Middle East and Africa Cable Connector Market: Industry Analysis and Forecast (2024-2030) by Product, Type, Vertical and, Region

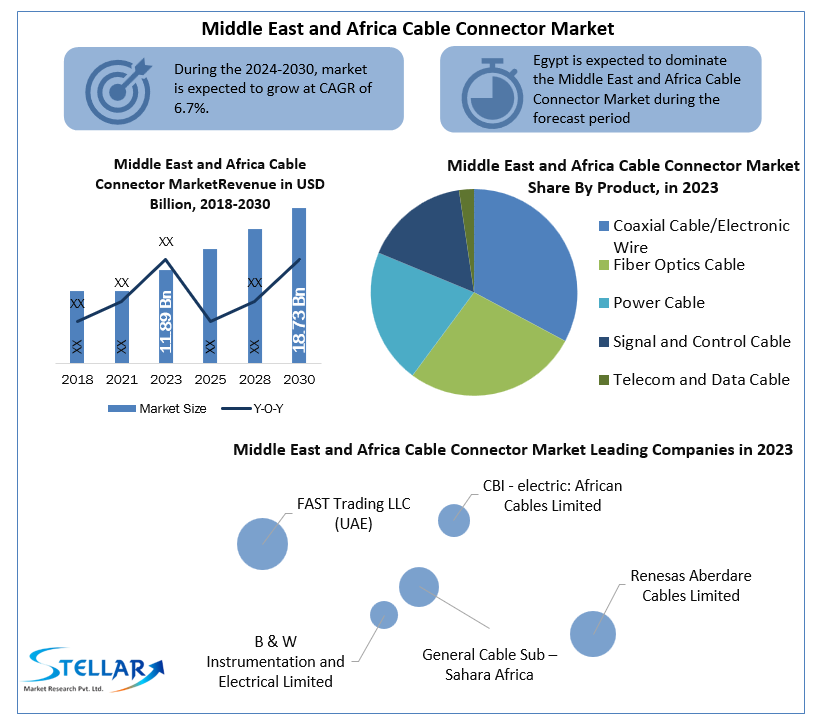

Middle East and Africa Cable Connector Market size was valued at US$ 11.89 Billion in 2023 and the total Middle East and Africa Cable Connector Market revenue is expected to grow at 6.7% through 2024 to 2030, reaching nearly US$ 18.73 Billion.

Format : PDF | Report ID : SMR_108

Middle East and Africa Cable Connector Market Overview:

An electrical cable connector is an electromechanical component used to connect electronic conductors to complete an electronic circuit. Male-ended plugs and female-ended jacks are the two types of cable connections available. Connectors, also known as input-output connectors, serve as the interface for connecting electrical equipment through cables. It is feasible to give high-transfer speed, larger bandwidth internet, and lower signal intensity with improved cables and connections. Cables and connectors are used in a variety of industries, including manufacturing, transportation, education, media, and security. The cable connector market's growth is being fueled by reliable connectivity, high performance, and efficiency.

In recent years, middle eastern countries have witnessed a steep population growth and economic development that resulted in a high increase in power and energy demands in the gulf region. A region’s production and consumption of electricity are one of the key indicators of the cable connector market of that region. In December 2021, Saudi Arabia and Egypt announced a joint collaboration of a US$ 1. billion electricity interconnection project which is expected to begin in 2022 ensuring an exchange of 3 GW of electricity between the two countries. Projects like these are expected to fuel the growth of the power cable connector segment in the middle eastern region in the forecast period (2024-2030).

To get more Insights: Request Free Sample Report

Middle East and Africa Cable Connector Market Dynamics:

One of the major drivers of the MEA cable connector market is favorable government policies of the gulf countries in the energy and power sector. For example, Under the Emirates National Grid Project, UAE is aiming to integrate the emirates into a complete national level grid. One advantage of such projects is that it allows the commercial exchange of electricity among power companies. These projects are expected to be responsible for driving the growth of the power cable connector segment in gulf countries in the forecast period (2024-2030).

A major restraint in the MEA cable connector market is the lack of power and IT infrastructure in the rural areas of the gulf countries. According to an IDC report, gulf countries’ lack of IT infrastructure is a major challenge in 42% of organizations e.g. Oil & Gas, Energy & Power, Industry & Manufacturing etc. This in turn is expected to hamper the cable connector market growth in the same forecast period.

Middle East and Africa Cable Connector Market Segment Analysis:

By Product, Power cable segment is expected to dominate the MEA cable connector market in 2030. The power cable segment is expected to witness a CAGR of 7.2% in the aforementioned forecast period. South Africa, the third-largest economy in Africa, has a huge energy sector. The country is also planning to completely shift their energy dependence from coal to electricity by 2050. They have also aimed to reach 77 GW of energy production by 2030. Coaxial cable segment is expected to follow the power cable segment in terms of cable connector market growth with a CAGR of 5.8% in the same forecast period.

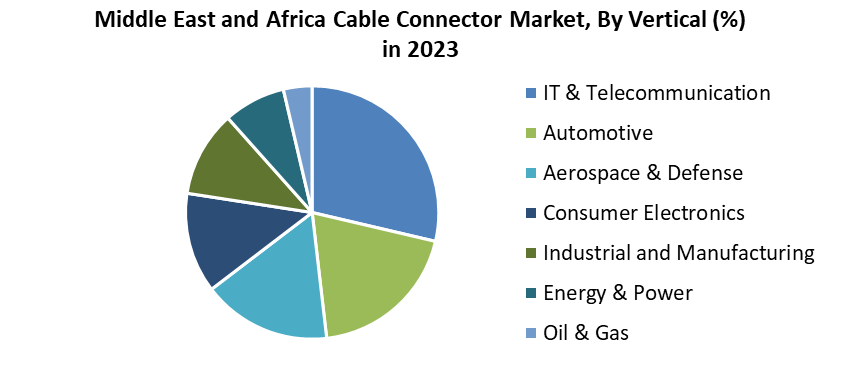

By Vertical, Oil and Gas segment is expected to dominate the MEA cable connector market in 2030. Many electric pieces of equipment e.g. circuit breakers, magnetic starters, panel boards, etc are used in the oil and gas industry. Electrical cable connectors like pogo pin connectors, VGA connectors, blade connectors are among them. Therefore the growth of the oil and gas industry is directly proportional to that of the cable connector market. One such example is the Upper Zakum project, located off the coast of Abu Dhabi worth US$ 20 billion, in its 25 years of existence only 10% of its total capacity has been utilized.

Middle East and Africa Cable Connector Market Regional Insights:

Increased demand for high bandwidth networks from different industries e.g. telecom, oil, etc is expected to drive the growth of the cable connector market in the MEA region. Many government initiatives have implemented many policies to improve the network infrastructure for efficient data transmission. Companies like African Cables and B & W Instrumentation are the key players leading the growth of the market in the African region.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Middle East and Africa Cable Connector market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The market report examines all segments of the industry, with a focus on significant players such as market leaders, followers, and new entrants. The report includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favorable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry. The research also aids in comprehending the Middle East and Africa Cable Connector market dynamics and structure by studying market segments and forecasting market size. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Middle East and Africa Cable Connector market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Major breakthroughs in the Middle East and Africa Cable Connector industry are discussed, as well as organic and inorganic growth plans. Various companies are focusing on organic growth strategies such as new product releases, product approvals, and other items such as patents and events. Inorganic growth strategies used in the industry included acquisitions, partnerships, and collaborations.

Middle East and Africa Cable Connector Market Scope:

|

Middle East and Africa Cable Connector Market Scope |

|

|

Market Size in 2023 |

USD 11.89 Bn. |

|

Market Size in 2030 |

USD 18.73 Bn. |

|

CAGR (2024-2030) |

6.7% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Product

|

|

By Type

|

|

|

By Vertical

|

|

|

Country Scope |

South Africa |

Middle East and Africa Cable Connector Market Players

- CXD Middle East LLC

- BEST POWER CONTROLS ME W.L.L

- TRINCO ELECTRONICS TRADING LLC

- It Plus LLC

- FAST Trading LLC (UAE)

- Renesas Aberdare Cables Limited

- CBI - electric: African Cables Limited

- B & W Instrumentation and Electrical Limited

- General Cable Sub – Sahara Africa

Frequently Asked Questions

Gulf countries have the highest growth rate in the middle east and africa cable connector market.

The key players are CXD Middle East LLC, BEST POWER CONTROLS ME W.L.L, TRINCO, ELECTRONICS TRADING LLC, It Plus LLC, FAST Trading LLC (UAE), Renesas Aberdare Cables Limited, CBI - electric: African Cables Limited, B & W Instrumentation and Electrical Limited, General Cable Sub – Sahara Africa.

Gulf countries have the largest share in the middle east and africa cable connector market.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Middle East and Africa Cable Connector Market: Target Audience

2.3. Middle East and Africa Cable Connector Market: Primary Research (As per Client Requirement)

2.4. Middle East and Africa Cable Connector Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Value, 2023-2030

4.1.1. Market Share Analysis, By Region, By Value, 2023-2030 (In %)

4.1.1.1. Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.1.2. Market Share Analysis, By Product, By Value, 2023-2030 (In %)

4.1.2.1. Middle East and Africa Market Share Analysis, By Product, By Value, 2023-2030 (In %)

4.1.2.1.1. South Africa Market Share Analysis, By Product, By Value, 2023-2030 (In %)

4.1.2.1.2. GCC Market Share Analysis, By Product, By Value, 2023-2030 (In %)

4.1.2.1.3. Egypt Market Share Analysis, By Product, By Value, 2023-2030 (In %)

4.1.2.1.4. Nigeria Market Share Analysis, By Product, By Value, 2023-2030 (In %)

4.1.2.1.5. Rest of Middle East and Africa Market Share Analysis, By Product, By Value, 2023-2030 (In %)

4.1.3. Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1. Middle East and Africa Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.1. South Africa Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.2. GCC Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.3. Egypt Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.4. Nigeria Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.3.1.5. Rest of Middle East and Africa Market Share Analysis, By Type, By Value, 2023-2030 (In %)

4.1.4. Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.4.1. Middle East and Africa Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.4.1.1. South Africa Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.4.1.2. GCC Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.4.1.3. Egypt Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.4.1.4. Nigeria Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.1.4.1.5. Rest of Middle East and Africa Market Share Analysis, By Vertical, By Value, 2023-2030 (In %)

4.2. Stellar Competition matrix

4.2.1. Middle East and Africa Stellar Competition Matrix

4.3. Key Players Benchmarking

4.3.1. Key Players Benchmarking by Product, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1. M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1. Market Drivers

4.5.2. Market Restraints

4.5.3. Market Opportunities

4.5.4. Market Challenges

4.5.5. PESTLE Analysis

4.5.6. PORTERS Five Force Analysis

4.5.7. Value Chain Analysis

Chapter 5 Middle East and Africa Cable Connector Market Segmentation: By Product

5.1. Middle East and Africa Cable Connector Market, By Product, Overview/Analysis, 2023-2030

5.2. Middle East and Africa Cable Connector Market, By Product, By Value, Market Share (%), 2023-2030 (USD Billion)

5.3. Middle East and Africa Cable Connector Market, By Product, By Value, -

5.3.1. Coaxial Cable/Electronic Wire

5.3.2. Fiber Optics Cable

5.3.3. Power Cable

5.3.4. Signal and Control Cable

5.3.5. Telecom and Data Cable

Chapter 6 Middle East and Africa Cable Connector Market Segmentation: By Type

6.1. Middle East and Africa Cable Connector Market, By Type, Overview/Analysis, 2023-2030

6.2. Middle East and Africa Cable Connector Market Size, By Type, By Value, Market Share (%), 2023-2030 (USD Billion)

6.3. Middle East and Africa Cable Connector Market, By Type, By Value, -

6.3.1. PCB Connectors

6.3.2. Circular/Rectangular Connectors

6.3.3. Fiber Optic Connectors

6.3.4. IO Connectors

Chapter 7 Middle East and Africa Cable Connector Market Segmentation: By Vertical

7.1. Middle East and Africa Cable Connector Market, By Vertical, Overview/Analysis, 2023-2030

7.2. Middle East and Africa Cable Connector Market Size, By Vertical, By Value, Market Share (%), 2023-2030 (USD Billion)

7.3. Middle East and Africa Cable Connector Market, By Vertical, By Value, -

7.3.1. IT & Telecommunication

7.3.2. Automotive

7.3.3. Aerospace & defense

7.3.4. Consumer Electronics

7.3.5. Industrial and Manufacturing

7.3.6. Energy & Power

7.3.7. Oil & Gas

Chapter 8 Middle East and Africa Cable Connector Market Segmentation: By Region

8.1. Middle East and Africa Cable Connector Market Size, By Value, 2023-2030 (USD Billion)

8.1.1. South Africa

8.1.2. GCC

8.1.3. Egypt

8.1.4. Nigeria

8.1.5. Rest of Middle East and Africa

Chapter 9 Company Profiles

9.1. Key Players

9.1.1. CXD Middle East LLC

9.1.1.1. Company Overview

9.1.1.2. Product Portfolio

9.1.1.3. Financial Overview

9.1.1.4. Business Strategy