Malaysia Esports Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

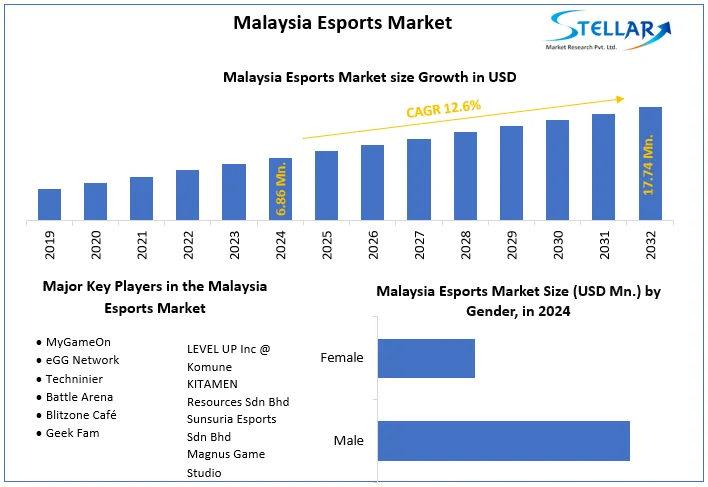

The Malaysia Esports Market size was valued at USD 6.86 Mn. in 2024 and the total Malaysia Esports revenue is expected to grow at a CAGR of 12.6% from 2025 to 2032, reaching nearly USD 17.74 Mn. in 2032.

Format : PDF | Report ID : SMR_1701

Malaysia Esports Market Overview

The comprehensive report offers an in-depth analysis of the Malaysia Esports Market by STELLAR and meticulously examines its evolution, trends, and driving forces. It divides the current landscape, delineating dimensions, growth patterns, and significant trends shaping the market's trajectory. E-sports, driven by the proliferation of online games and broadcasting platforms like Twitch.tv, has flourished globally and in Malaysia.

The report addresses the factors influencing youth participation in e-sports, focusing on government support, hedonic value, social influences, and price. Through quantitative analysis, it reveals that hedonic value and price significantly influence Malaysian youth's intention to engage in e-sports, with hedonic value exhibiting the strongest impact. However, social influence and government support show insignificant effects. These findings provide valuable insights for policymakers and marketers to foster the growth of e-sports in Malaysia, emphasizing the importance of hedonic value. This study represents a pioneering effort in understanding the interplay of these factors in Malaysian e-sports participation.

To get more Insights: Request Free Sample Report

Malaysia Esports Market Dynamics:

Growth of Esports Among the Youngsters in Malaysia to Drive the Malaysia Esports Market

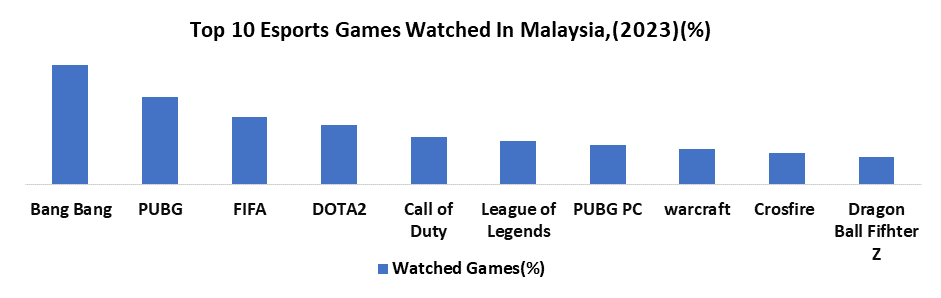

The Malaysia esports market booms within its massive millennial and Gen Z demographic, boasting over 14 million gamers. The market driven by mobile gaming's surge, titles like Mobile Legends Bang Bang and PUBG Mobile attract youth, democratizing esports. With lucrative tournaments and professional teams emerging, esports become a promising career avenue for aspiring Malaysians.

The Malaysia esports market witnesses increased viewership and engagement as more youngsters join and watch tournaments, translating to higher advertising revenue and sponsorships. Government recognition of esports as a legitimate sport attracts investments in infrastructure like training facilities and high-speed internet. This growth fuels the gaming ecosystem, boosting gaming cafes, hardware sales.

The Malaysia esports industry flourishes with games like Mobile Legends (ML) and Players Unknown Battlegrounds (PUBG), featuring lucrative international tournaments and local competitions with significant prize pools. Accessibility is key, requiring only basic hardware. Esports bridges virtual and real worlds, attracting professionals like Max Verstappen and fostering talent like Ady Rahimy Rashid.

Relationship between Government Support and Intention to Adopt E-Sports:

The Malaysian government's robust support for esports development is evident. The Youth and Sports Ministry's commitment aims to establish Malaysia as a prime hub for video game-based sports activities. Research indicates a positive correlation between government backing and esports adoption with financial and non-financial support significantly impacting business performance. Additionally, governments worldwide including non-authoritarian states like the US and UK, actively endorse esports, recognizing its status as a legitimate sport. This support fosters innovation, productivity, and international collaboration, amplifying the sector's growth potential.

Malaysia Esports Market Segment Analysis

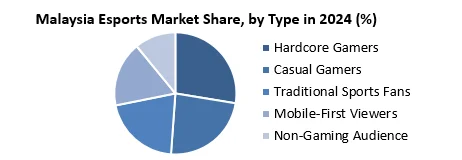

Based on Type, the Mobile first Viewers segment held the largest market share of about 50% in the Malaysia Esports Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 12.7% during the forecast period. Malaysia Esports Market dominates thanks to rapid tech growth and widespread use of smart devices with data connectivity, integrating seamlessly into the gaming landscape.

In the Malaysia Esports Market’s Mobile gaming breaks barriers and allowing anyone with a smartphone to engage in popular titles like Mobile Legends Bang Bang (100+ million monthly users) and PUBG Mobile (1+ billion downloads), fostering widespread participation and viewership. In the Market, viewing habits Favor mobile devices and offering convenience on the move. The Platforms like YouTube Gaming and Twitch provide dedicated apps and catering to this mobile viewership trend and enhancing accessibility and engagement with esports content anytime, anywhere. The Malaysia esports market witnesses a surge in viewership with the rise of mobile-specific titles and the optimization of traditional games for mobile play. This trend attracts a significant segment of gamers, amplifying engagement and participation in esports events.

The rise of mobile esports market in Malaysia prompts investment in infrastructure, such as dedicated facilities and training programs. Also, looking forward the dominance of mobile-first viewers suggests ongoing growth in the Malaysian esports market and offering substantial potential for increasing and nurturing the local esports community.

|

Malaysia Esports Market Scope |

|

|

Market Size in 2024 |

USD 6.86 Million |

|

Market Size in 2032 |

USD 17.74 Million |

|

CAGR (2025-2032) |

12.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Gender

|

|

By Type

|

|

|

By Revenue Model

|

|

Leading Key Players in the Malaysia Esports Market

- MyGameOn

- eGG Network

- Techninier

- Battle Arena

- Blitzone Café

- Geek Fam

- LEVEL UP Inc @ Komune

- KITAMEN Resources Sdn Bhd

- Sunsuria Esports Sdn Bhd

- Magnus Game Studio

Frequently Asked Questions

Player Well-being and Sustainability Infrastructure Accessibility and Inclusivity are expected to be the major restraining factors for the Malaysia Esports market growth.

The Malaysia Esports Market size was valued at USD 6.86 Million in 2024 and the total Malaysia Esports revenue is expected to grow at a CAGR of 12.6 % from 2025 to 2032, reaching nearly USD 17.74 Million By 2032.

1. Malaysia Esports Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Malaysia Esports Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Malaysia Esports Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Malaysia Esports Market: Dynamics

4.1. Malaysia Esports Market Trends

4.2. Malaysia Esports Market Drivers

4.3. Malaysia Esports Market Restraints

4.4. Malaysia Esports Market Opportunities

4.5. Malaysia Esports Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Malaysia Esports Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Malaysia Esports Market Size and Forecast, by Gender (2024-2032)

5.1.1. Male

5.1.2. Female

5.2. Malaysia Esports Market Size and Forecast, by Type (2024-2032)

5.2.1. Hardcore Gamers

5.2.2. Casual Gamers

5.2.3. Traditional Sports Fans

5.2.4. Mobile-First Viewers

5.2.5. Non-Gaming Audience

5.3. Malaysia Esports Market Size and Forecast, by Revenue Model (2024-2032)

5.3.1. Sponsorship & advertising

5.3.2. Esports betting & fantasy site

5.3.3. Prize pool

5.3.4. Amateur & micro tournament

5.3.5. Merchandising

5.3.6. Ticket sale

6. Company Profile: Key Players

6.1. MyGameOn

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. eGG Network

6.3. Techninier

6.4. Battle Arena

6.5. Blitzone Café

6.6. Geek Fam

6.7. LEVEL UP Inc @ Komune

6.8. KITAMEN Resources Sdn Bhd

6.9. Sunsuria Esports Sdn Bhd

6.10. Magnus Game Studio

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook