Blood Screening Market: Global Industry Overview and Forecast (2024-2030) Trends, Dynamics, Segmentation

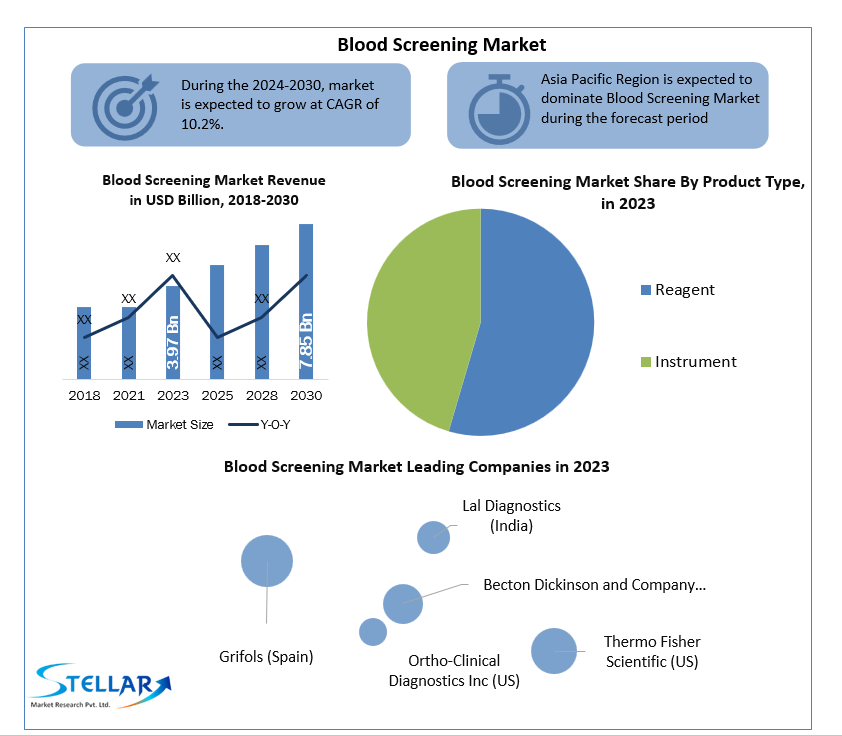

Blood Screening Market size was valued at US$ 3.97 Bn. in 2023 and the total revenue is expected to grow at 10.2% through 2024 to 2030, reaching nearly US$ 7.85 Bn. by 2030.

Format : PDF | Report ID : SMR_1103

Blood Screening Market Overview:

A blood screening is a procedure in which donated blood is tested for various infectious diseases such as HBV, HCV, HIV1, and HIV2. The high growth of the market was due to increased blood donations, an increase in the incidence of infectious diseases, and government programs.

The actions of various organizations and governments increase awareness of donations and pre-transfusion blood screening. According to WHO, about 108 million blood donations are collected annually worldwide. About 50% of these blood donations are collected in high-income countries that are home to less than 20% of the total population. Therefore, increased awareness along with high demand for safe blood creates opportunities for the blood screening market in developing countries.

Blood Screening Market report examines the market's growth drivers and segments (Conductive Material, Application, End-User, and Region). Data has been provided by market participants and regions (North America, APAC, Europe, MEA, and South America). This market study takes an in-depth look at all of the significant advancements occurring across all industry sectors. To provide key data analysis for the historical period (2018-2022), statistics, infographics, and presentations are used. The report examines the Blood Screening markets, Drivers, Restraints, Opportunities, and Challenges. This SMR report includes Blood Screening investor recommendations based on a detailed analysis of the current competitive landscape of the Blood Screening market.

To get more Insights: Request Free Sample Report

Blood Screening Market Dynamics:

Increase in the number of patients related to cardiovascular diseases

Increased incidence of cancer, cardiovascular, neurological, genetic and other disorders is expected to further market growth. According to a Globocan report, worldwide, there are an estimated 19.2 million young people with cancer by 2020 million and that number is expected to reach 24.5 million by 2030. Unhealthy eating habits, obesity, heavy drinking and alcohol abuse, and a sedentary lifestyle increase the incidence of chronic diseases. Therefore, an increase in the incidence of chronic diseases is expected to boost the blood screening market.

Technological advancement in the field of blood screening

A growing number of new product approvals and technological advances are expected to boost blood screening market growth. For example, in February 2021, Health Canada approved two GenDx products for NGS, NGSgo-AmpX v2 and NGSgo-MX6-1, for the development of a single HLA gene and the integration of six HLA genetically modified genes. multiplexed, respectively. In addition, innovations in the market are growing and companies are focusing on the development of novel experiments based on biomarker technology. For example, in April 2021, CardiNor, a Norwegian-based company, received a $ 1.4 million grant to develop an ELISA biomarker-based diagnostic test for heart disease. Advances are aimed at making routine diagnoses of patients easier.

According to the WHO, life expectancy is now more than 80 years for most developed economies as a result of early diagnosis, availability of improved health facilities, and increased spending on health care. Based on the U.S. National Cancer Institute’s Surveillance Epidemiology and End Results (SEER) Database, 38% of women and 43% of men are estimated to have had cancer during their lifetime. About two thirds of all new cancers are found in people 65 and older, indicating that aging can put people at risk for cancer. Blood screening can play an important role in early detection as it contributes significantly to the management of cancer, infectious diseases and heart disease. Therefore, the growing demand for blood screening for chronic diseases is expected to further market growth.

Huge opportunities for the market players

Many market players focus on mergers and acquisitions to strengthen their market position. This strategy enables companies to increase skills, increase product portfolios, and develop skills, which will boost market growth during forecasting. For example, in January 2021, Thermo Fisher Scientific, Inc. announced the acquisition of Mesa Biotech, Inc. — a $ 450 million diagnostic company to expand its product portfolio. Similarly, in April 2021, GenMark Diagnostics, Inc. acquired by F. Hoffmann-La Roche Ltd. GenMark Diagnostics, Inc. has patented technology, such as the ePlex and eSensor XT-8 that can be used to diagnose blood-borne diseases.

High prices for blood tests

Increasing prices for blood screening are among the main factors hindering this market growth. Lack of replacement products is another reason for high prices. This problem is also compounded by the significant variability in the number of different uses of each blood screening product. Low- and middle-income countries are most affected by low pocket spending and unfair reimbursement conditions. According to the WHO, about 50% of health care funding in low-income countries comes from out-of-pocket payments, compared to ~ 14% in high-income countries and 30% in middle-income countries.

Strong regulatory environment is expected to delay market growth. The regulatory environment is becoming increasingly difficult, and the FDA is becoming increasingly cautious as the reliance on blood screening for difficult medical decisions is growing. The FDA also conducts a post-market investigation of IVD products to ensure a balance between performance and claims. For example, in October 2021, Magellan Diagnostics recalled its LeadCare II, LeadCare Ultra Blood Lead, and LeadCare Plus tests due to the threat of invalid low side effects. Therefore, strict adherence to the rules of procedure for authorization of blood screening reduces market growth.

Blood Screening Market Segment Analysis:

By Product Type, Reagent is held to dominate the blood screening market by 2023 and is expected to maintain its dominance over the forecast period. High accuracy and precision in detecting the presence and Product Type of various elements in a small sample can drive the market.

In addition, reagents are very expensive for customers and offer high return on investment to retailers. The high cost and reusable environment of tools hinders the growth of the metal segment in the blood screening market during the forecast period 2024-2030.

Instrument has played a major role in the market due to the introduction of devices in the market after its marketing approval. For example, in October 2017, the FDA approved a test for Roche's Cobas Zika donor Zika virus test. This will prevent the spread of the Zika virus in the U.S. by donating blood.

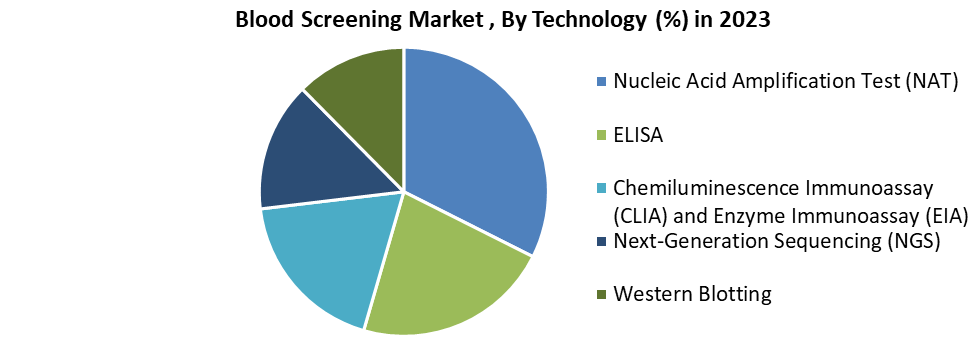

By Technology, Nucleic acid amplification test (NAT) is expected to grow rapidly due to its high sensitivity and its specificity of viral nucleic acid. Testing detects nucleic acid prematurely than other testing methods and, thus, reduces the window time for HBV, HCV, and HIV infection.

The NAT was introduced in developed countries in the early 1990s and early 2000s. About 33 countries worldwide use NAT for HIV and 27 countries with hepatitis B virus as of 2014. The mechanisms underlying this category are polymerase chain reaction, ligase chain reaction. , and to enhance intermediate writing.

In October 2016, Roche obtained U.S.FDA approval for the next generation of Cobas MPX donor testing to prevent the spread of viruses through blood transfusions. Cobas MPX assay NAT detection of five viruses HIV-1 Group O, HIV-1 Group M, HIV-2, HBV, and HCV, in one sample.

ELISA holds the second largest market share. The growth of these technologies has led to continuous improvements in their specificity, lower costs compared to NAT, and an increase in the spread of infectious diseases in the Asia Pacific region. There are various generations of ELISA available in the market.

Blood Screening Market Regional Insights:

In 2023, North America held the largest blood screening market share. The presence of key industrial players, increased acceptance of the blood screening process, FDA strict transfusion rules, and the low cost of the patient are obligatory to maintain its position during forecasting.

The U.S. leads the blood screening market due to the local presence of key players like Roche Diagnostics, Abbott, and Danaher. One of the reasons for continuing to dominate is the availability of well-established R&D infrastructure and reimbursement policies. Moreover, according to the American Cancer Society, by 2022, about 1,918,030 new cancer cases and about 609,360 cancer deaths are expected to occur in the US alone. These factors are expected to contribute to the continued governance of the U.S. In addition, the regulatory and refund environment continues to evolve to accommodate the rapid research progress in the sector. In addition, the FDA is developing new regulatory strategies in relation to the NGS, which is expected to improve innovation in testing, while ensuring that the data generated by these tests is accurate and reliable.

Asia Pacific is one of the fastest-growing region due to increased public awareness about blood donation, rising patient prices, and the growing focus of key industry players in developing countries in the region. China, Japan, India, Singapore, and Australia are major contributors to the Asia Pacific region. While, the Indian market is in a unique position compared to other Asia Pacific countries, such as China and Japan, due to more relaxed regulatory guidelines and the importation of more machinery and building materials. Its market is expected to witness significant growth due to increased investment by private and foreign companies, which can help provide effective testing at low cost. A well-expanded network of laboratories in clinics and hospitals in India is leading to the rapid adoption of blood testing techniques.

In India, testing for infectious diseases has led to an increase in the demand for blood tests. Major infectious diseases, such as sexually transmitted diseases, HIV / AIDS, ventilator-acquired pneumonia, tuberculosis, and hospital-acquired infections, all serve as important features of the market. Although blood tests are more expensive and only affordable for the middle and upper economy, rapid economic development is expected to increase people's purchasing power. This feature, along with the need for better diagnostics and preventive medicine, provides an expected growth of the Indian blood screening market.

The objective of this report is to present an in-depth analysis of the Blood Screening Market to industry stakeholders. The report provides the recent trends in the Blood Screening Market and how these factors will impact on new business investment and market enhancement during the forecast period. The report also provides an understanding of the potential of the Blood Screening Market and the competitive structure of the market by analyzing market leaders, market fans, and regional players.

The quality and quantity data provided in the Blood Screening Market report assist the readers to understand which market Conductive Materials, regions are expected to grow in value, market factors, and key opportunity areas, which will impact industry growth and predictable market growth with respect to time. The report includes the competitive status of key competitors in the industry and their recent developments in the Blood Screening Market. The report also provides a comprehensive set of factors such as company size, market share, market growth, revenue, production capacity, and profits of key players in the Blood Screening Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Blood Screening Market is easy for a new player to gain an edge in the market, do they come and go in the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political factors that help in analyzing how much a government can impact the Market. Economic variables assist in the calculating economic performance drivers that can affect the Market. Analyzing the impact of the overall environment and the impact of environmental concerns on the Blood Screening Market is aided by legal factors.

Blood Screening Market Scope:

|

Blood Screening Market Scope |

|

|

Market Size in 2023 |

USD 3.97 Bn. |

|

Market Size in 2030 |

USD 7.85 Bn. |

|

CAGR (2024-2030) |

10.2% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Product Type

|

|

By Technology

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Blood Screening Market Key Players

- Lal Diagnostics (India)

- Becton Dickinson and Company (US)

- Thermo Fisher Scientific (US)

- Ortho-Clinical Diagnostics Inc (US)

- Grifols (Spain)

- Danaher Corporation (Beckman Coulter)

- Abbott Laboratories (US)

- Bio-Rad Laboratories Inc. (US)

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare (Germany)

- Alpha Test House (India)

- National Institute of Biologicals (India)

- Sigma Test and Research Centre (India)

- Roche Diagnostics (Switzerland)

- BioMerieux (France)

Frequently Asked Questions

Reagent is the leading product Product Type segment of Blood Screening market.

The market size of the Blood Screening is expected to reach by USD 7.85 Bn. in Blood Screening Market.

The forecast period of Blood Screening market is 2024-2030.

NAT is the leading technology segment of Blood Screening market.

- Scope of the Report

- Research Methodology

- Research Process

- Global Blood Screening Market: Target Audience

- Global Blood Screening Market: Primary Research (As per Client Requirement)

- Global Blood Screening Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Region in 2023 (%)

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

- Stellar Competition matrix

- Global Stellar Competition Matrix

- North America Stellar Competition Matrix

- Europe Stellar Competition Matrix

- Asia Pacific Stellar Competition Matrix

- South America Stellar Competition Matrix

- Middle East and Africa Stellar Competition Matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Region in 2023 (%)

- Global Blood Screening Market Segmentation

- Global Blood Screening Market, by region (2023-2030)

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- Global Blood Screening Market, by Product Type (2023-2030)

- Reagent

- Instrumental

- Global Blood Screening Market, by Technology (2023-2030)

- Nucleic Acid Amplification Test (NAT)

- ELISA

- Chemiluminescence Immunoassay (CLIA) and Enzyme Immunoassay (EIA)

- Next-Generation Sequencing (NGS)

- Western Blotting

- Global Blood Screening Market, by region (2023-2030)

- North America Blood Screening Market Segmentation

- North America Blood Screening Market, by Product Type (2023-2030)

- Reagent

- Instrumental

- North America Blood Screening Market, by Technology (2023-2030)

- Nucleic Acid Amplification Test (NAT)

- ELISA

- Chemiluminescence Immunoassay (CLIA) and Enzyme Immunoassay (EIA)

- Next-Generation Sequencing (NGS)

- Western Blotting

- North America Blood Screening Market, by Country (2023-2030)

- United States

- Canada

- Mexico

- North America Blood Screening Market, by Product Type (2023-2030)

- Europe Blood Screening Market Segmentation

- Europe Blood Screening Market, by Product Type (2023-2030)

- Europe Blood Screening Market, by Technology (2023-2030)

- Europe Blood Screening Market, by Country (2023-2030)

- Asia Pacific Blood Screening Market Segmentation

- Asia Pacific Blood Screening Market, by Product Type (2023-2030)

- Asia Pacific Blood Screening Market, by Technology (2023-2030)

- Asia Pacific Blood Screening Market, by Country (2023-2030)

- Middle East and Africa Blood Screening Market Segmentation

- Middle East and Africa Blood Screening Market, by Product Type (2023-2030)

- Middle East and Africa Blood Screening Market, by Technology (2023-2030)

- Middle East and Africa Blood Screening Market, by Country (2023-2030)

- South America Blood Screening Market Segmentation

- South America Blood Screening Market, by Product Type (2023-2030)

- South America Blood Screening Market, by Technology (2023-2030)

- South America Blood Screening Market, by Country (2023-2030)

- Company Profiles

- Key Players

- Lal Diagnostics (India)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Becton Dickinson and Company (US)

- Thermo Fisher Scientific (US)

- Ortho-Clinical Diagnostics Inc (US)

- Grifols (Spain)

- Danaher Corporation (Beckman Coulter)

- Abbott Laboratories (US)

- Bio-Rad Laboratories Inc. (US)

- F. Hoffmann-La Roche Ltd.

- Siemens Healthcare (Germany)

- Alpha Test House (India)

- National Institute of Biologicals (India)

- Sigma Test and Research Centre (India)

- Roche Diagnostics (Switzerland)

- BioMerieux (France)

- Lal Diagnostics (India)

- Key Players

- Key Findings

- Recommendations