Automotive Exterior Composites Market: Global Industry Overview and Forecast (2024-2030) Trends, Dynamics, Segmentation by Conductive Material, Application, Application and Region

Automotive Exterior Composites Market size was valued at US$ 11.89 Bn. in 2023 and the total revenue is expected to grow at 5.20% through 2024 to 2030, reaching nearly US$ 16.96 Bn. by 2030.

Format : PDF | Report ID : SMR_547

Automotive Exterior Composites Market Overview:

The automotive exterior composites market is one of the prime spots in the composite industry as it garners the sheer interest of many of the global players. The exterior is currently the second largest market share of automotive components behind the lower part of the hood and accounts for more than a quarter of the total market.

Automotive Exterior Composites Market report examines the market's growth drivers and segments (Conductive Material, Application, End-User, and Region). Data has been provided by market participants and regions (North America, APAC, Europe, MEA, and South America). This market study takes an in-depth look at all of the significant advancements occurring across all industry sectors. To provide key data analysis for the historical period (2017-2020), statistics, infographics, and presentations are used. The report examines the Automotive Exterior Composites markets, Drivers, Restraints, Opportunities, and Challenges. This SMR report includes Automotive Exterior Composites investor recommendations based on a detailed analysis of the current competitive landscape of the Automotive Exterior Composites market.

To get more Insights: Request Free Sample Report

COVID-19 pandemic on the Automotive Exterior Composites Market:

The economic impact of COVID-19 on used industries has finally been enormous. Travel restrictions have caused the decline of many markets, and growth has slowed as a result. The closure of the facilities has forced production facilities to remain closed, with a negative impact on the automotive composites holding market due to the loss of revenue due to the low acceptance of composites solutions across industries. All major industries are facing disruptions, such as supply chain failure, technological adoption, and office closures. Since the removal of travel restrictions, growth in all markets has gained tremendous strength.

Disruption of supply chain operations delayed vehicle production and thus hampered the growth of the global automotive exterior composite market. In addition, declining demand in the automotive industry has been caused by the COVID-19 epidemic, which is affecting the growth of the global automotive exterior composites market.

Automotive Exterior Composites Market Dynamics:

The Automotive Exterior Composites Market is expected to flourish in the coming years due to its various benefits such as high strength and weight of composite components, excellent surface finish, excellent rust and abrasion resistance, and durability. The combined effects of the above-mentioned products offer various benefits to car manufacturers as these features not only help car manufacturers meet stricter rules for improving fuel efficiency and reducing carbon emissions but also provide durable components and the benefit of minimal maintenance, costs. It is expected that there will be a permanent replacement of the metal parts and composites, especially in the external services, in the expected future.

Composites Formed with Injection-Molded and Resin-Infused Composites are expected to offer a higher market share during forecasting due to the growing popularity of foreign heavyweight car parts to improve fuel economy. The demand for quality products that can withstand rust, abrasion, and weather conditions is driving the global automotive component market.

Automotive Exterior Composites Market Segment Analysis:

Automotive Exterior Composites Market, by Type

Injection moulded composites: Injectable Composition Compounds refer to the process by which building materials are mixed and heated to make them easier to mould. This is achieved by improving the efficiency of the asset, which makes it possible for high-speed production with increasing compliance from component to component. In addition, these compounds allow for greater design freedom due to their ease of production.

Compression moulded composites: Compactly formed compounds allow the production of components with high strength and durability. These can be used to make parts such as bumpers, fenders, front modules, door and roof, and liftgates for car applications. They are also lightweight, durable and resistant to impact. Compressed moulds are made by placing fiberglass or carbon fibers in the mould and then pressing to compress the indirect prepreg. Fibers direct themselves under high temperatures, allowing for better materials such as strength and durability. The most commonly used resin is an unpolished polyester (or vinyl ester) resin.

Resin-Infused composites: Resin-based composites are a type of composite Type that is embedded in the Type during production. They use a combination of fibers and fillers to form a component with desirable properties, such as durability or heat resistance. The resin infusion is also called Pultrusion, which allows for faster production than other forms of fortification. Resin insulation has the advantage of allowing less waste during production, which is why it is widely used in industrial applications such as aerospace manufacturing and aerospace components.

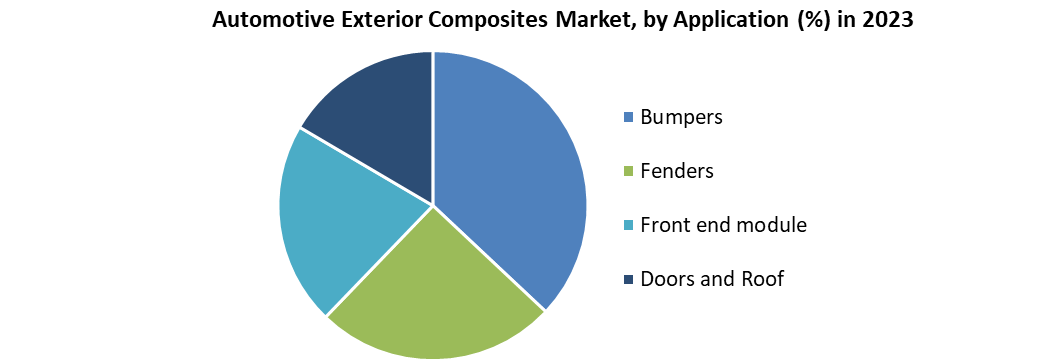

Automotive Exterior Composites Market, by Application

The use of external vehicle combinations on bumpers is expected to grow at a much higher CAGR during the forecast period. Growth can be attributed to an increase in the demand for lightweight materials due to its many benefits, which include a high degree of strength and weight, corrosion resistance, and flexibility; which helps manufacturers to lose weight and improve fuel efficiency without compromising safety.

External vehicle compounds are used on fenders to withstand the impact of a collision. By using these building materials, it is possible to protect drivers and passengers from injury by extreme pressure or force. These structures also help to protect the visual field of drivers so that they can easily identify potential road accidents.

Automotive Exterior Composites are widely used in the Front-End Module due to their lightweight Type and advanced features. They offer high strength against corrosion, high dimensional stability, and high durability and reduce repair costs for end users. External car parts help to increase fuel efficiency by reducing weight without compromising on durability or integrity.

Blended compounds are compounds made up of two or more compounds that form substances that have very different physical or chemical properties that, when combined, produce a new substance with distinct individual components. These compounds have been used in Automotive Exterior Composites for Door & Roof panelling to alter steel to lose weight and improve fuel efficiency. These compounds are lightweight, non-corrosive, and offer a better coverage than steel panels that make it an option for Car Doors and Roofs.

Automotive Exterior Composites Market Regional Insights:

North America is expected to remain the largest market for foreign car compounds at the time of forecasting. The high penetration of compounds combined with healthy car production, especially in the USA and Mexico is driving the regional market. The USA is likely to maintain its regional dominance during the forecast period, while Mexico will continue to register healthy growth at the same time, driven by its sound policies that attract car manufacturers to invest in the region.

Asia-Pacific is predicted to witness the highest growth during the forecast period, driven by China, Japan, South Korea and India. Despite China's slowdown in economic growth, the country is expected to remain one of the world's most attractive markets for the next five years. India, a relatively small market, is expected to see dramatic growth in the next five years supported by a number of government initiatives aimed at improving the manufacturing sector.

Europe is expected to remain the second largest market in the next five years, driven by Germany and France. Other Eastern countries are also likely to show significant growth in the coming years as these countries attract global attention by capturing investment from car manufacturers around the world.

The objective of this report is to present an in-depth analysis of the Automotive Exterior Composites Market to industry stakeholders. The report provides the recent trends in the Automotive Exterior Composites Market and how these factors will impact on new business investment and market enhancement during the forecast period. The report also provides an understanding of the potential of the Automotive Exterior Composites Market and the competitive structure of the market by analyzing market leaders, market fans, and regional players.

The quality and quantity data provided in the Automotive Exterior Composites Market report assist the readers to understand which market Conductive Materials, regions are expected to grow in value, market factors, and key opportunity areas, which will impact industry growth and predictable market growth with respect to time. The report includes the competitive status of key competitors in the industry and their recent developments in the Automotive Exterior Composites Market. The report also provides a comprehensive set of factors such as company size, market share, market growth, revenue, production capacity, and profits of key players in the Automotive Exterior Composites Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Automotive Exterior Composites Market is easy for a new player to gain an edge in the market, do they come and go in the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political factors that help in analyzing how much a government can impact the Market. Economic variables assist in the calculating economic performance drivers that can affect the Market. Analyzing the impact of the overall environment and the impact of environmental concerns on the Automotive Exterior Composites Market is aided by legal factors.

Automotive Exterior Composites Market Scope:

|

Automotive Exterior Composites Market |

|

|

Market Size in 2023 |

USD 11.31 Bn. |

|

Market Size in 2030 |

USD 16.12 Bn. |

|

CAGR (2024-2030) |

5.2% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Type

|

|

by Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Automotive Exterior Composites Market Key Players

- Celanese (US)

- DSM (Switzerland)

- DowDuPont (US)

- Huntsman Corporations (US)

- Ashland Performance Materials (US)

- LyondellBasell (Netherlands)

- Owens Corning (US)

- AOC Resins (Switzerland)

- Plastic Omnium (France)

- Samvardhana Motherson Group (India)

- Denso Corporation (Japan)

- Rochling Group (Germany)

- Valeo Group (France)

- Stahl Automotive Solutions (US)

- Toray Industries Inc (Japan)

Frequently Asked Questions

Resin-infused composites are the leading type of application segment of Automotive Exterior Composites market.

The market size of the Automotive Exterior Composites is expected to reach by USD 16.96 Bn. in Automotive Exterior Composites Market.

The forecast period of Automotive Exterior Composites market is 2024-2030

Compression moulding are the leading type of type/variety segment of Automotive Exterior Composites market.

1. Scope of the Report

2. Research Methodology

2.1. Research Process

2.2. Global Automotive Exterior Composites Market: Target Audience

2.3. Global Automotive Exterior Composites Market: Primary Research (As per Client Requirement)

2.4. Global Automotive Exterior Composites Market: Secondary Research

3. Executive Summary

4. Competitive Landscape

4.1. Market Share Analysis by Region in 2023(%)

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Stellar Competition matrix

4.2.1. Global Stellar Competition Matrix

4.2.2. North America Stellar Competition Matrix

4.2.3. Europe Stellar Competition Matrix

4.2.4. Asia Pacific Stellar Competition Matrix

4.2.5. South America Stellar Competition Matrix

4.2.6. Middle East and Africa Stellar Competition Matrix

4.3. Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

4.4. Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

4.5. Market Dynamics

4.5.1. Market Drivers

4.5.2. Market Restraints

4.5.3. Market Opportunities

4.5.4. Market Challenges

4.5.5. PESTLE Analysis

4.5.6. PORTERS Five Force Analysis

4.5.7. Value Chain Analysis

5. Global Automotive Exterior Composites Market Segmentation

5.1. Global Automotive Exterior Composites Market, by region (2023-2030)

5.1.1. North America

5.1.2. Europe

5.1.3. Asia-Pacific

5.1.4. Middle East & Africa

5.1.5. South America

5.2. Global Automotive Exterior Composites Market, by Type (2023-2030)

5.2.1. Injection Molded

5.2.2. Compression molded

5.2.3. Resin Infused

5.3. Global Automotive Exterior Composites Market, by Application (2023-2030)

5.3.1. Bumpers

5.3.2. Fenders

5.3.3. Front end module

5.3.4. Doors and Roofs

5.3.5. Others

6. North America Automotive Exterior Composites Market Segmentation

6.1. North America Automotive Exterior Composites Market, by Type (2023-2030)

6.1.1. Injection Molded

6.1.2. Compression molded

6.1.3. Resin Infused

6.2. North America Automotive Exterior Composites Market, by Application (2023-2030)

6.2.1. Bumpers

6.2.2. Fenders

6.2.3. Front end module

6.2.4. Doors and Roofs

6.2.5. Others

6.3. North America Automotive Exterior Composites Market, by Country (2023-2030)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Automotive Exterior Composites Market Segmentation

7.1. Europe Automotive Exterior Composites Market, by Type (2023-2030)

7.2. Europe Automotive Exterior Composites Market, by Application (2023-2030)

7.3. Europe Automotive Exterior Composites Market, by Country (2023-2030)

8. Asia Pacific Automotive Exterior Composites Market Segmentation

8.1. Asia Pacific Automotive Exterior Composites Market, by Type (2023-2030)

8.2. Asia Pacific Automotive Exterior Composites Market, by Application (2023-2030)

8.3. Asia Pacific Automotive Exterior Composites Market, by Country (2023-2030)

9. Middle East and Africa Automotive Exterior Composites Market Segmentation

9.1. Middle East and Africa Automotive Exterior Composites Market, by Type (2023-2030)

9.2. Middle East and Africa Automotive Exterior Composites Market, by Application (2023-2030)

9.3. Middle East and Africa Automotive Exterior Composites Market, by Country (2023-2030)

10. South America Automotive Exterior Composites Market Segmentation

10.1. South America Automotive Exterior Composites Market, by Type (2023-2030)

10.2. South America Automotive Exterior Composites Market, by Application (2023-2030)

10.3. South America Automotive Exterior Composites Market, by Country (2023-2030)

11. Company Profiles

11.1. Key Players

11.1.1. Celanese (US)

11.1.1.1. Company Overview

11.1.1.2. Product Portfolio

11.1.1.3. Financial Overview

11.1.1.4. Business Strategy

11.1.1.5. Key Developments

11.1.2. DSM (Switzerland)

11.1.3. DowDuPont (US)

11.1.4. Huntsman Corporations (US)

11.1.5. Ashland Performance Materials (US)

11.1.6. LyondellBasell (Netherlands)

11.1.7. Owens Corning (US)

11.1.8. AOC Resins (Switzerland)

11.1.9. Plastic Omnium (France)

11.1.10. Samvardhana Motherson Group (India)

11.1.11. Denso Corporation (Japan)

11.1.12. Rochling Group (Germany)

11.1.13. Valeo Group (France)

11.1.14. Stahl Automotive Solutions (US)

11.1.15. Toray Industries Inc (Japan)

12. Key Findings

13. Recommendations