon-neutral. Individual customers can now go "off the grid" with their own renewable energy sources, while commercial consumers and municipalities can pursue the same aim on a bigger scale due to these technologies. Energy efficient technologies, Generation technologies, Grid technologies, and carbon sequestration are the four types of the technology utilised in sustainable energy generation, as well as their impact on customer choice and future business models for power utilities.

Smart home technologies, technology utilised in smart/energy-neutral buildings, innovative interior and outdoor lighting technologies, and sensor-based consumption are all examples of energy efficiency technologies.

Carbon sequestration is the process of removing carbon dioxide and other greenhouse gases from the atmosphere using engineering-based technologies or business-nature collaborations.

Carbon Neutral Market Regional Insights:

North America region is expected to dominate the Carbon Neutral market during the forecast period 2024-2030. North America region is expected to hold the largest market shares of xx% by 2030. President Joe Biden has signed an executive order to make the federal government carbon-neutral by 2050, with a 65% in global-warming greenhouse gas emissions by 2030 and an all-electric fleet of cars and trucks by 2050. According to a recent analysis by DNV, North America must be carbon neutral by 2042 and carbon negative thereafter to satisfy global climate change goals.

Canada recently set a goal of achieving net-zero emissions by 2050, as well as boosted its greenhouse gas reduction targets for 2030. By 2030, it plans to reduce greenhouse gas emissions by 40 to 45 percent compared to 2005 levels. These are the major key drivers that are expected to drives the growth of the North America region in the carbon neutral market during the forecast period 2024-2030

Europe is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. Between 2016 and 2020, the number of carbon-neutral airports in Europe increased dramatically. There were 146 carbon-neutral airports in the Europe as of May 2020, the bulk of which were in Scandinavia. Airports Council International (ACI) Europe launched the Airport Carbon Accreditation programme in 2009 to acknowledge airports' efforts to minimise their carbon footprint. By 2030, ACI hopes to have 100 carbon-neutral airports.

The objective of the report is to present a comprehensive analysis of the Carbon Neutral Market to the stakeholders in the industry. The report provides trends that are most dominant in the Carbon Neutral Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Carbon Neutral Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Carbon Neutral Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Carbon Neutral Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Carbon Neutral Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Carbon Neutral Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Carbon Neutral Market is aided by legal factors.

Carbon Neutral Market Scope:

|

Carbon Neutral Market |

|

|

Market Size in 2023 |

USD 55.23 Bn. |

|

Market Size in 2030 |

USD 84.15 Bn. |

|

CAGR (2024-2030) |

6.2% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Carbon Neutral Fuel

|

|

By Vertical

|

|

|

By Component

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Carbon Neutral Market Key Players

- The Carbonneutral Company (US)

- Control Union (Netherlands)

- Carbon Footprint (England)

- Enablon (France)

- SAP (Germany)

- Dakota Software (US)

- ProcessMAP (US)

- IsoMetrix (South Africa)

- IBM (US)

- Schneider Electric (France)

- Salesforce (US)

- ENGIE (France)

- Ambuja Cements (India)

- Nippon Steel (Japan)

- JSW Group (India)

Frequently Asked Questions

North America is expected to hold the highest share in the Carbon Neutral Market.

The Carbon neutral Company (US), Control Union (Netherlands), Carbon Footprint (England), Enablon (France), and SAP (Germany) are the top key players in the Carbon Neutral Market.

Energy and Utilities vertical segment hold the largest market share in the Carbon Neutral market by 2030.

The market size of the Carbon Neutral market is expected to reach US $84.15 Bn. by 2030.

The market size of the Carbon Neutral market was worth US $55.23 Bn. in 2023.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1.Research Process

2.2.Global Carbon Neutral Market: Target Audience

2.3.Global Carbon Neutral Market: Primary Research (As per Client Requirement)

2.4.Global Carbon Neutral Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Value, 2023-2030

4.1.1.Market Share Analysis, By Region, By Value, 2023-2030 (In %)

4.1.1.1.North America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.2.Europe Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.3.Asia Pacific Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.4.South America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.5.Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.1.2. Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.1. North America Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.1.1.USA Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.1.2.Canada Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.1.3.Mexico Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2. Europe Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.1.UK Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.2.France Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.3.Germany Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.4.Italy Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.5.Spain Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.6.Sweden Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.7.Austria Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.2.8.Rest of Europe Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3. Asia Pacific Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3.1.China Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3.2.India Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3.3.Japan Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3.4.South Korea Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3.5.Australia Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3.6.ASEAN Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.3.7.Rest of APAC Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.4. South America Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.4.1.Brazil Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.4.2.Argentina Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.4.3.Rest of South America Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.5. Middle East and Africa Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.5.1.South Africa Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.5.2.GCC Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.5.3.Egypt Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.5.4.Nigeria Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.2.5.5.Rest of Middle East and Africa Market Share Analysis, By Carbon Neutral Fuel, By Value, 2023-2030 (In %)

4.1.3. Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.1. North America Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.1.1.USA Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.1.2.Canada Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.1.3.Mexico Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2. Europe Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.1.UK Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.2.France Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.3.Germany Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.4.Italy Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.5.Spain Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.6.Sweden Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.7.Austria Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.2.8.Rest of Europe Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3. Asia Pacific Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3.1.China Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3.2.India Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3.3.Japan Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3.4.South Korea Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3.5.Australia Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3.6.ASEAN Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.3.7.Rest of APAC Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.4. South America Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.4.1.Brazil Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.4.2.Argentina Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.4.3.Rest of South America Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.5. Middle East and Africa Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.5.1.South Africa Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.5.2.GCC Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.5.3.Egypt Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.5.4.Nigeria Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.3.5.5.Rest of Middle East and Africa Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.4.Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.1. North America Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.1.1.USA Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.1.2.Canada Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.1.3.Mexico Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2. Europe Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.1.UK Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.2.France Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.3.Germany Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.4.Italy Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.5.Spain Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.6.Sweden Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.7.Austria Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.2.8.Rest of Europe Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3. Asia Pacific Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3.1.China Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3.2.India Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3.3.Japan Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3.4.South Korea Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3.5.Australia Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3.6.ASEAN Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.3.7.Rest of APAC Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.4. South America Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.4.1.Brazil Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.4.2.Argentina Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.4.3.Rest of South America Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.5. Middle East and Africa Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.5.1.South Africa Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.5.2.GCC Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.5.3.Egypt Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.5.4.Nigeria Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.1.4.5.5.Rest of Middle East and Africa Market Share Analysis, By Component, By Value, 2023-2030 (In %)

4.2. Stellar Competition matrix

4.2.1.Global Stellar Competition Matrix

4.2.2.North America Stellar Competition Matrix

4.2.3.Europe Stellar Competition Matrix

4.2.4.Asia Pacific Stellar Competition Matrix

4.2.5.South America Stellar Competition Matrix

4.2.6.Middle East and Africa Stellar Competition Matrix

4.3. Key Players Benchmarking

4.3.1.Key Players Benchmarking By Product, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1.M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1.Market Drivers

4.5.2.Market Restraints

4.5.3.Market Opportunities

4.5.4.Market Challenges

4.5.5.PESTLE Analysis

4.5.6.PORTERS Five Force Analysis

4.5.7.Value Chain Analysis

Chapter 5 Global Carbon Neutral Market Segmentation: By Carbon Neutral Fuel

5.1.Global Carbon Neutral Market, By Carbon Neutral Fuel, Overview/Analysis, 2023-2030

5.2.Global Carbon Neutral Market, By Carbon Neutral Fuel, By Value, Market Share (%), 2023-2030 (USD Million)

5.3.Global Carbon Neutral Market, By Carbon Neutral Fuel, By Value, -

5.3.1.Biodiesel

5.3.2.Bio-ethanol

5.3.3.Bio-butanol

5.3.4.Others

Chapter 6 Global Carbon Neutral Market Segmentation: By Vertical

6.1.Global Carbon Neutral Market, By Vertical, Overview/Analysis, 2023-2030

6.2.Global Carbon Neutral Market Size, By Vertical, By Value, Market Share (%), 2023-2030 (USD Million)

6.3.Global Carbon Neutral Market, By Vertical, By Value, -

6.3.1.Manufacturing

6.3.2.Energy and Utilities

6.3.3.Residential and Commercial Buildings

6.3.4.Transportation and Logistics

6.3.5.IT and Telecom

6.3.6.Others

Chapter 7 Global Carbon Neutral Market Segmentation: By Component

7.1.Global Carbon Neutral Market, By Component, Overview/Analysis, 2023-2030

7.2.Global Carbon Neutral Market Size, By Component, By Value, Market Share (%), 2023-2030 (USD Million)

7.3.Global Carbon Neutral Market, By Component, By Value, -

7.3.1.Solutions

7.3.2.Services

Chapter 8 Global Carbon Neutral Market Segmentation: By Region

8.1.Global Carbon Neutral Market, By Region – North America

8.1.1.North America Carbon Neutral Market Size, By Carbon Neutral Fuel, By Value, 2023-2030 (USD Million)

8.1.2.North America Carbon Neutral Market Size, By Vertical, By Value, 2023-2030 (USD Million)

8.1.3.North America Carbon Neutral Market Size, By Component, By Value, 2023-2030 (USD Million)

8.1.4.By Country – U.S.

8.1.4.1. U.S. Carbon Neutral Market Size, By Carbon Neutral Fuel, By Value, 2023-2030 (USD Million)

8.1.4.2. U.S. Carbon Neutral Market Size, By Vertical, By Value, 2023-2030 (USD Million)

8.1.4.3. U.S. Carbon Neutral Market Size, By Component, By Value, 2023-2030 (USD Million)

8.1.4.4. Canada Carbon Neutral Market Size, By Value, 2023-2030 (USD Million)

8.1.4.5. Mexico Carbon Neutral Market Size, By Value, 2023-2030 (USD Million)

8.2.Europe Carbon Neutral Market Size, By Value, 2023-2030 (USD Million)

8.2.1.UK

8.2.2.France

8.2.3.Germany

8.2.4.Italy

8.2.5.Spain

8.2.6.Sweden

8.2.7.Austria

8.2.8.Rest of Europe

8.3. Asia Pacific Carbon Neutral Market Size, By Value, 2023-2030 (USD Million)

8.3.1.China

8.3.2.India

8.3.3.Japan

8.3.4.South Korea

8.3.5.Australia

8.3.6.ASEAN

8.3.7.Rest of APAC

8.4. Middle East and Africa Carbon Neutral Market Size, By Value, 2023-2030 (USD Million)

8.4.1.South Africa

8.4.2.GCC

8.4.3.Egypt

8.4.4.Nigeria

8.4.5.Rest of Middle East and Africa

8.5. South America Carbon Neutral Market Size, By Value, 2023-2030 (USD Million)

8.5.1.Brazil

8.5.2.Argentina

8.5.3.Rest of South America

Chapter 9 Company Profiles

9.1.Key Players

9.1.1.The Carbonneutral Company (US)

9.1.1.1.Company Overview

9.1.1.2.Tube Portfolio

9.1.1.3.Financial Overview

9.1.1.4.Business Strategy

9.1.1.5.Key Developments

9.1.2.Control Union (Netherlands)

9.1.3.Carbon Footprint (England)

9.1.4.Enablon (France)

9.1.5.SAP (Germany)

9.1.6.Dakota Software (US)

9.1.7.ProcessMAP (US)

9.1.8.IsoMetrix (South Africa)

9.1.9.IBM (US)

9.1.10.Schneider Electric (France)

9.1.11.Salesforce (US)

9.1.12.ENGIE (France)

9.1.13.Ambuja Cements (India)

9.1.14.Nippon Steel (Japan)

9.1.15.JSW Group (India)

9.2.Key Findings

9.3.Recommendations