Food Service Equipment Market: Global Industry Overview and Forecast (2024-2030)

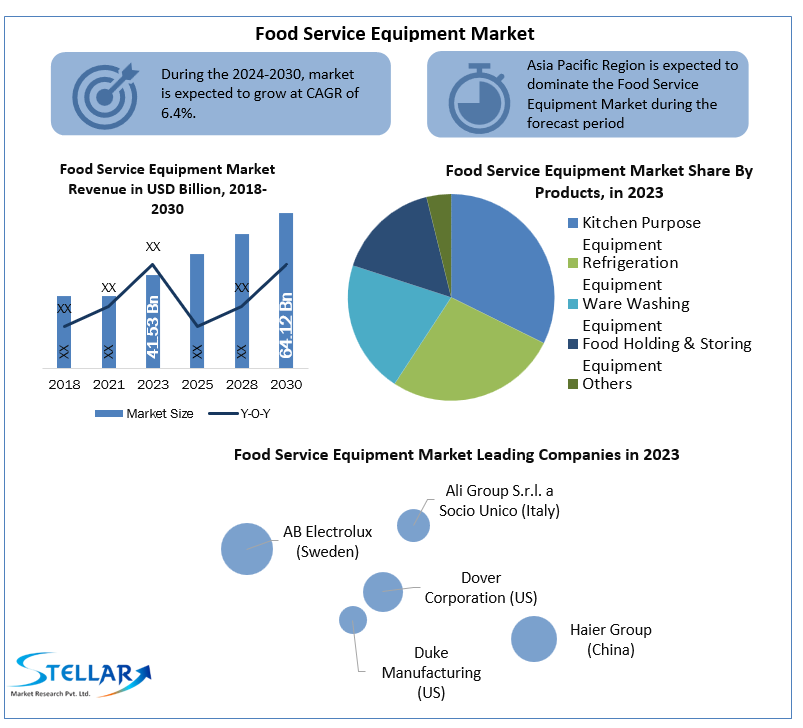

Food Service Equipment Market size was valued at US$ 41.53 Bn. in 2023 and the total revenue is expected to grow at 6.4% through 2024 to 2030, reaching nearly US$ 64.12 Bn. by 2030.

Format : PDF | Report ID : SMR_1155

Food Service Equipment Market Overview:

Changing food consumption patterns, increasing demand and taking on the growing hospitality sector are some of the critical drivers of the market. In addition, digital growth, demand for sustainable & eco-friendly equipment, and strong consumer safety practices are expected to create promising growth opportunities in the market in the coming forecast period.

Food Service Equipment Market report examines the market's growth drivers and segments (Conductive Material, Application, End-User, and Region). Data has been provided by market participants and regions (North America, APAC, Europe, MEA, and South America). This market study takes an in-depth look at all of the significant advancements occurring across all industry sectors. To provide key data analysis for the historical period (2016-2020), statistics, infographics, and presentations are used. The report examines the Food Service Equipment markets, Drivers, Restraints, Opportunities, and Challenges. This SMR report includes Food Service Equipment investor recommendations based on a detailed analysis of the current competitive landscape of the Food Service Equipment market.

Food Service Equipment Market Covid-19 Impacts:

The COVID-19 epidemic has led to the temporary closure of food service activities due to strict social reduction laws and housing practices imposed by governments worldwide. This has led to negative growth in the industry as both manufacturing and sales were negligible by 2020. However, as governments announce easing housing closures and early vaccines, the food service industry is expected to bounce back in the forecast period. While restaurant traffic is expected to take a long time to reach normalcy, customers are finally expected to recover off-site, pick-up, and online delivery services. Due to the subsequent increase in the number of feet in restaurants and institutional kitchens, the volatile market is expected to flourish in the coming years.

Food Service Equipment Market Dynamics:

The market is changing following the changing needs of customers to equip their kitchen areas. Changing social norms associated with technological advances has created a dynamic market environment for resources used in the end-use field. From the acquisition of food preparation and storage equipment, such as cooking stoves, scanners, and refrigerators, to the availability of customized food-preparation ingredients, a range of highly technologically advanced products and young people have entered the market over the years and is expected to reap market growth over time. In addition, the rapid technological advances achieved with the help of continuous Research and Development (R&D) activities have enabled electronics manufacturers to provide their clients with technologically efficient operations.

Demand for the market has grown exponentially due to the emergence of several chains of typical restaurants in North America and Europe. Companies are authorized to sell certified kitchen appliances that are certified according to safety regulations set by several regulatory bodies worldwide. These safety standards are intended to create a safe environment for restaurant operators and consumers. The National Sanitation Foundation (NSF), an American product testing, testing, and non-profit organization, has developed equipment safety standards to ensure that food safety requirements and sanitation procedures are complied with in the field of final use. As food safety is paramount, standards are set for materials, design, and machinery.

Growing awareness about energy efficiency and environmentally friendly programs is helping consumers to consume energy-efficient appliances, thus creating market opportunities. Global energy policies emphasize reducing greenhouse gas (GHG) emissions to reduce the growing impact of climate change. End customers increasingly prefer electrical appliances that carry the ENERGY STAR logo, the energy-saving feature that helps restaurants, kitchens, and cafes save energy while reducing repair costs and utilities. As reported in the 2018 US Energy Star program, the Environmental Protection Agency (EPA), the ENERGY STAR branded food service equipment helps end-users save USD 5,300 or approximately 340 MMBTU per year.

To get more Insights: Request Free Sample Report

Food Service Equipment Market Segment Analysis:

On the basis of products, the share of kitchen equipment makes up a significant portion of the revenue of more than 38.34% of the total market by 2021 and is projected to witness rapid growth from 2022 to 2027. Appropriate kitchen equipment is required to establish a new business or remodel space available to ensure efficiency. The growth of part of the purpose kitchen appliances depends mainly on the use of new products in commercial kitchens depending on the space and budget of the kitchen. The growing demand for food preparation utensils in food service kitchens has encouraged manufacturers to increase their focus on things that include the latest technology solutions and exterior design designs. Plugging sensors into purpose kitchen appliances, such as fries, ovens, and cooking utensils has led to real-time hiring of food preparation.

In addition, restaurants are shifting to smaller kitchens due to increased rental outlets. This forces food service producers to develop designs for their products, making them more compact, purposeful, and faster. The refrigeration component has created a significant market share in 2021. The increased popularity of ready-to-eat items has forced restaurant chains to equip themselves with modern refrigerators. This has led manufacturers to install bidirectional Internet of Things (IoT) connections in commercial refrigerators to monitor goods and temperatures remotely.

On the basis of end-users, the Full-Service Restaurant (FSR) segment is expected to have a significant revenue share of more than 44.49% of the market by 2021. The high market share of FSR could be attributed to the emergence of digital dining trends, which have forced foodservice operators to submit modern equipment to speed up the preparation process and reduce delivery time. Subsequent changes in the cuisine of formal events and informal gatherings during tourism and tourism activities have raised the profile of fully serviced restaurants over the past few years. As a result, part of the FSR is expected to retain its dominance over the forecast period.

The Quick Service Restaurants (QSRs) component is expected to register rapid growth during the forecast period. This may be due to increased working people and the global trade in outstanding restaurants by establishing franchisee joints. QSR emphasizes menu creation, luxury, and competitive prices. In addition, the introduction of continuous products in the food service market has been recognized as an additional incentive that allows timely consumers to access high-quality cooked items quickly.

Food Service Equipment Market Regional Insights:

The Asia Pacific market accounted for a significant portion of the revenue of almost 35.35% by 2023 and is expected to maintain its market dominance over the forecast period. Fast-growing restaurant cultures in the west and the expansion of the tourism industry, particularly in Singapore, Malaysia, Indonesia and Australia, drive the demand for food service supplies in the region. In addition, restaurants add more food to their menus due to the growing number of customers exploring new foods and improving the taste of different types of food. In addition, the increased consumption of processed foods is expected to create a growing demand for these machines in the Asia Pacific region.

With the US moving forward, the North American region is expected to dominate the market by 2023 and is expected to account for about 18.85% of its budget by 2030. The presence of established brands such as McDonald's, Burger King Corporation, KFC Corporation, and Starbucks Coffee Company, among others. In addition, government programs affecting the tourism and immigration sector are expected to improve the food industry in the near future, which may work out in terms of exports to the region. The South American market is expected to grow significantly due to the growing demand for foreign labour or domestic delivery.

The objective of this report is to present an in-depth analysis of the Food Service Equipment Market to industry stakeholders. The report provides the recent trends in the Food Service Equipment Market and how these factors will impact on new business investment and market enhancement during the forecast period. The report also provides an understanding of the potential of the Food Service Equipment Market and the competitive structure of the market by analyzing market leaders, market fans, and regional players.

The quality and quantity data provided in the Food Service Equipment Market report assist the readers to understand which market Conductive Materials, regions are expected to grow in value, market factors, and key opportunity areas, which will impact industry growth and predictable market growth with respect to time. The report includes the competitive status of key competitors in the industry and their recent developments in the Food Service Equipment Market. The report also provides a comprehensive set of factors such as company size, market share, market growth, revenue, production capacity, and profits of key players in the Food Service Equipment Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Food Service Equipment Market is easy for a new player to gain an edge in the market, do they come and go in the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political factors that help in analyzing how much a government can impact the Market. Economic variables assist in the calculating economic performance drivers that can affect the Market. Analyzing the impact of the overall environment and the impact of environmental concerns on the Food Service Equipment Market is aided by legal factors.

Food Service Equipment Market Scope:

|

Food Service Equipment Market |

|

|

Market Size in 2023 |

USD 39.04 Bn. |

|

Market Size in 2030 |

USD 60.27 Bn. |

|

CAGR (2024-2030) |

6.4% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Products

|

|

By End-Users

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Food Service Equipment Market Key Players

- AB Electrolux (Sweden)

- Ali Group S.r.l. a Socio Unico (Italy)

- Dover Corporation (US)

- Duke Manufacturing (US)

- Haier Group (China)

- SMEG S.p.A. (Italy)

- The Middleby Corporation (US)

- Abhay Raj Equipment (India)

- The Grafyt (India)

- Kitchenrama Fod Service Limited (India)

- Alamo Refrigeration (US)

- FDD Catering Equipment (UK)

- Foodservice Equipment Marketing Ltd (UK)

- Maruzen (Japan)

- Jestic Foodservice Solutions (UK)

Frequently Asked Questions

Kitchen purpose equipment is the leading Products segment of Food Service Equipment market.

The market size of the Food Service Equipment is expected to reach by USD 64.12 Bn. in Food Service Equipment Market.

The forecast period of Food Service Equipment market is 2024-2030.

Full-Service Restaurant is the leading End-Users segment of Food Service Equipment market.

- Scope of the Report

- Research Methodology

- Research Process

- Global Food Service Equipment Market: Target Audience

- Global Food Service Equipment Market: Primary Research (As per Client Requirement)

- Global Food Service Equipment Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2023(%)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- South America Stellar Competition Matrix

- Middle East and Africa Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2023(%)

- Global Food Service Equipment Market Segmentation

- Global Food Service Equipment Market, by region (2023-2030)

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- Global Food Service Equipment Market, by Products (2023-2030)

- Kitchen Purpose Equipment

- Refrigeration Equipment

- Ware Washing Equipment

- Food Holding & Storing Equipment

- Others

- Global Food Service Equipment Market, by End-Users (2023-2030)

- Full-Service Restaurant (FSR)

- Quick Service Restaurant (QSR)

- Institutional

- Others

- Global Food Service Equipment Market, by region (2023-2030)

- North America Food Service Equipment Market Segmentation

- North America Food Service Equipment Market, by Products (2023-2030)

- Kitchen Purpose Equipment

- Refrigeration Equipment

- Ware Washing Equipment

- Food Holding & Storing Equipment

- Others

- North America Food Service Equipment Market, by End-Users (2023-2030)

- Full-Service Restaurant (FSR)

- Quick Service Restaurant (QSR)

- Institutional

- Others

- North America Food Service Equipment Market, by Country (2023-2030)

- United States

- Canada

- Mexico

- North America Food Service Equipment Market, by Products (2023-2030)

- Europe Food Service Equipment Market Segmentation

- Europe Food Service Equipment Market, by Products (2023-2030)

- Europe Food Service Equipment Market, by End-Users (2023-2030)

- Europe Food Service Equipment Market, by Country (2023-2030)

- Asia Pacific Food Service Equipment Market Segmentation

- Asia Pacific Food Service Equipment Market, by Products (2023-2030)

- Asia Pacific Food Service Equipment Market, by End-Users (2023-2030)

- Asia Pacific Food Service Equipment Market, by Country (2023-2030)

- Middle East and Africa Food Service Equipment Market Segmentation

- Middle East and Africa Food Service Equipment Market, by Products (2023-2030)

- Middle East and Africa Food Service Equipment Market, by End-Users (2023-2030)

- Middle East and Africa Food Service Equipment Market, by Country (2023-2030)

- South America Food Service Equipment Market Segmentation

- South America Food Service Equipment Market, by Products (2023-2030)

- South America Food Service Equipment Market, by End-Users (2023-2030)

- South America Food Service Equipment Market, by Country (2023-2030)

- Company Profiles

- Key Players

- AB Electrolux (Sweden)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Ali Group S.r.l. a Socio Unico (Italy)

- Dover Corporation (US)

- Duke Manufacturing (US)

- Haier Group (China)

- SMEG S.p.A. (Italy)

- The Middleby Corporation (US)

- Abhay Raj Equipment (India)

- The Grafyt (India)

- Kitchenrama Fod Service Limited (India)

- Alamo Refrigeration (US)

- FDD Catering Equipment (UK)

- Foodservice Equipment Marketing Ltd (UK)

- Maruzen (Japan)

- Jestic Foodservice Solutions (UK)

- AB Electrolux (Sweden)

- Key Players

- Key Findings

- Recommendations