Austria Bike Sharing Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

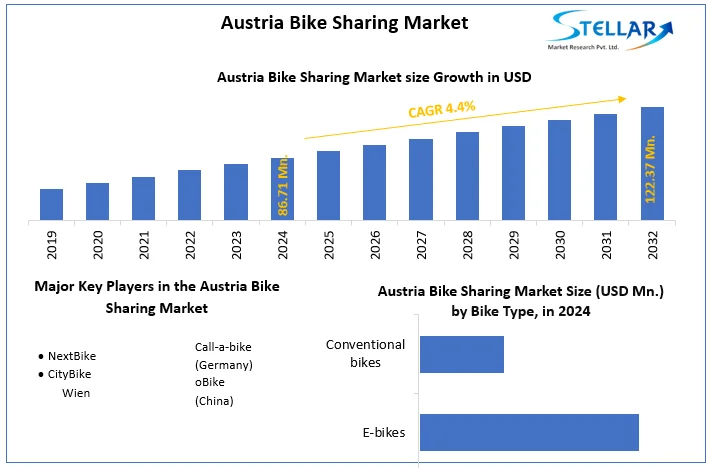

Austria Bike Sharing Market size was valued at US$ 86.71 Million in 2024 and the total Austria Bike Sharing Market revenue is expected to grow at 4.4% through 2025 to 2032, reaching nearly US$ 122.37 Million.

Format : PDF | Report ID : SMR_212

Austria Bike Sharing Market Overview:

The city of Vienna has a long tradition of operating a bicycle sharing system (BSS). Citybike in Vienna is one of the world's first ICT-based urban bicycle sharing systems. It has been in operation since 2013. At fixed stations, users check in and check out via a touch panel terminal with debit and credit card payment capabilities. It is run by the advertising agency Gewista (a subsidiary of JCDecaux) and is the predecessor of the famous Vélo`v in Lyon and Vélib` in Paris, using the same concept. Until 2020, Citybike Wien operates 116 stations with 1500 bicycles. By the end of 2020, Citybike Wien had a total of 513,820 registered users.

Austria Bike Sharing Market Dynamics:

Personal customer service, high quality, adaptability to individual needs, attractive cycling infrastructure and routes have been identified as the three most important success factors for sharing a bike from a tourism perspective. Experts interviewed as part of the survey emphasized particularly focused service and customer relationships to be able to offer individually tailored offers. The possibility of one-way rental of cycling from A to B is also becoming more and more important to customers. Many aspects of the systems currently available are highly regarded, but some systems lack accessories and multilingualism. However, the biggest challenge is that the Austrian bicycle-sharing system creates a largely heterogeneous situation for incompatible systems. There is no super-regional concept. In short, the tourism potential of the area remains unused.

To get more Insights: Request Free Sample Report

The potential for cycling-related offers in the tourism industry is generally estimated to be very high. In the future, further increase in bicycle sharing is expected. This is driven by increased professionalism and personalized customer-oriented offers. Technological development in the electric bicycle sector is expected help reach new user groups. At the same time, collaboration is becoming more and more important to improve the overall customer experience. A visionary solution to this challenge and the current deficit identified is a common information and booking system proposed for all bicycle sharing systems in Austria and beyond.

The friendliness of the Citybike compared to other bike sharing offers (LEIHRADL nextbike operating in the Vienna region, Freiradl decommissioned, Call a bike operated by DB Bahn in many cities in Germany) is already at all-time high on the streets of Austria. According to Survey by Cycle Competence Austria, awareness level of Austrian people is 63% which is considered as a good penetration level for any new brand. Studies also show that most users do not use BSS bikes often and usually only use them once or twice a year. Shared bicycles are mainly used for leisure rides. Despite the very high percentage of leisure trips in Vienna, about 6.28% used shared bicycles to get in and out of work. This means that BSS is used by some users as an alternative to everyday transportation.

Implementation Costs and Administrative Burden on Austria Bike Sharing Market:

The OBIS manual on bicycle sharing describes the cost of implementing an offer of € 2,500 to € 3,000 per shared bicycle. According to another source, the investment cost to build a new train station in Vienna amounts to about 50,000 to 70,000 euros. Graz, Austria's second largest city, plans to introduce the same BSS as Vienna in 2018, and the city estimates that 30 bike shared stations will cost 50,000-100,000 euros as an initial cost. Information on the operating costs of Citybike Wien is limited, but the cost is estimated at € 25,000 per station. The manual shows a running cost of € 1500-2500 per bike for this model. This BSS model, including the Citybike Wien, is typically funded through advertising on shared bicycles and other public areas.

The high initial investment costs allow stakeholders (politicians, planners, local governments, etc.) to make pre-implementation decisions, which is a complex process. In densely populated metropolitan areas, the placement of rental station locations can lead to complex negotiations with other authorized users. This usually happens when you need to convert a street parking space to a rental location. In addition, coordination with transportation networks in other cities and regions is unavoidable for successful implementation. This requires management processes related to transportation planning. There are no legal obstacles to implementation, except for minor legal aspects such as zoning, liability and contractual issues (details, opt-out clauses, etc.).

Austria Bike Sharing Market Development Insights:

For future development, two key development trends have been identified to attract more potential users. The first is to increase the density of stations or expand the system to serve more people in a reasonable service area. This is expected to ultimately help raise awareness through the visibility of the bike on the road. Such an enhanced "Robust" infrastructure for bike sharing will conquer more potential users. The second important future development is said to be based on ICT. In other words, it's a short-term booking to guarantee your bike at a station near you. Identification methods such as phone and card (displayed by card / bank / credit), other simple booking / identification systems, smartphone apps for displaying the availability and status of bicycles, and reporting broken bicycles. Further development is expected due to the diversification of. One need to integrate different BSSs for booking / identification so that users with accounts in one BSS are automatically recognized by other systems.

The objective of the report is to present a comprehensive analysis of the Austria Bike Sharing Market to the stakeholders in the industry. The report provides trends that are most dominant in the Austria Bike Sharing Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Austria Bike Sharing Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Austria Bike Sharing Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Austria Bike Sharing Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Austria Bike Sharing Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Austria Bike Sharing Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Bike Sharing Market is aided by legal factors.

Austria Bike Sharing Market Scope:

|

Austria Bike Sharing Market |

|

|

Market Size in 2024 |

USD 86.71 Mn. |

|

Market Size in 2032 |

USD 122.37 Mn. |

|

CAGR (2025-2032) |

4.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Model

|

|

By Model

|

|

|

|

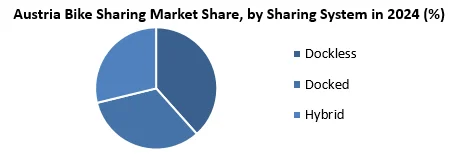

By Sharing System

|

Austria Bike Sharing Market Players:

- NextBike

- CityBike Wien

- Call-a-bike (Germany)

- oBike (China)

Frequently Asked Questions

Vienna, Lower Austria and Burgenland region have the highest growth rate in the Austria Bike Sharing market.

Next Bike, City Bike Wien, Call-a-bike are the key players in the Austria Bike Sharing market.

Docked and P2P sharing segment is dominating the market with highest share owing to abundance of docking stations in the regions of Vienna, Vorarlberg and others.

1. Austria Bike Sharing Market: Research Methodology

1.1. Research Process

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data triangulation

1.4. Research Assumption

2. Austria Bike Sharing Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Austria Bike Sharing Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Service Segment

3.2.3. End-user Segment

3.2.4. Revenue (2024)

3.2.5. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. Austria Bike Sharing Market: Dynamics

4.1. Market Trends

4.2. Market Driver

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Regulatory Landscape

5. Austria Bike Sharing Market Size and Forecast by Segments (by Value in USD Million)

5.1. Austria Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Austria Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station based

5.3. Austria Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

6. Company Profile: Key players

6.1. NextBike

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.3. Business Portfolio

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. CityBike Wien

6.3. Call-a-bike

6.4. oBike

7. Key Findings

8. Industry Recommendations