Germany Bike Sharing Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

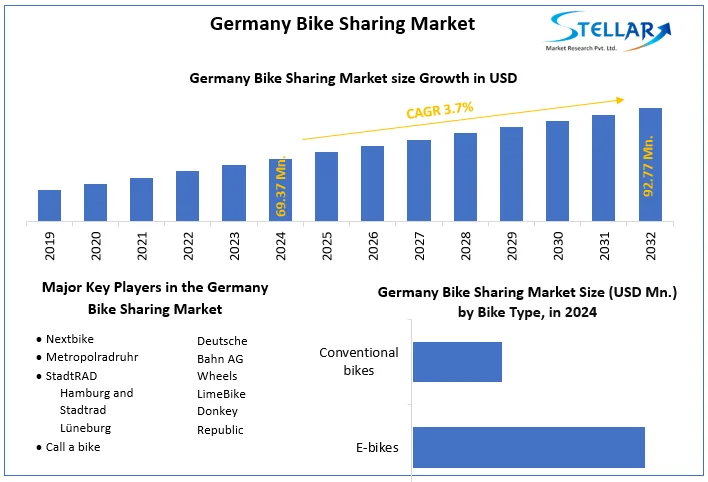

Germany Bike Sharing Market size was valued at US$ 69.37 Million in 2024 and the total Germany Bike Sharing Market revenue is expected to grow at 3.7% through 2025 to 2032, reaching nearly US$ 92.77 Million.

Format : PDF | Report ID : SMR_118

Germany Bike Sharing Market Overview:

Bike-sharing systems (BSS) have evolved as an extra part of the urban transportation system in numerous cities and regions across Germany and around the world in recent years. Bike-sharing is available in over 2,100 places throughout the world as of early 2020, with almost 18 million bicycles. Bicycles can be rented quickly, flexibly, and for short periods of time. In addition to utilising a bicycle for a round trip, certain trip phases can also be completed on a bicycle, fostering intermodal travel. Combining BSS with public transportation, in particular, can provide certain benefits, which is why it is routinely pursued in BSS design. There are currently 102 system operating in Germany and the market is expected to register CAGR of 3.7%

To get more Insights: Request Free Sample Report

Germany Bike Sharing Market Dynamics:

Aside from public transportation, there are a number of other factors that influence BSS usage ion Germany. Various aspects of the transportation system are among them. The utilization of bike-sharing is increased when there is a well-developed system of bike lanes and other bicycle infrastructure. Bike-sharing is inextricably linked to land usage. In general, the amount of traffic created in a given location is proportional to the population and employment density in that area. This means that bike-sharing should be available near places that generate a high volume of journeys, such as universities, major employers, or train stations. Bike-sharing is primarily available in city centres, where demand is high and trips are often short, increasing bike utilization. Bicycle usage in Germany peaks in June and September, then drops dramatically throughout the winter, reaching a nadir in January and February. Short-term weather events, such as rain and snow, also have an adverse effect on bike-sharing. According to German Transport Authority, bad weather has a greater impact on journeys that can be replaced by public transportation. They can also identify the unfavorable impact of darkness and humidity on the number and length of trips taken.

Cologne serves as a transportation centre for both intra-city and inter-city travel. The public transportation system is well-developed, including of light rail and buses that transport approximately 280 million people per year. Two primary stations serve the city, linking it to regional and long-distance trains. Cycling's part of the modal split in Cologne has climbed in recent years, reaching 18% in 2017. At least once a week, 46% of all locals ride their bikes. The city encourages people to use intermodal transportation. On the outskirts of the city and in nearby towns, there are 40 Park+Ride stations. Changes between bicycle and rail are possible thanks to a high number of bicycle parking facilities at rail stations, totaling more than 14,300 parking spots.

There are currently three separate bike-sharing companies operating in the city, all of which are organized without fixed docks and operate a total of 4,000 bikes. Nextbike, whose data is analysed in this study, operates 1,450 of these bicycles. A small number of pedelecs are also included in the nextbike BSS. Scooters are not included in this BSS, but there are various companies in Cologne who rent scooters. The BSS has been in operation since May 2015, and it is run in collaboration with KVB, the public transportation company. The system, known as flexzone, covers an area of 84 km2 in Cologne's central districts on both sides of the Rhine. It is a free-floating system.

National Cycling plan 3.0 of Germany: A key market Driver:

The National Cycling Plan is the German government's initiative for encouraging people to cycle and helps in the bike sharing market growth. It contains concepts, thematic focuses, and specific objectives that the federal government, federal states, and local governments, as well as other players, pursue within their respective spheres of influence. All of the NRVP 3.0's actions and goals were organized in consultation with professional associations and officials from federal, state, and local governments. The Plan also incorporates suggestions derived from an online public survey.

The National Cycling Plan 3.0's guiding objectives:

1. To provide Germany with a well-developed bike infrastructure.

2. Germany will become a cycling commuter country.

3. Cycling is at the heart of today's transportation networks.

4. Cycling will grow more common in both urban and rural settings.

5. Cycling's Vision Zero

6. Bicycle cargo transport in cities

7. Germany will become a cycling nation.

8. Cycling to become more intelligent, connected, and smart.

Approximately 11% of all travels in Germany are now performed by bicycle. It is expected to greatly raise this percentage in the next years; our neighbours Denmark and the Netherlands demonstrate that this field has enormous potential. Cycling accounts for 18% of traffic in Denmark, and much more so in the Netherlands, where it accounts for 27%. Many individual initiatives and packages of interventions by all stakeholders will be required to boost overall bicycle utilisation. To encourage more people in Germany to switch to cycling in the future, officials at the federal, state, and local levels will have to work together.

Availability of Bike Sharing in Germany:

The "Fahrradverleihsystem" is another name for non-tourist bike sharing. Bike sharing is, in many situations, the responsibility of the local government, therefore it is ultimately a political activity for greater sustainability. The number of bicycle thefts is reduced, which is a desirable side effect. In Germany, the availability of bike sharing is improving all the time. Rent-a-bike stations, also known as "Fahrradmietstationen," are frequently found near major train stations and offer bicycles for rent 24 hours a day, seven days a week. The premise is similar to the car-sharing approach in general. Participants must complete an online registration form, make an initial deposit, and supply personal information as well as a payment method for ongoing rental transactions.

Germany Bike Sharing Market Key Players Scenario:

- Call a bike:

There are only two major market players: Deutsche Bahn AG and its subsidiary DB Rent GmbH, as well as the service "Call a bike" with a German-only website and nextbike GmbH. The nextbike website is available in English. A subsidiary of Deutsche Bahn group firm DB Rent GmbH. There are over 250 stations. Aachen, Berlin, Frankfurt am Main, Karlruhe, Köln, München, Stuttgart, and 50 other ICE railway stations are all represented.

1. For all customers, the first 30 minutes of each rental period are free.

2. After that, 0.08 EUR each minute.

3. The registration cost of 5.00 EUR is transformed into a rental balance.

4. There are special rates for HVV clients and BahnCard holders.

- StadtRAD Hamburg and Stadtrad Lüneburg:

DB Rent GmbH, a subsidiary of Deutsche Bahn AG, is a parent company of StadtRAD Hamburg and Stadtrad Lüneburg. There are more than 70 stations in the company. Only available in Hamburg. The same conditions apply as before, but with a different name. Clients of Call a Bike can use Konrad Kassel without having to register.

- Metropolradruhr:

There are over 150 stations of the company across the Germany. Bochum, Bottrop, Dortmund, Duisburg, Essen, Gelsenkirchen, Hamm, Herne, Mülheim a.d.R. are among the company's locations. Each billing period lasts 30 minutes (1.00 EUR). Long-term rates are available (full day ticket - 9.00 EUR, or a yearly abonnement for 48 EUR with the first 30 min free of charge, each additional 30 min 0.50 EUR). Special pricing are available for VRR clients.

- Nextbike:

Nextbike is present in Augsburg, Berlin, Bielefeld, Coburg, Dresden, Düsseldorf, Erfurt, Flensburg, Frankfurt, Gütersloh, Hamburg, Hannover, Leipzig, Magdeburg, München, Norderstedt, Offenbach, Offenburg, Potsdam, and Tübingen with more than 100 stations across the above regions. Biling cycle is same as Metropolradruhr.

Germany Bike Sharing Market Scope:

|

Germany Bike Sharing Market |

|

|

Market Size in 2024 |

USD 69.37 Mn. |

|

Market Size in 2032 |

USD 92.77 Mn. |

|

CAGR (2025-2032) |

3.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Bike Type

|

|

By Model

|

|

|

By Sharing System

|

|

Germany Bike Sharing Market Players

- Nextbike

- Metropolradruhr

- StadtRAD Hamburg and Stadtrad Lüneburg

- Call a bike

- Deutsche Bahn AG

- Wheels

- LimeBike

- Donkey Republic

Frequently Asked Questions

Berlin. Lipzeig and Frankfurt region have the highest growth rate in the Germany Bike Sharing Market

Nextbike, Metropolradruhr, StadtRAD Hamburg and Stadtrad Lüneburg, Call a bike, Deutsche Bahn AG, Wheels,LimeBike, Donkey Republic are the key players in the Germany Bike Sharing market.

Augsburg, Berlin, Bielefeld, Coburg, Dresden, Düsseldorf, Erfurt, Flensburg, Frankfurt, Gütersloh, Hamburg, Hannover, Leipzig are the top regions in the Germany bike sharing market in terms of system installations.

1. Germany Bike Sharing Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Germany Bike Sharing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Germany Bike Sharing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Product Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Germany Bike Sharing Market: Dynamics

4.1. Germany Bike Sharing Market Trends

4.2. Germany Bike Sharing Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technological Roadmap

4.6. Regulatory Landscape

5. Germany Bike Sharing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Germany Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Germany Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station Based

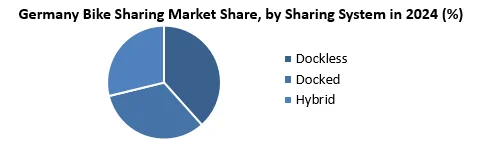

5.3. Germany Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

6. Company Profile: Key Players

6.1. Nextbike

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Metropolradruhr

6.3. StadtRAD Hamburg and Stadtrad Lüneburg

6.4. Call a bike

6.5. Deutsche Bahn AG

6.6. Wheels

6.7. LimeBike

6.8. Donkey Republic

7. Key Findings

8. Industry Recommendations