Precision Farming Software Market: Industry Analysis and Forecast (2024-2030)

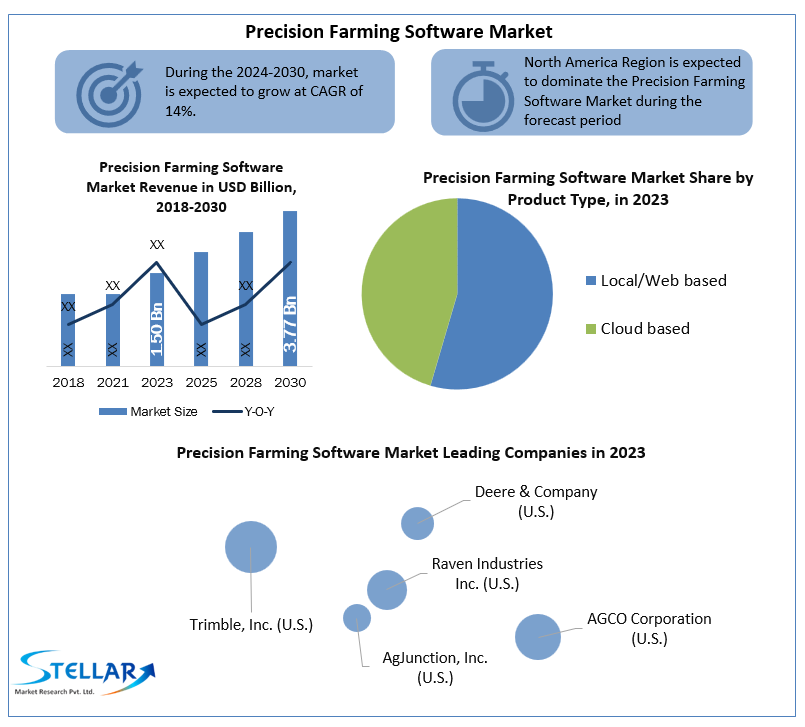

Precision Farming Software market is expected to reach US$ 3.77 Bn. in 2030 from US$ 1.50 Bn. in 2023 at CAGR of 14 % during the forecast period.

Format : PDF | Report ID : SMR_1047

Precision Farming Software Market Overview:

The precision farming software market is expected to grow significantly over the forecast period. The Precision Farming Software market is segmented into product type, application and region. Further on the basis of product the precision farming software market is sub-segmented into local/web-based type and cloud-based type. Moreover, on the basis of application the market is segmented into crop management, financial management, farm inventory management, personnel management, weather tracking and forecasting. Geographically the market is further segmented into North America, Europe, Asia-Pacific, South America and MEA.

Precision Farming Software Market Dynamics:

The precision farming software market has demonstrated growth potential over the last few years and is estimated to grow likewise during the forecast period as well. Precision Farming Software market is expected to reach US$ 3.77 Bn. in 2030 from US$ 1.50 Bn. in 2023 at CAGR of 14 % during the forecast period. The precision farming software market is driven by the fact that farming technologies are now being integrated with mobile technology. Farmers these days require more farm efficiency and they are willing to opt for software-based agriculture methods that serves their purpose well.

To get more Insights: Request Free Sample Report

Moreover, strengthening of intellectual property rights over agricultural software innovations is also one of the key reasons for growth of precision farming software market. As the adoption level of technology and web-based farming tools rises more and more farmers are expected to enter the precision farming software ecosystem that will boost the growth of the market.

The precision agriculture and farming software tools enable the farmers to maximize the yield and revenue related to crops. These tools assist the farmers with various levels of decision making involved in the farming process like planting schedule, maintenance instructions, and environmental factors that can impact the crop quality and crop yield. The development of the precision farming software industry is aided by several research organisations and associations.

Growing population, coupled with rising food consumption, as well as widespread adoption of cloud computing technologies in agricultural data management, will propel the precision farming software market forward. Additionally, there are other factors such as the integration of mobile technology with farming techniques, the increased usage of agricultural software to maintain farm productivity, and government backing for the use of new agriculture techniques that are likely to drive the precision farming software market forward.

One of the key restraining factors of the precision farming software market is the requirement of high capital investment. The magnitude of the investment required can only be put to use by farmers and agriculturist that are in strong financial position. Moreover, there is added requirement of literacy to be able to understand and process the data that is given as output by these precision farming software tools. However, with the incoming high speed internet connectivity and integration of mobile and handheld devices with agriculture and precision farming software tools the market is estimated to rise during the forecast period.

Precision Farming Software Market Segment Analysis:

On the basis of product, the precision farming software market is sub-segmented into local/web-based type and cloud-based type. Cloud based product type is expected to grow during the forecast period because of the various advantages it offers. The data storage capability of a cloud-based type precision farming software is way better than the conventional local web or premise-based system. Additionally, cloud-based precision farming tool is highly energy efficient as compared to local/web-based precision farming tool. Cloud based precision farming tool is also cost saving and hence all these factors will boost the share of cloud-based farming software tools during the forecast period.

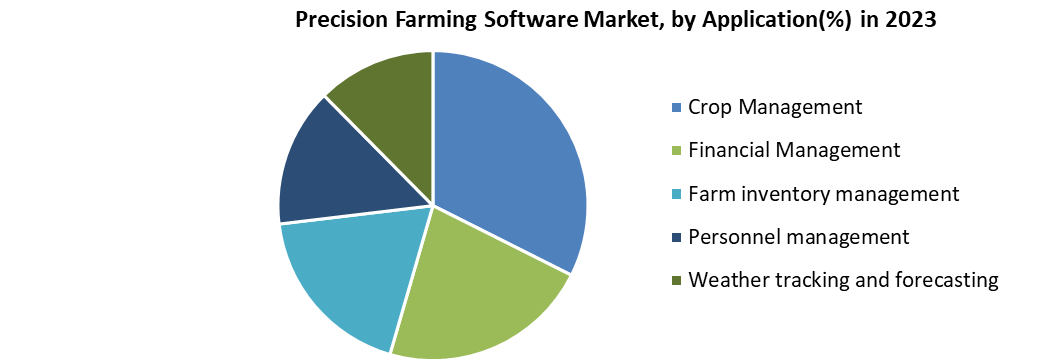

On the basis of application, the precision farming software market is segmented into crop management, financial management, farm inventory management, personnel management, weather tracking and forecasting. Amongst all the segments based on application the crop management segment is expected to hold the highest market share as it helps the agriculturists and farmers understand field variability.

Additionally, it helps the farmers maximize their yield. The crop management system also informs the farmer about the soil quality, weather conditions and the effect fertilizers can have on the overall yield of the crop. Soil monitoring is a part of crop management segment that is used to detect the optimum soil parameters that are needed for efficient yield in that specific harvest season.

Weather tracking and forecasting is projected to grow highest during the forecast period as it updates the farmers about the prevalent climatic conditions such as humidity, temperature, rain, wind speed etc. Additionally weather tracking can help farmers predict the incoming of monsoon, probability of precipitation, amount of cloud cover and maximum and minimum temperatures. All these factors can help the farmer make prudent farming decisions that can potentially save farmer’s field, property, family and business.

Precision Farming Software Market Regional Insights:

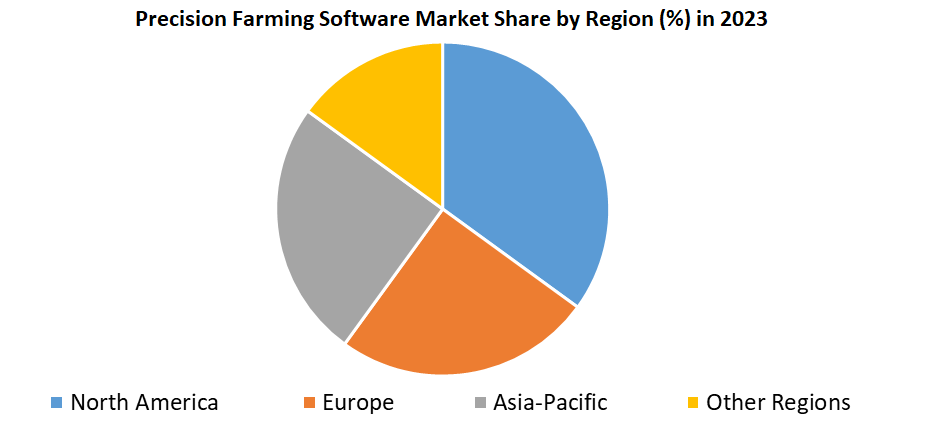

On the basis of regions, the precision farming software market is segmented into North America, Europe, Asia-Pacific and rest of the word which constitutes other regions. North America region holds the largest market share amongst all the regions of the precision farming software market. This is due to early adoption, high market penetration of technologies like IoT and cloud-based data transfer and monitoring systems in farming sector of the North American region. GNSS based solutions and Wide Area Augmentation systems (WAAS) are two of the most popular technologies prevalent in North America.

Europe holds the second highest market share by regions of the precision farming software market. The market is greatly driven by the demand for Real-Time kinetic technology, robotics, networks, variable rate irrigation, fertilizer and sprayer controllers and remote sensing technology.

The precision farming software market in Asia-Pacific region is expected to grow at the highest rate as APAC region has large farmlands and ever-increasing population. China and India two of the world’s most populated countries are present in the APAC region and hence are projected to drive the precision farming software market upwards. Moreover, there is increased expenditure and political support from the governments of the constituent countries regarding precision farming software that is also driving the overall growth of the market.

The objective of the report is to present a comprehensive analysis of the Precision Farming Software market to the stakeholders in the industry. The report provides trends that are most dominant in the Precision Farming Software market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Precision Farming Software Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Precision Farming Software market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Precision Farming Software market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Precision Farming Software market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Precision Farming Software market. The report also analyses if the Precision Farming Software market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Precision Farming Software market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Precision Farming Software market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Precision Farming Software market is aided by legal factors.

Precision Farming Software Market Scope:

|

Precision Farming Software Market |

Market Segmentation |

||

|

Market Indicators: |

Details |

by Product Type |

|

|

Historical Data: |

2018-2022 |

by Application |

|

|

Forecast Period |

2024-2030 |

by Region |

|

|

Base Year: |

2023 |

||

|

CAGR: |

14 % |

||

|

Market Size in 2021: |

USD 1.50 Billion |

||

|

Market size in 2027: |

USD 3.77 Billion |

||

Precision Farming Software Market Key Players

- Deere & Company (U.S.)

- Trimble, Inc. (U.S.)

- Raven Industries Inc. (U.S.)

- AgJunction, Inc. (U.S.)

- AGCO Corporation (U.S.)

- i.Agri Limited (New Zealand)

- Observant (Australia)

- Agrivi Ltd (UK)

- Monsanto Company (US)

- Dickey-John Corporation (US)

- Ag Leader Technology (US)

- CNH Industrial NV (UK)

- SST Development Group (Australia)

- Farmers edge (Canada)

- IBM (US)

Frequently Asked Questions

North America region is projected to hold the highest share in the Precision Farming Software market due high market penetration of technologies like IoT and cloud-based data transfer and monitoring systems in farming sector. The users in North America are early adopters when it comes to new technology.

The precision farming software market is driven by its ability to offer predictive analytics features like expected waste, yield size and profitability which helps farmers and agriculturists make optimal decisions throughout the season.

The forecast period is from 2023 to 2030 which covers the duration of 6 years.

Precision Farming Software market is projected to be at a value of USD 3.77 billion in 2030.

- Scope of the Report

- Research Methodology

- Research Process

- Global Precision Farming Software Market: Target Audience

- Global Precision Farming Software Market: Primary Research (As per Client Requirement)

- Global Precision Farming Software Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2023 (%)

- North America

- Europe

- Asia Pacific

- Other Regions

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- Other Regions Stellar Competition Matrix

- Key Players Benchmarking: by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2023 (%)

- Precision Farming Software Market Segmentation

- Precision Farming Software Market, by Region (2023-2030)

- North America

- Europe

- Asia-Pacific

- Other Regions

- Precision Farming Software Market, by Product Type (2023-2030)

- Local/Web based

- Cloud based

- Precision Farming Software Market, by Application (2023-2030)

- Crop Management

- Financial Management

- Farm inventory management

- Personnel management

- Weather tracking and forecasting

- Precision Farming Software Market, by Region (2023-2030)

- North America Precision Farming Software Market Segmentation

- North America Precision Farming Software Market, by Product Type (2023-2030)

- Local/Web based

- Cloud based

- North America Precision Farming Software Market, by Application (2023-2030)

- Crop Management

- Financial Management

- Farm inventory management

- Personnel management

- Weather tracking and forecasting

- North America Precision Farming Software Market, by Product Type (2023-2030)

- Europe Precision Farming Software Market Segmentation

- Europe Precision Farming Software Market, by Product Type (2023-2030)

- Europe Precision Farming Software Market, by Application (2023-2030)

- Asia Pacific Precision Farming Software Market Segmentation

- Asia Pacific Precision Farming Software Market, by Product Type (2023-2030)

- Asia Pacific Precision Farming Software Market, by Application (2023-2030)

- Other Regions Precision Farming Software Market Segmentation

- Other Regions Precision Farming Software Market, by Product Type (2023-2030)

- Other Regions Precision Farming Software Market, by Application (2023-2030)

- Company Profiles

- Key Players

- Deere & Company (U.S.)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Trimble, Inc. (U.S.)

- Raven Industries Inc. (U.S.)

- AgJunction, Inc. (U.S.)

- AGCO Corporation (U.S.)

- i.Agri Limited (New Zealand)

- Observant (Australia)

- Agrivi Ltd (UK)

- Monsanto Company (US)

- Dickey-John Corporation (US)

- Ag Leader Technology (US)

- CNH Industrial NV (UK)

- SST Development Group (Australia)

- Farmers edge (Canada)

- IBM (US)

- Deere & Company (U.S.)

- Key Players

- Recommendations

- Key Findings