Rock Climbing Equipment Market: Global Industry Overview and Forecast (2024-2030)

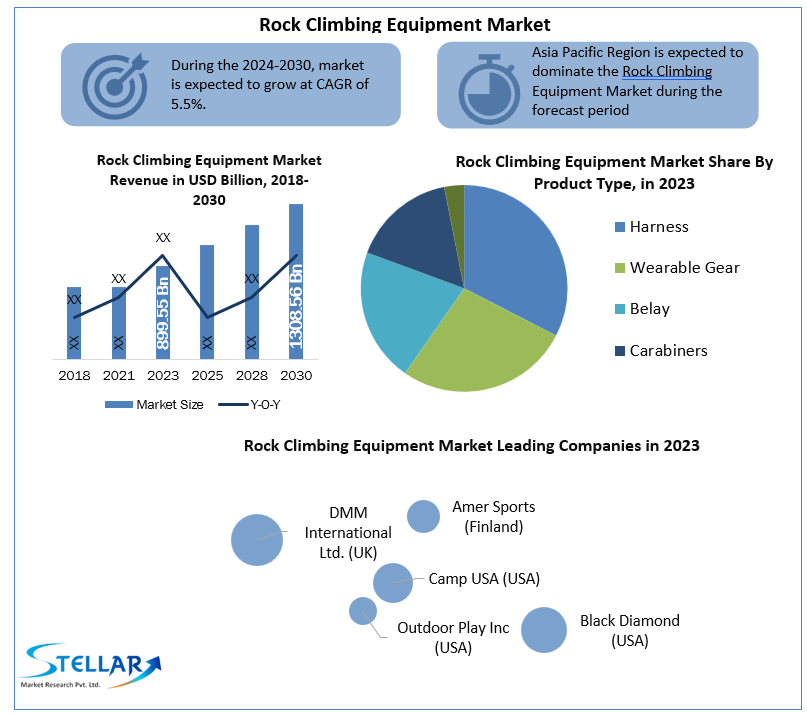

Rock Climbing Equipment Market is expected to grow at a CAGR of 5.5% during the forecast period. Rock Climbing Equipment Market is expected to reach US$ 1308.56 Million in 2030 from US$ 899.55 Million in 2023.

Format : PDF | Report ID : SMR_1041

Rock Climbing Equipment Market Overview:

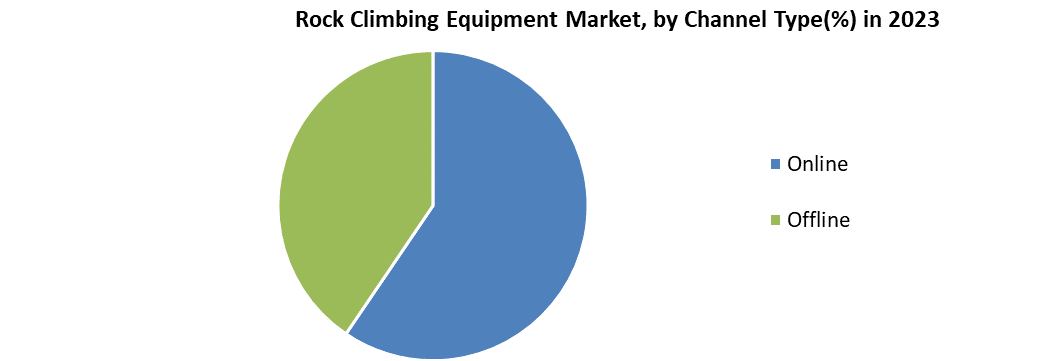

The Rock Climbing Equipment Market is studied by segments like Product Type (Harness, Wearable Gear, Belay, Carabiners, Passive Protection), Channel Type (Online and Offline) and Region (North America, Europe, Asia-Pacific, and Rest of the World). The report consists of the Trend, Forecast, Competitive Analysis, and Growth Opportunities of the market.

For the forecast period of 2024 to 2030, the report provides a complete analysis that reflects today's Rock Climbing Equipment Market realities and future market prospects. To provide a comprehensive perspective of the market, the research segments and analyses it in great detail. The key data and observations offered in the study can help market participants and investors identify low-hanging fruit in the market and build growth strategies.

To get more Insights: Request Free Sample Report

Covid-19 Impact:

The pandemic of COVID-19 in APAC in 2020 had a significant negative consequence in the business of a number of countries. Due to the dangers of COVID-19, most governments in the region implemented a lockdown. To prevent the infection from spreading, gyms and outdoor activities around the region were closed. However, in the first half of 2021, a restriction on travelling in public places was abolished, with essential sanitization laws and social distancing standards in place, thanks to progressive vaccination programs in many nations around the area. As a result of these factors, the region's rock climbing equipment market is expected to grow over the forecast period.

Rock Climbing Equipment Market Dynamics:

Among teenagers and young people, rock climbing is a popular activity because it helps them improve their health and fitness by strengthening muscles, decreasing stress, improving flexibility, developing mental strength and preventing chronic diseases. Producers of rock climbing equipment are expected to find considerable opportunities in regions or nations with a rising trend of young people, as well as areas where the bulk of the population is relatively young. During the forecast period, this is expected to support manufacturers in consolidating their market share and revenue.

Rock climbing uses almost the same level of energy as running at an 8 to 11 minute per mile speed, which contributes in the removal of undesirable fat from the body. As a result, rock climbing is appealing as a fitness exercise and is expected to grow over time, especially among young adults and teenagers. Furthermore, an increased awareness of the health benefits associated with rock climbing is projected to drive the rock climbing equipment market.

One of the significant trends in the rock-climbing equipment market is the rise of customer reviews online and easy internet connection. The tourism sector has benefited from technological advancements such as internet access and smartphones. These advancements are intended to improve the overall travel process by making it easier to plan, book, and enjoy a vacation. In terms of testimonials, the web enables consumers to access to a plethora of useful information and resources. Travelers might feel more at ease about their route and destination thanks to these amenities. Not only does the internet allow direct access to destination photographs, videos, and weather reports, but it also provides direct access to maps and guides.

The potential demand for rock climbing as a career/profession among young consumers, as well as the addition of rock climbing as an official sport in the Olympics two years ago, are likely to drive the rock-climbing equipment market share throughout the forecast period.

Rock climbing is a popular competitive sport and recreational activity that follows a set of standards to prevent accidents and injury. However, accidents due to equipment failure are expected to have a substantial impact on the rock climbing equipment market globally over the forecast period. During the forecast period, safety concerns about equipment failure may hinder the growth of the rock climbing equipment market. To avoid accidents and injuries, rock climbing follows a number of rules. Accidents caused by equipment failure, on the other hand, have been a major obstacle for climbers in recent years.

The most typical equipment failures are uncomfortable shoes and harnesses, rope or even anchor failures, and others. To improve their skills and tactics, most first-time hikers, amateurs, and intermediates need instruction from professional and experienced teachers and trainers. In addition, there are less experienced and professional teachers or trainers than there are amateurs, intermediates and first timers. As a result, such factors are projected to stifle market expansion over the forecast period.

Market Regulations:

In 1960, the UIAA or The International Climbing and Mountaineering Federation began developing safety guidelines by testing ropes. Since then, it has produced standards for over twenty different types of safety gear, including as helmets, harnesses, and crampons.

For standard harmonization, the UIAA interacts with CEN (Commission Europeenne de Normalisation or European Standards Committee), the European Committee for Standardization. In some circumstances, the UIAA requests further tests, resulting in a standard that is more stringent than the CEN. As a result, the UIAA standards may vary slightly from those of the CEN.

The UIAA Safety Commission reviews and updates the UIAA Safety Standards on a regular basis to ensure that they continue to meet the fluctuating nature and requirements of the market and the climbing and mountaineering world. Mountaineering and climbing incidents are continually reviewed by the Commission to see if the standards are high enough. Standards are not only changed, but also newly introduced on a regular basis.

In India, there is a sport management system. The IMF (Indian Mountaineering Foundation) represents India in the IFSC and oversees sport climbing activities in the nation strictly following the IFSC guidelines. Through different Zonal Committees, the IMF National Sport Climbing Committee develops, coordinates, and implements sport climbing events and activities around the country.

Rock Climbing Equipment Market Segment Analysis:

The rock climbing equipment market is divided into harness, carabiner, wearable gear, passive protection and belay segments based on product type. Wearable gear is likely to dominate as the fastest-growing market during the forecasted timeframe, despite seeing a fall recently due to the pandemic. Wearable gears like rock climbers' helmets and shoes are frequently purchased since they protect the climbers.

Because of the huge number of professional rock climbers in the region, Europe is likely to be the largest market for rock climbing equipment during the forecast period. The primary markets in Europe include France, Austria, the United Kingdom, and Germany, which are projected to drive demand for Rock Climbing Equipment in the coming years.

Due to a major growth in people's interest in rock climbing, the rock climbing equipment market in North America is likely to develop at a high rate throughout the forecast period.

On the other hand, During the forecast period, APAC will account for 42 % of market growth. The rock climbing equipment market in Asia Pacific region is dominated by China and Japan. The market in this region will increase at a faster rate than the market in other regions. The addition of rock climbing as an official sport in the Olympics would aid the growth of the rock climbing equipment market in APAC over the forecast period.

To understand the Rock Climbing Equipment industry and study the market trends. Focusing on the product type and distribution channel of Rock-Climbing Equipment, knowing the drivers and challenges of the same. Understanding the market segment geographically to gauge the growth potential.

The report includes analytical models like the Porter’s Five Forces, which helps in understanding the operating environment of the competition in the Rock Climbing Equipment Market and thereby study the stakeholders to derive an efficient strategy; and PESTLE Analysis to gain a macro perspective of the Rock Climbing Equipment Industry in terms of political aspects like Government stability, policies, trade regulation and economic aspects like market trends, taxes and inflation. It also provides the effect of environmental factors and influence of social and legal aspects on the Rock Climbing Equipment Market.

Rock Climbing Equipment Market Scope:

|

Rock Climbing Equipment Market |

|

|

Market Size in 2023 |

USD 899.55 Mn. |

|

Market Size in 2030 |

USD 1308.56 Mn. |

|

CAGR (2024-2030) |

5.5% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Product Type

|

|

by Channel Type

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Rock Climbing Equipment Market Key Players:

- Amer Sports (Finland)

- Camp USA (USA)

- Black Diamond (USA)

- Outdoor Play Inc (USA)

- DMM International Ltd. (UK)

- Kailas (China)

- Edelrid GmbH & Co. KG (Germany)

- Mammut (Switzerland)

- Petzl (France)

- Oberalp S.p.a. (Italy)

- Singing Rock (Czech Republic)

- Metolius Climbing (USA)

- Grivel (Italy)

- Trango (USA)

- Mad Rock (USA)

Frequently Asked Questions

The wearable gear product type is expected to hold the highest share in the Rock Climbing Equipment Market.

The market size of the Rock Climbing Equipment Market is estimated to be 1308.56 Million by 2030.

The forecast period for the Rock Climbing Equipment Market is 2023-2029.

The market size of the Rock Climbing Equipment Market in 2023 was 899.55 Million.

- Scope of the Report

- Research Methodology

- Research Process

- Global Rock Climbing Equipment Market: Target Audience

- Global Rock Climbing Equipment Market: Primary Research (As per Client Requirement)

- Global Rock Climbing Equipment Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2023 (%)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- South America Stellar Competition Matrix

- Middle East and Africa Stellar Competition Matrix

- Key Players Benchmarking: by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2023 (%)

- Global Rock Climbing Equipment Market Segmentation

- Global Rock Climbing Equipment Market, by Region (2023-2030)

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- Global Rock Climbing Equipment Market, by Product Type (2023-2030)

- Harness

- Wearable Gear

- Belay

- Carabiners

- Passive Protection

- Global Rock Climbing Equipment Market, by Channel Type (2023-2030)

- Online

- Offline

- Global Rock Climbing Equipment Market, by Region (2023-2030)

- North America Rock Climbing Equipment Market Segmentation

- North America Rock Climbing Equipment Market, by Product Type (2023-2030)

- Harness

- Wearable Gear

- Belay

- Carabiners

- Passive Protection

- North America Rock Climbing Equipment Market, by Channel Type (2023-2030)

- Online

- Offline

- North America Rock Climbing Equipment Market, by Country (2023-2030)

- United States

- Canada

- Mexico

- North America Rock Climbing Equipment Market, by Product Type (2023-2030)

- Europe Rock Climbing Equipment Market Segmentation

- Europe Rock Climbing Equipment Market, by Product Type (2023-2030)

- Europe Rock Climbing Equipment Market, by Channel Type (2023-2030)

- Europe Rock Climbing Equipment Market, by Country (2023-2030)

- Asia Pacific Rock Climbing Equipment Market Segmentation

- Asia Pacific Rock Climbing Equipment Market, by Product Type (2023-2030)

- Asia Pacific Rock Climbing Equipment Market, by Channel Type (2023-2030)

- Asia Pacific Rock Climbing Equipment Market, by Country (2023-2030)

- Middle East and Africa Rock Climbing Equipment Market Segmentation

- Middle East and Africa Rock Climbing Equipment Market, by Product Type (2023-2030)

- Middle East and Africa Rock Climbing Equipment Market, by Channel Type (2023-2030)

- Middle East and Africa Rock Climbing Equipment Market, by Country (2023-2030)

- South America Rock Climbing Equipment Market Segmentation

- South America Rock Climbing Equipment Market, by Product Type (2023-2030)

- South America Rock Climbing Equipment Market, by Channel Type (2023-2030)

- South America Rock Climbing Equipment Market, by Country (2023-2030)

- Company Profiles

- Key Players

- Amer Sports (Finland)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Camp USA (USA)

- Black Diamond (USA)

- Outdoor Play Inc (USA)

- DMM International Ltd. (UK)

- Kailas (China)

- Edelrid GmbH & Co. KG (Germany)

- Mammut (Switzerland)

- Petzl (France)

- Oberalp S.p.a. (Italy)

- Singing Rock (Czech Republic)

- Metolius Climbing (USA)

- Grivel (Italy)

- Trango (USA)

- Mad Rock (USA)

- Amer Sports (Finland)

- Key Players

- Key Findings

- Recommendations