Spain Bike Sharing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

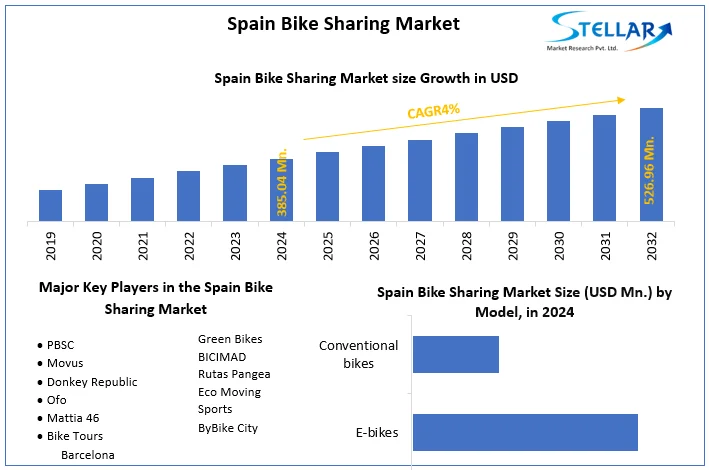

Spain Bike Sharing Market size was valued at US$ 385.04 million in 2024 and the total Spain Bike Sharing Market revenue is expected to grow at 4% through 2025 to 2032, reaching nearly US$ 526.96 million.

Format : PDF | Report ID : SMR_159

Spain Bike Sharing Market Overview:

The Spanish sharing economy is more than today's reality. More than ever, there are services that are expected to people who share their car and move around the city. For example, car sharing and bike sharing appeared only a few years ago and have had a positive impact on Barcelona's sustainable development. And bicycle sharing is becoming more popular not only in Barcelona but also in other parts of the world. With the help of rentals, riders will have easier access to their bikes. Cycling is not only comfortable, fun and sociable, but also good for health. Spain bike sharing market is expected to register CAGR of 4% during the forecast period.

Spain Bike Sharing Market Dynamics:

The low cost and versatility of shared transport has allowed this new concept to flourish in Spain:

In the last two years, Spain bike sharing market is showing atractive growth. It's the cheapest, most sustainable and healthiest way to get around the city. The aim is to transform cities into more sustainable spaces, by providing an alternative mode of transport that reduces the volume of pollution and other harmful environmental impacts. With cities quieter and less trafficked, bicycles want to move around and help improve air quality, especially in larger cities like Barcelona.

Recent data on bike-sharing sales suggest high profitability. In fact, over the past few years, bicycle sales have grown rapidly, outpacing car sales. After seeing the popularity keep growing over time, the next step is to share all the bikes, alleviating the overcrowding problem. No need to go to the store to find the model, in return for payment, but this mode of transport is geared towards the collective purpose of making it easier, simpler and more efficient.

To get more Insights: Request Free Sample Report

Getting around town faster and easier with bike sharing is the new normal:

Due to the design of Barcelona, the city has adapted to the use of bicycles. Many people here use bicycles to commute every day. It's a smart way to get around the city and a great way to be eco-friendly. Years ago, the Barcelona city council pioneered the concept and eventually rolled out the Bicycle service in the city. Then, private companies want to develop the service provided by the town hall, with alternative uses, such as diversified payment methods and more user-friendly applications.

Revolution of Bicing on the streets of Spain:

The success of PBSC powered BICING lies in the numbers. In the first year, the public bike sharing program increased passenger numbers by 9%. This represents 11,000 more users compared to the previous period. Access to the bicycle sharing system has also increased significantly. At launch, the new BICING advanced into 11 new areas within Barcelona. Also, in some areas where bike-sharing is already in place, the number of smart stations has nearly doubled, allowing residents living outside the city center to have more transportation for their daily commute. Electric bike is used by 9 cyclists per day, while the mechanical bike is used by 6 cyclists per day. Also, the distance traveled by electric bicycles is much longer, 750 km a month instead of 320km on average. The average age of vice subscribers is 39 years. We are proud to provide Barcelona residents with a modern and environmentally friendly urban mobility solution.

Bicing Prices in Barcelona and Madrid:

New bike launches by PBSC is driving the Spanish sharing economy:

PBSC launches the second bicycle sharing system in Spain, offering 437 bicycles and electric bicycles at 46 smart stations in San Sebastian PBSC has launched the latest bike-sharing system, dBizi, which is a collaboration between PBSC and Movus / Urbaser. Equipped with the latest micromobility technology, this system replaces the systems of previous competitors in the city. Improvements include more bikes and smart stations, more robust and durable bikes and electric bikes, improved software, and a smoother user experience. Both FIT and EFIT electric bikes will be available throughout the city.

Cyclists can unlock their bikes using a QR code printed on every frame via the PBSC app that is already working in San Sebastian. Introduced in many parts of the city, the system improves mobility options for San Sebastian / Donostia commuters and tourists by providing reliable first and last mile solutions. The brand of the system matches the color and design of Dbus, making it easy for commuters to recognize. Bicycles will be available from December 11, 2020, after the station has been available in the last few weeks. This system is the second system in Spain after Barcelona and has cemented its position as an industry leader on the international arena.

Key players Overview:

BICIMAD:

This service was recently acquired by a Madrid city council member. We offer electric bike rentals to users in the M30 area. There are two ways to purchase or use this service: register on the website or rent from a designated parking lot. Both costs vary depending on when they are used, but the cheapest way to use them is to register online with the purchase of a card.

Positive aspects of BICIMAD:

If you want to visit the center of Madrid, this is the best option because of the low cost and the great selection of bikes. This decreases as you move away from the center (Plaza Sol).

The community formed around this service often deals with bicycles, and it is difficult to find a bicycle in good condition when renting. If you have problems with your bike or billing, the telephone service is quick and efficient.

OBIKE:

This service differs from other services in that it does not have a fixed station. When the bike is no longer in use, users can park their bike anywhere in the city. Then another user can book and upload from your mobile phone. In that respect, it is certainly a more flexible service than BiciMAD.

Obike The process of renting and using a shared bicycle is very simple. Use the iOS or Android app to find out where your nearest bike is, scan the QR code to unlock and enter. When you're done, secure the parking lot with your padlock and return to the parking lot.

Positive aspects of BICIMAD:

The lack of a fixed station to park was very helpful.

The objective of the report is to present a comprehensive analysis of the Spain Bike Sharing Market to the stakeholders in the industry. The report provides trends that are most dominant in the Spain Bike Sharing Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Spain Bike Sharing Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Spain Bike Sharing Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Bike Sharing Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Spain Bike Sharing Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Spain Bike Sharing Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Spain Bike Sharing Market is aided by legal factors.

Spain Bike Sharing Market Scope:

|

Spain Bike Sharing Market |

|

|

Market Size in 2024 |

USD 385.04 Mn. |

|

Market Size in 2032 |

USD 526.96 Mn. |

|

CAGR (2025-2032) |

4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Model

|

|

By Model

|

|

|

|

By Sharing System

|

Spain Bike Sharing Market Players

- PBSC

- Movus

- Donkey Republic

- Ofo

- Mattia 46

- Bike Tours Barcelona

- Green Bikes

- BICIMAD

- Rutas Pangea

- Eco Moving Sports

- ByBike City

Frequently Asked Questions

Barcelona, Madrid and la Paz region have the highest growth rate in the Spain Bike Sharing market

PBSC, Movus, Donkey Republic, Ofo, Mattia 46, Bike Tours Barcelona, Green Bikes, BICIMAD, Rutas Pangea, Eco Moving Sports, ByBike City are the key players in the Spain Bike Sharing market.

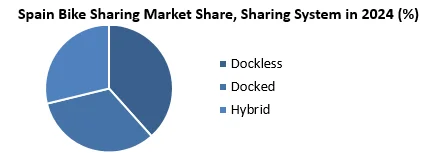

Docked sharing system is dominating the regional market of Spain with market share of approximately 70% and YOY rate of 5%

1. Spain Bike Sharing Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Spain Bike Sharing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Spain Bike Sharing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Product Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Spain Bike Sharing Market: Dynamics

4.1. Spain Bike Sharing Market Trends

4.2. Spain Bike Sharing Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Spain Bike Sharing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Spain Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Spain Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station Based

5.3. Spain Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

6. Company Profile: Key Players

6.1. PBSC

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Movus

6.3. Donkey Republic

6.4. Ofo

6.5. Mattia 46

6.6. Bike Tours Barcelona

6.7. Green Bikes

6.8. BICIMAD

6.9. Rutas Pangea

6.10. Eco Moving Sports

6.11. ByBike City

7. Key Findings

8. Industry Recommendations