Italy Bike Sharing Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

Italy Bike Sharing Market size was valued at US$ 104.8 Million in 2024 and the total Italy Bike Sharing Market revenue is expected to grow at 5% through 2025 to 2032, reaching nearly US$ 154.84 Million.

Format : PDF | Report ID : SMR_183

Italy Bike Sharing Market Overview:

According to a survey performed in May 2020 in Italy, 60% of people said they ride their bike or use a bike sharing system. The biggest percentage of bikers was found in the country's north-east, where 73.6% of people stated they ride their bikes at least once a week. Only 47.7% of respondents in the south of the country, on the other hand, said they did use the bike sharing. Italy bike sharing market is expected to register CAGR of 5% during the forecast period.

Italy Bike Sharing Market Dynamics:

In Rome, Uber bike sharing costs €0.50 to unlock the bike and then €0.20 per minute after that. At this stage, the bikes are very easy to find around the city, but you can also lock your bike for up to 60 minutes while you run errands or go sight-seeing. The entire cost is typically far less than renting a bike for the day in Rome (which can easily cost €20), plus you have the freedom of dumping the bike anywhere you like and locking it for the next person to use.

Rome is the first Italian city to debut the bikesharing scheme, with 700 bicycles appearing across the city, and a further 2,800 planned to be deployed over the coming weeks. Uber Jump bicycles now available in Rome. Rome`s mayor, Virginia Raggi, has announced the launch of bikesharing service JUMP for the Italian capital.

To get more Insights: Request Free Sample Report

Rome is the first city in Italy to debut the bikesharing scheme, with 3,500 bicycles planned to be deployed over the coming weeks. The red pedal assisted bicycles are fitted with GPS tracking and a shopping basket at the front. The bikes can be found in the Uber app, which allows the user to locate the nearest bike and then unlock it with a pin that is provided in the app. The rental fee is 20 cents per minute and 50 cents will be added to the bicycle rental. The bike can also be paused for up to 30 minutes. The Program covers a large area of ??Rome, from the center to EUR, Copperè, Monteverde Nuovo and Fleming. Bicycles can be parked in a safe place in the city, but to avoid damage, they cannot be parked along the Lungotevere River. There is a charge for vehicles parked along the river. The arrival of the Uber Jump is a year after Gobee. Bike removed the bike from Rome and Europe after allegations that 60% of the European fleet was destroyed, stolen or dumped in the river.

New public bike sharing scheme launched in Trieste:

The new public bike sharing system of the Italian Municipality of Trieste was officially inaugurated on Monday, 3 February 2020 in the city`s Piazza Libertà. The system, known as BiTS, is being implemented as part of the city's 'Integrated Sustainable Urban Development Plan' (PISUS) at a cost of €390,000, with funds made available by the Friuli Venezia Giulia Region and the Municipality of Trieste. The aim of the system is to develop sustainable mobility by promoting walking and cycling to reduce urban pollution and by offering an ecofriendly mobility service to tourists visiting the city.

In this first phase of the project there will be ten stations, all of which will be located in strategic points for mobility in the city, such as the Piazza LibertàStazione, Teatro Romano, Stazione Marittima, Piazza Hortis, Stazione Rogers, Teatro Rossetti, Cumano Musei and the Park Bovedo. At these stations, it will be possible to pick up and deposit 130 bicycles owned by the Municipality, of which 94 are traditional bicycles and 36 are electric bikes. In addition, 18 bicycles (usually 12 and 6 electricity) are rented to the municipalities free of charge by the port authorities. All bikes are available 24 hours a day, 7 days a week. Users can register to use BiTS bikes via the operator's website and the recently updated Bicin Città app in terms of both design and functionality. Users can register in minutes, create their own account, purchase a subscription, and use the app to share and return their bikes at various stations. All trips less than 30 minutes are free and you can purchase a 6-month subscription through June 30, 2020 for an iconic price of € 3 to celebrate this new service.

Italy's bike-sharing market to gain Chinese competitor:

Italy has the highest number of bike-sharing services in Europe, according to the latest figures available from the Ministry of the Environment. This number will soon increase with the addition of a new competitor, top Chinese bike-sharing company Mobike, which announced on Tuesday that it has entered the Italian market following talks with the government. Local rights.

Currently in Italy, visitors and locals can ride one of the 13,770 shared bikes operated by seven different companies in 200 towns and villages across the Mediterranean country, according to a monthly report. November 2016 by the Department's National Shared Observatory. Mobility. This compares with two players in Germany, Call a Bike, operated by a subsidiary of the railway company Deutsche Bahn AG, and nextbike GmbH, four in Belgium, one country and three locally and Velib', a large-scale public bike-sharing system in Paris that will soon be operated by the Franco-Spanish group Smoovengo.

In Italy, bike sharing got its real start in 2003 when a company called Bicincitta (Italian for Bikesinthecity) launched the first bike-sharing program we know today, a system in which the user charges a bicycle. Locked in a rack or electronic socket, mount it, then return it to any station in the system. Based in the northern city of Turin, Bicincitta operates a fleet of 6,241 bikes across 1,418 stations in 115 municipalities. Users sign up online, paying a membership fee of up to 49 euros ($57) a year. Bicincitta also operates in Switzerland and Spain, according to its website. In Milan and Verona, Clear Channel has 4,900 bikes and 289 stations. Also operating in Italy are Centro in bici (31 cities, 2,498 bikes, 230 stations), By Bike (272 bicycles, 32 stations), Ecospazio (24 municipalities, 217 bikes, 30 stations).

A relatively recent arrival is TMR srl, which launched in the southern city of Palermo with 191 bikes, and EMove (three urban locations, 22 bikes, three stations). In Italy, the lion's share of the bike sharing business is located in the wealthier, more industrialized North (64 percent), followed by 22 percent in the South and 14 percent in the central regions, according to the environment ministry. The Mediterranean country is the fourth overseas market for China's Mobike, following Singapore, Britain and Japan.

Mobike is scheduled to deploy hundreds of bikes to Florence for a trial run this week, with 30 minutes on a bike costing 0.3 euros. In August, 4,000 bicycles will be officially launched in Florence and Milan. Users can locate the Mobike using a mobile phone app and unlock it by scanning a QR code on the bike.

The objective of the report is to present a comprehensive analysis of the Italy Bike Sharing Market to the stakeholders in the industry. The report provides trends that are most dominant in the Italy Bike Sharing Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Italy Bike Sharing Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Italy Bike Sharing Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Bike Sharing Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Italy Bike Sharing Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Italy Bike Sharing Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Italy Bike Sharing Market is aided by legal factors.

Italy Bike Sharing Market Scope:

|

Italy Bike Sharing Market |

|

|

Market Size in 2024 |

USD 104.8 Mn. |

|

Market Size in 2032 |

USD 154.84 Mn. |

|

CAGR (2025-2032) |

5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Model

|

|

By Model

|

|

|

|

By Sharing System

|

Italy Bike Sharing Market Players

Frequently Asked Questions

Rome, Trieste, Milan, and Florence region have the highest growth rate in the Italy Bike Sharing market.

BiTS, BIKEMI, MOBIKE, OFO and JUMP Bike are the key players in the Italy Bike Sharing market.

Station based model segment is dominating the regional market of Italy with market share of approximately 55% with YOY growth rate of 4.8%. Moreover, P2P bike sharing models are also popular in Italy.

1. Italy Bike Sharing Market: Research Methodology

1.1. Research Process

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Italy Bike Sharing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Italy Bike Sharing Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Product Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Italy Bike Sharing Market: Dynamics

4.1. Market Trends

4.2. Market Driver

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Italy Bike Sharing Market Size and Forecast by Segments (by Value in USD Million)

5.1. Italy Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Italy Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. Station based

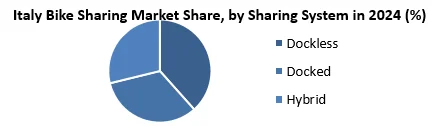

5.3. Italy Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

6. Company Profile: Key players

6.1. BiTS

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.3. Business Portfolio

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. Bikemi

6.3. Mobike

6.4. Ofo

6.5. JUMP Bike

7. Key Findings

8. Industry Recommendations