UK Bike Sharing Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

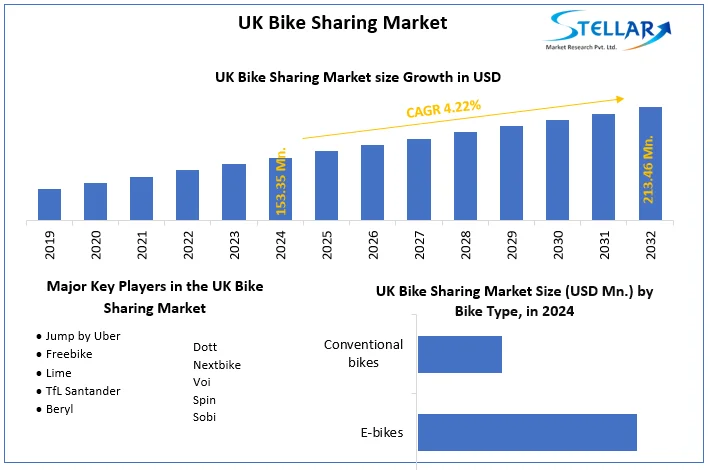

UK Bike Sharing Market size was valued at US$ 153.35 Million in 2024 and the total UK Bike Sharing Market revenue is expected to grow at 4.22% through 2025 to 2032, reaching nearly US$ 213.46 Million.

Format : PDF | Report ID : SMR_116

UK Bike Sharing Market Overview:

From May 2020, demand increased and stayed within the projected range of what it would have been if the pandemic had not occurred. This indicates that, despite the epidemic, the London bike-sharing scheme was a resilient mode of transportation in 2020. Previous research, for example, in New York, has emphasised the robustness of bikesharing. Some restrictions were loosened in May 2020 in UK; for example, persons who couldn't work from home were advised to go to work, avoiding public transportation if possible. As a result, while public transportation ridership has declined, bike sharing is increased in UK with CAGR of 4.22%.

To get more Insights: Request Free Sample Report

UK Bike Sharing Market Dynamics:

The advancement of technology has hastened the transition from traditional forms of transportation to shared mobility, which is defined as different modes of transportation that are shared on an as-needed basis. Car sharing, carpooling, ride sharing, and bike sharing are examples of new types of shared mobility that have exploded in popularity in recent years. This transformation will necessitate a thorough knowledge of the effects of shared mobility on public transportation demand and road use by policymakers, transportation planners, and managers, as well as regulation to control and modify these rising collaborative consumptions. Shared mobility, according to the bulk of extant studies, would change urban transportation.

Measures of effort and comfort have a substantial impact on bike sharing market and distance to a docking station is the most important aspect of bike sharing use in UK. When there are additional bike lanes or bike paths near the bike sharing station, the number of bike sharing trips increases. Bike sharing is also influenced by land use and physical settings, such as train and bus terminals, restaurants, and universities. People prefer to utilize the bike sharing service on weekdays rather than weekends, as well as during peak hours, and when the travel duration is less than 30 minutes.

Key launches in UK bike Sharing Market:

- Tier, a German micromobility business, held an event in London on August 2020 to introduce their "Tier Four" scooter and their "Energy Network" idea. Tier is one of approximately 20 firms trying to conduct escootershares in parts of the UK as part of the DfT trials, and they're eager to show off their unique features to the market. They already have a fleet of roughly 45000 escooters operating in 70 cities across Europe, giving them a significant amount of expertise.

- Spin has lauched E bikes in Milton Keynes on 15 July 2020. It is the first in the UK to allow passengers to conclude their journeys practically anywhere in the operational zone rather than at a limited number of terminals. Ginger and Lime will be added soon, making this a three-way competitive escootershare experiment in the UK for the first time. Ginger has a modest escootershare in Middlesbrough, and Lime has a (just reopened) electric bikeshare in Milton Keynes, but Spin is a relative newcomer in the UK, despite having operated a number of other escootershares throughout the world, including over 1200 in Washington DC.

- Freebike's electric bikes, often known as "pedal assist" or pedelecs, will soon be added to Liverpool's citybike bikeshare system. Homeport, which was also the system supplier for the existing manual bicycle fleet there, owns Freebike. Because Liverpool is a hilly city, the electric assist will undoubtedly come in handy.

- The Liverpool citybike system has been in operation since 2014, with 152 bicycles docked at 844 docking points in 93 docking stations (another 33 stations were deleted a while back due to underuse - the system has continued to expand and decline since then). Most dock-based systems have a bike-to-capacity ratio of around 45%, implying that Liverpool is short 228 bikes. Citybike bikeshare is expected to launch more 350 bikes in docks by Feb 2022.

Increasing Bike Riding Promotion Schemes in UK:

CoMoUK launched a series of promotions in Glasgow and Edinburgh, including free journeys and cheap passes. The advertising were made possible thanks to a grant from Transport Scotland's Smarter Choices, Smarter Places programme, which is managed by Paths for All. Cycling Scotland also contributed to a Stirling promotion. The 30 minute free ride campaign and discounted 'return to work' pass stand out as the most effective initiatives, with 32 percent of Scottish respondents attributing their use of the scheme at least partly to these incentives. This translates to 37% of Glasgow respondents, 20% of Edinburgh respondents, and 13% of Stirling respondents.

Glasgow Bike Sharing:

The number of visitors visiting Glasgow increased by 21% on average from June to September. The unique offers that were financed had an influence on recruiting new customers to utilise bike sharing. In Glasgow, 69,456 passes were redeemed, nearly double the number of "unique users" from the previous year (88 percent average over the 4 months). Because the number of trips did not grow at the same pace, it's possible that some existing customers (who were most likely commuting several days a week) were riding less frequently, while new and existing riders were taking more leisure and utility trips.

Edinburg Bike Sharing:

A total of 6,436 '30-minute free ride' subsidised journeys were made in Edinburgh, with 17,996 trips utilising multi-use 'return to work' cards. The £10 permits offered riders unlimited access to the scheme for four months in order to encourage long-term cycling adoption. When these initiatives were combined, the number of journeys increased even more than in Glasgow. Over the course of four months, the number of travels increased by 74% on average. Although the increase in riders was less than in Glasgow, it was nevertheless significant at 64 percent. These stats have been updated to reflect the increased fleet size since 2019. The findings demonstrate that the combination of passes in Edinburgh has drawn new cyclists while also enticing them to return.

UK Bike Sharing Market Scope:

|

UK Bike Sharing Market |

|

|

Market Size in 2024 |

USD 153.35 Mn. |

|

Market Size in 2032 |

USD 213.46 Mn. |

|

CAGR (2025-2032) |

4.22% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Bike Type

|

|

By Model

|

|

|

By Sharing System

|

|

UK Bike Sharing Market Players

- Jump by Uber

- Freebike

- Lime

- TfL Santander

- Beryl

- Dott

- Nextbike

- Voi

- Spin

- Sobi

Frequently Asked Questions

London, Glasgow and Edinburg region have the highest growth rate in the UK Bike Sharing Market

Jump by Uber, Freebike, Lime, TfL Santander, Beryl, Dott, Nextbike, Voi, Spin, and Sobi are the key players in the UK Bike Sharing Market.

1. UK Bike Sharing Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. UK Bike Sharing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. UK Bike Sharing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Product Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. UK Bike Sharing Market: Dynamics

4.1. UK Bike Sharing Market Trends

4.2. UK Bike Sharing Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. UK Bike Sharing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. UK Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. UK Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station Based

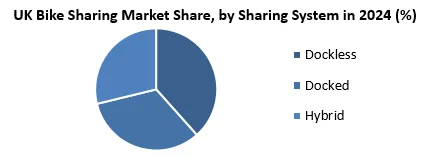

5.3. UK Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

6. Company Profile: Key Players

6.1. Jump by Uber

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Freebike

6.3. Lime

6.4. TfL Santander

6.5. Beryl

6.6. Dott

6.7. Nextbike

6.8. Voi

6.9. Spin

6.10. Sobi

7. Key Findings

8. Industry Recommendations