Asia Pacific UPS Battery Market: Industry Analysis and Forecast (2024-2030) by Topology, Product Type, Application

Asia Pacific UPS Battery Market size was valued at US$ 345.03 Mn. in 2023. UPS Battery will encourage a great transformation of economic growth in the Asia Pacific.

Format : PDF | Report ID : SMR_136

Asia Pacific UPS Battery Market Definition:

A UPS is often used to protect hardware such as computers, data centers, communications equipment, or other electrical equipment against power outages that could result in injuries, fatalities, major business disruption, or data loss. An uninterruptible power supply (UPS) provides emergency power to a load when the input power fails. A UPS differs from an auxiliary or emergency power system or a backup generator in that it protects against power outages by providing energy stored in batteries, supercapacitors, or flywheels practically quickly.

To get more Insights: Request Free Sample Report

Asia Pacific UPS Battery Market Dynamics:

Rapid technological advancements, government initiatives, digitalization of economies, and an increase in the middle-income group's disposable income are also fueling the region's overall economic growth, propelling it from a developing to a developed phase. Several countries in the region are implementing smart grid technology to improve energy transmission and distribution. For example, China is one of the most promising countries for smart grid deployment. ECHONET Lite is a new interface standard established by Japan to achieve the policy of direct connection between home energy management systems and smart meters, which also necessitates the installation of a UPS battery. Japan focuses on developing effective methods for the sensible use of energy by buildings and factories, among other locations, through its Energy Conversation Act, which was passed in 1979 and updated in 2010.

The building of data centers in APAC is increasing as hyper-scale and cloud service companies continue to invest. For example, in terms of data center development, Hong Kong and China led the way in 2019, followed by Australia, India, Japan, and Singapore. Apart from these countries, Thailand, Indonesia, and Malaysia have also made significant investments in data center development. Throughout the forecast period, the introduction of 5G in various countries, as well as cooperation between telecommunication providers and service providers in the creation of edge data centers. As a result, the growing number of data centers along with the growing adoption of UPS batteries are expected to boost the regional market growth throughout the forecast period.

With the growing usage of modular UPS systems, growing need for colocation facilities, and growing demand for UPS in BFSI and IT infrastructure, the Asia Pacific UPS battery market is expected to grow rapidly throughout the forecast period. Insurance firms, commercial banks, non-banking financial companies, and other financial institutions make up the BFSI sector. UPS systems are vital for delivering constant and uninterrupted power supply for the proper functioning of numerous operations within the BFSI sector, such as ATMs, financial transfers, online transactions, and data centers, and thus accounts for one of the largest consumers.

Automation and digitalization increase power consumption in many operations, resulting in a surge in UPS demand across the region. Governments in APAC countries are taking steps to computerize and digitize offices and departments, which necessitates a constant supply of power. In addition, smart city projects have sparked a surge in demand for security equipment including storage and closed-circuit television cameras. The increased focus on domestic security, in conjunction with smart city development, is boosting the adoption of UPS systems. Major initiatives in India including Digital India and Smart City projects, the growing need for clean power across verticals, numerous ongoing infrastructure projects, the development of surveillance needs, and the digitization of electronic gadgets at home are all driving up UPS battery demand in APAC.

Asia Pacific UPS Battery Market Segment Analysis:

By Product Type, the UPS Battery market is segmented into Lead-acid, Lithium-Ion, Nickel Cadmium, and Others. The Lithium-Ion segment is expected to grow at the highest CAGR of 9.3% during the forecast period. Li-ion batteries are widely utilized in a variety of electronic devices, such as smartphones and laptop computers. They're also employed in electric automobiles as a key component. In addition, these batteries are becoming a viable option for uninterruptible power supplies and energy storage systems, including the use of renewable energy sources like solar and wind. Because of their built-in battery monitoring and management systems, Li-ion batteries are more reliable than other batteries.

Li-ion batteries are also substantially lighter and smaller, which makes them appropriate for non-traditional UPS applications, including peak shaving, grid sharing, and industrial or process control assistance, including a high cycle count, shorter charge times, and minimum double service life compared to lead-acid batteries. Furthermore, Li-ion has a number of advantages over other DC storage systems for UPS applications, which is boosting the segment growth for the UPS battery market growth.

Recent Development in Asia Pacific Region UPS Battery Market:

CYRUSONE (US), in collaboration with GDS Holdings Limited (China), spent USD 100 million on the development of data centers in China in October 2017.

Oracle (US) constructed a new data center in Seoul in July 2019 to accommodate the growing demand for cloud computing services in the country. Equinix Inc. (US) and GIC launched a joint venture in April 2020 to build and manage hyper-scale data centers in Japan.

In November 2019, AirTrunk (Australia) invested USD 1 billion in the development of data centers in Sydney's northern suburbs.

Amazon announced in November 2020 that it would invest about USD 2.8 billion in India to build a new AWS cloud data center.

Alibaba Group (China) inaugurated its second Availability Zone in Mumbai, India, in September 2018.

CtrlS Datacenters Ltd (India) announced plans to invest USD 278.6 million in three hyper-scale data centers in India in February 2019.

As a result of these developments, the demand for UPS batteries in the region is expected to rise significantly throughout forecast period.

COVID-19 Impact on Asia Pacific UPS Battery Market:

According to the World Health Organization (WHO), India, China, Russia, and South Korea, are among the countries most affected by the COVID-19 outbreak. The outbreak is having a negative impact on companies all across the globe. In addition, the world economy had a slowdown in 2020, which has continued into the first quarter of 2021. Globally, the epidemic has disrupted UPS battery businesses and supplies. Market participants have encountered operational difficulties, which are expected to last until the middle of 2021. The global energy & power industry is one of the primary industries experiencing significant disruptions as a result of the COVID-19 pandemic, which is stifling the global UPS battery market's growth. To combat and limit the pandemic, the UPS battery industry has been significantly impacted by government shutdowns, travel prohibitions, trade bans, and border lockdowns.

The objective of the report is to present a comprehensive analysis of the Asia Pacific UPS Battery Market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific UPS Battery Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific UPS Battery Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific UPS Battery Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific UPS Battery Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific UPS Battery Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Asia Pacific UPS Battery Market. The report also analyses if the Asia Pacific UPS Battery Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific UPS Battery Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific UPS Battery Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific UPS Battery Market is aided by legal factors.

Asia Pacific UPS Battery Market Scope:

|

Asia Pacific UPS Battery Market |

|

|

Market Size in 2023 |

USD 345.03 Mn |

|

Market Size in 2030 |

USD 642.98 Bn. |

|

CAGR (2024-2030) |

9.3% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Topology

|

|

By Product Type

|

|

|

By Application

|

|

|

Country Scope |

|

Asia Pacific UPS Battery Market Key Players:

- CSB Battery Co., Ltd.

- East Penn Manufacturing Company

- Eaton Corporation plc

- Exide Industries Limited

- FIAMM Energy Technology S.p.A.

- GS Yuasa International Ltd.

- leoch International Technology Limited Inc

- Schneider Electric SE

- Vertiv Group Corporation

Frequently Asked Questions

China is expected to hold the highest share in the UPS Battery Market.

The market size of the UPS Battery Market by 2030 is expected to reach at US$ 642.98 Mn.

The forecast period for the UPS Battery Market is 2024-2030.

The market size of the UPS Battery Market in 2023 was valued at US$ 345.03 Mn.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Asia Pacific UPS Battery Market: Target Audience

2.3. Asia Pacific UPS Battery Market: Primary Research (As per Client Requirement)

2.4. Asia Pacific UPS Battery Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Value, 2023-2030

4.1.1. Asia Pacific Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.1.1. China Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.1.2. India Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.1.3. Japan Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.1.4. South Korea Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.1.5. Australia Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.1.6. ASEAN Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.1.7. Rest of APAC Market Share Analysis, By Topology, By Value, 2023-2030 (In %)

4.1.2. Asia Pacific Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.2.1. China Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.2.2. India Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.2.3. Japan Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.2.4. South Korea Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.2.5. Australia Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.2.6. ASEAN Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.2.7. Rest of APAC Market Share Analysis, By Product Type, By Value, 2023-2030 (In %)

4.1.3. Asia Pacific Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.1.3.1. China Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.1.3.2. India Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.1.3.3. Japan Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.1.3.4. South Korea Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.1.3.5. Australia Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.1.3.6. ASEAN Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.1.3.7. Rest of APAC Market Share Analysis, By Application, By Value, 2023-2030 (In %)

4.2. Stellar Competition matrix

4.2.1. Asia Pacific Stellar Competition Matrix

4.3. Key Players Benchmarking

4.3.1. Key Players Benchmarking By Topology, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1. M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1. Market Drivers

4.5.2. Market Restraints

4.5.3. Market Opportunities

4.5.4. Market Challenges

4.5.5. PESTLE Analysis

4.5.6. PORTERS Five Force Analysis

4.5.7. Value Chain Analysis

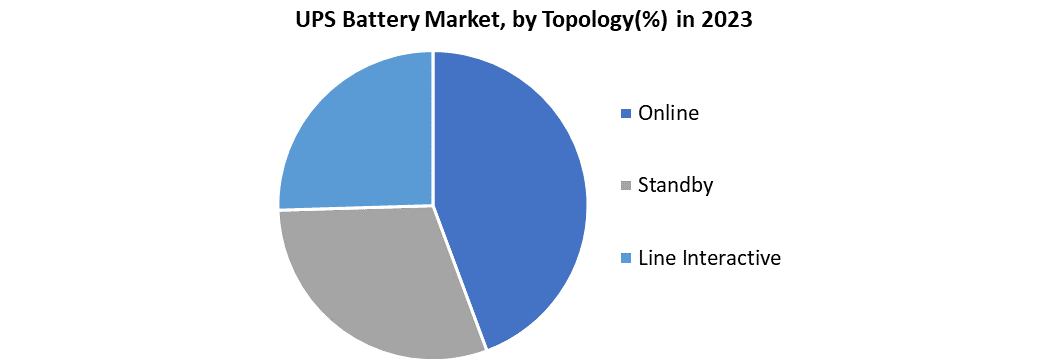

Chapter 5 Asia Pacific UPS Battery Market Segmentation: By Topology

5.1. Asia Pacific UPS Battery Market, By Topology, Overview/Analysis, 2023-2030

5.2. Asia Pacific UPS Battery Market, By Topology, By Value, Market Share (%), 2023-2030 (USD Million)

5.3. Asia Pacific UPS Battery Market, By Topology, By Value, -

5.3.1. Online

5.3.2. Standby

5.3.3. Line Interactive

Chapter 6 Asia Pacific UPS Battery Market Segmentation: By Product Type

6.1. Asia Pacific UPS Battery Market, By Product Type, Overview/Analysis, 2023-2030

6.2. Asia Pacific UPS Battery Market Size, By Product Type, By Value, Market Share (%), 2023-2030 (USD Million)

6.3. Asia Pacific UPS Battery Market, By Product Type, By Value, -

6.3.1. Lead-acid

6.3.2. Lithium-Ion

6.3.3. Nickel Cadmium

6.3.4. Others

Chapter 7 Asia Pacific UPS Battery Market Segmentation: By Application

7.1. Asia Pacific UPS Battery Market, By Application, Overview/Analysis, 2023-2030

7.2. Asia Pacific UPS Battery Market Size, By Application, By Value, Market Share (%), 2023-2030 (USD Million)

7.3. Asia Pacific UPS Battery Market, By Application, By Value, -

7.3.1. Residential

7.3.2. Commercial

7.3.3. Data center

7.3.4. Industrial

Chapter 8 Asia Pacific UPS Battery Market Size, By Value, 2023-2030 (USD Million)

8.1.1. China

8.1.2. India

8.1.3. Japan

8.1.4. South Korea

8.1.5. Australia

8.1.6. ASEAN

8.1.7. Rest of APAC

Chapter 9 Company Profiles

9.1. Key Players

9.1.1. CSB Battery Co., Ltd.

9.1.1.1. Company Overview

9.1.1.2. Source Portfolio

9.1.1.3. Financial Overview

9.1.1.4. Business Strategy

9.1.1.5. Key Developments

9.1.2. East Penn Manufacturing Company

9.1.3. Eaton Corporation plc

9.1.4. Exide Industries Limited

9.1.5. FIAMM Energy Technology S.p.A.

9.1.6. GS Yuasa International Ltd.

9.1.7. leoch International Technology Limited Inc

9.1.8. Schneider Electric SE

9.1.9. Vertiv Group Corporation

9.2. Key Findings

9.3. Recommendations