Home Care Packaging Market: Global Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics, Segmentation by Material, Product, Type, and Region.

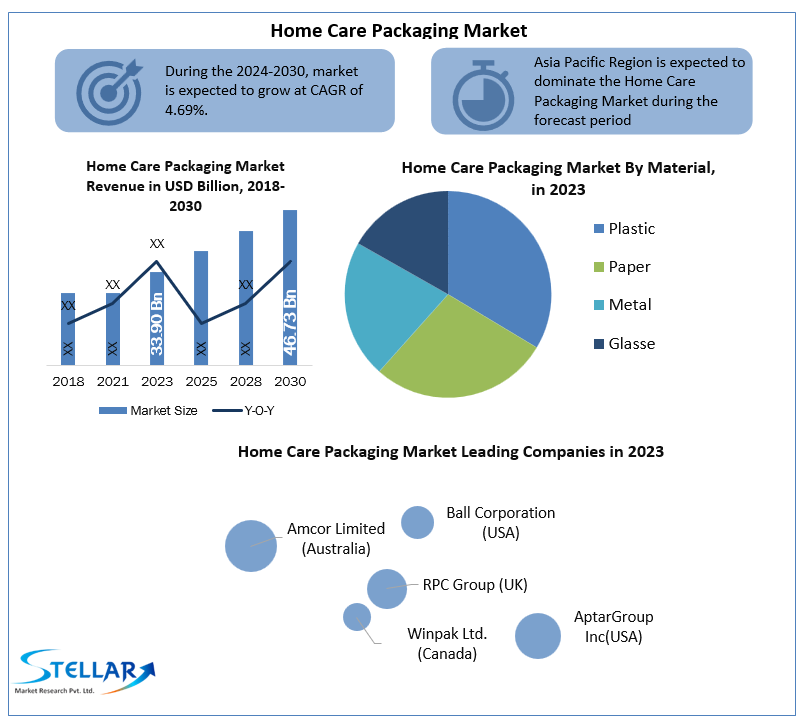

The Home Care Packaging Market was valued at US$ 33.90 Bn. in 2023. Global Home Care Packaging Market size is estimated to grow at a CAGR of 4.69 %.

Format : PDF | Report ID : SMR_191

Home Care Packaging Market Overview:

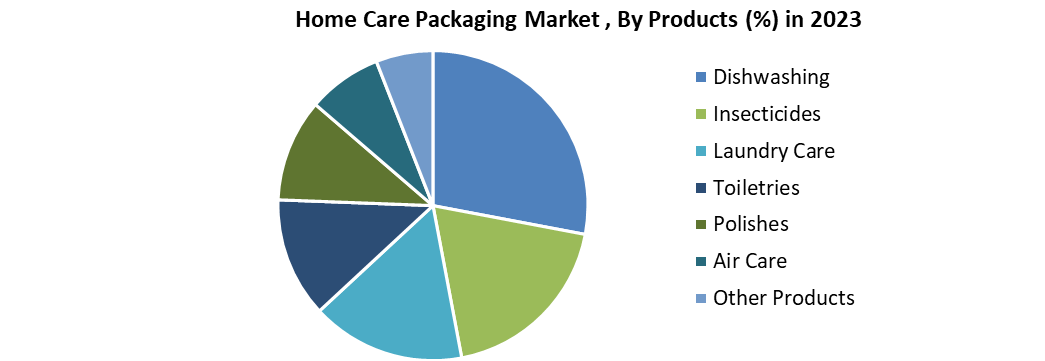

In the current home care packaging market scenario, a great deal going on. Innovative products, which make consumers’ lives easier or simply are increasing the purchasing power of home care products. The industry has relied on plastic packaging to protect home care products, household cleaners, laundry detergents, creams, and similar products. Today, a variety of dishwashing, insecticides, laundry care, toiletries, polishes, air care and detergents, cleaning products, and household chemicals, are preferring in every home. Key players operating in the market are focusing on deployment of packaging sustainable solutions, which can provide ideal protection for the contents with keeping the child safety concern at the forefront. The home care packaging market report covers the all-detail analysis of the market forecast numbers for packaging.

Before the pandemic period, the home care category was on a downward trend across developing markets. Currently, health concerns and months spent at home have impacted on shopping behaviour of consumers for home care products, which is expected to drive the need for packaging. The sales for home care products are stagnating in developed countries. In the developing market, the volume sales of home care products are expected to grow through small pack sizes that make product affordable. consumers are demanding more eco-friendly packaging and brand owners are working toward a circular economy. According to the SMR analysis, some of the market projections are as follow:

Home Care Packaging Market is expected to reach US $40.75 Bn by 2030.

Consumers’ engagement with home care and cleaning products is expected to grow at 4.8% rate of CAGR.

Asia Pacific region is projected to be leading region in the home care packaging market by 2030, which is expected to contribute more than 40% share in the global market during the forecast period.

To get more Insights: Request Free Sample Report

Home Care Packaging Market Dynamics:

An increase in awareness related to personal grooming is expected to drive the home care packaging market growth. Increasingly, consumers are also looking for products, which are more convenient packages, mainly pouches. Shoppers also want pouches because they like how easy it is to open, store, and reseal. Some of the packaging trends like low cost, ease of use, and storage are expected to boost the adoption of the home care products.

Strong consumer sales positive for home care products is sign for packaging demand

As consumers have become more conscious about personal and home care after the COVID-19 pandemic. The demand for surface care, and toilet care-related products is expected to witness escalating growth. An adoption of healthier lifestyles and concerns among individuals about health and hygienic living to avoid germs, bacteria, dust, and dirt, per capita spending on home care products are some of the factors, which are expected to drive the strong consumer sales for home care products. A focus on health and wellbeing is witnessed across the FMCG industry from packaged food and personal hygiene to home cleaning packaging.

Ecommerce leads the way: Home Care Packaging

COVID-19 pandemic has pushed consumers to migrate to online channels for many products including home care products. With demand for buying household products online is expected to grow during forecast period. Many consumers turned to online shopping, which drive the e-commerce sector boom. In the home care packaging market, the brands, who can adopt the shift in buying behaviours and deliver the best user experience will forming footprint in the market and win the ecommerce game. Home care brands are focusing to increase their consumer base by demonstrating their strengths, with the usages of naturally derived formulas.

Home Care Packaging Market Segment Analysis:

Plastic packaging Material: Dominant share in the market

The plastic is widely preferred for packaging because of its features like flexibility, strength, and durability. It’s ideal usages through all major packaging types creates demand for plastic. With compare with the other packaging material, plastic remains highly flexible and can be mold into any shape. High demand from the retail industry, increase in-income households and demand for PET bottles are some of the factors, which drives the plastic packaging adoption. In the home care packaging market, a gradual shift in customer preference toward adopting flexible plastic packaging over its rigid counterpart has witnessed. Flexible plastic packaging materials are 80% lighter in weight over rigid plastic materials. Key players are developing packaging solution, which contains less virgin material and high rate of post-consumer recycling.

Home Care Packaging Market Regional Insights:

Asia Pacific region is projected to be leading region.

The Asia Pacific region is expected to contribute more than 40% share in the home care packaging market during the forecast period. The home care product industry is expected to grow at more than 10 % rate of CAGR, which drives the demand for home care products packaging. The presence of high population base across developing economies like China and India, demand for home care products, and shift in consumer lifestyle are factors, which are expected to boost the regional market growth in the near future. High sales growth of consumer goods and rising consumer expenditures are also driving the home care products industry. Toilet cleaners have a large demand in the urban and semi-urban areas across developing markets. For instance, In India, Government initiatives, such as ‘SwachBharath’ and smart city development projects are expected to increase the demand for home care products and its packaging.

United States Home Care Packaging market is expected to grow at a CAGR of 9.25%

In the USA, the home care products market has witnessed a growth because of consumer preference among individuals to lead a healthier lifestyle. In 2020, the country has reported US $ 14 trillion household spending and personal income was recorded at 1950.5 Bn. Home care brands and packaging suppliers are concentrating on a constant spree to innovate and create differentiation. Household care packaging has untapped opportunities, which reduces plastic pollution by substituting plastic bottles with more sustainable packaging solutions like paper bottles.

The objective of the report is to present a comprehensive analysis of the Home Care Packaging Market to the stakeholders in the industry. The report provides trends that are most dominant in the Home Care Packaging Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Home Care Packaging Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Home Care Packaging Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Home Care Packaging Market. The report also analyses if the Home Care Packaging Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Home Care Packaging Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Home Care Packaging Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the market is aided by legal factors.

Home Care Packaging Market Scope:

|

Home Care Packaging Market |

|

|

Market Size in 2022 |

USD 33.90 Bn. |

|

Market Size in 2029 |

USD 46.73 Bn. |

|

CAGR (2023-2029) |

4.69% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Material

|

|

By Type

|

|

|

By Products

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Home Care Packaging Market Key Players:

- Amcor Limited (Australia)

- Ball Corporation (USA)

- RPC Group (UK)

- Winpak Ltd. (Canada)

- AptarGroup Inc (USA)

- Mondi (South Africa)

- Bemis Company Inc. (U.S.)

- Rexam plc (U.K)

- Sonoco Products Company (U.S.)

- Silgan Holdings (U.S.A)

- RPC Group (U.K.)

- Constantia Flexibles Group GmbH (Austria)

- DS Smith PLC (U.K)

- Can-Pack SA (Poland)

- Winpak Ltd. (Canada)

- Sonoco Products Company (U.S.)

- Silgan Holdings (U.S.)

- ProAmpac LLC

- Tetra Laval (Switzerland)

Frequently Asked Questions

The Asia Pacific region is expected to hold the highest share in the Home Care Packaging Market.

The market size of the Home Care Packaging Market by 2030is US$ 46.73 Bn.

The forecast period for the Home Care Packaging Market is 2024-2030

The market size of the Home Care Packaging Market in 2023 was US$ 33.90 Bn.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Home Care Packaging Market: Target Audience

2.3. Global Home Care Packaging Market: Primary Research (As per Client Requirement)

2.4. Global Home Care Packaging Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2023-2030(In %)

4.1.1.1. North America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.2. Europe Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.3. Asia Pacific Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.4. South America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.1.5. Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Global Home Care Packaging Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.3.1.1. Global Market Share Analysis, By Material, 2023-2030 (Value US$ MN)

4.3.1.1.1. Plastic

4.3.1.1.2. Paper

4.3.1.1.3. Metal

4.3.1.1.4. Glass

4.3.1.2. Global Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.3.1.2.1. Bottles & Containers

4.3.1.2.2. Metal Cans

4.3.1.2.3. Cartons & Corrugated Box

4.3.1.2.4. Pouches & Bags

4.3.1.2.5. Other Types

4.3.1.3. Global Market Share Analysis, By Products, 2023-2030 (Value US$ MN)

4.3.1.3.1. Dishwashing

4.3.1.3.2. Insecticides

4.3.1.3.3. Laundry Care

4.3.1.3.4. Toiletries

4.3.1.3.5. Polishes

4.3.1.3.6. Air Care

4.3.1.3.7. Other Products

4.4. North America Home Care Packaging Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.4.1.1. North America Market Share Analysis, By Material, 2023-2030 (Value US$ MN)

4.4.1.1.1. Plastic

4.4.1.1.2. Paper

4.4.1.1.3. Metal

4.4.1.1.4. Glass

4.4.1.2. North America Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.4.1.2.1. Bottles & Containers

4.4.1.2.2. Metal Cans

4.4.1.2.3. Cartons & Corrugated Box

4.4.1.2.4. Pouches & Bags

4.4.1.2.5. Other Types

4.4.1.3. North America Market Share Analysis, By Products, 2023-2030 (Value US$ MN)

4.4.1.3.1. Dishwashing

4.4.1.3.2. Insecticides

4.4.1.3.3. Laundry Care

4.4.1.3.4. Toiletries

4.4.1.3.5. Polishes

4.4.1.3.6. Air Care

4.4.1.3.7. Other Products

4.4.1.4. North America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.4.1.4.1. US

4.4.1.4.2. Canada

4.4.1.4.3. Mexico

4.5. Europe Home Care Packaging Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.5.1.1. Europe Market Share Analysis, By Material, 2023-2030 (Value US$ MN)

4.5.1.2. Europe Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.5.1.3. Europe Market Share Analysis, By Products, 2023-2030 (Value US$ MN)

4.5.1.4. Europe Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.5.1.4.1. UK

4.5.1.4.2. France

4.5.1.4.3. Germany

4.5.1.4.4. Italy

4.5.1.4.5. Spain

4.5.1.4.6. Sweden

4.5.1.4.7. Austria

4.5.1.4.8. Rest Of Europe

4.6. Asia Pacific Home Care Packaging Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.6.1.1. Asia Pacific Market Share Analysis, By Material, 2023-2030 (Value US$ MN)

4.6.1.2. Asia Pacific Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.6.1.3. Asia Pacific Market Share Analysis, By Products, 2023-2030 (Value US$ MN)

4.6.1.4. Asia Pacific Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.6.1.4.1. China

4.6.1.4.2. India

4.6.1.4.3. Japan

4.6.1.4.4. South Korea

4.6.1.4.5. Australia

4.6.1.4.6. ASEAN

4.6.1.4.7. Rest Of APAC

4.7. South America Home Care Packaging Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.7.1.1. South America Market Share Analysis, By Material, 2023-2030 (Value US$ MN)

4.7.1.2. South America Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.7.1.3. South America Market Share Analysis, By Products, 2023-2030 (Value US$ MN)

4.7.1.4. South America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.7.1.4.1. Brazil

4.7.1.4.2. Argentina

4.7.1.4.3. Rest Of South America

4.8. Middle East and Africa Home Care Packaging Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.8.1.1. Middle East and Africa Market Share Analysis, By Material, 2023-2030 (Value US$ MN)

4.8.1.2. Middle East and Africa Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.8.1.3. Middle East and Africa Market Share Analysis, By Products, 2023-2030 (Value US$ MN)

4.8.1.4. Middle East and Africa Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.8.1.4.1. South Africa

4.8.1.4.2. GCC

4.8.1.4.3. Egypt

4.8.1.4.4. Nigeria

4.8.1.4.5. Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1.1. Global Stellar Competition Matrix

5.1.2. North America Stellar Competition Matrix

5.1.3. Europe Stellar Competition Matrix

5.1.4. Asia Pacific Stellar Competition Matrix

5.1.5. South America Stellar Competition Matrix

5.1.6. Middle East and Africa Stellar Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Material, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in Products

5.3.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. AMCOR LIMITED.

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. BALL CORPORATION

6.1.3. RPC GROUP

6.1.4. WINPAK LTD.

6.1.5. APTARGROUP INC

6.1.6. MONDI

6.1.7. BEMIS COMPANY INC.

6.1.8. REXAM PLC

6.1.9. SONOCO PRODUCTS COMPANY

6.1.10. SILGAN HOLDINGS

6.1.11. RPC GROUP

6.1.12. CONSTANTIA FLEXIBLES GROUP GMBH

6.1.13. DS SMITH PLC

6.1.14. CAN-PACK SA

6.1.15. WINPAK LTD.

6.1.16. SONOCO PRODUCTS COMPANY

6.1.17. Silgan Holdings

6.1.18. ProAmpac LLC

6.1.19. Tetra Laval

6.2. Key Findings

6.3. Recommendations