Luxury Car Rental Market: Global Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics, Segmentation

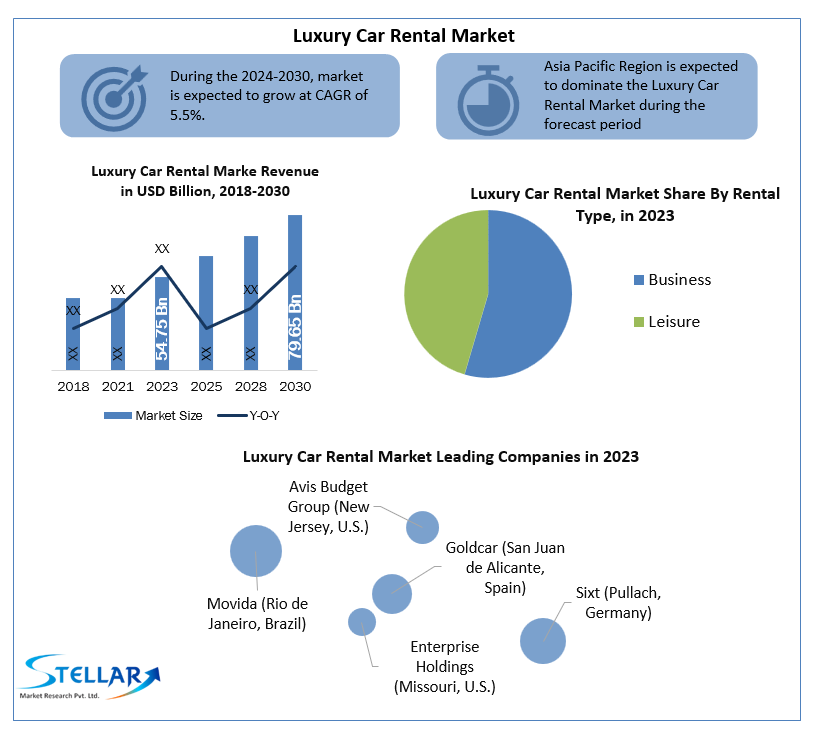

Luxury Car Rental Market was valued at USD 54.75 billion in 2023. Global Luxury Car Rental Market size is estimated to grow at a CAGR of 5.5 % over the forecast period.

Format : PDF | Report ID : SMR_1056

Luxury Car Rental Market Definition:

A luxury car is one that offers superior performance, comfort, quality, and prestige than a conventional car for a higher price. Renting a luxury car is getting increasingly popular. There are companies that rent out luxury cars for a charge. Depending on personal preferences, this arrangement may last an hour, a day, or even weeks.

Further, the Luxury Car Rental market is segmented by Rental Type, Mode of Booking and geography. On the basis of Rental Type, the Luxury Car Rental market is segmented under Business and Leisure. Based on the Mode of Booking, the Luxury Car Rental market is segmented under the Online and Offline. By geography, the market covers the following Regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. For each segment, the market sizing and forecasts have been done on the basis of value (in USD Billion).

To get more Insights: Request Free Sample Report

Luxury Car Rental Market Dynamics:

Demand-responsive transport is getting more popular: Luxury passenger vehicles and chartered vehicles fitted with features such as real-time feedback, vehicle monitoring, and end-user rating are examples of demand-responsive transportation services. Several smartphone applications make it easy to locate luxury cars and compare pricing with car rental businesses. This is driving the Luxury Car Rental Market.

For example, in February 2021, Humax said that it will provide the ‘Auto Rent RAiDEA’ to the WTC mobility service platform, allowing customers to compare the nearest taxi, and luxury car rental pricing in a single app.

In April 2021, GoAir has collaborated with Eco Europcar to introduce automobile rental services in 100+ Indian cities, including 25 airport terminals. GoAir will also provide chauffeur-driven cars through Eco Europcar, varying from mid-range to premium car classes.

Increased digitization in this sector: All market participants give improved services and discounts to promote reservations by increasing their efficiency and implementing new automated technology.

Digitization, one of the most popular automated technologies today, is affecting every sector, including the Luxury Car Rental Market. Rental organisations have embraced technology in order to boost profits while enhancing client satisfaction. A luxury Car rental management system is used by luxury car rental firms to improve their efficiency and streamline their operations. This improved service because digitization drives the market.

Expensive rents and high deposits: This market has some costly operations like obtaining a significant deposit, ranging from USD 2,500 to USD 50,000, and placing GPS trackers in the cars to track them if anything goes wrong during the rental.

It also entails determining if the renter possesses personal insurance, which will cover liability as well as the car’s value, or at least a portion of it. For example, fleet insurance on a $200,000 car might cost from around $400 to $1300 per month, but many policies possess high rates and don’t cover consumer theft.

In some locations, the market growth is hampered by a small number of people opting for these services. As a result, during the forecast period, these cost concerns are expected to limit the market growth.

Luxury Car Rental Market COVID-19 Insights:

In 2020, the COVID-19-induced shutdown and economic crisis had a substantial financial impact on manufacturers. Economic uncertainty, supply chain interruption, and fear among client segments resulted from the COVID-19 outbreak. The market, on the other hand, did not recover until most countries’ lockdowns were released and government affairs returned to normal. Rental car companies were forced to shift into emergency mode, selling off as many vehicles as they could due to lockdowns imposed to limit the spread of the virus. In 2020, major firms such as Hertz, Advantage Rent a Car, and Europcar declared bankruptcy.

Luxury Car Rental Market Segment Analysis:

By Rental Type, the business segment dominated the Luxury Car Rental Market with 57% share in 2023.

Most private companies and government agencies have rented expensive Luxury cars to their top executives for many years. The companies change the cars that are rented to employees based on their job title and annual development. It also allows the company to avoid adding the cost of such luxury cars to the inventory of its fixed assets while allowing executives to utilise them for conferences and client trips. As a consequence, during the forecast period, existing trends are likely to fuel market growth.

During the forecast period, the leisure category is expected to grow at the fastest rate. Consumers prefer to pay for using luxury cars rather than purchasing and owning them, and they want to pay for the privilege of utilising them for a short period. This need is expected to drive the market. According to SMR, the percentage of luxury cars rented instead of purchased was negligible a few years ago, but has already risen to at least 20%. During the forecast period, these elements are expected to increase the leisure segment’s growth.

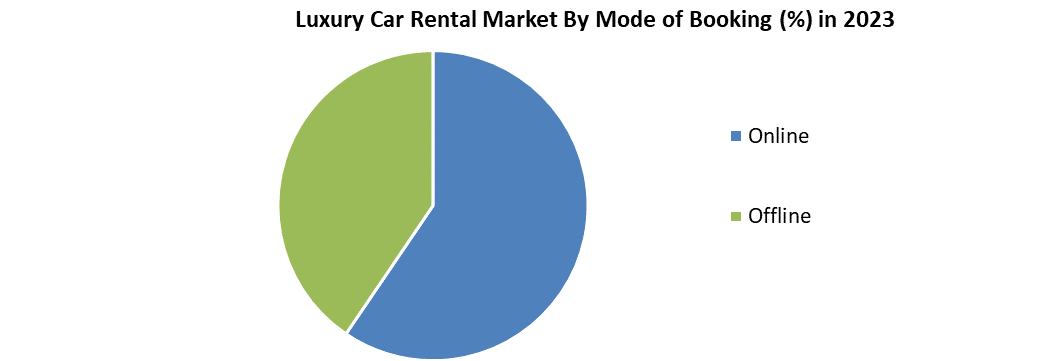

By Mode of Booking, the Online segment dominated the Luxury Car Rental Market with 56% share in 2023.

Young people are becoming more interested in the online segment. The online booking option provides the customer with a large selection of luxury cars from which to choose. In addition, luxury cars offer year-round availability and may be booked at any time. It allows customers to compare pricing flexibly and gives data on the availability status of luxury cars, their conditions, and associated offers without a physical enquiry. Business owners may also simply manage all bookings using the web app booking system.

Luxury Car Rental Market Regional Insights:

Asia Pacific region dominated the Luxury Car Rental Market with 34.81% share in 2023. The massive population of China and India, which together make more than 38% of the world’s population, is a key driver of the region’s growing market. The rise in the number of billionaires in the Asia Pacific can also be related to the increase in the growth of the market in this region (APAC). According to SMR, Asia Pacific remains the frontrunner, with 1,153 billionaires in 2021, up 387 from the previous year, owing primarily to Chinese and Indian entries. Exotic car rental is still a new business area in APAC than Europe and North America; but, given the tendencies indicated above, it is expected to grow greatly during the forecast period.

Luxury Car Rental Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market’s major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Global Luxury Car Rental market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Luxury Car Rental market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Global Luxury Car Rental Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Luxury Car Rental market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Luxury Car Rental market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Global Luxury Car Rental market.

The report provides Porter’s Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Global Luxury Car Rental market. The report also analyses if the Global Luxury Car Rental market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Luxury Car Rental market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Global Luxury Car Rental market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Global Luxury Car Rental market is aided by legal factors.

Luxury Car Rental Market Scope:

|

Luxury Car Rental Market |

|

|

Market Size in 2023 |

USD 54.75 Bn. |

|

Market Size in 2030 |

USD 79.65 Bn. |

|

CAGR (2024-2030) |

5.5% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Rental Type

|

|

By Mode of Booking

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Luxury Car Rental Market Key Players:

- Avis Budget Group (New Jersey, U.S.)

- Goldcar (San Juan de Alicante, Spain)

- Sixt (Pullach, Germany)

- Enterprise Holdings (Missouri, U.S.)

- Movida (Rio de Janeiro, Brazil)

- Fox Rent a Car (Texas, U.S.)

- Hertz (Florida, U.S.)

- Localiza (Belo Horizonte, Brazil)

- Unidas (New York, U.S.)

- eHi Car Services (Shanghai, China)

Frequently Asked Questions

Asia Pacific region is expected to hold the highest share in the Luxury Car Rental Market.

The market size of the Luxury Car Rental Market by 2030 is expected to reach USD 79.65 Billion.

The forecast period for the Luxury Car Rental Market is 2024-2030.

The market size of the Luxury Car Rental Market in 2023 was valued at USD 54.75 Billion.

- Scope of the Report

- Research Methodology

- Research Process

- Global Luxury Car Rental Market: Target Audience

- Global Luxury Car Rental Market: Primary Research (As per Client Requirement)

- Global Luxury Car Rental Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2023(%)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- South America Stellar Competition Matrix

- Middle East and Africa Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2023(%)

- Global Luxury Car Rental Market Segmentation

- Global Luxury Car Rental Market, by Region (2023-2030)

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- Global Luxury Car Rental Market, by Rental Type (2023-2030)

- Business

- Leisure

- Global Luxury Car Rental Market, by Mode of Booking (2023-2030)

- Online

- Offline

- Global Luxury Car Rental Market, by Region (2023-2030)

- North America Luxury Car Rental Market Segmentation

- North America Luxury Car Rental Market, by Rental Type (2023-2030)

- Business

- Leisure

- North America Luxury Car Rental Market, by Mode of Booking (2023-2030)

- Online

- Offline

- North America Luxury Car Rental Market, by Country (2023-2030)

- United States

- Canada

- Mexico

- North America Luxury Car Rental Market, by Rental Type (2023-2030)

- Europe Luxury Car Rental Market Segmentation

- Europe Luxury Car Rental Market, by Rental Type (2023-2030)

- Europe Luxury Car Rental Market, by Mode of Booking (2023-2030)

- Europe Luxury Car Rental Market, by Country (2023-2030)

- Asia Pacific Luxury Car Rental Market Segmentation

- Asia Pacific Luxury Car Rental Market, by Rental Type (2023-2030)

- Asia Pacific Luxury Car Rental Market, by Mode of Booking (2023-2030)

- Asia Pacific Luxury Car Rental Market, by Country (2023-2030)

- Middle East and Africa Luxury Car Rental Market Segmentation

- Middle East and Africa Luxury Car Rental Market, by Rental Type (2023-2030)

- Middle East and Africa Luxury Car Rental Market, by Mode of Booking (2023-2030)

- Middle East and Africa Luxury Car Rental Market, by Country (2023-2030)

- South America Luxury Car Rental Market Segmentation

- South America Luxury Car Rental Market, by Rental Type (2023-2030)

- South America Luxury Car Rental Market, by Mode of Booking (2023-2030)

- South America Luxury Car Rental Market, by Country (2023-2030)

- Company Profiles

- Key Players

- Avis Budget Group (New Jersey, U.S.)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Goldcar (San Juan de Alicante, Spain)

- Sixt (Pullach, Germany)

- Enterprise Holdings (Missouri, U.S.)

- Movida (Rio de Janeiro, Brazil)

- Fox Rent a Car (Texas, U.S.)

- Hertz (Florida, U.S.)

- Localiza (Belo Horizonte, Brazil)

- Unidas (New York, U.S.)

- eHi Car Services (Shanghai, China)

- Avis Budget Group (New Jersey, U.S.)

- Key Players

- Key Findings

- Recommendations